by Calculated Risk on 9/25/2008 06:04:00 PM

Thursday, September 25, 2008

Deal or no Deal: The Situation remains Fluid

From MarketWatch: No deal reached at White House, officials say

President Bush was unable to seal a deal between Republicans and Democrats on his $700 billion mortgage rescue plan, officials said.From the WSJ: White House Meeting Ends With Bailout Still in Flux

[O]ne opponent of the tentative agreement, Sen. Richard Shelby (R., Ala.) told reporters after the meeting with President Bush that lawmakers still haven't reached an agreement on financial bailout legislation. "I don't believe we have an agreement," said Sen. Shelby, the ranking Republican on the Senate Banking Committee. "There are still a lot of different opinions."Who knows. I think there will be some sort of deal this weekend before Congress goes into recess (September 26 is the Target for Adjournment).

...

Sen. Bob Corker (R., Tenn.) said: "I believe that we will pass this legislation before the markets open on Monday."

Bailout: Agreement on Principles

by Calculated Risk on 9/25/2008 04:58:00 PM

Agreement on PrinciplesNot much here. We need details on the equity sharing and other provisions.

1. Taxpayer Protectiona. Requires Treasury Secretary to set standards to prevent excessive or inappropriate executive compensation for participating companies2. Oversight and Transparency

b. To minimize risk to the American taxpayer, requires that any transaction include equity sharing

c. Requires most profits to be used to reduce the national debta. Treasury Secretary is prohibited from acting in an arbitrary or capricious manner or in any way that is inconsistent with existing law3. Homeownership Preservation

b. Establishes strong oversight board with cease and desist authority

c. Requires program transparency and public accountability through regular, detailed reports to Congress disclosing exercise of the Treasury Secretary’s authority

d. Establishes an independent Inspector General to monitor the use of the Treasury Secretary’s authority

e. Requires GAO audits to ensure proper use of funds, appropriate internal controls, and to prevent waste, fraud, and abusea. Maximize and coordinate efforts to modify mortgages for homeowners at risk of foreclosure4. Funding Authority

b. Requires loan modifications for mortgages owned or controlled by the Federal Government

c. Directs a percentage of future profits to the Affordable Housing Fund and the Capital Magnet Fund to meet America’s housing needsa. Treasury Secretary’s request for $700 billion is authorized, with $250 billion available immediately and an additional $100 billion released upon his or her certification that funds are needed

b. final $350 billion is subject to a Congressional joint resolution of disapproval

The Cost of the Bailout

by Calculated Risk on 9/25/2008 03:53:00 PM

When I read the intial proposal (admittedly very vague), it appeared the Treasury could churn the $700 billion, and therefore could possibly end up losing all of it (like a gambler at a slot machine "reinvesting" all their winnings).

Although we still haven't seen the proposal, Bernanke noted yesterday (if I heard him correctly) that the plan didn't intend to reinvest any proceeds after a sale. So if Treasury bought MBS for $70 million and sold it for $50 million, the loss would be $20 million - but they wouldn't reinvest the $50 million and lose even more. Those proceeds would be returned to the Treasury.

As far as total losses, here are the some comments from PIMCO's Bill Gross in an interview with Mathew Padilla at Mortgage Insider: Taxpayers can gain from $700 billion rescue

Gross said the government must find the right price between the market value of the assets they are buying and the value they have on paper at the banks holding them.And on CNBC, Warren Buffett said (hat tip Bernie):

...

“It’s certainly possible if done right for the Treasury to make money for the tax payer,” Gross said.

emphasis added

[T]hey shouldn't buy these debt instruments at what the institutions paid. They shouldn't buy them at what they're carrying, what the carrying value is, necessarily. They should buy them at the kind of prices that are available in the market. People who are buying these instruments in the market are expecting to make 15 to 20 percent on those instruments. If the government makes anything over its cost of borrowing, this deal will come out with a profit. And I would bet it will come out with a profit, actually.Unfortunately the plan is to buy the assets at a premium to market prices and probably at prices close to, or even above, the carrying value.

The WSJ Real Time Economics blog has more: Running Numbers on Treasury Bailout Plan

In a research note Thursday, Goldman Sachs estimated that there are probably about $1.15 trillion in distressed assets in the market.The Goldman research note included calculations for losses also (ranging from none to $200 billion), although these were more examples than projections.

...

That number is higher than the figure proposed by the Treasury, but it represents the face value of the mortgages. Since the discussion focuses on delinquent or foreclosed loans, the government should be getting a discount. Paying as high as 70 cents on the dollar would translate into $1 trillion in buying power for $700 billion.

Price is still the key. Since Treasury doesn't plan on churning the $700 billion, the losses will be a portion of the amount invested - and the losses depend on how much Treasury pays (or overpays!) for the assets. The losses are unknowable at this point, but probably in the zero to $300 billion range. My guess - until we know more on pricing - would be towards the high side of that range.

FDIC Responds to Bloomberg Story on Deposit Insurance Fund

by Calculated Risk on 9/25/2008 03:12:00 PM

From the FDIC: Open Letter to Bloomberg News about FDIC Deposit Insurance Fund

Bloomberg reporter David Evans' piece ("FDIC May Need $150 Billion Bailout as Local Bank Failures Mount," Sept. 25) does a serious disservice to your organization and your readers by painting a skewed picture of the FDIC insurance fund. Let me be clear: The insurance fund is in a strong financial position to weather a significant upsurge in bank failures. The FDIC has all the tools and resources necessary to meet our commitment to insured depositors, which we view as sacred. I do not foresee – as Mr. Evans suggests – that taxpayers may have to foot the bill for a "bailout."

Let's look at the real facts about the FDIC insurance fund. The fund's current balance is $45 billion – but that figure is not static. The fund will continue to incur the cost of protecting insured depositors as more banks may fail, but we continually bring in more premium income. We will propose raising bank premiums in the coming weeks to ensure that the fund remains strong. And, at the same time, we will propose higher premiums on higher risk activity to create economic incentives for poorly managed banks to change their risk profiles. The fund is 100 percent industry-backed. Our ability to raise premiums essentially means that the capital of the entire banking industry – that's $1.3 trillion – is available for support.

Moreover, if needed, the FDIC has longstanding lines of credit with the Treasury Department. Congress, understanding the need to ensure that working capital is available to the FDIC to provide bridge funding between the time a bank fails and when its assets are sold, provided broad authority for us to borrow from Treasury's Federal Financing Bank. If necessary, we can potentially raise very large sums of working capital, which would be paid back as the FDIC liquidates assets of failed banks. As per our authorizing statute, any money we might borrow from the Treasury must be paid back from industry assessments. Only once in the FDIC's history have we had to borrow from the Treasury – in the early 1990s – and that money was paid back with interest in less than two years.

Finally, Mr. Evans' suggestion that the "government" could ever be "on the hook for uninsured deposits" demonstrates a misunderstanding of FDIC insurance. To protect taxpayers, we are required to follow the "least cost" resolution, which means that uninsured depositors are paid in full only if this is the least costly option for the FDIC. This usually occurs when a bidder for the failed bank is willing to pay a higher price for the entire deposit franchise. We are authorized to deviate from the "least cost" resolution only where a so-called "systemic risk" exception is made. This is an extraordinary procedure which we have never invoked. And again, any money we borrow from the Treasury Department must be repaid through industry assessments.

I am confident in the strength of the FDIC's resources to make good on our sacred pledge to insured depositors. And, remember, no depositor has ever lost a penny of insured deposits, and never will.

Report: Bailout to be in Installments

by Calculated Risk on 9/25/2008 02:40:00 PM

From the WSJ: Agreement Reached on Bailout Ahead of High-Level Meeting

... lawmakers agreed to legislative principles that would approve Treasury's request for the funds, but would break it into installments ... Treasury would have access to $250 billion immediately, with another $100 billion to follow if needed. Congress would be able to block the last installment through a vote if it was unhappy with the program.This was one of the good suggestions that came from Congress (and probably all of you).

WaMu Cliff Diving

by Calculated Risk on 9/25/2008 01:29:00 PM

WaMu's stock price now off 31%.

Fitch and S&P both cut their ratings earlier this week. And any hope for a deal is apparently fading ...

Bank Failure Friday might be interesting tomorrow. With $310 billion in assets (hat tip Nemo), WaMu would be the biggest bank failure in history - in fact it would be larger than the previous top ten added together (although maybe not in inflation adjusted terms).

UPDATE: Analyst Richard Bove put an estimage on a WaMu failure, from Bloomberg: FDIC May Need $150 Billion Bailout as Local Bank Failures Mount (hat tip Michael Brian)

A federal takeover of Washington Mutual, which has assets of $310 billion, could cost taxpayers $24 billion ... according to Richard Bove, an analyst at Miami-based Ladenburg Thalmann & Co.

Report: Dodd says Agreement Reached on Bailout

by Calculated Risk on 9/25/2008 01:10:00 PM

Update: From CNBC: Lawmakers Say Financial Bailout Agreement Reached

CNBC Headline:

Sen. Dodd: "Fundamental" Agreement Reached on Bailout.

WSJ Headline:

Rep. Frank says Congress 'on track' to pass rescue plan.

Still no details.

Pelosi Says Bailout Will be Passed

by Calculated Risk on 9/25/2008 11:13:00 AM

From MarketWatch: House Speaker Pelosi reassures market on rescue plan

Pelosi said the exact timing of the House vote would depend on the outcome of closed-door meetings currently underway on Capitol Hill.No details yet ...

Credit Spreads: Off the Charts

by Calculated Risk on 9/25/2008 10:47:00 AM

We've been tracking the TED spread as a measure of distress in the credit markets (the difference between the LIBOR interest rate and the three month T-bill). Usually the TED spread is less than 0.5%. The higher the spread, the greater the perceived credit risks (compared to "risk free" treasuries).

The TED spread has increased to 3.27% this morning. Completely off the charts! Here is the TED Spread from Bloomberg.

And the following graph is the A2/P2 spread from the Fed's commercial paper report. The A2/P2 Spread hit 409bp yesterday. This is literally off the chart compared to any previous period.

When the A2/P2 spread spiked to 160 last year that was considered shocking; now that spike looks minor. Click on graph for larger image in new window.

Click on graph for larger image in new window.

This is the spread between high and low quality 30 day nonfinancial commercial paper.

What is commercial paper (CP)? This is short term paper - less than 9 months, but usually much shorter duration like 30 days - that is issued by companies to finance short term needs. Many companies issue CP, and for many of these companies the risk of default is close to zero. This is the high quality CP. Lower rated companies also issue CP and this is the A2/P2 rating.

Usually the spread between the A2/P2 and AA paper shows the concern of default for the A2/P2 paper. But right now this shows the credit markets are essentially locked up waiting for The Mother of All Bailouts.

August New Home Sales: Lowest August Since 1982

by Calculated Risk on 9/25/2008 10:10:00 AM

According to the Census Bureau report, New Home Sales in August were at a seasonally adjusted annual rate of 460 thousand. Sales for July were revised up slightly to 520 thousand.  Click on graph for larger image in new window.

Click on graph for larger image in new window.

The first graph shows monthly new home sales (NSA - Not Seasonally Adjusted).

Notice the Red columns for 2008. This is the lowest sales for August since 1982. (NSA, 39 thousand new homes were sold in August 2008, 36 thousand were sold in August 1982).

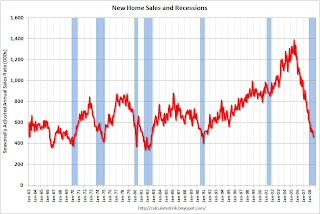

As the graph indicates, sales in 2008 are substantially worse than the previous years. The second graph shows New Home Sales vs. recessions for the last 45 years. New Home sales have fallen off a cliff.

The second graph shows New Home Sales vs. recessions for the last 45 years. New Home sales have fallen off a cliff.

Sales of new one-family houses in August 2008 were at a seasonally adjusted annual rate of 460,000, according to estimates released jointly today by the U.S. Census Bureau and the Department of Housing and Urban Development. This is 11.5 percent below the revised July rate of 520,000 and is 34.5 percent below the August 2007 estimate of 702,000.And one more long term graph - this one for New Home Months of Supply.

"Months of supply" is at 10.9 months.

"Months of supply" is at 10.9 months. Note that this doesn't include cancellations, but that was true for the earlier periods too. Sales are falling quickly, but inventory is declining too, so the months of supply is slightly lower than the peak of 11.2 months in March 2008.

The all time high for Months of Supply was 11.6 months in April 1980.

And on inventory:

The seasonally adjusted estimate of new houses for sale at the end of August was 408,000. This represents a supply of 10.9 months at the current sales rate.Inventory numbers from the Census Bureau do not include cancellations and cancellations are falling, but are still near record levels. Note that new home inventory does not include many condos (especially high rise condos), and areas with significant condo construction will have much higher inventory levels.

As I noted last month, I now expect that 2008 will be the peak of the inventory cycle (in terms of months of supply) and could be the bottom of the sales cycle for new home sales. But the news is still grim for the home builders. Usually new home sales rebound fairly quickly following a bottom (see the 2nd graph above), but this time I expect a slow recovery because of the overhang of existing homes for sales (especially distressed properties). If the recession is more severe than I currently expect, new home sales might fall even further.

This is a very weak report, but as grim as the news is for new home sales, I remain more pessimistic about existing home sales, and existing home prices, than new home sales.