by Calculated Risk on 10/31/2008 11:49:00 AM

Friday, October 31, 2008

Residential Investment and Home Improvement

We frequently discuss "residential investment" (RI) without mentioning the components of RI according to the Bureau of Economic Analysis (BEA). Residential investment includes new single family structures, multifamily structures, home improvement, broker's commissions, and a few minor categories. Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows the various components of RI as a percent of GDP for the last 50 years. The most important components are investment in single family structures followed by home improvement.

Investment in home improvement ($175.2 billion SAAR) is almost at the same level as investment in single family structures ($176.0 billion SAAR) in Q3 2008.

Let's take a closer look at these two key components of RI: As everyone knows, investment in single family structures has fallen off a cliff. This is the component of RI that gets all the media attention - although usually from stories about single family starts and new home sales (related to RI in single family structures).

As everyone knows, investment in single family structures has fallen off a cliff. This is the component of RI that gets all the media attention - although usually from stories about single family starts and new home sales (related to RI in single family structures).

Currently investment in single family structures is at 1.22% of GDP, significantly below the average of the last 50 years of 2.35% - and just above the record low in 1982 of 1.20%.

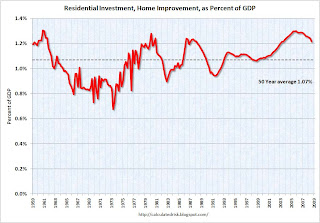

But what about home improvement? The third graph shows home improvement investment as a percent of GDP.

The third graph shows home improvement investment as a percent of GDP.

Home improvement is at 1.21% of GDP, off the high of 1.3% in Q4 2005 - but still well above the average of the last 50 years of 1.07%. Maybe lenders are boosting home improvement spending fixing up all those damaged REOs!

This would seem to suggest there is significant downside risk to home improvement spending over the next couple of years.

Frank: Bailout Funds are for Lending

by Calculated Risk on 10/31/2008 10:35:00 AM

From Reuters: Rep. Frank: bailout funds must be used for lending (hat tip Yal)

"I am deeply disappointed that a number of financial institutions are distorting the legislation that Congress passed at the president's request to respond to the credit crisis by making funds available for increased lending," Rep. Barney Frank said in a statement.But money is fungible, so how do we tell which funds are being used for which purpose?

"Any use of the these funds for any purpose other than lending -- for bonuses, for severance pay, for dividends, for acquisitions of other institutions, etc. -- is a violation of the terms of the Act."

Architecture Billings Index: Falls "precipitously"

by Calculated Risk on 10/31/2008 10:04:00 AM

I overlooked the ABI this month (hat tip Karl). Here is the American Institute of Architects billing index for September: Architecture Billings Index Falls More than Six Points Click on graph for larger image in new window.

Click on graph for larger image in new window.

Following three consecutive months of signs of greater stability in design activity, the Architecture Billings Index (ABI) fell precipitously, dropping more than six points. As a leading economic indicator of construction activity, the ABI shows an approximate nine to twelve month lag time between architecture billings and construction spending. The American Institute of Architects (AIA) reported the September ABI rating was 41.4, down sharply from the 47.6 mark in August (any score above 50 indicates an increase in billings). The inquiries for new projects score was 51.0. This is also the first time in 2008 that the institutional sector has fallen below the 50 mark.The key here is that the index fell off a cliff in early 2008, and that there is "an approximate nine to twelve month lag time between architecture billings and construction spending". We should expect weaker non-residential structure investment in late 2008 and throughout 2009.

“With all of the anxiety and uncertainty in the credit market, the conditions are likely to get worse before they get better,” said AIA Chief Economist Kermit Baker, PhD, Hon. AIA. “Many architects are reporting that clients are delaying or canceling projects as a result of problems with project financing.”

emphasis added

Q3: Office, Malls and Lodging Investment

by Calculated Risk on 10/31/2008 09:04:00 AM

Here are a couple of graphs for non-residential structure investment based on the underlying details for the Q3 GDP report.

Based on tighter lending standards, rising vacancy rates (lower occupancy rate for hotels), and the Architectural Billing index, and declining non-residential construction spending, it appears there will be a sharp slowdown in investment in offices, malls and hotels at the end of 2008 and through 2009.

So far this slowdown is not showing up in the BEA numbers. Click on graph for larger image in new window.

Click on graph for larger image in new window.

Investment in multimerchandise shopping structures (malls) increased slightly in Q3 2008, after peaking in Q4 2007.

Investment in lodging soared in Q3 to $48.3 billion (SAAR) from $36.5 billion (SAAR) in Q3 2007. This is probably due to builders rushing to finish projects.

This investment in lodging will probably decline sharply in the 2nd half of '08 and in '09 as builders cancel or postpone projects. As an example, from the WSJ: MGM Mirage Suspends Casino Projects as Profit Falls

Predevelopment work has been done on the MGM Grand Atlantic City, but the company will halt development until the economy and capital markets "are sufficiently improved," said Chairman and Chief Executive Terry Lanni.

He added that design and preconstruction work on its Las Vegas joint venture with Kerzner International and Istithmar is also being deferred.

MGM has been struggling to find financing to complete construction of its $11 billion CityCenter project on the Las Vegas Strip.

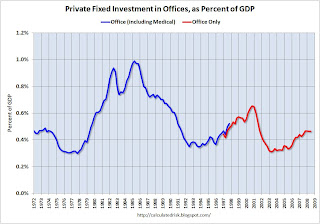

The second graph shows office investment as a percent of GDP since 1972. Office investment increased slightly in Q3 2008 in nominal dollars, but decreased slightly as a percent of GDP.

The second graph shows office investment as a percent of GDP since 1972. Office investment increased slightly in Q3 2008 in nominal dollars, but decreased slightly as a percent of GDP.With the office vacancy rate rising sharply, office investment will probably decline through 2009.

NOTE: In 1997, the Bureau of Economic Analysis changed the office category. In the earlier years, offices included medical offices. After '97, medical offices were not included (The BEA presented the data both ways in '97).

I expect investment in all three categories - malls, lodging and offices - to decline through 2009.

Real Personal Spending Declined Sharply in September

by Calculated Risk on 10/31/2008 08:37:00 AM

As expected - based on the advance GDP report - the BEA reports that real Personal Consumption Expenditures (PCE) declined sharply in September.

The year-over-year change in real PCE is now negative for the first time since 1991.

The change from June (third month of Q2) to September declined at a 3.9% annual rate, the fastest 3 month decline since 1991. Note: I look at the change in the same month in each quarter (June to September here) to compare to the quarterly GDP report.

Here is the story from the WSJ: Consumer Spending Declines

Quotes on Possible Treasury Mortgage Plan

by Calculated Risk on 10/31/2008 12:29:00 AM

A few quotes from David Streitfeld's piece in the NY Times: Mortgage Plan May Aid Many and Irk Others

“Why am I being punished for having bought a house I could afford? I am beginning to think I would have rocks in my head if I keep paying my mortgage.”

Todd Lawrence, homeowner, outside Norwich, Conn.

“If the lunch truly is free, the demand for free lunches will be large.”

Paul McCulley, PIMCO

“If the government says, ‘Prove that you can’t afford your house and we’ll redo your mortgage,’ then people are going to try to qualify.”

Peter Schiff, President of Euro Pacific Capital

“I guess they are forcing me to deliberately stop paying to look worse than I am. Crazy, don’t you think?”

Anonymous Countrywide borrower, Los Angeles

Thursday, October 30, 2008

Report: Almost Half of Nevada Homeowners Underwater

by Calculated Risk on 10/30/2008 09:32:00 PM

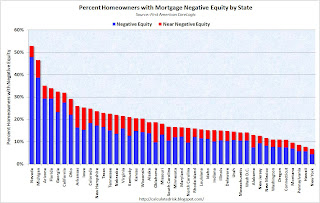

The WSJ reports on a new report from First American CoreLogic that estimates 48% of homeowners with a mortgage in Nevada owe more than their homes are worth. The WSJ reports that First American CoreLogic estimates 18% of homeowners with a mortgage nationwide are underwater.

Using the Census Bureau 2007 estimate of 51.6 million households with mortgages, 18% would be 9.3 homeowners with negative equity. This is less than the recent estimate from Moody's Economy.com of 12 million households underwater. Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows the percent of homeowners with mortgages underwater by state (data from First American CoreLogic via the WSJ)

Note: there is no data for Maine, Mississippi, North Dakota, South Dakota, Vermont, West Virginia and Wyoming.

It's interesting that the two worst states are Nevada and Michigan - one a bubble state, the other devastated by a poor economy. That pattern continues - everyone expects the bubble states of Arizona, Florida and California to be near the top of the list, and Ohio too because of the weak economy - but what about Arkansas, Iowa and even Texas?

The housing problems are everywhere.

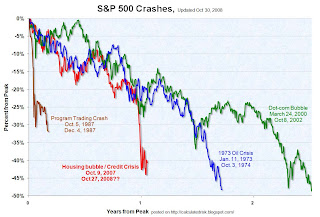

Comparing Stock Market Crashes

by Calculated Risk on 10/30/2008 07:22:00 PM

Fed Holds $145.7 Billion in Commercial Paper as of Oct 29

by Calculated Risk on 10/30/2008 04:47:00 PM

The Fed released the weekly balance sheet report today. The Fed reported that the Commercial Paper Funding Facility LLC holds $145.7 billion in 16 to 90 day commercial paper.

From Bloomberg: Fed Buys $145.7 Billion of Commercial Paper in Start of Program

The Federal Reserve bought commercial paper valued at $145.7 billion in the first days of the program aimed at backstopping the market, indicating the central bank is generating most of this week's record gains in short-term corporate borrowing.

The central bank extended $144.8 billion of loans as of yesterday to a unit that paid $143.9 billion for the debt, the Fed's weekly balance-sheet report said today.

Fed's Yellen: "Economy Contracting Significantly"

by Calculated Risk on 10/30/2008 03:57:00 PM

From San Francisco Fed President Dr. Janet Yellen: The Mortgage Meltdown, Financial Markets, and the Economy. Excerpt on the economic outlook:

[R]ecent data on the economy have been deeply worrisome. Data released this morning reveal that the economy contracted slightly in the third quarter. For the fourth quarter, it appears likely that the economy is contracting significantly. Mainly for this reason, inflationary risks have diminished greatly."It appears likely that the economy is contracting significantly". Strong words from a Fed president. Q4 is going to be ugly.

...

For consumers, the credit crunch is one of several negative factors accounting for the decline in spending in recent months. Consumer credit is costlier and harder to get: loan rates are up, loan terms are tougher, and increasing numbers of borrowers are being turned away entirely. This explains, in part, the exceptional weakness we have seen in auto sales. In addition, of course, employment has now declined for nine months in a row, and personal income, in inflation-adjusted terms, is virtually unchanged since April. Furthermore, household wealth is substantially lower as house prices have continued to fall and the stock market has declined sharply.

Business spending, too, is feeling the crunch in the form of a higher cost of capital and restricted access to credit. ... Some of our business contacts report that bank lines of credit are more difficult to negotiate, and many indicate that they have become cautious in managing liquidity, in committing to capital spending projects that can be deferred, and even in extending credit to customers and other

counterparties. Nonresidential construction also is headed lower largely because of the financial crisis; the market for commercial mortgage-backed securities, a mainstay for financing large projects, has all but dried up.

...

Until recently, weakness in domestic final demand was offset by a major boost from exporting goods and services to our trading partners. Unfortunately, economic growth in the rest of the world has slowed noticeably. ... As a result, exports will not provide as much of an impetus to growth as they did earlier in the year.

emphasis

added