by Calculated Risk on 10/01/2008 11:32:00 AM

Wednesday, October 01, 2008

Bailout Bill will Allow FDIC to Borrow Unlimited Amounts from Treasury

From the WSJ: Revised Bill Lets FDIC Borrow Without Limits

The Senate financial market rescue bill would temporarily allow the Federal Deposit Insurance Corp. to borrow unlimited amounts of money from the Treasury Department in connection with the larger government deposit coverage that would extend until the end of next year.The WSJ has the full text of the revised bill.

This is important because it would increase the backstop that the FDIC has to make sure that insured depositors can be repaid if their bank fails.

ISM manufacturing index plunges

by Calculated Risk on 10/01/2008 10:23:00 AM

From MarketWatch: U.S. Sept. ISM manufacturing index plunges to 43.5%

[M]anufacturers cut back production at a much faster pace than expected in September ... This is the lowest level since October 2001.It appears the economy slowed sharply in September.

Non-Residential Construction Spending Declines

by Calculated Risk on 10/01/2008 10:00:00 AM

It now appears that private non-residential construction has peaked, and I expect non-residential investment will decline sharply over the next year.

From the Census Bureau: August 2008 Construction at 1,072.1 Billion Annual Rate

Spending on private construction was at a seasonally adjusted annual rate of $759.6 billion, 0.3 percent below the revised July estimate of $761.8 billion.

Residential construction was at a seasonally adjusted annual rate of $343.6 billion in August, 0.3 percent above the revised July estimate of $342.5 billion.

Nonresidential construction was at a seasonally adjusted annual rate of $416.0 billion in August, 0.8 percent below the revised July estimate of $419.3 billion.

Click on graph for larger image in new window.

Click on graph for larger image in new window.The graph shows private residential and nonresidential construction spending since 1993.

Nonresidential spending has been strong as builders complete projects, but there is substantial evidence of a looming slowdown - less lending for new projects, less work for architects - and it appears the expected slowdown in non-residential spending has arrived.

The second graph shows the year-over-year change for private residential and non-residential construction spending.

The YoY change in non-residential spending is starting to slow down and will probably turn negative later this year or early in 2009.

Not only has Personal Consumption Expenditures (PCE) turned negative in Q3, but it now looks like non-residential investment in structures is starting to decline. This was one of few bright spots in the economy (along with exports), and a decline in non-residential investment is more evidence of a recession.

Businesses Complain of Credit Market Troubles

by Calculated Risk on 10/01/2008 08:36:00 AM

From the WSJ: Businesses Pressure Congress on Bailout Plan

General Electric Co. and Verizon Communications Inc. ... have begun lobbying drives. And Microsoft Corp., which has relatively limited borrowing needs, "strongly urges" Congress to reconsider a rescue package "that will re-instill confidence and stability in the financial markets," said the company's top lawyer, Brad Smith.The lobbying has really started. The Senate will vote on the bailout bill this evening.

Even Microsoft, which is sitting on a $23 billion hoard of cash, would be tested by a protracted credit crunch, as its chief executive, Steve Ballmer, noted Tuesday. Speaking to reporters in Norway, Mr. Ballmer said, "No company is immune to these issues."

...

[B]usinesses big and small said borrowing was getting harder as the cost of funds rose.

Corporate-bond issuance in the quarter plunged to $76.7 billion from $337.3 billion in the second quarter ... Companies overall were forced to reduce their borrowings on the short-term commercial paper market by $212 billion between the end of February and last Wednesday, as investors continued to back away from the corporate IOUs.

Tuesday, September 30, 2008

Mark-to-Market Quotes

by Calculated Risk on 9/30/2008 11:01:00 PM

"Suspending mark-to-market accounting, in essence, suspends reality."

Beth Brooke, global vice chair at Ernst & Young LLP, WSJ, Sept 30, 2008

"Blaming fair-value accounting for the credit crisis is a lot like going to a doctor for a diagnosis and then blaming him for telling you that you are sick."

analyst Dane Mott, JPMorgan Chase & Co., Bloomberg

"Suspending the mark-to-market prices is the most irresponsible thing to do. Accounting does not make corporate earnings or balance sheets more volatile. Accounting just increases the transparency of volatility in earnings."

Diane Garnick, Invesco Ltd., Bloomberg

Report: Senate to Vote on Bailout Wednesday Night

by Calculated Risk on 9/30/2008 09:01:00 PM

From CNN: Senate to vote on rescue plan Wednesday (hat tip pastafarian)

The Senate plans to vote on the $700 billion bank rescue plan Wednesday evening ... The bill adds new provisions - including raising the FDIC insurance cap from $100,000 to $250,000 - and will be attached to an existing revenue bill that the House also rejected Monday ... The vote is scheduled for after sundown, in observance of the Jewish holiday.

National Debt to Exceed $10 Trillion Tomorrow

by Calculated Risk on 9/30/2008 07:54:00 PM

It now looks like the National Debt will be over $10 Trillion tomorrow.

As of Sept 29th, the debt was $9,945,578,231,981.59

The surge in the National Debt over the last two weeks has been because of the Supplementary Financing Program (SFP) with the Treasury raising cash for the Fed's liquidity initiatives (announced a couple of weeks ago).

Today the Treasury sold $45 billion in 15 day Cash Management Bills that are all for the Fed. Tomorrow the Treasury will sell $50 billion in 42 day bills also for the Fed. And that Wednesday auction should put the National Debt over the $10 Trillion mark (we will know on Thursday).

For good measure, the Treasury is also selling another $45 billion for the Fed on Thursday.

The good news is the borrowing rates are pretty low!

Even though this rapid increase in the debt is being driven by the Fed's liquidity initiatives (and should be paid back), crossing $10 trillion will still be quite a milestone ...

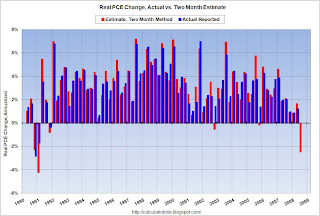

Estimating PCE Growth for Q3 2008

by Calculated Risk on 9/30/2008 04:19:00 PM

With the focus on the bailout bill yesterday, the August release from the Bureau of Economic Analysis (BEA) of personal income and outlays almost went unnoticed.

Asha Bangalore at Northern Trust noticed:

The July-August data point to a possible drop in consumer spending during the third quarter. If the forecast is accurate, it would be the first quarterly decline since fourth quarter of 1991. Given the importance of consumer spending in GDP, a drop in consumer spending in the third quarter raises the probability of a contraction in real GDP in the third quarter.I wrote:

This report is strong evidence that the U.S. economy is in recession and that the change in Personal Consumption Expenditures (PCE) will be negative for Q3.Let me explain why:

The BEA releases Personal Consumption Expenditures monthly as part of the Personal Income and Outlays report, and quarterly as part of the GDP report (also released separately quarterly).

You can use the monthly series to exactly calculate the quarterly change in PCE as reported in the GDP report. However, the quarterly change is not calculated as the change from the last month of one quarter to the last month of the next quarter. Instead, you have to average all three months of a quarter, and then take the change from the average of the three months of the preceding quarter.

So, for Q3, you would average real PCE for July, August and September, and then divide by the average for April, May and June. Of course you need to take this to the fourth power (for the annual rate) and subtract one (for a percentage increase). This gives the real annualized rate of change for the quarter as reported in the GDP report.

Of course the report for September hasn't been released yet, and will not be released until after the advance Q3 GDP report is released on October 30th. As an estimate, we can use the change from April to July, and the change from May to August (the Two Month Estimate) to approximate PCE growth for Q3.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the two month estimate versus the actual change in real PCE. The correlation is high (0.924).

Sometimes the growth rate for the third month of a quarter is substantially stronger or weaker than the first two months. As an example, in Q3 2005, PCE growth was strong for the first two months, but slumped in September because of hurricane Katrina. So the two month estimate was too high.

And the following quarter (Q4 2005), the two month estimate was too low. The first two months of Q4 were negatively impacted by the hurricanes, but real PCE growth in December was strong.

You can see a similar pattern in Q3 2001 because of 9/11.

But in general, the two month estimate is pretty accurate. Maybe September was exceptionally strong (very unlikely from anecdotal evidence), or maybe July and August will be revised upwards, but the two month estimate suggests real PCE will decline in Q3 by about 2.4% (annual rate).

Since PCE accounts for about 71% of GDP, this also suggests the change in real GDP in Q3 might be negative. This depends on exports and changes in inventories (investment will be weak).

If accurate, this will be the first decline in PCE since Q4 1991. This is strong evidence that the indefatigable U.S. consumer is finally throwing in the towel.

FASB, SEC to Issue Accounting Guidance

by Calculated Risk on 9/30/2008 04:09:00 PM

From Bloomberg: SEC, FASB Said to Issue Guidance on Fair-Value Accounting Rules

The SEC may say companies can rely more on assumptions ...in assessing how much assets are worth ... The SEC and FASB will probably [NOT] suspend the accounting rules ...More work for accountants.

Fed's Lockhart on Financial Crisis

by Calculated Risk on 9/30/2008 02:24:00 PM

Here is a good explanation of the problems in the credit markets from Atlanta Fed President Dennis Lockhart: A Working Financial Sector Matters to Us All

Credit markets remain quite strained. This is particularly the case in interbank markets in the United States and abroad. The interbank markets are a fundamental element of the plumbing of the financial world. Banks with excess balances put them to work by lending to other banks that have clients—companies and individuals—who need the funds.And on the economy:

The loan portfolios of U.S. banks and financial institutions are, as you would expect, mostly dollar-denominated. But foreign banks in recent years have also built sizeable "books of business" in dollars. The dollar interbank credit contraction is a worldwide problem that affects not only our banks here but banks overseas, particularly in Europe.

When banks lend or take on other forms of exposure to each other, they gauge the counterparty risk. In recent weeks, there has been a widespread withdrawal of confidence in counterparties that has resulted in efforts to reduce exposure.

As part of this, maturities have shortened, risk spreads (typically measured as the interest rate spread over U.S. Treasuries) have widened, the cost of hedging against default risk (another measure of perceived counterparty risk) has risen dramatically, and the range of assets accepted as collateral has narrowed. Also, demand for liquidity provided by the Federal Reserve has intensified.

This contraction in availability and rise of the cost of credit have worsened as well for corporate and business borrowers. We've heard anecdotes confirming this from contacts throughout the Southeast. In short, Main Street is being affected.

Prior to September, we at the Federal Reserve Bank of Atlanta had a rather downbeat outlook for the second half of 2008 and early 2009. We expected—and continue to expect—a very weak second half reflecting contracting consumer spending, weaker business investment, and slower export volume.Note that Lockhart was already pessimistic before September, and for good reasons. The PCE numbers for August, released yesterday by the BEA, strongly suggest the long anticipated consumer recession has started. September will probably be worse.

Export demand has been an important factor that has helped sustain the U.S. manufacturing sector in recent months. But economic growth prospects in many of our major trading partners have weakened notably in recent months, and this weakening has dampened the outlook for the export sector.

Conditions in labor markets also have weakened. During the first half of 2008 the data showed that residential construction and related manufacturing industries were reducing their workforce while other businesses were hesitant to add to payrolls. But more recently the data suggest that layoffs have become more widespread, and hiring intentions have pulled back further.

Weak labor markets feed into weak income growth and sluggish consumer spending. Reports from retailers suggest that the outlook for the upcoming holiday season has been pared back as consumers are expected to tighten their belts further. At the same time, lending standards for most types of consumer credit have tightened.

emphasis added

And Lockhart is clearly pessimistic on business spending, layoffs, and especially the slowdown of U.S. trading partners (impacting exports). The recession is here.

Note: I think the PCE numbers were somewhat overlooked with the focus on the House vote on the bailout plan. I'll put up a somewhat technical post this afternoon on the two month method, and why it suggests a decline in PCE in Q3 (and probably a decline in Q3 GDP).