by Calculated Risk on 10/09/2008 07:06:00 PM

Thursday, October 09, 2008

Trade Deficit and Oil

Something a little different ...

Tomorrow morning the Department of Commerce will release the trade deficit report for August. Some people might be looking at this report to see the impact of falling oil prices and slowing export growth.

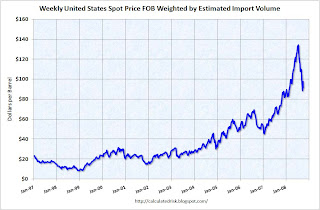

It is helpful to remember that oil prices peaked in July, but there is a lag between spot price and import prices. Therefore I expect import oil prices to be a little higher for August than July. Click on table for larger image in new window.

Click on table for larger image in new window.

This graph, based on data from the EIA, shows the weekly spot prices for oil weighted by import volume.

I expect that the collapse in oil prices will not show up until the September trade deficit report.

Oil prices fell even further today, from the AP: Demand destruction: Oil prices drop to 1-year low.

And export growth may be slowing, but I don't expect to see much evidence in the August report. If we look at container traffic at the Los Angeles area ports, exports were still strong in August.

So the trade deficit tomorrow probably won't show either the impact from falling oil prices or slowing export growth. Just something to remember when we read the news reports.