by Calculated Risk on 10/07/2008 08:29:00 AM

Tuesday, October 07, 2008

Credit Crisis: LIBOR Rate Increases

From Bloomberg: Libor for Overnight Dollar Loans Jumps as Credit Freeze Deepens

The London interbank offered rate, or Libor, that banks charge each other for such loans rose 157 basis points to 3.94 percent today, the British Bankers' Association said. The corresponding rate for euros climbed 22 basis points to 4.27 percent, the highest in four days. The Tokyo interbank rate stayed at the highest level this year and the Libor-OIS spread, a gauge of cash scarcity among banks, widened to a record.However the TED spread, difference between the LIBOR interest rate and the three month T-bill, has declined slightly to 3.69.

Also, Dow Jones is reporting that the commercial paper (CP) market "dislocation worsens" as CP rates continue to rise.

Monday, October 06, 2008

Possible G8 and Fed Action

by Calculated Risk on 10/06/2008 09:24:00 PM

MarketWatch is reporting: France said to seek emergency G8 meeting

France is proposing through diplomatic channels that the Group of Eight industrialized nations hold an emergency summit to contain the U.S.-triggered financial crisis, according to a published report.Also Reuters reported: Fed, Treasury mulling commercial paper support

In an unsourced article dated Tuesday, Japanese business daily Nikkei reported on its Web site from Tokyo that the Group of Seven finance ministers and central bankers are likely to talk about holding an emergency meeting when they meet in Washington as early as Friday.

Among steps under consideration would be funding a special purpose vehicle as opposed to outright purchase of commercial paper ... Aiding the commercial paper market may test the limits of the Fed's authority because of the possibility of losses.Apparently CNBC's Steve Leisman reported (I didn't see it) that the Fed might announce tomorrow morning some sort of program to buy commercial paper.

The Impact of Less Equity Withdrawal on Consumption

by Calculated Risk on 10/06/2008 08:13:00 PM

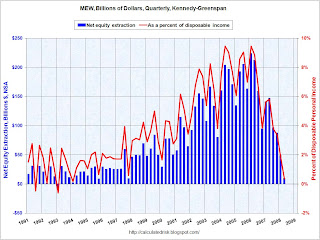

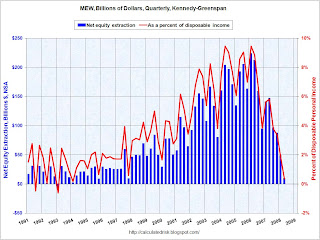

Earlier today I posted the Q2 2008 home equity extraction data provided by the Fed's Dr. James Kennedy. This shows that equity withdrawal has fallen almost to zero as of Q2. Click on graph for larger image in new window.

Click on graph for larger image in new window.

For Q2 2008, Dr. Kennedy has calculated Net Equity Extraction as $9.5 billion, or 0.3% of Disposable Personal Income (DPI).

Note: This data is based on the mortgage system presented in "Estimates of Home Mortgage Originations, Repayments, and Debt On One-to-Four-Family Residences," Alan Greenspan and James Kennedy, Federal Reserve Board FEDS working paper no. 2005-41.

Equity extraction was close to $700 billion per year in 2004, 2005 and 2006, before declining to $471 billion last year and will probably be less than $100 billion in 2008.

The questions are: how much will this impact consumption? And over what period?

Unfortunately there is no clear answer. Fed Chairman Bernanke has argued that falling house prices, not equity extraction, impacts consumption (from the WSJ in 2007):

"Our sense ... is that consumers respond to changes in the value of their home essentially because there’s a change in their wealth, not because there’s a change in their access to liquid assets."Others place more weight on MEW. Since equity withdrawal is a somewhat recent development, and there are many factors that impact consumption, it is hard to develop a predictive model on the impact of MEW on consumption. Equity withdrawal probably started in earnest with the Tax Reform Act of 1986 that eliminated the interest deduction for credit cards and consumer loans.

...

Mr. Bernanke went on to reiterate it’s the price of homes, not MEW or financial contagion that represents the biggest risk of spillover from the housing slump. ... [H]e said a hit to consumer spending could be expected on the order of “4 cents and 9 cents on the dollar” of lost home wealth.

In an Economic Letter in 2006, Fed economist John V. Duca wrote:

We can think of the overall impact of home prices on consumption as the combination of two parts—the traditional wealth effect and the relatively new and growing phenomenon of mortgage equity withdrawal (MEW). In recent years, U.S. households have been extracting housing wealth through home-equity loans, cash-out mortgage refinancings or by not fully rolling over capital gains from sales into down payments on subsequent home purchases. Because home-equity loans and mortgages are collateralized, they usually carry lower interest rates than unsecured loans; thus, homeowners can borrow more cheaply. Also, by making housing wealth more accessible, financial innovations have opened new avenues for families to act more quickly on their consumption preferences.Duca didn't mention the impact of falling house prices.

Consistent with a growing liquidity, or MEW effect, some new studies have found wealth effects are now greater than earlier research suggested. One estimates that a $100 rise in housing wealth leads to a $9 increase in spending. Another finds that increases in housing wealth generate three times the spending from stock-price gains. Neither study, however, directly examines whether housing wealth has a greater impact on consumption today because of the greater ease of accessing home equity.

...

The limited U.S. econometric evidence indicates that the strong pace of MEW may have boosted annual consumption growth by 1 to 3 percentage points in the first half of the present decade. This implies that a slowing of home-price appreciation into the low single digits might shave 1 to 2 percentage points off consumption growth and 0.75 to 1.5 percentage points from GDP growth for a few years.

While these estimates provide an idea of housing’s potential economic impact, considerable uncertainty exists about how much a slowdown in MEW might restrain consumption growth.

As far as when the impact occurs, on the wealth effrect, Carroll, Otsuka, and Slacalek, How Large Is the Housing Wealth Effect? A New Approach October 18, 2006 suggested that the impact would be over several quarters:

[W]e estimate that the immediate (next-quarter) marginal propensity to consume from a $1 change in housing wealth is about 2 cents, with a final long run effect around 9 cents.For MEW, it is also uncertain. Kennedy and Greenspan tried to quantify the data in Sources and Uses of Equity Extracted from Homes, however:

Our results do not provide an estimate of the [marginal propensity to consume (MPC)] out of housing wealth; nor do they address the question as to whether extraction of housing wealth has an effect on PCE in addition to the standard wealth effect.My guess is that the MEW effect lasts over several quarters (only a guess). Greenspan estimated that approximately 50% of MEW is consumed, and in interviews he suggested it is probably consumed over several quarters. Since MEW was $471 billion in 2007, and will probably be under $100 billion in 2008, we can estimate that half of the $400 billion or so decline in MEW (or $200 billion) is the drag on PCE in 2008 from less MEW.

That is a big number, but to put that in perspective, PCE increased over $500 billion from 2007 to 2008. So nominal PCE will increase in 2008, although consumption will probably slow sharply.

PCE will also be impacted by lost jobs and changes in consumer psychology (all the scary news will probably lead to less consumer spending).

Nearly six out of ten Americans believe another economic depression is likely, according to a poll released Monday.So once again it will be difficult to separate out the various factors impacting consumption. This will probably be an area of significant econometric research over the next few years.

The CNN/Opinion Research Corp. poll, which surveyed more than 1,000 Americans over the weekend, cited common measures of the economic pain of the 1930s:25% unemployment rate; widespread bank failures; and millions of Americans homeless and unable to feed their families.

It does appear that real personal consumption expenditures declined in Q3 2008 for the first time since 1991. And some of that decline is probably related to the decline in MEW.

Gross to Fed: Cut Rates to 1%, Buy Commercial Paper

by Calculated Risk on 10/06/2008 06:51:00 PM

From PIMCO's Bill Gross: Nothing to Fear but McFear Itself

[The Fed] must also take another bold step: outright purchases of commercial paper. They should also cut interest rates to 1%, because we are experiencing asset deflation, and the threat of headline inflation is long past.

This American Life: On the Bailout

by Calculated Risk on 10/06/2008 06:02:00 PM

Another Frightening Show About the Economy

Alex Blumberg and NPR's Adam Davidson—the two guys who reported our Giant Pool of Money episode—are back, in collaboration with the Planet Money podcast. They'll explain what happened this week, including what regulators could've done to prevent this financial crisis from happening in the first place.This is an excellent discussion and includes a discussion of the commercial paper market. BTW, the WSJ reports today that the Fed is considering intervening in the financial CP market: Fed Looks to Ease Strains in Commercial-Paper Market

U.S. officials are examining ways to ease deepening strains in the commercial paper market, which have been hit by an unwillingness among money market investors to hold risky assets.Alex at American Life was kind enough to mention Calculated Risk at the conclusion of The Giant Pool of Money, and he mentioned us in the following articles (thanks Alex!):

The move could involve the Federal Reserve making an unusual foray into unsecured lending.

Daring to Say Loans Made No Sense

Deep Reporting, Engaging Stories on This American Life

BofA Cuts Dividend in Half, Sees Further Weakening

by Calculated Risk on 10/06/2008 04:21:00 PM

From BofA: Bank of America Announces Third Quarter Earnings and Capital Raising Initiatives

Bank of America Corporation today reported third quarter 2008 net income of $1.18 billion, or $0.15 per share, down from $3.70 billion, or $0.82 per share, a year earlier.And a few key excerpts:

...

The company intends to sell common stock with a target of raising $10 billion. In addition, the Board of Directors has declared a quarterly dividend on common stock of $0.32 to be paid on December 26, 2008 to shareholders of record on December 5, 2008. Assuming the current number of issued and outstanding shares, the reduction from $0.64 paid in recent quarters would add more than $1.4 billion to capital each quarter.

"These are the most difficult times for financial institutions that I have experienced in my 39 years in banking," said Kenneth D. Lewis, chairman and chief executive officer. "We believe it is prudent to raise capital to very substantial levels in this uncertain environment. Both economic and financial market conditions have changed significantly in the last two months. We were willing to operate at capital levels over the short-term that were good, but not at our targeted levels, given projections two months ago. We now believe it is important to be at or near our 8 percent Tier 1 capital ratio target given the recessionary conditions and outlook for still weaker economic performance which we expect to drive higher credit losses and depress earnings. We believe that achieving higher capital levels today will position our company to provide credit to those consumers and businesses that are attracted to our strength and stability.

emphasis added

Reflecting deteriorating economic conditions, the consumer credit card business experienced a decrease in purchase volumes, slowing repayments and increased delinquencies during the quarter.And delinquencies are spreading:

Increased loss and delinquency trends first experienced in the home equity and homebuilder portfolios have now spread into the first mortgage, unsecured consumer lending and credit card portfolios. Deterioration has been more pronounced in California and Florida, which have been hit harder by home price depreciation and rising unemployment than in other markets. Commercial losses in sectors other than real estate and small business also increased, but remain below normalized ranges.

FDIC’s Bair Expects Wachovia Deal Today

by Calculated Risk on 10/06/2008 03:28:00 PM

From the WSJ Real Time Economics: FDIC’s Bair: Wachovia Deal ‘Today’; Tougher Regulation Needed

Speaking Monday before the National Association for Business Economics, [Federal Deposit Insurance Corp. Chairman Sheila] Bair said the FDIC wasn’t driving the negotiations between Wachovia and its two suitors, Citigroup and Wells Fargo, though it is talking with all parties.

...

“We’re all working together with regulators…to come at a solution and outcome that serves the public interest and I think we will have one today,” Bair said.

Mall and Strip Center Vacancy Rates Rise Sharply

by Calculated Risk on 10/06/2008 12:19:00 PM

From the WSJ: Mall Vacancies Grow as Retailers Pack Up Shop

For strip centers and other open-air shopping venues, the vacancy rate climbed to 8.4% in the third quarter from 8.1% in the second quarter. That marks the highest rate since 1994, according to Reis. Meanwhile, retailers' closures outpaced new leases by 2.8 million square feet in U.S. strip centers in the third quarter, the third consecutive quarterly net decline. It is the first nine-month period of so-called negative net absorption since Reis started tracking the data in 1980.

...

The vacancy rate at malls in the top 76 U.S. markets rose to 6.6% in the third quarter, up from 6.3% in the previous quarter, to its highest level since late 2001, according to Reis.

Click on image for larger graph in new window.

Click on image for larger graph in new window.This graph shows the strip mall vacancy rate since Q2 2007. Note that the graph doesn't start at zero to better show the change.

Q2 2008: Mortgage Equity Withdrawal Plunges to Near Zero

by Calculated Risk on 10/06/2008 11:13:00 AM

Here are the Kennedy-Greenspan estimates (NSA - not seasonally adjusted) of home equity extraction for Q2 2008, provided by Jim Kennedy based on the mortgage system presented in "Estimates of Home Mortgage Originations, Repayments, and Debt On One-to-Four-Family Residences," Alan Greenspan and James Kennedy, Federal Reserve Board FEDS working paper no. 2005-41.  Click on graph for larger image in new window.

Click on graph for larger image in new window.

For Q2 2008, Dr. Kennedy has calculated Net Equity Extraction as $9.5 billion, or 0.3% of Disposable Personal Income (DPI).

This graph shows the net equity extraction, or mortgage equity withdrawal (MEW), results, both in billions of dollars quarterly (not annual rate), and as a percent of personal disposable income.

Last week the Bank of England reported that MEW was slightly negative in the UK in the 2nd quarter.

Less equity extraction means less consumption over the next few quarters. I'll have more on this later ...

DOW Breaks 10K, Party Like It's 1999

by Calculated Risk on 10/06/2008 10:02:00 AM

DOW under 10K. From March 29, 1999 (15 sec CNBC Promo):