by Calculated Risk on 9/25/2008 02:40:00 PM

Thursday, September 25, 2008

Report: Bailout to be in Installments

From the WSJ: Agreement Reached on Bailout Ahead of High-Level Meeting

... lawmakers agreed to legislative principles that would approve Treasury's request for the funds, but would break it into installments ... Treasury would have access to $250 billion immediately, with another $100 billion to follow if needed. Congress would be able to block the last installment through a vote if it was unhappy with the program.This was one of the good suggestions that came from Congress (and probably all of you).

WaMu Cliff Diving

by Calculated Risk on 9/25/2008 01:29:00 PM

WaMu's stock price now off 31%.

Fitch and S&P both cut their ratings earlier this week. And any hope for a deal is apparently fading ...

Bank Failure Friday might be interesting tomorrow. With $310 billion in assets (hat tip Nemo), WaMu would be the biggest bank failure in history - in fact it would be larger than the previous top ten added together (although maybe not in inflation adjusted terms).

UPDATE: Analyst Richard Bove put an estimage on a WaMu failure, from Bloomberg: FDIC May Need $150 Billion Bailout as Local Bank Failures Mount (hat tip Michael Brian)

A federal takeover of Washington Mutual, which has assets of $310 billion, could cost taxpayers $24 billion ... according to Richard Bove, an analyst at Miami-based Ladenburg Thalmann & Co.

Report: Dodd says Agreement Reached on Bailout

by Calculated Risk on 9/25/2008 01:10:00 PM

Update: From CNBC: Lawmakers Say Financial Bailout Agreement Reached

CNBC Headline:

Sen. Dodd: "Fundamental" Agreement Reached on Bailout.

WSJ Headline:

Rep. Frank says Congress 'on track' to pass rescue plan.

Still no details.

Pelosi Says Bailout Will be Passed

by Calculated Risk on 9/25/2008 11:13:00 AM

From MarketWatch: House Speaker Pelosi reassures market on rescue plan

Pelosi said the exact timing of the House vote would depend on the outcome of closed-door meetings currently underway on Capitol Hill.No details yet ...

Credit Spreads: Off the Charts

by Calculated Risk on 9/25/2008 10:47:00 AM

We've been tracking the TED spread as a measure of distress in the credit markets (the difference between the LIBOR interest rate and the three month T-bill). Usually the TED spread is less than 0.5%. The higher the spread, the greater the perceived credit risks (compared to "risk free" treasuries).

The TED spread has increased to 3.27% this morning. Completely off the charts! Here is the TED Spread from Bloomberg.

And the following graph is the A2/P2 spread from the Fed's commercial paper report. The A2/P2 Spread hit 409bp yesterday. This is literally off the chart compared to any previous period.

When the A2/P2 spread spiked to 160 last year that was considered shocking; now that spike looks minor. Click on graph for larger image in new window.

Click on graph for larger image in new window.

This is the spread between high and low quality 30 day nonfinancial commercial paper.

What is commercial paper (CP)? This is short term paper - less than 9 months, but usually much shorter duration like 30 days - that is issued by companies to finance short term needs. Many companies issue CP, and for many of these companies the risk of default is close to zero. This is the high quality CP. Lower rated companies also issue CP and this is the A2/P2 rating.

Usually the spread between the A2/P2 and AA paper shows the concern of default for the A2/P2 paper. But right now this shows the credit markets are essentially locked up waiting for The Mother of All Bailouts.

August New Home Sales: Lowest August Since 1982

by Calculated Risk on 9/25/2008 10:10:00 AM

According to the Census Bureau report, New Home Sales in August were at a seasonally adjusted annual rate of 460 thousand. Sales for July were revised up slightly to 520 thousand.  Click on graph for larger image in new window.

Click on graph for larger image in new window.

The first graph shows monthly new home sales (NSA - Not Seasonally Adjusted).

Notice the Red columns for 2008. This is the lowest sales for August since 1982. (NSA, 39 thousand new homes were sold in August 2008, 36 thousand were sold in August 1982).

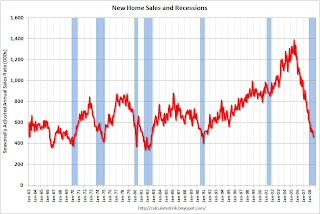

As the graph indicates, sales in 2008 are substantially worse than the previous years. The second graph shows New Home Sales vs. recessions for the last 45 years. New Home sales have fallen off a cliff.

The second graph shows New Home Sales vs. recessions for the last 45 years. New Home sales have fallen off a cliff.

Sales of new one-family houses in August 2008 were at a seasonally adjusted annual rate of 460,000, according to estimates released jointly today by the U.S. Census Bureau and the Department of Housing and Urban Development. This is 11.5 percent below the revised July rate of 520,000 and is 34.5 percent below the August 2007 estimate of 702,000.And one more long term graph - this one for New Home Months of Supply.

"Months of supply" is at 10.9 months.

"Months of supply" is at 10.9 months. Note that this doesn't include cancellations, but that was true for the earlier periods too. Sales are falling quickly, but inventory is declining too, so the months of supply is slightly lower than the peak of 11.2 months in March 2008.

The all time high for Months of Supply was 11.6 months in April 1980.

And on inventory:

The seasonally adjusted estimate of new houses for sale at the end of August was 408,000. This represents a supply of 10.9 months at the current sales rate.Inventory numbers from the Census Bureau do not include cancellations and cancellations are falling, but are still near record levels. Note that new home inventory does not include many condos (especially high rise condos), and areas with significant condo construction will have much higher inventory levels.

As I noted last month, I now expect that 2008 will be the peak of the inventory cycle (in terms of months of supply) and could be the bottom of the sales cycle for new home sales. But the news is still grim for the home builders. Usually new home sales rebound fairly quickly following a bottom (see the 2nd graph above), but this time I expect a slow recovery because of the overhang of existing homes for sales (especially distressed properties). If the recession is more severe than I currently expect, new home sales might fall even further.

This is a very weak report, but as grim as the news is for new home sales, I remain more pessimistic about existing home sales, and existing home prices, than new home sales.

New Home Sales Decline Sharply

by Calculated Risk on 9/25/2008 10:05:00 AM

From the Census Bureau: New Residential Sales in August 2008

Sales of new one-family houses in August 2008 were at a seasonally adjusted annual rate of 460,000, according to estimates released jointly today by the U.S. Census Bureau and the Department of Housing and Urban Development. This is 11.5 percent below the revised July rate of 520,000 and is 34.5 percent below the August 2007 estimate of 702,000.This is a very weak report. Analysis and graphs coming ...

Reports: Paulson Plan Deal Near

by Calculated Risk on 9/25/2008 09:18:00 AM

From the WSJ: Bailout Pact Gains Momentum Amid Push for Tough Controls

A likely bill would include limits on executive pay in situations where the government puts a large amount of money into a failing institution. In certain cases, the government could receive warrants that would give it the right to acquire shares in the company. Also included is beefed-up oversight through the Government Accountability Office, an investigative arm of Congress.The real question is the price mechanism for buying securities.

Likely not included is a controversial idea to let judges alter the terms of mortgages during bankruptcy proceedings.

Vikas Bajaj writes in the NY Times: Plan’s Mystery: What’s All This Stuff Worth?. See the story about the Bear Stearns Alt-A Trust 2006-7.

Bear Stearns bundled the loans into 37 different kinds of bonds, ranked by varying levels of risk, for sale to investment banks, hedge funds and insurance companies.This is the problem when you hear about the losses associated with a Trust. In this case the overall losses are only 1.6% so far (but this is Alt-A so it will get much worse), but many of lower tranches have been wiped out.

If any of the mortgages went bad — and, it turned out, many did — the bonds at the bottom of the pecking order would suffer losses first, followed by the next lowest, and so on up the chain. By one measure, the Bear Stearns Alt-A Trust 2006-7 has performed well: It has suffered losses of about 1.6 percent. Of those loans, 778 have been paid off or moved through the foreclosure process.

But by many other measures, it’s a toxic portfolio.

We don't know if Paulson will overpay for assets - losing money for the taxpayers - and that is why warrants are necessary.

Weekly Unemployment Claims Jump to 493,000

by Calculated Risk on 9/25/2008 08:44:00 AM

The DOL reports on weekly unemployment insurance claims:

In the week ending Sept. 20, the advance figure for seasonally adjusted initial claims was 493,000, an increase of 32,000 from the previous week's revised figure of 461,000. It is estimated that the effects of Hurricane Gustav in Louisiana and the effects of Hurricane Ike in Texas added approximately 50,000 claims to the total. The 4-week moving average was 462,500, an increase of 16,000 from the previous week's revised average of 446,500.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows weekly claims. The four moving average is at 462,500.

Some of the jump in unemployment claims is a result of the hurricanes - and should be temporary - but away from the financial crisis this shows there are significant weaknesses in the labor market and real economy.

GE Warns: "Difficult Conditions", Sees No Near Term Improvement

by Calculated Risk on 9/25/2008 08:29:00 AM

The WSJ reports: GE Cuts Earnings Forecast, Suspends Stock Buyback that GE lowered its earning guidance, suspended its stock buyback, and will probably not increase its dividend.

[GE cited] "unprecedented weakness and volatility in the financial-services markets," and ... issued a harrowing projection for the economy, as predicting "that difficult conditions in the financial-services markets are not likely to improve in the near future."