by Calculated Risk on 11/11/2008 02:02:00 PM

Tuesday, November 11, 2008

Fannie, Freddie to Present Loan Mod Plan at 2PM ET

by Calculated Risk on 11/11/2008 12:19:00 PM

From the WSJ: Fannie, Freddie Work on Mass Loan Modification Plan

Fannie Mae, Freddie Mac and U.S. officials are expected to announce plans Tuesday to speed up the modification of hundreds of thousands of loans ... The streamlined effort will target certain loans that are 90 days or more past due ... The program will aim to bring the ratio of mortgage payments for these homeowners to 38% of their income by modifying interest rates and in some cases forgiving portions of principal debt ...

The announcement is expected to come at a press conference at 2 p.m. at the Federal Housing Finance Agency ...

LIBOR Declines to 2.18%

by Calculated Risk on 11/11/2008 11:36:00 AM

From Bloomberg: Libor for Dollars Falls as Central Banks Provide Cash Funding

The London interbank offered rate, or Libor, that banks charge each other for three-month loans in dollars slid 6 basis points to 2.18 percent today, the 22nd consecutive decline and the lowest level since Oct. 29, 2004, according to British Bankers' Association data.The three-month LIBOR was at 2.24% yesterday and the rate peaked at 4.81875% on October 10th.

The U.S. bond market is closed today for Veterans Day so many of the other indicators are not available.

Toll: Record Low Homebuyer Demand

by Calculated Risk on 11/11/2008 10:01:00 AM

"Unfortunately, the preliminary signs of stability we had discussed in early September, during our 2008 third quarter earnings call, were upended by the past month's financial crisis. Results of this crisis -- accelerating fears of job losses, a large decline in consumer spending, a significant capital crunch, increased credit market disruption, and plummeting stock market values -- all contributed to drive our cancellations up to 233 units (about 30% of current-quarter-contracts, or 9% of beginning-quarter-backlog), and drive home buyer confidence and our traffic and demand down to record lows."From MarketWatch: Home builder says buyer traffic, demand plummet after financial crisis

Robert Toll, CEO Toll Brothers, Nov 11, 2008

Unfortunately, the preliminary signs of stability we had discussed in early September, during our 2008 third quarter earnings call, were upended by the past month's financial crisis," said Chief Executive Robert Toll in a prepared statement.Not surprising. Also the cancellation rate rose to 30%, far above Toll's historical average of 7%, but still below the record highs of recent years.

The crisis contributed to pushing up cancellations and drove homebuyer confidence and the company's traffic and demand to record lows, the CEO said, pointing to "accelerating fears of job losses, a large decline in consumer spending, a significant capital crunch, increased credit market disruption, and plummeting stock market values."

...

"Given the significant uncertainty surrounding sales paces, cancellation rates, market direction, unemployment trends and numerous other aspects of the overall economy, we are not comfortable offering delivery, revenue or earnings guidance for the coming year," said Chief Financial Officer Joel Rassman.

Downey Savings: "Substantial Doubt" About Survival

by Calculated Risk on 11/11/2008 09:51:00 AM

From Reuters: Option ARM specialist Downey Financial may fail

Downey Financial Corp ... one of the largest specialists in "option" adjustable-rate mortgages, said on Monday its survival was in doubt because it may fail to raise enough capital to satisfy its regulators.Something to watch this friday!

In its quarterly report filed with the U.S. Securities and Exchange Commission, Downey said there was "substantial doubt" about its ability and that of its banking unit "to continue as going concerns for a reasonable period of time."

Major Mall Owner Warns of Possible Default

by Calculated Risk on 11/11/2008 01:07:00 AM

From the WSJ: Mall Owner Is Warning of Default

Ailing mall owner General Growth Properties Inc. warned Monday in a government filing that its failure to refinance or extend $1 billion in debt due this month could trigger default on billions of dollars in debt and its ability to continue operations would be in "substantial doubt."From the GGP 10-Q on the economy:

...

General Growth has $900 million in debt coming due Nov. 28 on two luxury malls on the Las Vegas strip. It has another $58 million in bonds due on Dec. 1.

Deteriorating economic conditions will have an adverse affect on our revenues and available cash, and may also impair our ability to sell our properties.

General and retail economic conditions continue to weaken, and we expect this weakness to continue and worsen in 2009 as the economy enters a recessionary or near recessionary period. Consumer spending recently declined for the first time in 17 years, the unemployment rate is expected to rise, consumer confidence has decreased dramatically and the stock market remains extremely volatile. Given these expected economic conditions, we believe there is a significantly increased risk that the sales of stores operating in our centers will decrease, negatively affecting their ability to make minimum rent payments and increasing the risk of tenant bankruptcies. In addition to the direct adverse effect of tenant failures to pay minimum rents and tenant bankruptcies on our operations, these events also negatively affect our ability to attract and maintain minimum rent levels for new tenants. These circumstances negatively affect our revenues and available cash, and also reduce the value of our properties, reducing the likelihood that we would be able to sell such properties, on attractive terms or at all.

Monday, November 10, 2008

The UK Retail Recession

by Calculated Risk on 11/10/2008 08:49:00 PM

From the Financial Times: Plunge in UK retail sales and home deals (hat tip Jonathan)

High street sales suffered their sharpest annual fall in nearly four years in October and home purchases fell to a record low ... in a further sign of the UK economy’s deepening woes.In the U.S., the year-over-year change in nominal retail sales went negative in September. The following graph shows the year-over-year change in nominal and real U.S. retail sales since 1993.

...

The BRC report says total retail sales were 0.1 per cent below their October 2007 level ... “A fall in the value of total sales is extremely rare,” said Helen Dickinson, head of retail at the consultancy KPMG.

...

The housing picture is no better, according to the RICS. The average number of completed sales per surveyor fell to 10.9 over the past three months, the weakest sales record since the survey began in 1978.

Click on graph for larger image in new window.

Click on graph for larger image in new window.The Census Bureau reported that nominal retail sales decreased 1.0% year-over-year (retail and food services decreased 1.0%) in Septebmer, and real retail sales (adjusting with PCE) declined by 4.3% on a YoY basis.

Retail sales for October will be reported on Friday, and based on retailer reports, the numbers will be ugly.

AmEx to Become Bank Holding Company

by Calculated Risk on 11/10/2008 06:56:00 PM

Fed Press Release:

The Federal Reserve Board on Monday announced its approval of the applications and notices under sections 3 and 4 of the Bank Holding Company Act by American Express Company and American Express Travel Related Services Company, Inc., both of New York, New York, to become bank holding companies on conversion of American Express Centurion Bank, Salt Lake City, Utah, to a bank, and to retain certain nonbanking subsidiaries, including American Express Bank, FSB, Salt Lake City, Utah.American Express has approximately $127 billion in consolidated assets, and becoming a bank holding company allows access to financing from the Federal Reserve for some of these assets. More details are in the Fed Order.

Fannie: $100 Billion May Not be Enough

by Calculated Risk on 11/10/2008 05:49:00 PM

From Bloomberg: Fannie Says $100 Billion Pledge From Treasury May Not Be Enough

Fannie Mae may need more than the $100 billion in funding pledged by the U.S. Treasury to stay afloat after reporting a record $29 billion loss and confronting more difficulty in issuing and refinancing debt.Here is the Fannie 10-Q filed with the SEC. This statement is under "Risks Relating to Our Business" and is not a prediction from Fannie, just a statement of a possible risk. The huge loss reported today was mostly because of a reduction in deferred tax assets.

``This commitment may not be sufficient to keep us in solvent condition or from being placed into receivership,'' if there are further ``substantial'' losses or if the company is unable to sell unsecured debt, Washington-based Fannie said in a filing today with the U.S. Securities and Exchange Commission.

Here are a few excerpts from the Fannie section on Housing and Economic Conditions:

Growth in U.S. residential mortgage debt outstanding slowed to an estimated annual rate of 2.0% based on the first six months of 2008, compared with an estimated annual rate of 8.3% based on the first six months of 2007, and is expected to continue to decline to a growth rate of about 0% in 2009.

We continue to expect that home prices will decline 7% to 9% on a national basis in 2008, and that home prices nationally will decline 15% to 19% from their peak in 2006 before they stabilize. Through September 30, 2008, home prices nationally have declined 10% from their peak in 2006. (Our estimates compare to approximately 12% to 16% for 2008, and 27% to 32% peak-to-trough, using the Case-Schiller index.) We currently expect home price declines at the top end of our estimated ranges. We also expect significant regional variation in these national home price decline percentages, with steeper declines in certain areas such as Florida, California, Nevada and Arizona. The deteriorating economic conditions and related government actions that occurred in the third quarter of 2008 have increased the uncertainty of future economic conditions, including home price movements. Therefore, while our peak-to-trough home price forecast is at the top end of the 15% to 19% range, there is increasing uncertainty about the actual amount of decline that will occur.So Fannie is expecting house price declines of around 32% using the Case-Shiller index.

Credit Crisis Indicators: Little Progress

by Calculated Risk on 11/10/2008 01:32:00 PM

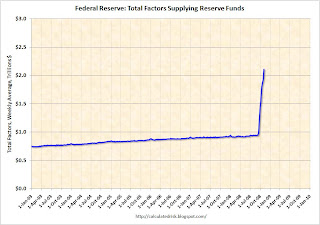

A daily update ... day to day there has been little progress, but overall most indicators have improved since the crisis started.

As an example, the LIBOR is down sharply from 4.82% on Oct 10th to 2.24% today. And the TED spread is at 2.0% from 4.63%. The progress is slow, but there has been progress.

The London interbank offered rate, or Libor, that banks say they charge each other for such loans declined 5 basis points to 2.24 percent today, the lowest level since November 2004, the British Bankers' Association said.The three-month LIBOR was at 2.29% on Friday. The rate peaked at 4.81875% on Oct. 10. (Better)

With the effective Fed Funds rate at 0.23% (as of Friday), this is probably somewhat in the right range. At some point, I'd like to see the effective Fed funds rate close to the target rate (currently 1.0%).

The TED spread is around 2.0, but still too high. The peak was 4.63 on Oct 10th. I'd like to see the spread move back down to 1.0 or lower. A normal spread is about 0.5.

Here is a list of SFP sales. It has been a few days without an announcement from the Treasury... (no progress).

Click on graph for larger image in new window.

The Federal Reserve assets increased $105 billion last week to $2.075 trillion. Note: the graph shows Total Factors Supplying Federal Reserve Funds and is an available series that is close to assets.

So far the Federal Reserve assets are still increasing rapidly. It will be a good sign - sometime in the future - when the Fed assets start to decline.

Graph from the Fed.

Graph from the Fed.This is the spread between high and low quality 30 day nonfinancial commercial paper.

The Fed is buying higher quality commercial paper (CP) and this is pushing down the yield on this paper (0.82% yesterday!) - and increasing the spread between AA and A2/P2 CP. So this indicator has been a little misleading. But it now sounds like the Fed might intervene in other companies and just the talk of possible Fed action is probably pushing down the A2/P2 rates. If the credit crisis eases, I'd expect a significant decline in this spread.

The LIBOR is down and the TED spread is flat - so there is little progress today - and any progress is coming directly from Fed intervention and increases in the Fed balance sheet, so there is still a long way to go.