by Calculated Risk on 10/09/2008 08:57:00 PM

Thursday, October 09, 2008

Dr. Evil and Mini-Me

Just in good fun ... (hat tip NoVAOnlooker)

|  |

| See: Bailout Role Elevates U.S. Official | |

| Hank Paulson ("Dr. Evil") | Neel Kashkari ("Mini-Me") |

Gordon Brown: Follow Our Lead

by Calculated Risk on 10/09/2008 07:36:00 PM

Before the G7 meets in Washington tomorrow, British Prime Minister Gordon Brown writes in The Times: We must lead the world to financial stability. Excerpts:

The stability and restructuring programme for Britain that we announced this week is the first to address at one and the same time the three essential components of a modern banking system - sufficient liquidity, funding and capital.

So the Bank of England has pledged to double the amount of liquidity it provides to the banks; we have guaranteed new lending between the banks so that we can get the banks lending to each other again; and at least £50 billion will be made available to recapitalise our banks.

We will take stakes in banks in exchange for a return and will guarantee interbank lending on commercial terms. And at the heart of these reforms are clear principles of transparency, integrity, responsibility, good housekeeping and co-operation across borders.

But because this is a global problem, it requires a global solution. Indeed this now moves to a global stage with a range of international meetings starting this week with the G7 and the IMF and, we propose, culminating in a leaders meeting in which we must lay down the principles and the new policies for restructuring our banking and financial system all around the globe.

... I believe through wider European co-operation and also co-ordination among the leading economies, there are four broad steps we must now all take to restore our international financial system.

First, every bank in every country must meet capital requirements that ensure confidence. Just as in the UK we have made at least £50 billion of new capital available, so other countries where banks have insufficient capital will need to take measures to address this. Only strong and solid banks will be able to serve the global economy.

Secondly, short-term liquidity is simply a means of keeping the system going. What really matters for the future is to open the money markets that have been closed for medium-term funding from the private sector. ...

Thirdly, we must have stronger international rules for transparency, disclosure and the highest standards of conduct. ...

And fourthly, national systems of supervision are simply inadequate to cope with the huge cross-continental flows of capital in this new, ever more interdependent world. ...

Trade Deficit and Oil

by Calculated Risk on 10/09/2008 07:06:00 PM

Something a little different ...

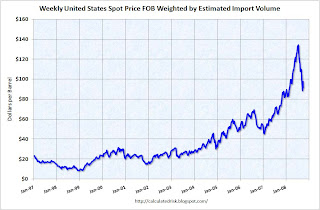

Tomorrow morning the Department of Commerce will release the trade deficit report for August. Some people might be looking at this report to see the impact of falling oil prices and slowing export growth.

It is helpful to remember that oil prices peaked in July, but there is a lag between spot price and import prices. Therefore I expect import oil prices to be a little higher for August than July. Click on table for larger image in new window.

Click on table for larger image in new window.

This graph, based on data from the EIA, shows the weekly spot prices for oil weighted by import volume.

I expect that the collapse in oil prices will not show up until the September trade deficit report.

Oil prices fell even further today, from the AP: Demand destruction: Oil prices drop to 1-year low.

And export growth may be slowing, but I don't expect to see much evidence in the August report. If we look at container traffic at the Los Angeles area ports, exports were still strong in August.

So the trade deficit tomorrow probably won't show either the impact from falling oil prices or slowing export growth. Just something to remember when we read the news reports.

Citi: Will Not Ask that Wells Fargo-Wachovia merger be enjoined

by Calculated Risk on 10/09/2008 05:49:00 PM

From the WSJ: Text of Citi Statement on Wachovia Deal

Citi announced today that it had reached no agreement with Wells Fargo following several days of discussions about matters related to Wachovia. The dramatic differences in the parties' transaction structures and their views of the risks involved made it impossible to reach a mutually acceptable agreement.The key points are: the negotiation is over, Citi will not try to stop the Wells acquisition of Wachovia, and Citi will pursue damages.

...

Citi believes that it has strong legal claims against Wachovia, Wells Fargo and their officers, directors, advisors and others for breach of contract and for tortious interference with contract. Citigroup plans to pursue these damage claims vigorously on behalf of its shareholders. However, Citigroup has decided not to ask that the Wells Fargo-Wachovia merger be enjoined.

More Cliff Diving Today: S&P Off 40% from Peak

by Calculated Risk on 10/09/2008 03:29:00 PM

The Dow Jones Industrial Average is now below 8900 8800 8700.

The S&P 500 is off 40% from the peak of last October.

Krugman says:

Stock prices are, however, the least of our worries. The money markets are frozen; the TED spread is 4.14%. (CR: now 4.23)

G7 meeting tomorrow, IMF-World Bank over the weekend. Now is the time for major action — an announcement of coordinated capital injections, liquidity measures, and more. If we’ve had nothing except vague assurances by Monday ...

Reuters: Treasury may recapitalize banks this month

by Calculated Risk on 10/09/2008 01:02:00 PM

From Reuters: Treasury may capitalize banks by end October: source

The U.S. Treasury Department plans to start directly injecting capital in U.S. banks as soon as the end of October in exchange for passive investment stakes according to a financial policy source familiar with Treasury Secretary Henry Paulson's thinking.Here we go ...

...

White House spokeswoman Dana Perino said later on Thursday that Paulson is "actively considering" capital injections into troubled U.S. banks.

...

The source familiar with Paulson's thinking said Treasury was working "extremely fast" to put together a capital injection plan ... the injections would likely be made public ...

Also Roubini explains: How authorization to recapitalize banks via public capital injections (“partial nationalization”) was introduced - indirectly through the back door - into the TARP legislation

Iceland seizes Kaupthing, Closes Stock Exchange

by Calculated Risk on 10/09/2008 11:16:00 AM

“What we have learned from this whole exercise over the last few years is that it is not wise for a small country to try to take a leading role in international banking.”Update from Reuters: Iceland PM asks public not to take out lots of cash

Geir Haarde, Prime Minister of Iceland

"I want to emphasise ... that people remain calm and understand that the transaction system is fully functioning and deposits are safe," Haarde said.From The Times: Iceland seizes Kaupthing as meltdown continues

"I also ask the public not to withdraw large sums of money from the banks. It will make things more difficult."

Crisis-hit Iceland has taken control of Kaupthing, its biggest bank, and suspended trading on its stock exchange for two days.

With the nationalisation of Kaupthing, the Icelandic Government now has control of all three of the country's big banks — Kaupthing, Landsbanki and Glitnir ...

The OMX Nordic Exchange Iceland said it will not re-open until Monday, due to “unusual market conditions." Meanwhile trading in the Icelandic crown ground to a halt.

Good Morning

by Anonymous on 10/09/2008 09:52:00 AM

I will have you know I had a cup of coffee this morning. For the first time in about a month. I am sure that any of you long-term caffeine addicts who have ever had to quit cold turkey for an extended period of time will understand why this fact demands celebration. For me, for the rest of my days, "PPI" will no longer mean Producer Price Index--who cares about that?--but Proton Pump Inhibitor, which is a wonder drug.

At any rate, while I still lack the key qualities of a decent blogger--energy, wit, intelligence, stamina, the attention span God gave a rutabaga--I wanted you to know that I'm still here and in the process of crawling out from under a nasty bout of weather. Who knows but what I might even have something actually relevant to say in the near future? Bear with me, forgive my absence, and I'll try to ease myself back in to regular blogging.

To all of you who have sent messages and inquiries to me and to CR, let me say that your kindness and warmth has meant a great deal. The Pig and I are grateful. (OK, well, mostly me, but the Pig tries to be grateful.)

Now, back to the TED Spread . . .

TED Spread at Record

by Calculated Risk on 10/09/2008 09:05:00 AM

Here is the TED Spread from Bloomberg. The TED spread hit a record 4.13 this morning. This is far above the highs reached during the previous waves of the credit crisis.

Note: the TED spread is the difference between the LIBOR interest rate and the three month T-bill. Usually the TED spread is less than 0.5%. The higher the spread, the greater the perceived credit risks (compared to "risk free" treasuries).

From Bloomberg: Libor Dollar Rate Jumps to Highest in Year; Credit Stays Frozen

The cost of borrowing in dollars for three months in London soared to the highest level this year as coordinated interest-rate reductions worldwide failed to revive lending among banks for any longer than a day.The credit markets are still in severe distress.

...

The London interbank offered rate, or Libor, for three-month loans rose to 4.75 percent today, the highest level since Dec. 28. The Libor-OIS spread, a measure of cash scarcity, widened to a record.

NY Times: Recapitalization Plan Being Considered

by Calculated Risk on 10/09/2008 12:45:00 AM

From the NY Times: U.S. May Take Ownership Stake in Banks

Having tried without success to unlock frozen credit markets, the Treasury Department is considering taking ownership stakes in many United States banks to try to restore confidence in the financial system ...This would essentially be the plan supported by most economists.

Treasury officials say the just-passed $700 billion bailout bill gives them the authority to inject cash directly into banks that request it. Such a move would quickly strengthen banks’ balance sheets and, officials hope, persuade them to resume lending. In return, the law gives the Treasury the right to take ownership positions in banks, including healthy ones.

The proposal resembles one announced on Wednesday in Britain.