by Calculated Risk on 10/10/2008 10:34:00 AM

Friday, October 10, 2008

Market Take from Cartoonist Eric G. Lewis

President Bush to Speak at 10:30 AM ET

by Calculated Risk on 10/10/2008 09:34:00 AM

Markets are cliff diving.

Dow is was down below 8000. Update: Now up to 8400 (expect volatilty!)

The Bush news conference is scheduled for 10 AM 10:30 AM.

Here is the CNBC feed.

And a live feed from C-SPAN.

Volcker: We Have the Tools to Manage the Crisis

by Calculated Risk on 10/10/2008 09:01:00 AM

Former Fed Chairman Paul Volcker writes in the WSJ: We Have the Tools to Manage the Crisis Excerpts:

Today, the financial crisis has reached a critical point. .... For months, the real economy, apart from housing, had not been much affected by the developing crisis. Now, a full-scale recession appears unavoidable. ...Volcker has been warning about these problems for years, and he clearly believes we have the tools to "manage" the crisis. But do we have the leadership? The 2nd headline to his piece is: "Now we need the leadership to use them."

Those are facts.

They are the culmination of economic imbalances, a succession of financial bubbles and financial crises that have been building for years. It's no wonder that confidence in markets, banks, and financial management has been badly eroded. Without effective action, fear might take hold, threatening orderly recovery.

Fortunately, there is also good reason to believe that the means are now available to turn the tide. Financial authorities, in the United States and elsewhere, are now in a position to take needed and convincing action to stabilize markets and to restore trust.

First of all, there is now clear recognition that the problem is international, and international coordination and cooperation is both necessary and underway. The days of finger pointing and schadenfreude are over. The concerted reduction in central bank interest rates is one concrete manifestation of that fact.

More important in existing circumstances is the clear determination of our Treasury, of European finance ministries, and of central banks to support and defend the stability of major international banks. That approach extends to providing fresh capital to supplement private funds if necessary.

...

The inevitable recession can be moderated. The groundwork can be laid for reconstructing the financial system and the regulatory and supervisory arrangements from the bottom up. The extraordinary interventions by the government (and taxpayer) should be ended as soon as reasonably feasible.

That rebuilding will be the job of another day ...

There is, and must be, recognition of the essential role that free and competitive financial markets play in a vigorous, innovative economic system. There needs to be understanding, in that context, that financial ups and downs -- and financial crises -- will be inevitable, even with responsible economic policies and sensible regulation. But never again should so much economic damage be risked by a financial structure so fragile, so overextended, so opaque as that of recent years.

Financial Crisis: A Global Response?

by Calculated Risk on 10/10/2008 06:04:00 AM

Mark Landler and Edmund Andrews write in the NY Times: Nations Weighing Global Approach as Chaos Spreads

The United States and Britain appear to be converging on a similar blueprint for stemming the financial chaos sweeping the world, one day before a crucial meeting of leaders begins in Washington that the White House hopes will result in a more coordinated response.Here is the proposal from Prime Minister Gordon Brown in The Times: We must lead the world to financial stability.

The British and American plans, though far from identical, have two common elements according to officials: injection of government money into banks in return for ownership stakes and guarantees of repayment for various types of loans.

However according to the NY Times article, it sounds like the U.S. has only begun to consider these options:

One senior administration official argued that expecting an agreement on proposals like Mr. Brown’s would be “irrationally raising expectations.”Less developed than the Paulson plan? That plan was never clearly explained.

...

The White House confirmed that the Treasury Department was considering taking ownership positions in banks as part of its $700 billion rescue package. But officials said the idea was less developed than the plan to buy distressed assets from banks through “reverse auctions.”

The WSJ suggests: U.S. Weighs Backing Bank Debt

The U.S. is weighing two dramatic steps to repair ailing financial markets: guaranteeing billions of dollars in bank debt and temporarily insuring all U.S. bank deposits.Professor Krugman calls this weekend a Moment of Truth:

...

Under the U.K.'s recently announced plan, which it is now pitching to the G-7 members, the British government would guarantee up to £250 billion ($432 billion) in bank debt maturing up to 36 months. The British concept to expand its proposal to other countries has a lot of support from Wall Street and is being pored over by U.S. officials, according to people familiar with the matter.

[K]ey policy players have largely wasted the past four weeks. Now they’ve reached a moment of truth: They’d better do something soon — in fact, they’d better announce a coordinated rescue plan this weekend — or the world economy may well experience its worst slump since the Great Depression.

...

What should be done? The United States and Europe should just say “Yes, prime minister.” The British plan isn’t perfect, but there’s widespread agreement among economists that it offers by far the best available template for a broader rescue effort.

And the time to act is now. You may think that things can’t get any worse — but they can, and if nothing is done in the next few days, they will.

Thursday, October 09, 2008

Dr. Evil and Mini-Me

by Calculated Risk on 10/09/2008 08:57:00 PM

Just in good fun ... (hat tip NoVAOnlooker)

|  |

| See: Bailout Role Elevates U.S. Official | |

| Hank Paulson ("Dr. Evil") | Neel Kashkari ("Mini-Me") |

Gordon Brown: Follow Our Lead

by Calculated Risk on 10/09/2008 07:36:00 PM

Before the G7 meets in Washington tomorrow, British Prime Minister Gordon Brown writes in The Times: We must lead the world to financial stability. Excerpts:

The stability and restructuring programme for Britain that we announced this week is the first to address at one and the same time the three essential components of a modern banking system - sufficient liquidity, funding and capital.

So the Bank of England has pledged to double the amount of liquidity it provides to the banks; we have guaranteed new lending between the banks so that we can get the banks lending to each other again; and at least £50 billion will be made available to recapitalise our banks.

We will take stakes in banks in exchange for a return and will guarantee interbank lending on commercial terms. And at the heart of these reforms are clear principles of transparency, integrity, responsibility, good housekeeping and co-operation across borders.

But because this is a global problem, it requires a global solution. Indeed this now moves to a global stage with a range of international meetings starting this week with the G7 and the IMF and, we propose, culminating in a leaders meeting in which we must lay down the principles and the new policies for restructuring our banking and financial system all around the globe.

... I believe through wider European co-operation and also co-ordination among the leading economies, there are four broad steps we must now all take to restore our international financial system.

First, every bank in every country must meet capital requirements that ensure confidence. Just as in the UK we have made at least £50 billion of new capital available, so other countries where banks have insufficient capital will need to take measures to address this. Only strong and solid banks will be able to serve the global economy.

Secondly, short-term liquidity is simply a means of keeping the system going. What really matters for the future is to open the money markets that have been closed for medium-term funding from the private sector. ...

Thirdly, we must have stronger international rules for transparency, disclosure and the highest standards of conduct. ...

And fourthly, national systems of supervision are simply inadequate to cope with the huge cross-continental flows of capital in this new, ever more interdependent world. ...

Trade Deficit and Oil

by Calculated Risk on 10/09/2008 07:06:00 PM

Something a little different ...

Tomorrow morning the Department of Commerce will release the trade deficit report for August. Some people might be looking at this report to see the impact of falling oil prices and slowing export growth.

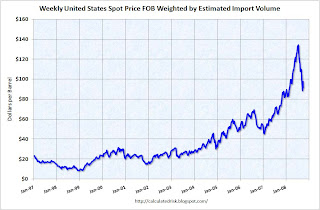

It is helpful to remember that oil prices peaked in July, but there is a lag between spot price and import prices. Therefore I expect import oil prices to be a little higher for August than July. Click on table for larger image in new window.

Click on table for larger image in new window.

This graph, based on data from the EIA, shows the weekly spot prices for oil weighted by import volume.

I expect that the collapse in oil prices will not show up until the September trade deficit report.

Oil prices fell even further today, from the AP: Demand destruction: Oil prices drop to 1-year low.

And export growth may be slowing, but I don't expect to see much evidence in the August report. If we look at container traffic at the Los Angeles area ports, exports were still strong in August.

So the trade deficit tomorrow probably won't show either the impact from falling oil prices or slowing export growth. Just something to remember when we read the news reports.

Citi: Will Not Ask that Wells Fargo-Wachovia merger be enjoined

by Calculated Risk on 10/09/2008 05:49:00 PM

From the WSJ: Text of Citi Statement on Wachovia Deal

Citi announced today that it had reached no agreement with Wells Fargo following several days of discussions about matters related to Wachovia. The dramatic differences in the parties' transaction structures and their views of the risks involved made it impossible to reach a mutually acceptable agreement.The key points are: the negotiation is over, Citi will not try to stop the Wells acquisition of Wachovia, and Citi will pursue damages.

...

Citi believes that it has strong legal claims against Wachovia, Wells Fargo and their officers, directors, advisors and others for breach of contract and for tortious interference with contract. Citigroup plans to pursue these damage claims vigorously on behalf of its shareholders. However, Citigroup has decided not to ask that the Wells Fargo-Wachovia merger be enjoined.

More Cliff Diving Today: S&P Off 40% from Peak

by Calculated Risk on 10/09/2008 03:29:00 PM

The Dow Jones Industrial Average is now below 8900 8800 8700.

The S&P 500 is off 40% from the peak of last October.

Krugman says:

Stock prices are, however, the least of our worries. The money markets are frozen; the TED spread is 4.14%. (CR: now 4.23)

G7 meeting tomorrow, IMF-World Bank over the weekend. Now is the time for major action — an announcement of coordinated capital injections, liquidity measures, and more. If we’ve had nothing except vague assurances by Monday ...

Reuters: Treasury may recapitalize banks this month

by Calculated Risk on 10/09/2008 01:02:00 PM

From Reuters: Treasury may capitalize banks by end October: source

The U.S. Treasury Department plans to start directly injecting capital in U.S. banks as soon as the end of October in exchange for passive investment stakes according to a financial policy source familiar with Treasury Secretary Henry Paulson's thinking.Here we go ...

...

White House spokeswoman Dana Perino said later on Thursday that Paulson is "actively considering" capital injections into troubled U.S. banks.

...

The source familiar with Paulson's thinking said Treasury was working "extremely fast" to put together a capital injection plan ... the injections would likely be made public ...

Also Roubini explains: How authorization to recapitalize banks via public capital injections (“partial nationalization”) was introduced - indirectly through the back door - into the TARP legislation