by Calculated Risk on 10/16/2008 12:30:00 AM

Thursday, October 16, 2008

NY Times: House Prices Far From Bottom

From Vikas Bajaj at the NY Times provides an overview: Home Prices Seem Far From Bottom

Home prices across much of the country are likely to fall through late 2009, economists say, and in some markets the trend could last even longer depending on the severity of the anticipated recession.Yes, house prices are still too high.

In hard-hit areas like California, Florida and Arizona, the grim calculus is the same: More and more homes are going up for sale, but fewer and fewer people are willing or able to buy them.

Wednesday, October 15, 2008

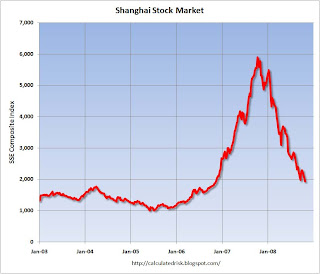

Asian Market Cliff Diving

by Calculated Risk on 10/15/2008 11:10:00 PM

Click on graph for larger image in new window.

Click on graph for larger image in new window.

The Shanghai SSE composite index has now lost more than two-thirds from the peak (still trading). This is the lowest level since late 2006.

And it's not just the Shanghai composite - it's an Asian market rout:

The Hang Seng is off 6.6%.

The Nikkei 225 is off 9.6%.

The Seoul Composite is off close to 6.8%.

CNN: Culprits of the Collapse

by Calculated Risk on 10/15/2008 09:17:00 PM

CNN is running a series called Culprits of the Collapse. They are naming their top ten culprits.

The problem I have with this piece is it centers on Greenspan's monetary policy and ignores Greenspan's far larger mistake; opposing oversight when many people were pointing out the extremely lax lending standards.

Bernanke: Fed may Consider Asset Bubbles

by Calculated Risk on 10/15/2008 06:03:00 PM

Here are a few comments from the Q&A. The official stance of the Fed has been to ignore asset bubbles - others have argued that the Fed must consider asset prices as part of monetary policy. This has been an area of significant research in recent years for obvious reasons.

Here are some comments from Greenspan in 2002 after the stock bubble:

If the bursting of an asset bubble creates economic dislocation, then preventing bubbles might seem an attractive goal. But whether incipient bubbles can be detected in real time and whether, once detected, they can be defused without inadvertently precipitating still greater adverse consequences for the economy remain in doubt.I don't think significant asset bubbles are really that hard to identify.

...

If the postmortem of recent monetary policy shows that the results of addressing the bubble only after it bursts are unsatisfactory, we would be left with less-appealing choices for the future. In that case, finding ways to identify bubbles and to contain their progress would be desirable, though history cautions that prospects for success appear slim.

Alan Greenspan, Issues for Monetary Policy, December 19, 2002

Here are Bernanke's comments from Bloomberg: Bernanke Weighs Limiting Consolidation, Asset Bubbles (hat tip James)

Federal Reserve Chairman Ben S. Bernanke said the central bank will consider discarding its long- standing aversion to interfering with asset-price bubbles and warned that the banking business may be concentrated in too few companies.

Officials should review how supervision and interest rates can minimize the ``dangerous phenomenon'' of bubbles in housing, stocks and other assets that risk bringing the financial system and economy down with them when they burst, Bernanke said.

``There is no doubt that as we emerge from the current crisis that we are all going to look very hard at that issue and what can be done about it,'' he told the Economic Club of New York in his broadest remarks on future regulatory changes since the credit crisis deepened last month.

S&P may downgrade $280 billion of Alt-A

by Calculated Risk on 10/15/2008 05:26:00 PM

From Bloomberg: S&P Reviews $280.1 Billion of Alt-A Mortgage Debt

Standard & Poor's said it may downgrade $280.1 billion of Alt-A mortgage securities, the most that the ratings company has identified in a single announcement for bonds backed by the loans.The beat goes on.

The debt may be cut in part because S&P has boosted estimates for losses on each foreclosure on Alt-A loans with at least five years of fixed rates to 40 percent, from 35 percent ...

``There has been a persistent rise in the level of delinquencies among the Alt-A mortgage loans supporting these transactions,'' S&P analysts Scott Davey and Ernestine Warner said in the statement.

More Cliff Diving Today

by Calculated Risk on 10/15/2008 04:16:00 PM

Dow off 7.9%

S&P 500 off 8.5%

NASDAQ off 9.0%

The recession is deepening (and was deepening before the most recent wave of the credit crisis). And there is no significant sign of improvement in the credit markets. All the economic news will be bad for some time ... and after the September retail report this morning, I expect Q3 PCE (to be released Oct 30th) to be strongly negative - and GDP to decline too.

Fed's Beige Book: "more pessimistic about the economic outlook"

by Calculated Risk on 10/15/2008 02:38:00 PM

Reports indicated that economic activity weakened in September across all twelve Federal Reserve Districts. Several Districts also noted that their contacts had become more pessimistic about the economic outlook.From the Fed Beige Book on real estate and construction:

Residential real estate and construction activity weakened or remained low in all Districts. ... Several Districts noted continuing downward price pressures and an increasing supply of homes for sale due to rising foreclosures.And for Commercial Real Estate (CRE):

Most Districts reported commercial real estate and construction activity had slowed, with New York, San Francisco and Dallas noting the sharpest declines. In contrast, Cleveland and St. Louis indicated steady activity. Increases in vacancy rates or sublease space were noted in Chicago, Boston, New York, Atlanta, and San Francisco. Several Districts reported project delays and cancellations due to tighter credit conditions and increased economic uncertainty.An ugly report.

Credit Crisis Indicators: Worse

by Calculated Risk on 10/15/2008 02:05:00 PM

This will be a daily post. Here are a few indicators I'm watching for progress on the credit crisis.

Here is a list of SFP sales. Two more $30 billion auctions announced today. NO PROGRESS.

Update:

Bob in MA sent me this:

The two year swap spread from Bloomberg: No progress.

Bernanke: Stabilizing the Financial Markets and the Economy

by Calculated Risk on 10/15/2008 12:19:00 PM

From Fed Chairman Ben Bernanke: Stabilizing the Financial Markets and the Economy. Excerpt on the economy:

Stabilization of the financial markets is a critical first step, but even if they stabilize as we hope they will, broader economic recovery will not happen right away. Economic activity had been decelerating even before the recent intensification of the crisis. The housing market continues to be a primary source of weakness in the real economy as well as in the financial markets, and we have seen marked slowdowns in consumer spending, business investment, and the labor market. Credit markets will take some time to unfreeze. And with the economies of our trading partners slowing, our export sales, which have been a source of strength, very probably will slow as well. These restraining influences on economic activity, however, will be offset somewhat by the favorable effects of lower prices for oil and other commodities on household purchasing power. Ultimately, the trajectory of economic activity beyond the next few quarters will depend greatly on the extent to which financial and credit markets return to more normal functioning.Bernanke is looking for longer term improvement - the next few quarters will be ugly for sure.

emphasis added

Jamie Dimon: "If you are not fearful, you're crazy"

by Calculated Risk on 10/15/2008 10:20:00 AM

Some excerpts from the JPMorgan conference call (hat tip Brian). Note: it is rumored that Dimon will be the new treasury secretary if Obama is elected President.

Meredith Whitney: I just want to be clear in terms of the decline in originations on your mortgage portfolio, was that more credit based or in terms of tightening underwriting standards or LIBOR challenge?

Jamie Dimon: The origination business, and I think it's true for a lot of people in the industry, Meredith, people have gone back to old fashioned 80% LTV, real verified income, more disciplined appraisals, and then in some areas they won't even go to 85% LTV because of expected home decreases so we are not at 85% in California, Nevada, or Florida we're at 65. So that's why it's down. I think it's true for us and everybody else. Almost everything being originated is eligible for Fannie Mae, Freddie Mac, or FHA. So therefore you have this great reduction. Obviously the quality of that stuff is going to be much higher.

Meredith Whitney: Thank you for that. My follow-up, given the fact that the industry is pulling back credit across the board is that sort of a chicken and egg question, are you seeing areas where you've pulled back credit deteriorating much further? Obviously the sand states are experiencing the most deterioration but have you given an example of seeing all your competitors being a catalyst for deteriorating credit?

Jamie Dimon: I think the answer is yes but we'll never really know ... Let me make general comments about a crisis like this. One of the things that happens which I think the government is to cushion on, a lot of individual actors. I am talking about you as investors, banks as providers of credit, individuals, small businesses, large businesses, all start to take actions that are rationale for them as an individual or corporation, but in total, can cause exactly what you are talking about. And that's one of the things that the government is trying to reverse. Not just the banks. It's the individuals who invest in banks, people who provide capital to other financial institutions, moving money back overseas, so you do see a little bit of that, and they are trying to arrest that. That is the one thing that's got people most scared and they are trying to stop it. Like I said before I think what the government is doing is pretty powerful medicine. I say the governments around the world is pretty powerful medicine, and I think will you start to see some beneficial effect of that in the next couple weeks.

Meredith Whitney: if you really believed that you'd buyingbeginningcredit card lines, right?

Jamie Dimon: ... we are buying slightly more risky assets and we're growing our businesses everywhere so we're not panicking. Credit card receivables are up. We are not pulling out of California . We're still marketing. Obviously we try and modify what's going on, but we are not going to say, yahoo this is over, extend credit liake we did without fear. If you are not fearful, you're crazy.

Meredith Whitney: I'm fearful.

Jamie Dimon: we know you are. We're waiting for you to reverse your position.

William Tanona: Some of the other investment banks provided some pretty good color in terms of where they have certain assets marked within their investment bank. Just wonder if you guys would be willing to provide that same level of detail across prime, alt-A, prime, subprime.

Jamie Dimon: Leverage loans we did [took marks of 29% on total commitments], and I'll give you some numbers now. Ready? Prime, loans is not really applicable. Alt-A performing about mid 70s, nonperforming 40s. That's loans. Alt-A securities, high 20s. Subprime mid-30s. CMBS mid-80s, that's all we are going to give you because it's competitive information.

emphasis added