by Calculated Risk on 10/21/2008 03:17:00 PM

Tuesday, October 21, 2008

DataQuick: 42% of California Bay Area Sales from Foreclosures

From DataQuick: Bay Area home sales up 45% over '07; median price falls to $400K

Bay Area home sales soared last month above the record-low levels of a year ago, marking the largest gain in over six years. The median sale price did the opposite, diving to $400,000 - 40 percent below its summer 2007 peak - as more sales shifted to lower-cost inland markets laden with foreclosures.The inland areas have seen the most foreclosure activity and largest price declines. The increase in sales (prior to the recent wave of the credit crisis) suggests prices are closer to the eventual bottom in the inland areas than for the higher priced areas.

...

Although sales rose in some coastal communities in September, it was the region's less expensive inland markets that pushed sales up so sharply.

...

DataQuick's September sales reflect closed escrows, meaning buyers made their purchase decisions in mid-to-late summer, before the worst of the economic news hit in recent weeks. Statistics over the next month will begin to show how housing demand has fared this fall.

...

[N]early 42 percent of all existing homes sold across the Bay Area last month had been foreclosed on at some point in the prior 12 months, up from 36.1 percent in August and 6.9 percent a year ago. Foreclosures tend to sell at a discount and are concentrated in relatively affordable neighborhoods.

...

Foreclosure activity is at or near record levels ...

We have to be careful with median prices because so much of the activity is foreclosure resales in lower prices areas, and this distorts the mix of houses being sold and lowers the median price.

Credit Crisis Indicators: More Progress

by Calculated Risk on 10/21/2008 02:00:00 PM

I'm tracking a few credit market indicators daily.

The U.S. economy is already in a recession, but without some improvement in the credit markets, the recession would be even worse. Fortunately there has been some improvement in the credit markets since the announcement early last week of Treasury equity investments in several major financial institutions. However there is still a long way to go ...

Click on graph for larger image in new window.

This graph shows the high, low, and the close for the three month treasury bill since the beginning of the year.

A good sign would be if the daily volatility subsides, and the yield moves up closer to the Fed funds rate, or about 1.25%.

The yield is increasing, but the daily volatility is still very high.

Here is a list of SFP sales. No new announcements today, but this will take some time. No Progress.

This is the spread between high and low quality 30 day nonfinancial commercial paper.

This is the spread between high and low quality 30 day nonfinancial commercial paper. During a recession, this spread usually increases because the risk of default for lower quality paper increases. However the recent values (over 400 bps) are far in excess of normal. If the credit crisis eases, I'd expect a significant decline in this spread.

MSC Industrial Comments on Economy

by Calculated Risk on 10/21/2008 01:45:00 PM

MSC Industrial Supply (MSC) supplies industrial products to industrial customers. They had some interesting comments today on their conference call about the economy (hat tip Brian):

MSC: “In the last several weeks, customers' sentiment has turned dramatically downwards. Here are a few of the things we have recently heard and I'll quote a few of them. One quote is our new orders are down substantially in the last few weeks. Another is that corporate has told us to reduce inventory. What we have also heard is make due with what you have. And finally, another quote is capital expenditures are on hold. Customers are concerned about the economy and the lack of available credit. They're reducing inventories, orders, and order size and there has been a trend toward deferring capital expenditures. There is a lack of visibility and until that improves, customers will continue to act in this manner. This has affected the smaller manufacturers and machine shops that still make up a significant portion of MSC sales to a greater extent than our larger customers.”More real economy cliff diving.

Analyst: In terms of the environment we're dealing with here today, I am interested in all of your opinions, your viewpoint in terms of how does this current environment look to you relative to past downturns with we have seen.

MSC: David, we view this time as unprecedented in history. The economy is undergoing a huge change, how that is going to shake out all remains to be seen, but I think what is important to know is it's a huge change that, frankly, no one had a chance to see coming, so we than specifically in our customer base there is a tremendous amount of fear that is gripping customers and evidenced by what we have seen the last couple of weeks in October, almost buying paralysis, that is really the way that we think about it, and frankly, in speaking with so many customers what we see happening.... if you go back to 9/11, pre-9/11, the economy was coming down in fact on a sequential basis over a period of many, many months, it slowed down and then there was the obvious tragic event of 9/11. What is has happened here with the credit crisis is while the economy was by no means booming, it was kind of rolling along and we almost think that what typically would have taken six, seven, eight, 9, 12 months to start to come down happened almost literally overnight. If you think about the ISM being in a flat 49-ish, 50 range for many, many months throughout the year to have it swoon as it did in September at 43, which, by the way, as I am sure you know is at 9/11 levels. From all the time that the ISM has been tracked, I don't believe it's been a point where the ISM measurement ever dropped off the cliff as fast. Even pre-9/11, the ISM was drifting downward to ultimately hit that level but it was not at kind of the steady state where it was, which is, you know, with the slower economy but, frankly, with the latest measurements showing was that things fell off a cliff.

One more thing to also note that our customer base is much more diversified [from the 9/11 period]. Very different from back then. We were just getting started with our large customer segment, for example, when where today the large customer segment is a much larger and vibrant part of our growth equation and that will, as it's already shown, will help to diversify us from that small to midsize manufacturing customer where the pressure on them is just enormous.

emphasis added

LIBOR Continues to Decline

by Calculated Risk on 10/21/2008 09:37:00 AM

From the WSJ: Libor's Move Downward Continues

According to data from the British Bankers' Association, three-month U.S. dollar Libor dropped to 3.83375%, the lowest since September 26, from Monday's fixing of 4.05875%. The rate has shed nearly 100 basis points since peaking at 4.81875% on October 10.The TED spread has dropped to 2.61 this morning. This is still above the peaks of the previous waves of the credit crisis: in August 2007 the TED spread peaked at around 2.4, in Dec 2007 at about 2.2, and in March of 2008 at just over 2.0. There is still a long way to go.

The one-month rate fell to 3.5275% Tuesday from Monday's 3.75125%.

...

The three-month BOR/OIS spread narrowed to 271.4 basis points from around 293 basis points Monday as tensions eased.

Also this just shows some loosening in the credit markets - an important step - but the economic data in general suggests the U.S. recession is still getting worse.

National City, Fifth Third, KeyCorp Post Losses

by Calculated Risk on 10/21/2008 09:26:00 AM

From Bloomberg: National City, Fifth Third, KeyCorp Post Losses on Bad Loans

National City posted a $729 million loss and set plans to cut 4,000 jobs, or 14 percent of the workforce, according to a statement today. Fifth Third said it may ask to be included in the Treasury's plan to buy stakes in U.S. banks, and KeyCorp will limit new student loans and scale back lending for boats and recreational vehicles.The confessional is still busy, especially for regional banks.

...

Fifth Third in Cincinnati ... reported a loss of $56 million ... and Cleveland-based KeyCorp's loss was $36 million ...

Federal Reserve announces Money Market Funding Facility

by Calculated Risk on 10/21/2008 09:20:00 AM

It had been a few days without a day new Fed funding facility ...

From the Fed: Federal Reserve announces the creation of the Money Market Investor Funding Facility (MMIFF)

The Federal Reserve Board on Tuesday announced the creation of the Money Market Investor Funding Facility (MMIFF), which will support a private-sector initiative designed to provide liquidity to U.S. money market investors.

Under the MMIFF, authorized by the Board under Section 13(3) of the Federal Reserve Act, the Federal Reserve Bank of New York (FRBNY) will provide senior secured funding to a series of special purpose vehicles to facilitate an industry-supported private-sector initiative to finance the purchase of eligible assets from eligible investors. Eligible assets will include U.S. dollar-denominated certificates of deposit and commercial paper issued by highly rated financial institutions and having remaining maturities of 90 days or less. Eligible investors will include U.S. money market mutual funds and over time may include other U.S. money market investors.

Graphs: Housing Starts and Builder Confidence

by Calculated Risk on 10/21/2008 12:41:00 AM

Here are the graphs for housing starts and builder confidence based on the data released while out I was out hiking last week. Click on graph for larger image in new window.

Click on graph for larger image in new window.

Total housing starts were at an annual pace of 817K units in September, the lowest rate since Jan 1991 (798K SAAR).

Starts for single family structures (544K) were the lowest since Feb 1982 (541K). The Census Bureau has been tracking starts since Jan 1959, and the lowest month for single family structures was Oct 1981 (523K units SAAR) - so it is possible that a new record low will be set in October 2008.  The second graph shows the builder confidence index from the National Association of Home Builders (NAHB).

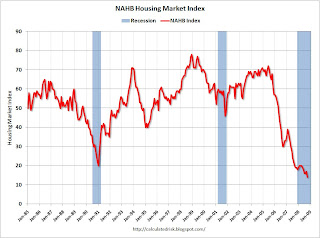

The second graph shows the builder confidence index from the National Association of Home Builders (NAHB).

Builder confidence index was at a record low in October.

Usually housing bottoms look like a "V"; this one will probably look more like an "L". (this refers to activity like starts and sales, but will probably also be apparent in the confidence survey).

Report: Iceland to Accept IMF Bailout

by Calculated Risk on 10/21/2008 12:11:00 AM

From The Times: Iceland agrees emergency $6bn deal with IMF

The credit crunch claimed its first sovereign scalp last night as Iceland readied itself to accept an International Monetary Fund (IMF) bailout. ... The IMF may provide about $1 billion in emergency cash for Iceland with the balance lent by Norway, Sweden and Denmark and additional money possibly coming from Russia and Japan.Quite a fall for Iceland.

...

The IMF is likely to attach stringent conditions to the loan, including the stipulation that Iceland quickly deleverage its three nationalised banks Kaupthing, Landsbanki and Glitner.

Note: I'm back from my hiking trip in Zion and Bryce. I'll post a few pictures when I get a chance. Best to all.

Monday, October 20, 2008

Fitch: House Prices to Fall 10% over next 18 months

by Calculated Risk on 10/20/2008 05:31:00 PM

From the WSJ Real Time Economics: Fitch: Housing Prices Have 10% to Go Before Stabilizing

“Fitch’s analysis shows that the 29% rise in prices realized between 2004 and 2006 ... has been reversed. With prices returning to early 2004 levels, Fitch believes that most of the additional 10% decline ... will occur over the next eighteen months. Fitch then expects declines thereafter to moderate.”

DataQuick: SoCal home sales up, 50% of Sales from Foreclosures

by Calculated Risk on 10/20/2008 03:41:00 PM

From DataQuick: Southland home sales up, prices down; foreclosures now half the market (hat tip Peter Viles at L.A. Land)

Southern California home sales shot up by an unprecedented 65 percent last month from the dismal, record lows of a year ago, when a credit crunch slammed the brakes on home financing. September sales also posted a rare gain over August as price cuts lured more buyers. Foreclosure resales rose to half of all transactions.DataQuick shows median house prices have fallen significantly in SoCal, but these median prices are distorted by the mix of houses sold.

A total of 20,497 new and resale houses and condos closed escrow in the six-county Southland in September, up 5.8 percent from 19,366 in August and up 64.6 percent from 12,455 in September 2007, according to San Diego-based MDA DataQuick, a real estate information service.

Last month's sales were the highest for any month since December 2006 and the year-over-year gain was the highest for any month in DataQuick's statistics, which go back to 1988. However, last month's sales were still the second-lowest for any September since 1996 and were 17 percent below the 20-year sales average for that month.

...

"The pitifully low September 2007 sales numbers weren't tough to beat. More impressive was that this September's sales volume bucked the seasonal norm and rose above August. Steep price declines, especially inland, have improved housing affordability quite a bit and may keep sales levels well above the record lows we saw late last year and early this year. It will depend on the severity of this economic downturn," said John Walsh, MDA DataQuick president.

"You have to view last month's sales in the proper context," he cautioned. "They represent escrow closings, which reflect purchase decisions made in mid-to-late summer. That was before the dramatic worsening of the nation's economic crisis in recent weeks. Over the next few weeks our sales data will begin to show how the meltdown in financial markets this fall has impacted housing demand."

...

Fifty percent of all existing homes that closed escrow in September had been foreclosed on at some point in the prior year. That's up from 45.5 percent in August and 12.6 percent in September last year.

At the county level, such foreclosure resales ranged from 36.8 percent of September resales in Orange County to 68.9 percent in Riverside County. In Los Angeles County foreclosure resales were 39.1 percent of all resales; in San Diego 47.3 percent; San Bernardino 63.1 percent and in Ventura County 44.0 percent.

...

Indicators of market distress continue to move in different directions. Foreclosure activity is at or near record levels ...