by Calculated Risk on 10/15/2008 09:14:00 AM

Wednesday, October 15, 2008

NY Fed: Manufacturing conditions "deteriorated significantly in October"

From the NY Fed: Empire State Manufacturing Survey

The Empire State Manufacturing Survey indicates that conditions for New York manufacturers deteriorated significantly in October. The general business conditions index dropped 17 points to a record-low -24.6. The new orders index also fell to a record low, and the indexes for shipments, unfilled orders, and inventories all declined sharply. The prices paid index eased significantly, to its lowest level of the year, while the prices received index also fell, although less sharply. Employment indexes were negative. Future indexes declined markedly with exceptionally large declines in the future new orders and shipments indexes.Talk about cliff diving.

emphasis added

Retail Sales Decline Sharply in September

by Calculated Risk on 10/15/2008 08:30:00 AM

The Census Bureau reports that retail sales plunged in September:

The U.S. Census Bureau announced today that advance estimates of U.S. retail and food services sales for September, adjusted for seasonal variation and holiday and trading-day differences, but not for price changes, were $375.5 billion, a decrease of 1.2 percent from the previous month and 1.0 percent below September 2007.The following graph shows the year-over-year change in nominal and real retail sales since 1993.

Click on graph for larger image in new window.

Click on graph for larger image in new window.To calculate the real change, the monthly PCE price index from the BEA was used (September PCE prices were estimated based on the increases for the last 3 months).

Although the Census Bureaureported that nominal retail sales decreased 1.0% year-over-year (retail and food services decreased 1.0%), real retail sales declined by 4.3% (on a YoY basis).

The stimulus checks appeared to help consumer spending in Q2, but Q3 is very weak. This weakness in retail sales is probably because of the weak job market and less mortgage equity withdrawal (MEW) by homeowners (the Home ATM is empty!).

Retail sales are a key portion of consumer spending and real retail sales are now clearly in recession.

Tuesday, October 14, 2008

Fed's Yellen: "U.S. economy appears to be in a recession"

by Calculated Risk on 10/14/2008 11:31:00 PM

From San Francisco Fed President Janet Yellen: The Financial System and the Economy. Here are Dr. Yellen's comments on the economy:

The recent flow of economic data suggests that the economy was weaker than expected in the third quarter, probably showing essentially no growth at all. Growth in the fourth quarter appears to be weaker yet, with an outright contraction quite likely. Indeed, the U.S. economy appears to be in a recession.That is pretty much a clean sweep. All sectors are now slowing or in recession (except possibly government spending).

...

By now, virtually every major sector of the economy has been hit by the financial shock. I’ll start with consumer spending, where the news has not been good. Employment has now declined for nine months in a row, and personal income, in inflation-adjusted terms, is virtually unchanged since April. Household wealth is substantially lower as house prices have continued to slide and the stock market has declined sharply. On top of this, consumer credit is costlier and harder to get: loan rates are up, loan terms are tougher, and increasing numbers of borrowers are being turned away entirely. Even before the extraordinary deterioration in financial market conditions over the past few weeks, the evidence was accumulating that consumer spending had weakened. In real terms, consumer spending was flat or contracted in recent months.

...

Business spending, too, is feeling the crunch, as firms face weak final demand for their products, a higher cost of capital, and restricted credit. ... We’ve even begun to see some signs of a slowdown for the previously very strong IT industry across the country and in the Bay Area in particular. ... A tech slowdown could intensify with the fall-off in consumer spending, and the weakening in business spending could come into play since the financial industry is a heavy user of both IT equipment and software.

...

Nonresidential construction is another sector that has been affected by the financial crisis, in part because the market for commercial mortgage-backed securities, a mainstay for financing large projects, has all but dried up. ... With financing unavailable, I’m hearing talk about substantial cutbacks on new projects and planned capital improvements on existing buildings.

...

Until recently, we have received a major boost from exporting goods and services to our trading partners. Unfortunately, the news on foreign demand has also turned weaker. Economic growth in the rest of the world, particularly in Europe and Japan, has slowed for a number of reasons, including spillovers from the U.S. slowdown, and most importantly, the financial meltdown that now has intensified substantially in Europe and elsewhere. ... As a result, exports will not provide as much of an impetus to growth as they did earlier in the year.

emphasis added

GMAC Limits Loans to Buyers with 700+ FICO Scores

by Calculated Risk on 10/14/2008 10:38:00 PM

From Bloomberg: GMAC's Lending Limits May Add to GM's U.S. Sales Woes (hat tip Justin)

GMAC said yesterday it's granting financing only to buyers with scores of at least 700, who represent about 58 percent of U.S. consumers. The Detroit-based company, now controlled by Cerberus Capital Management LP, provided 43 percent of GM's second-quarter auto loans.Tighter credit equals fewer sales. This remains me of the old saying (that is true during a credit crunch): Bankers only lend money to people who don't need it.

WSJ: Some Signs of Credit Thaw

by Calculated Risk on 10/14/2008 10:18:00 PM

From the WSJ: Credit Shows Signs of Easing on Bank Rescue

The overnight dollar London interbank offered rate, or Libor, which reflects bank borrowing costs, fell to 2.18% on Tuesday from 2.47% the previous day. But the three-month Libor, a benchmark for many mortgages and corporate loans, remained high at 4.6%.This is a very small improvement.

Data is only available weekly for some of the indicators of credit stress (see Credit Crisis: Watching for Signs of Progress), but the 3-month treasury and TED spread showed only small improvements.

The yield on 3 month treasuries rose slightly to 0.235%. I'm looking for less daily volatility and for the yield to move up closer to the Fed funds rate, or above 1.25%.

The TED spread declined to 4.30 from 4.64 on Friday. This is still far above the highs reached during the previous waves of the credit crisis. I'm looking for the TED spread to decline below 2.0 (0.5 is normal).

Also the Treasury announced another $45 billion Supplementary Financing Program (SPF) auction to support the Fed. If this program slows down borrowing, I think that would be a good sign.

There was some slight improvement today.

The First Great Depression

by Calculated Risk on 10/14/2008 06:15:00 PM

A little humor - Jon Stewart intro (31 seconds).

And the Decabox (4 min 37 sec), the last minute is very funny ...

LA Times: Retailers cutting back on holiday hiring

by Calculated Risk on 10/14/2008 04:31:00 PM

Andrea Chang at the LA Times writes: Retailers cutting back on holiday hiring

A recent survey of more than 1,000 managers responsible for hiring hourly workers found that each manager planned on hiring an average of 3.7 seasonal employees this year, roughly 33% less than the 5.6 workers they hired during last year's holiday period.

...

Last year there were 618,000 holiday hires in the retail sector in November and December, according to the National Retail Federation [NRF]. But that number is likely to be significantly lower this year, said Daniel Butler, vice president of retail operations with the group.

He predicted that holiday hiring numbers would drop to 2001 levels, when consumers reined in their spending after 9/11. Retailers made just 402,500 holiday hires that year.

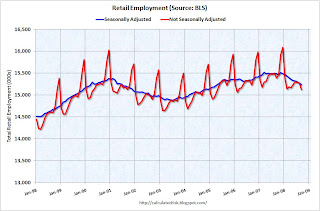

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the Seasonally Adjusted (SA) and Not Seasonally Adjusted (NSA) retail employment from the Bureau of Labor Statistics (BLS).

NOTE: Y-axis doesn't start at zero to better show the change.

Usually retailers start hiring seasonal workers in October (maybe 15% of the temporary holiday workforce) and add over 700 thousand total seasonal employees. Based on the above survey and the forecast from the NRF, retailers will probably only add around 400 to 450 thousand seasonal employees this holiday season.

In early 2007, I was repeatedly asked "Where is the consumer bust?" I answered: "This is just Act II ... but if the play unfolds as I suspect it might, Hamlet dies in Act V". The consumer would be the last to go.

Well, Hamlet is now dead. The consumer recession has arrived just in time for the holidays.

Roubini Sees Worst Recession in 40 Years

by Calculated Risk on 10/14/2008 02:57:00 PM

Click image for video. |

From Bloomberg: Roubini Sees Worst Recession in 40 Years, Rally's End

Nouriel Roubini, the professor who predicted the financial crisis in 2006, said the U.S. will suffer its worst recession in 40 years, causing the rally in the stock market to ``sputter.''

``There are significant downside risks still to the market and the economy,'' Roubini, 50, a New York University professor of economics, said in an interview with Bloomberg Television. ``We're going to be surprised by the severity of the recession and the severity of the financial losses.''

The economist said the recession will last 18 to 24 months, driving unemployment to 9 percent, and already depressed home prices will fall another 15 percent.

...

``The stock market is going to stop rallying soon enough when they see the economy is really tanking,'' Roubini added.

Up in Smoke?

by Calculated Risk on 10/14/2008 12:53:00 PM

The front page (pdf) of the LA Times offers this amusing juxtaposition of the bailout and the California wildfires (hat tip Jim)

Click on photo for larger image in new window.

Research: Housing Busts and Household Mobility

by Calculated Risk on 10/14/2008 12:01:00 PM

Early this year I wrote:

Less worker mobility [due to negative equity] is kind of like arteriosclerosis of the economy. It lowers the overall growth potential.In a new research paper, Fernando Ferreira, Joseph Gyourko (both from Wharton) and Joseph Tracy (New York Fed) quantify the impact of negative equity on household mobility: Housing Busts and Household Mobility, NBER, © 2008

Perhaps as many as 15 to 20 million households will be saddled with negative equity by 2009. Even if most of these homeowners don't "walk away", there might still be a negative impact on the economy due to less worker mobility.

How do housing busts affect residential mobility? The current market downturn has raised fears that local communities will suffer as social capital is depleted due to foreclosures forcing defaulting homeowners to move. One recent media report indicates that 220,000 homes were lost to foreclosure just during the second quarter of 2008, which is nearly triple the number over the same time period in 2007. Default-induced moves always are the first mobility-related impact observed during a downturn, but they need not be the last or the most importantly economically. In fact, much previous research indicates that factors such as falling home prices or rising interest rates that typically are associated with housing market declines can ‘lock-in’ people to their homes—reducing, not raising mobility.And their conclusion:

Having negative equity in one’s home reduces mobility rates ... by nearly 50 percent from its baseline level according to our estimates. That the net impact of negative equity is to reduce, not raise, mobility certainly does not mean that defaults and foreclosures are insignificant consequences of this condition. However, it does signify that the preponderant effect is for owners to remain in their homes for longer periods of time, not to default and move to another residence.The economic impact from less household mobility isn't quantified in the paper.

Finally, reduced mobility has its own unique set of consequences which have not been clearly identified or discussed in the debate about the current housing crisis. Substantially lower household mobility is likely to have various social costs including poorer labor market matches, diminished support for local public goods, and lesser maintenance and reinvestment in the home.

emphasis added

To size the problem: According to the Census Bureau, from 2005 to 2006, approximately 1.7 million owner-occupied households, moved to a different county or state. If approximately 1 in 6 households (the same proportion as with negative equity according to Moody's) will not accept a transfer now because of depressed home values that would be almost 300,000 households per year that will be reluctant to accept job transfers.

This will not only impact the earning potential of these households, but this could also impact the performance of various companies. A significant majority of households that migrate have incomes above the median - and negative equity situations will limit the ability of companies to transfer these senior employees. Less household mobility could be a signficant drag on the economy for several years.