by Calculated Risk on 11/10/2008 12:34:00 PM

Monday, November 10, 2008

Retail: Quotes of the Day

A couple of great quotes:

"There's a new realization that holding a gift card from a troubled retailer is like having a bank account without FDIC insurance."From the LA Times: Gift card holders may be out of luck in retail bankruptcies. Gift card buyers beware ...

Jerry Hirsch writing in the LA Times

Note that the Circuit City bankruptcy is somewhat unusual in that most retailers file for bankruptcy after the holiday season. Bloomberg had an article about this last week: `Tis the Season for Retailer Visions of Liquidations

In the last quarter century, about a fifth of large retailers that went bankrupt, including RH Macy & Co. Inc. and FAO Schwarz, did so in January, using holiday sales cash to jump-start reorganizations or finance liquidations.And the second quote of the day:

...

From 1980 to 2008, of the 105 large public retailers that filed for bankruptcy with assets of more then $100 million, only seven did so in December ... That was less than half the 18 that did so in January --the most popular filing month for large retailers ...

This bankruptcy season is different. ...

"Confidence has deteriorated so badly that merchants and bankers don't even believe in Santa Claus any more."Maybe this year is a little different than normal with more bankruptcies before the holidays, but I expect to see more retailer bankruptcies in early 2009.

Martin Zohn, a bankruptcy lawyer in New York, from Bloomberg article.

Fed and Treasury announce restructuring of AIG financial support

by Calculated Risk on 11/10/2008 09:33:00 AM

The Federal Reserve Board and the U.S. Treasury on Monday announced the restructuring of the government's financial support to the American International Group (AIG) in order to keep the company strong and facilitate its ability to complete its restructuring process successfully. These new measures establish a more durable capital structure, resolve liquidity issues, facilitate AIG's execution of its plan to sell certain of its businesses in an orderly manner, promote market stability, and protect the interests of the U.S. government and taxpayers.Plus some new credit facilities from the Fed.

Equity Purchase

The U.S. Treasury on Monday announced that it will purchase $40 billion of newly issued AIG preferred shares under the Troubled Asset Relief Program. This purchase will allow the Federal Reserve to reduce from $85 billion to $60 billion the total amount available under the credit facility established by the Federal Reserve Bank of New York (New York Fed) on September 16, 2008.

In one new facility, the New York Fed will lend up to $22.5 billion to a newly formed limited liability company (LLC) to fund the LLC’s purchase of residential mortgage-backed securities from AIG's U.S. securities lending collateral portfolio. ... As a result, the $37.8 billion securities lending facility established by the New York Fed on October 8, 2008, will be repaid and terminated.

...

In the second new facility, the New York Fed will lend up to $30 billion to a newly formed LLC to fund the LLC's purchase of multi-sector collateralized debt obligations (CDOs) on which AIG Financial Products has written credit default swap (CDS) contracts.

Circuit City Files Bankruptcy

by Calculated Risk on 11/10/2008 09:18:00 AM

From the WSJ: Circuit City Files for Bankruptcy

Troubled electronics retailer Circuit City Stores Inc. filed for Chapter 11 bankruptcy Monday in an effort to stay ahead of lenders owed $898 million.There is a good chance that Circuit City will be gone in January - another serious blow for mall owners.

...

The lenders have agreed to loan Circuit City $1.1 billion to keep the retailer's doors open through the holiday season.

Larger Bailout for AIG

by Calculated Risk on 11/10/2008 12:28:00 AM

From the NY Times: A.I.G. May Get More in Bailout

The Treasury Department and the Federal Reserve were near a deal to abandon the initial bailout plan and invest another $40 billion in the company ... When the restructured deal is complete, taxpayers will have invested and lent a total of $150 billion to A.I.G., the most the government has ever directed to a single private enterprise. ... The revised deal, which may be announced as early as Monday morning ...What a mess ...

Sunday, November 09, 2008

"A microcosm" of CRE in New York

by Calculated Risk on 11/09/2008 07:24:00 PM

Charles Bagli at the NY Times provides some details for one building in New York: Market’s Collapse Echoes in a Manhattan Tower

The first sign of trouble came over the summer when iStar Financial, a real estate finance company, decided not to move into the 100,000 square feet of space ...Sublease space really hurt the NY office market in previous downturns, and it appears to be happening again.

Several weeks later, Metropolitan Life Insurance ... quietly began shopping for tenants to sublease 100,000 square feet ...

And last month, Centerline Capital Group, a suddenly struggling commercial property finance and investment company, confirmed that it would not be moving into its 100,000 square feet ...

The companies signed leases for as much as $132 a square foot ... many brokers say they would be lucky to get $95 a square foot today.

The Commercial Real Estate Bust

by Calculated Risk on 11/09/2008 04:42:00 PM

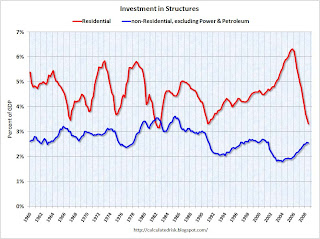

Since investment in non-residential structures is slowing (especially malls, hotels, and offices), a key question is how did the commercial real estate (CRE) investment boom compare to the residential housing bubble? And how did the CRE boom compare to previous CRE booms?

The following graph shows residential investment compared to investment in non-residential structures as a percent of GDP since 1960. All data from the BEA.

Note: Residential investment is primarily single family structures, multi-family structures, commissions, and home improvement. Click on graph for larger image in new window.

Click on graph for larger image in new window.

The recent housing boom and bust is very clear (in red).

Residential investment was 3.3% of GDP in Q3 2008, the lowest level since 1982 (just under 3.2%).

Non-residential investment in structures increased to almost 4% of GDP in Q3. This investment is slowing down right now (the Census Bureau has reported declines in non-residential investment for the last two months), and investment in non-residential structures will almost certainly be negative in Q4.

The current non-residential boom was greater than the late '90s boom, but much less than the non-residential boom in the '80s.

However much of the recent boom in non-residential investment is energy related. The second graph compares residential investment to non-residential investment in structures excluding Power and Petroleum exploration as a percent of GDP since 1960. With this comparison, the recent boom is less than the late '90s boom, and far less than the S&L related '80s boom. This clearly shows that the recent boom in non-residential investment (ex power and petro) was not as excessive as the housing bubble.

This clearly shows that the recent boom in non-residential investment (ex power and petro) was not as excessive as the housing bubble.

Residential investment has declined by 3% of GDP so far from the peak. Non-residential investment would have to decline to about 1% of GDP (see first graph) to match the impact of GDP from the residential bust so far. And excluding power and petroleum, non-residential investment would have to be below zero to match the impact on GDP from the residential bust!

In percentage terms, residential has collapsed by about 50% (compared to GDP). Non-residential would have to decline to less than 2.0% of GDP (1.3% of GDP ex-power and petroleum) - the lowest level in history by far - to match the residential collapse in percentage terms.

Also, the recent boom for CRE was much less than the S&L related boom in the '80s, and even less than the late '90s CRE boom.

Some areas of non-residential investment have been overbuilt, and I've forecast significant declines for investment in offices, malls, and lodging. But those looking for a collapse in CRE investment comparable to the current residential investment bust are wrong.

WSJ: $586 Billion Stimulus Package in China

by Calculated Risk on 11/09/2008 10:49:00 AM

From the WSJ: China Announces $586 Billion Stimulus Package

China's government announced a two-year stimulus exceeding a half-trillion dollars to offset the impact of slowing global growth ...Professor Roubini cautioned last week about a hard landing in China (Note: Roubini argues that China's economy needs to grow at more than 6% per year to absorb the about 24 million workers joining the labor force every year): The Rising Risk of a Hard Landing in China: The Two Engines of Global Growth – U.S. and China – are Now Stalling

Just a year ago, China had adopted an unprecedented "tight" monetary policy, a step up in its three-year effort to keep the fast-growing economy from barreling out of control because it was expanding too quickly.

In conclusion the risk of a hard landing in China is sharply rising; a deceleration in the Chinese growth rate to 7% in 2009 - just a notch above a 6% hard landing – is highly likely and an even worse outcome cannot be ruled out at this point. The global economy is already headed towards a global recession as advanced economies are all in a recession and the U.S. contraction is now dramatically accelerating. The first engine of global growth – the U.S. on the consumption side – has now already shut down. The second engine of global growth – China on the production side – is also on its way to stalling. Thus, with the two main engines of global growth now in serious trouble a global hard landing is now almost a certainty. And a hard landing in China will have severe effects on growth in emerging market economies in Asia, Africa and Latin America as Chinese demand for raw materials and intermediate inputs has been a major source of economic growth for emerging markets and commodity exporters. The sharp recent fall in commodity prices and the near collapse of the Baltic Freight index are clear signals that Chinese and global demand for commodities and industrial inputs is sharply falling. Thus, global growth – at market prices – will be close to zero in Q3 of 2008, likely negative in Q4 of 2009 and well into negative territory in 2009. So brace yourself for an ugly and protracted global economic contraction in 2009.

Saturday, November 08, 2008

Some in Congress push for TARP Aid for Automakers

by Calculated Risk on 11/08/2008 08:11:00 PM

From the WSJ: Pelosi, Reid Press for TARP Aid for Auto Industry

House Speaker Nancy Pelosi and Senate Majority Leader Harry Reid sent ... a letter to Treasury Secretary Henry Paulson urging him to assist the Big Three auto makers by considering broadening the $700 billion Troubled Asset Relief Program to help the troubled industry.Everyone wants a piece of the TARP.

...

Though the administration is reluctant to widen the program to cover autos, there has been discussion among Bush officials of expanding use of the $700 billion to buy equity stakes in a range of financial-sector companies, moving beyond just banks and insurers. The focus would be on assisting companies that provide financing to the broad economy, such as bond insurers and specialty finance firms ...

Franklin Bank Failure and Commercial Real Estate

by Calculated Risk on 11/08/2008 04:27:00 PM

From Bloomberg:Ranieri Becomes Victim of Crisis as Franklin Seized

Lewis Ranieri, who helped create the mortgage-securities market in the 1980s while at Salomon Brothers Inc., became a victim of its collapse after his Houston-based bank was seized.This is a key point: Many of the bank failures will not be directly from residential, but from Construction & Development (C&D) and commercial real estate (CRE) loans.

...

``The residential side was not their problem, it was clearly the commercial side,'' said David Lykken, co-founder of Mortgage Banking Solutions, an Austin, Texas-based consulting firm. ``The reason it took a little longer is because that trailed residential,''

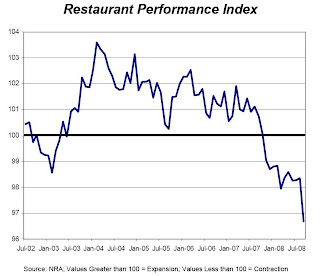

Restaurant Outlook Grim

by Calculated Risk on 11/08/2008 06:35:00 AM

From the National Restaurant Association: NRA research finds majority of operators report sales and traffic declines; expectations at an all-time low level. (hat tip Lyle)

“The September decline in the Restaurant Performance Index was the result of broad-based declines across the index components, with both the Current Situation and Expectations indices falling to record lows,” said Hudson Riehle, senior vice president of Research and Information Services for the Association. “Nearly two out of three restaurant operators reported negative same-store sales and traffic levels in September, while 50 percent expect their sales in six months to be lower than the same period in the previous year.”

“The rapid deterioration in economic conditions is reflected in operator sentiment, with a record 42 percent of restaurant operators saying the economy is currently the number-one challenge facing their business,” Riehle added. “Operators aren’t optimistic about the economy looking forward either, with 50 percent expecting economic conditions to worsen in six months.”

Click on graph for larger image in new window.

Any reading below 100 suggests contraction. This index doesn't have a long history, so it is not surprising that the index is at a record low.

Still the index is between below 100 for 13 consecutive months. It is typical in a recession for consumers to pull back on discretionary spending, and restaurants usually feel the pain acutely.

Note that this was for September. It appears October consumer spending was much worse.