by Calculated Risk on 10/08/2008 08:28:00 AM

Wednesday, October 08, 2008

Fed Funds Rate Cut 50 bps, Global Rate Cuts

Some easing of global monetary conditions is therefore warranted. Accordingly, the Bank of Canada, the Bank of England, the European Central Bank, the Federal Reserve, Sveriges Riksbank, and the Swiss National Bank are today announcing reductions in policy interest rates. The Bank of Japan expresses its strong support of these policy actions.

...

The Federal Open Market Committee has decided to lower its target for the federal funds rate 50 basis points to 1-1/2 percent. The Committee took this action in light of evidence pointing to a weakening of economic activity and a reduction in inflationary pressures.

Incoming economic data suggest that the pace of economic activity has slowed markedly in recent months. Moreover, the intensification of financial market turmoil is likely to exert additional restraint on spending, partly by further reducing the ability of households and businesses to obtain credit. Inflation has been high, but the Committee believes that the decline in energy and other commodity prices and the weaker prospects for economic activity have reduced the upside risks to inflation.

UK: £50 Billion Recapitalisation, £200 Billion Special Liquidity Schemes

by Calculated Risk on 10/08/2008 02:39:00 AM

Chancellor Alistair Darling statement:

After consultation with the Bank of England and the Financial Services Authority, the Government announces that it is bringing forward specific and comprehensive measures to ensure the stability of the financial system and to protect ordinary savers, depositors, businesses and borrowers.

In summary the proposals announced today are intended to:Provide sufficient liquidity in the short term; Make available new capital to UK banks and building societies to strengthen their resources permitting them to restructure their finances, while maintaining their support for the real economy; and Ensure that the banking system has the funds necessary to maintain lending in the medium term.

In these extraordinary market conditions, the Bank of England will take all actions necessary to ensure that the banking system has access to sufficient liquidity. In its provision of short term liquidity the Bank will extend and widen its facilities in whatever way is necessary to ensure the stability of the system. At least £200 billion will be made available to banks under the Special Liquidity Scheme.

Until markets stabilise, the Bank will continue to conduct auctions to lend sterling for three months, and also US dollars for one week, against extended collateral. It will review the size and frequency of those operations as necessary.

Bank debt that is guaranteed under the Government’s guarantee scheme will be eligible in all of the Bank’s extended-collateral operations. The Bank next week will bring forward its plans for a permanent regime underpinning banking system liquidity, including a Discount Window facility.

In addition the Government is establishing a facility, which will make available Tier 1 capital in appropriate form (expected to be preference shares or PIBS) to “eligible institutions”. Eligible institutions are UK incorporated banks (including UK subsidiaries of foreign institutions) which have a substantial business in the UK and building societies.

However applications are invited for inclusion as an eligible institution from any other UK incorporated bank (including UK subsidiaries of foreign institutions). In reviewing these applications the Government will give due regard to an institution’s role in the UK banking system and the overall economy.

Following discussions convened by HM Treasury, the following major UK banks and the largest building society have confirmed their participation in a Government-supported recapitalisation scheme.

These institutions comprise:

Abbey

Barclays

HBOS

HSBC Bank plc

Lloyds TSB

Nationwide Building Society

Royal Bank of Scotland

Standard Chartered

These institutions have committed to the Government that they will increase their total Tier 1 capital by £25bn. This is an aggregate increase and individual increases will vary from institution to institution. In order to facilitate this process the Government is making available £25bn to be drawn on by these institutions if desired to assist in this process as preference share capital or PIBS and is also willing to assist in the raising of ordinary equity if requested to do so. The above institutions have committed to the Government that this will be concluded by the end of the year.

In addition to this, the Government stands ready to provide an incremental minimum of £25bn of further support for all eligible institutions, in the form of preference shares, PIBS or, at the request of an eligible institution, as assistance to an ordinary equity fund-raising.

The amount to be issued per institution will be finalised following detailed discussions. If the Government is to provide the capital, the issue will carry terms and conditions that appropriately reflect the financial commitment being made by the taxpayer. In reaching agreement on capital investment the Government will need to take into account dividend policies and executive compensation practices and will require a full commitment to support lending to small businesses and home buyers.

The Government will take decisive action to reopen the market for medium term funding for eligible institutions that raise appropriate amounts of Tier 1 capital.

Specifically the Government will make available to eligible institutions for an interim period as agreed and on appropriate commercial terms, a Government guarantee of new short and medium term debt issuance to assist in refinancing maturing, wholesale funding obligations as they fall due.

Subject to further discussion with eligible institutions, the proposal envisages the issue of senior unsecured debt instruments of varying terms of up to 36 months, in any of sterling, US dollars or Euros. The current expectation is that the guarantee would be issued out of a specifically designated Government-backed English incorporated company. The Government expects the take-up of the guarantee to be of the order of £250bn, and will keep this under review alongside ongoing monitoring of capital positions and lending volumes.

To qualify for this support the relevant institution must raise Tier 1 capital by the amount and in the form the Government considers appropriate whether by Government subscription or from other sources. It is being made available immediately to the eight institutions named above in recognition of their commitment to strengthen their aggregate capital position.

The Government has informed the European Commission of these proposals and is actively talking to other countries about extending these proposals and has committed to work together with them to strengthen the international system.

The Government is moving ahead immediately with the internationally agreed proposal for colleges of supervision and other measures to improve supervision of the system. After discussions with the major economies at the G7 meeting on Friday, the Government and other countries agreed on the need for a meeting at heads of Government level.

Tuesday, October 07, 2008

Homeowners with Negative Equity

by Calculated Risk on 10/07/2008 11:41:00 PM

From the WSJ: Housing Pain Gauge: Nearly 1 in 6 Owners 'Under Water'

About 75.5 million U.S. households own the homes they live in. After a housing slump that has pushed values down 30% in some areas, roughly 12 million households, or 16%, owe more than their homes are worth, according to Moody's Economy.com.This is close to my estimate of homeowners with negative or no equity. These homeowners are at risk for default if they experience a negative event (like divorce or health problems) or they simply decide to mail in the keys. The number will probably rise to 20 million or more by the time house prices bottom.

The Export Slowdown

by Calculated Risk on 10/07/2008 08:18:00 PM

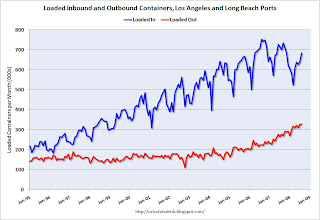

This graph shows the combined loaded inbound and outbound traffic at the ports of Long Beach and Los Angeles in TEUs (TEUs: 20-foot equivalent units or 20-foot-long cargo container). Although containers tell us nothing about value, container traffic does give us an idea of the volume of goods being exported and imported. Click on graph for larger image in new window.

Click on graph for larger image in new window.

Inbound traffic grew quickly for a number of years, but appears to be declining (there is a strong seasonal component). Inbound traffic is off about 6% from 2007 (using the last two months of July and August).

Outbound traffic was flat for years, but has been increasing the last few years. Outbound traffic is up 20% from 2007.

However it appears export growth will be slowing. From the WSJ: Slowing Export Machine Is Starting to Sputter

Export growth is expected to fall sharply in coming months ... Many U.S. producers are already seeing a slump in new orders ... The outlook has dimmed so quickly that economists are having a hard time keeping their projections current.

...

The upshot is that exports will no longer serve as the counterweight to weakness in the domestic economy. Over the past year, real goods exports surged by $114 billion, or 12%, up across every major category. They now make up nearly 13.5% of gross domestic product, the highest percentage since World War II.

The second graph shows imports and exports as a percent of GDP since 1947 through Q2 2008.

The second graph shows imports and exports as a percent of GDP since 1947 through Q2 2008.Over the years, both exports and imports have increased as a percent of GDP. Exports now make up almost 13.5% of GDP (imports as a percent of GDP are at 18.5%). With the decline in oil prices - and the weaker U.S. economy - imports as a percent of GDP will probably decline over the next year.

With the global slowdown, export growth will also slow, and might even decline too. This has been a key source of strength for the U.S. economy, and especially for manufacturing employment.

UK: Government to Invest in Banks

by Calculated Risk on 10/07/2008 05:36:00 PM

From The Times: British taxpayer to be tied into £50bn bank bailout

Britain’s taxpayers will tomorrow be committed to spending more than £50 billion to bail out the high-street banks in a bid to avert a cataclysmic failure of confidence, The Times learnt tonight.That is 2:30 AM ET.

...

The taxpayer will take a stake in banks that seek assistance through the purchase of preference shares ... Holders of preference shares are first in line for payout of dividends but they do not carry voting rights. The bail-out is expected to be structured so that the Government also receives rights to ordinary bank shares at low prices, holding out the prospect of profits if and when banks recover.

...

The part-nationalisation of the banks [will be called] “recapitalisation” ... the term used by Mr Darling ...

Mr Darling confirmed that he would be making a statement before the London Stock Markets opened tomorrow and another in the Commons later. It is believed the first will come at around 7.30 am.

This is the type of plan supported by most economists in the U.S. (as opposed to Paulson's TARP). Krugman notes: Britain leads the way?

Unlike the Paulson plan, this sounds as if it makes sense. However, given the strong financial linkages among the world’s economies, I wonder how much Britain can do on its own. Let’s see what the plan actually looks like; if it’s good, it can be a model for US emulation, and for the eurozone too if they can get their act together.

Spain Tries a TARP, UK to Announce "Dramatic Rescue Package"

by Calculated Risk on 10/07/2008 04:11:00 PM

Spain tries a TARP. From the Financial Times: Spain announces emergency fund

Spain on Tuesday became the latest European nation to take unilateral measures to deal with the world’s deepening financial crisis, announcing a €30-50bn emergency fund to provide liquidity to the financial system by buying Spanish bank assets.And in the UK, from The Mail: Rescue package for Britain's banks agreed at crisis summit after shares go into freefall

...

The fund, whose details will be fleshed out during the regular cabinet meeting on Friday, will be managed by the Spanish treasury to buy the assets of financial institutions.

The Government will tomorrow unveil a dramatic rescue package aimed at easing the crisis engulfing Britain's banks.

Gordon Brown tonight held a crisis summit with the governor of the Bank of England and the chairman of the Financial Services Authority as pressure mounted on ministers to take immediate action.

...

It is believed the package will include a proposal to inject capital into the banks to shore up their balance sheets.

emphasis added

Office Vacancy Rate Rises Sharply

by Calculated Risk on 10/07/2008 02:29:00 PM

From Bloomberg: New York's Top Office Vacancies Jump 43% on Layoffs

Vacancies for Class A space rose to 7.7 percent in Manhattan, up from 6.9 percent in the second quarter and 5.4 percent a year ago. There's 18.5 million square feet for rent, up from 12.9million feet a year ago, according to Cushman statistics.The CRE slump is here.

...

Nationwide, the office vacancy rate reached 13.6 percent in the third quarter from 13.1 percent in the second quarter, according to a report released Monday by Reis, Inc. a New York- based provider of real estate data.

Bernanke: Economic Outlook "has worsened"

by Calculated Risk on 10/07/2008 01:14:00 PM

From Fed Chairman Bernanke: Current Economic and Financial Conditions

Considerable experience in both industrialized and emerging economies has shown that severe financial instability, together with the associated declines in asset prices and disruptions in credit markets, can take a heavy toll on the broader economy if left unchecked.Short version: the ecomomic outlook is grim - expect a rate cut.

...

By potentially restricting future flows of credit to households and businesses, the developments in financial markets pose a significant threat to economic growth.

...

Economic activity had shown signs of decelerating even before the recent upsurge in financial-market tensions. As has been the case for some time, the housing market continues to be a primary source of weakness in the real economy as well as in the financial markets. However, the slowdown in economic activity has spread outside the housing sector. Private payrolls have continued to contract, and the declines in employment, together with earlier increases in food and energy prices, have eroded the purchasing power of households. This sluggishness of real incomes, together with tighter credit and declining household wealth, is now showing through more clearly to consumer spending. Indeed, since May, real consumer outlays have contracted significantly. Meanwhile, in the business sector, worsening sales prospects and a heightened sense of uncertainty have begun to weigh more heavily on investment spending as well.

The intensification of financial turmoil and the further impairment of the functioning of credit markets seem likely to increase the restraint on economic activity in the period ahead. Even households with good credit histories are now facing difficulties obtaining mortgage loans or home equity lines of credit. Banks are also reducing credit card limits, and denial rates on automobile loan applications reportedly are rising. Businesses, too, are confronting diminished access to credit. For example, disruptions in the commercial paper market and tightening of bank lending standards have made it more difficult for businesses to obtain the working capital they need to meet everyday operating expenses such as payrolls and inventories.

All told, economic activity is likely to be subdued during the remainder of this year and into next year. The heightened financial turmoil that we have experienced of late may well lengthen the period of weak economic performance and further increase the risks to growth.

...

Overall, the combination of the incoming data and recent financial developments suggests that the outlook for economic growth has worsened and that the downside risks to growth have increased. At the same time, the outlook for inflation has improved somewhat, though it remains uncertain. In light of these developments, the Federal Reserve will need to consider whether the current stance of policy remains appropriate.

emphasis added

Grassley: SEC Allowed "excessively risky behavior"

by Calculated Risk on 10/07/2008 11:28:00 AM

From Bloomberg: Cox's SEC Censored Paper Showing It Ignored Bear Stearns Plunge

U.S. Securities and Exchange Commission Chairman Christopher Cox's regulators stood by as shrinking capital ratios and growing subprime holdings led to the collapse of Bear Stearns Cos., according to an unedited version of a study by the agency's inspector general.

The report by Inspector General H. David Kotz was requested by Senator Charles Grassley ... Before it was released to the public on Sept. 26, Kotz deleted 136 references, many detailing SEC memos, meetings or comments, at the request of the agency's Division of Trading and Markets that oversees investment banks.

``People can judge for themselves, but it sure looks like the SEC didn't want the public to know about the red flags it apparently ignored in allowing Bear Stearns and other investment banks to engage in excessively risky behavior,'' Grassley said in an e-mailed statement.

Federal Reserve Announces Commercial Paper Funding Facility

by Calculated Risk on 10/07/2008 09:10:00 AM

From the Fed: Board announces creation of the Commercial Paper Funding Facility (CPFF) to help provide liquidity to term funding markets

The Federal Reserve Board on Tuesday announced the creation of the Commercial Paper Funding Facility (CPFF), a facility that will complement the Federal Reserve's existing credit facilities to help provide liquidity to term funding markets. The CPFF will provide a liquidity backstop to U.S. issuers of commercial paper through a special purpose vehicle (SPV) that will purchase three-month unsecured and asset-backed commercial paper directly from eligible issuers. The Federal Reserve will provide financing to the SPV under the CPFF and will be secured by all of the assets of the SPV and, in the case of commercial paper that is not asset-backed commercial paper, by the retention of up-front fees paid by the issuers or by other forms of security acceptable to the Federal Reserve in consultation with market participants. The Treasury believes this facility is necessary to prevent substantial disruptions to the financial markets and the economy and will make a special deposit at the Federal Reserve Bank of New York in support of this facility.Commercial Paper Funding Facility (CPFF) Terms and Conditions (57 KB PDF)

The commercial paper market has been under considerable strain in recent weeks as money market mutual funds and other investors, themselves often facing liquidity pressures, have become increasingly reluctant to purchase commercial paper, especially at longer-dated maturities. As a result, the volume of outstanding commercial paper has shrunk, interest rates on longer-term commercial paper have increased significantly, and an increasingly high percentage of outstanding paper must now be refinanced each day. A large share of outstanding commercial paper is issued or sponsored by financial intermediaries, and their difficulties placing commercial paper have made it more difficult for those intermediaries to play their vital role in meeting the credit needs of businesses and households.

By eliminating much of the risk that eligible issuers will not be able to repay investors by rolling over their maturing commercial paper obligations, this facility should encourage investors to once again engage in term lending in the commercial paper market. Added investor demand should lower commercial paper rates from their current elevated levels and foster issuance of longer-term commercial paper. An improved commercial paper market will enhance the ability of financial intermediaries to accommodate the credit needs of businesses and households.