by Calculated Risk on 9/30/2008 07:54:00 PM

Tuesday, September 30, 2008

National Debt to Exceed $10 Trillion Tomorrow

It now looks like the National Debt will be over $10 Trillion tomorrow.

As of Sept 29th, the debt was $9,945,578,231,981.59

The surge in the National Debt over the last two weeks has been because of the Supplementary Financing Program (SFP) with the Treasury raising cash for the Fed's liquidity initiatives (announced a couple of weeks ago).

Today the Treasury sold $45 billion in 15 day Cash Management Bills that are all for the Fed. Tomorrow the Treasury will sell $50 billion in 42 day bills also for the Fed. And that Wednesday auction should put the National Debt over the $10 Trillion mark (we will know on Thursday).

For good measure, the Treasury is also selling another $45 billion for the Fed on Thursday.

The good news is the borrowing rates are pretty low!

Even though this rapid increase in the debt is being driven by the Fed's liquidity initiatives (and should be paid back), crossing $10 trillion will still be quite a milestone ...

Estimating PCE Growth for Q3 2008

by Calculated Risk on 9/30/2008 04:19:00 PM

With the focus on the bailout bill yesterday, the August release from the Bureau of Economic Analysis (BEA) of personal income and outlays almost went unnoticed.

Asha Bangalore at Northern Trust noticed:

The July-August data point to a possible drop in consumer spending during the third quarter. If the forecast is accurate, it would be the first quarterly decline since fourth quarter of 1991. Given the importance of consumer spending in GDP, a drop in consumer spending in the third quarter raises the probability of a contraction in real GDP in the third quarter.I wrote:

This report is strong evidence that the U.S. economy is in recession and that the change in Personal Consumption Expenditures (PCE) will be negative for Q3.Let me explain why:

The BEA releases Personal Consumption Expenditures monthly as part of the Personal Income and Outlays report, and quarterly as part of the GDP report (also released separately quarterly).

You can use the monthly series to exactly calculate the quarterly change in PCE as reported in the GDP report. However, the quarterly change is not calculated as the change from the last month of one quarter to the last month of the next quarter. Instead, you have to average all three months of a quarter, and then take the change from the average of the three months of the preceding quarter.

So, for Q3, you would average real PCE for July, August and September, and then divide by the average for April, May and June. Of course you need to take this to the fourth power (for the annual rate) and subtract one (for a percentage increase). This gives the real annualized rate of change for the quarter as reported in the GDP report.

Of course the report for September hasn't been released yet, and will not be released until after the advance Q3 GDP report is released on October 30th. As an estimate, we can use the change from April to July, and the change from May to August (the Two Month Estimate) to approximate PCE growth for Q3.

Click on graph for larger image in new window.

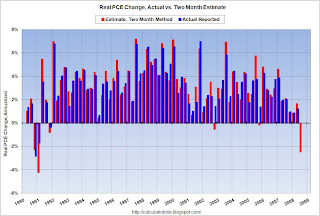

Click on graph for larger image in new window.This graph shows the two month estimate versus the actual change in real PCE. The correlation is high (0.924).

Sometimes the growth rate for the third month of a quarter is substantially stronger or weaker than the first two months. As an example, in Q3 2005, PCE growth was strong for the first two months, but slumped in September because of hurricane Katrina. So the two month estimate was too high.

And the following quarter (Q4 2005), the two month estimate was too low. The first two months of Q4 were negatively impacted by the hurricanes, but real PCE growth in December was strong.

You can see a similar pattern in Q3 2001 because of 9/11.

But in general, the two month estimate is pretty accurate. Maybe September was exceptionally strong (very unlikely from anecdotal evidence), or maybe July and August will be revised upwards, but the two month estimate suggests real PCE will decline in Q3 by about 2.4% (annual rate).

Since PCE accounts for about 71% of GDP, this also suggests the change in real GDP in Q3 might be negative. This depends on exports and changes in inventories (investment will be weak).

If accurate, this will be the first decline in PCE since Q4 1991. This is strong evidence that the indefatigable U.S. consumer is finally throwing in the towel.

FASB, SEC to Issue Accounting Guidance

by Calculated Risk on 9/30/2008 04:09:00 PM

From Bloomberg: SEC, FASB Said to Issue Guidance on Fair-Value Accounting Rules

The SEC may say companies can rely more on assumptions ...in assessing how much assets are worth ... The SEC and FASB will probably [NOT] suspend the accounting rules ...More work for accountants.

Fed's Lockhart on Financial Crisis

by Calculated Risk on 9/30/2008 02:24:00 PM

Here is a good explanation of the problems in the credit markets from Atlanta Fed President Dennis Lockhart: A Working Financial Sector Matters to Us All

Credit markets remain quite strained. This is particularly the case in interbank markets in the United States and abroad. The interbank markets are a fundamental element of the plumbing of the financial world. Banks with excess balances put them to work by lending to other banks that have clients—companies and individuals—who need the funds.And on the economy:

The loan portfolios of U.S. banks and financial institutions are, as you would expect, mostly dollar-denominated. But foreign banks in recent years have also built sizeable "books of business" in dollars. The dollar interbank credit contraction is a worldwide problem that affects not only our banks here but banks overseas, particularly in Europe.

When banks lend or take on other forms of exposure to each other, they gauge the counterparty risk. In recent weeks, there has been a widespread withdrawal of confidence in counterparties that has resulted in efforts to reduce exposure.

As part of this, maturities have shortened, risk spreads (typically measured as the interest rate spread over U.S. Treasuries) have widened, the cost of hedging against default risk (another measure of perceived counterparty risk) has risen dramatically, and the range of assets accepted as collateral has narrowed. Also, demand for liquidity provided by the Federal Reserve has intensified.

This contraction in availability and rise of the cost of credit have worsened as well for corporate and business borrowers. We've heard anecdotes confirming this from contacts throughout the Southeast. In short, Main Street is being affected.

Prior to September, we at the Federal Reserve Bank of Atlanta had a rather downbeat outlook for the second half of 2008 and early 2009. We expected—and continue to expect—a very weak second half reflecting contracting consumer spending, weaker business investment, and slower export volume.Note that Lockhart was already pessimistic before September, and for good reasons. The PCE numbers for August, released yesterday by the BEA, strongly suggest the long anticipated consumer recession has started. September will probably be worse.

Export demand has been an important factor that has helped sustain the U.S. manufacturing sector in recent months. But economic growth prospects in many of our major trading partners have weakened notably in recent months, and this weakening has dampened the outlook for the export sector.

Conditions in labor markets also have weakened. During the first half of 2008 the data showed that residential construction and related manufacturing industries were reducing their workforce while other businesses were hesitant to add to payrolls. But more recently the data suggest that layoffs have become more widespread, and hiring intentions have pulled back further.

Weak labor markets feed into weak income growth and sluggish consumer spending. Reports from retailers suggest that the outlook for the upcoming holiday season has been pared back as consumers are expected to tighten their belts further. At the same time, lending standards for most types of consumer credit have tightened.

emphasis added

And Lockhart is clearly pessimistic on business spending, layoffs, and especially the slowdown of U.S. trading partners (impacting exports). The recession is here.

Note: I think the PCE numbers were somewhat overlooked with the focus on the House vote on the bailout plan. I'll put up a somewhat technical post this afternoon on the two month method, and why it suggests a decline in PCE in Q3 (and probably a decline in Q3 GDP).

Case-Shiller Price Declines by City

by Calculated Risk on 9/30/2008 12:34:00 PM

The following graph shows the price declines from the peak for each city included in S&P/Case-Shiller indices. Click on graph for larger image in new window.

Click on graph for larger image in new window.

In Phoenix and Las Vegas, home prices have declined more than 34%. In Charlotte, prices have only declined about 2% from the peak.

This graph illustrates the point Professor Krugman made in August 2005: That Hissing Sound

When it comes to housing ... the United States is really two countries, Flatland and the Zoned Zone.There was a bubble in Flatland too caused by the rapid migration from renting to buying - facilitated by loose lending - that pushed up Flatland prices. But those bubbles were small compared to the bubbles in the Zoned Zones.

In Flatland, which occupies the middle of the country, it's easy to build houses. When the demand for houses rises, Flatland metropolitan areas, which don't really have traditional downtowns, just sprawl some more. As a result, housing prices are basically determined by the cost of construction. In Flatland, a housing bubble can't even get started.

But in the Zoned Zone, which lies along the coasts, a combination of high population density and land-use restrictions - hence "zoned" - makes it hard to build new houses. So when people become willing to spend more on houses, say because of a fall in mortgage rates, some houses get built, but the prices of existing houses also go up. And if people think that prices will continue to rise, they become willing to spend even more, driving prices still higher, and so on. In other words, the Zoned Zone is prone to housing bubbles.

Now that the bubble has burst, prices in the more bubbly Zoned Zones are falling much more than in Flatland.

Detroit is an exception with prices off 27% from the peak, even though Detroit never had a price bubble. The reason is Detroit has a weak economy and a declining population. Since housing is very durable, there is excess supply in Detroit, and prices for existing homes are below replacement costs.

Another exception is New York. Prices in New York are only off 10.6% even though New York is part of the Zoned Zone. New York had a price bubble, but until recently prices had held up pretty well. That is changing right now.

And here was Krugman's conclusion from August 2005:

Meanwhile, the U.S. economy has become deeply dependent on the housing bubble. The economic recovery since 2001 has been disappointing in many ways, but it wouldn't have happened at all without soaring spending on residential construction, plus a surge in consumer spending largely based on mortgage refinancing. .... Now we're starting to hear a hissing sound, as the air begins to leak out of the bubble. And everyone - not just those who own Zoned Zone real estate - should be worried.I think most people are worried now.

The Irish Guarantee

by Calculated Risk on 9/30/2008 10:29:00 AM

From the WSJ: Irish Government Moves to Safeguard Banking System

The Irish government Tuesday announced a surprise decision to safeguard the Irish banking system for two years, guaranteeing all deposits, covered bonds, senior debt and dated subordinated debt of the four main banks.

...

Finance Minister Brian Lenihan said the guarantee will cover €400 billion ($577.64 billion) of the €500 billion of bank assets involved. That is more than Ireland's gross domestic product of €190 billion and national debt of €45 billion.

...

Davy Research analyst Scott Rankin said: "The Irish government has taken out its bazooka."

Case-Shiller: House Prices Declined in July

by Calculated Risk on 9/30/2008 09:00:00 AM

Housing is the key. And house prices are still falling sharply ...

S&P/Case-Shiller released their monthly Home Price Indices for July this morning. This includes prices for 20 individual cities, and two composite indices (10 cities and 20 cities). Note: This is not the quarterly national house price index. Click on graph for larger image in new window.

Click on graph for larger image in new window.

The first graph shows the nominal Composite 10 and Composite 20 indices (the Composite 20 was started in January 2000).

The Composite 10 index was off 12.3% annual rate in July (from June), and is off 21.1% from the peak.

The Composite 20 index was off 10.1% annual rate in July (from June), and is off 19.5% from the peak.

Prices are still falling, and will probably continue to fall for some time.  The second graph shows the Year over year change in both indices.

The second graph shows the Year over year change in both indices.

The Composite 10 is off 17.5% over the last year.

The Composite 20 is off 16.3% over the last year.

More on prices later ... including selected cities.

LIBOR Hits All-time High of 6.88%

by Calculated Risk on 9/30/2008 08:31:00 AM

"The money markets have completely broken down, with no trading taking place at all. There is no market any more."From Bloomberg: Libor Surges Most on Record After U.S. Congress Rejects Bailout

Christoph Rieger, Dresdner Kleinwort in Frankfurt, Sept 30, 2008

The London interbank offered rate, or Libor, that banks charge each other for such loans climbed 431 basis points to an all-time high of 6.88 percent today, the British Bankers' Association said. The euro interbank offered rate, or Euribor, for one-month loans climbed to record 5.05 percent, the European Banking Federation said. The Libor-OIS spread, a gauge of the scarcity of cash, advanced to a record.Also President Bush spoke at 8:45AM ET.

Short excerpt from Bush:

"This is not the end of the legislation process. ... This is an urgent situation. Consequences will grow worse if we don't act. If we continue on this course, the economic damage will be painful and lasting. ... Congress must act. ... We will deliver."

Bailout: Senate to Vote on Wednesday

by Calculated Risk on 9/30/2008 02:57:00 AM

From Bloomberg: Senate May Try to Revive Bank-Rescue Bill as Early as Tomorrow

The U.S. Senate will try to salvage a $700 billion financial-rescue package after the measure was defeated in the House of Representatives. ...

``They're not going to totally revamp the bill,'' said Pete Davis, president of Davis Capital Investment Ideas in Washington, who spoke to House and Senate leaders yesterday. ``They'll make some minor changes and pass it. This is all about political cover.''

Monday, September 29, 2008

Dexia Fears Grow

by Calculated Risk on 9/29/2008 09:20:00 PM

From the Financial Times: Dexia shares fall amid capital concern (hat tip avinunu)

Shares in Dexia lost more than a quarter of their value on Monday on fears that the Belgian-French financial services group needed to raise capital.This article in lesoir.be suggests that it will take 6 to 7 billion euros to save Dexia: Entre 6 et 7 milliards pour sauver Dexia

...

The board met on Monday night “to assess the international financial situation”, according to a spokesperson ...