by Calculated Risk on 9/24/2008 01:51:00 PM

Wednesday, September 24, 2008

AP: Paulson Agrees to Executive Pay Limits as Part of Plan

From AP: Bush to address nation tonight on economy woes

But what about contingent shares, oversight, and transparency?

UPDATE: CNBC reports: Treasury Denies Report of Deal on Capping CEO Pay

Bank Run in Asia

by Calculated Risk on 9/24/2008 01:16:00 PM

From the NY Times: Anxious Depositors Withdraw Cash From Asian Bank (hat tip Dave B)

Throngs of depositors lined up outside the headquarters and branches of the Bank of East Asia here on Wednesday to withdraw their money, underlining widespread anxiety in Asia that Wall Street’s recent difficulties might spread across the Pacific.Check out the photo. It looks like the earlier bank runs at Northern Rock and IndyMac.

Bernanke on Recapitalization

by Calculated Risk on 9/24/2008 01:02:00 PM

I listened to Chairman Bernanke's testimony this morning. It is clear the goal is to recapitalize the banks, and Dr. Bernanke implied this would happen either by paying more than current book value (with the banks taking write-ups) or by building confidence in private investors after the toxic securities are bought by the taxpayers.

Bernanke went on to say that private investors might not be interested in investing if there were contingent shares outstanding - because they would be afraid of dilution.

From Bloomberg: Paulson, Bernanke Put Bank Aid Ahead of Best Deal

Treasury Secretary Henry Paulson and Federal Reserve Chairman Ben S. Bernanke have signaled that their priority is shoring up the nation's banks even if it means they don't get taxpayers the cheapest prices for the devalued assets the government buys.And if the program was changed to an RFC type recapitalization (as opposed to buying toxic assets), then most lenders wouldn't participate until they were at death's door.

``I am not advocating that the government intentionally overpay,'' Bernanke told the Joint Economic Committee today, in response to a question from U.S. Rep. Jim Saxton, a New Jersey Republican.

...

Senate Banking Committee Chairman Christopher Dodd has proposed that the Treasury potentially receive equity stakes in some companies that sell assets to the government. The stakes would ``vest'' in an amount equal to the 125 percent of the dollar value of the loss realized by the Treasury on the sale of the assets.

That type of ``loss participation'' proposal would endanger companies' ability to raise private capital afterwards, Jeffrey Rosenberg, head of credit strategy research at Bank of America Corp. in New York, wrote in a report yesterday.

What a mess.

And a final point, many people are saying the government can only lose a portion of the $700 billion because there will be offsetting assets. This is true in the Fannie and Freddie conservatorship (the mortgage assets mostly offset the debt of Fannie and Freddie), but it is not true here. Although Paulson and Bernanke are talking about hold-to-maturity prices, they are also talking about both buying and selling securities. A little math will show that if you take a loss (say 30%) on each transaction, it doesn't take many transaction to lose most of the entire $700 billion.

S&P cuts WaMu to 'poor quality'

by Calculated Risk on 9/24/2008 11:51:00 AM

From MarketWatch:

[S&P] ... lowered Washington Mutual Inc.'s counterparty credit rating to "poor quality" of CCC/C from BB-/B. "The downgrade was due to the increased likelihood that a potential sale of the company may not involve the whole company, which increases the risk of default for holding company creditors," said Victoria Wagner, an S&P credit analyst.Is it Friday yet?

emphasis added

Bernanke Live Video

by Calculated Risk on 9/24/2008 11:22:00 AM

For those that want to watch online, here is a live video from CNBC. (hat tip NoVAOnlooker)

Update: Over now.

Existing Home Sales, NSA

by Calculated Risk on 9/24/2008 10:43:00 AM

Here is a look at Not Seasonally Adjusted existing home sales: Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows Not Seasonally Adjusted (NSA) existing home sales for 2005 through 2008. Sales are lower in August 2008 compared to the previous three years.

NSA sales were reported at 489 thousand in August, about 15% less than August 2007. Usually NSA sales in August are higher than July, but not this year.

There have been 3.38 million sales so far in 2008, and sales are currently on pace for about 4.9 million total this year.

August Existing Home Sales Decline

by Calculated Risk on 9/24/2008 09:47:00 AM

From NAR: Existing-Home Sales Slide on Tight Mortgage Availability

Existing-home sales were down in August following a healthy gain in July as tight mortgage credit curtailed activity, according to the National Association of Realtors®. Sales rose in the Midwest and South but fell in the Northeast and West.

Nationally, existing-home sales – including single-family, townhomes, condominiums and co-ops –declined 2.2 percent to a seasonally adjusted annual rate1 of 4.91 million units in August from an upwardly revised pace of 5.02 million in July, but are 10.7 percent below the 5.50 million-unit pace in August 2007.

Total housing inventory at the end of August fell 7.0 percent to 4.26 million existing homes available for sale, which represents a 10.4-month supply at the current sales pace, down from a revised 10.9-month supply in July.

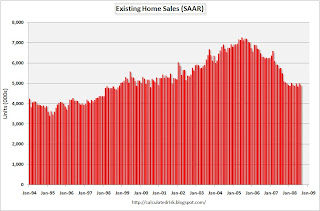

Click on graph for larger image in new window.

Click on graph for larger image in new window.The first graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1993.

Sales in August 2008 (4.91 million SAAR) were the weakest August since 1998 (4.74 million SAAR).

It's important to note that a large percentage of these sales were foreclosure resales (banks selling foreclosed properties). The NAR suggested two months ago that "short sales and foreclosures [account] for approximately one-third of transactions". Although these are real transactions, this means activity (ex-foreclosures) is running around 3.3 million SAAR.

The second graph shows nationwide inventory for existing homes. According to NAR, inventory decreased to 4.26 million in August, from an all time record 4.67 million homes for sale in July. Usually inventory peaks in mid-Summer, so July was probably the peak for inventory this year.

The second graph shows nationwide inventory for existing homes. According to NAR, inventory decreased to 4.26 million in August, from an all time record 4.67 million homes for sale in July. Usually inventory peaks in mid-Summer, so July was probably the peak for inventory this year. This decline was the normal seasonal pattern.

Most REOs (bank owned properties) are included in the inventory because they are listed - but not all. Some houses in the foreclosure process are listed as short sales - so those would be counted too.

The third graph shows the 'months of supply' metric for the last six years.

The third graph shows the 'months of supply' metric for the last six years.Months of supply declined to 10.4 months.

This follows the highest year end months of supply since 1982 (the all time record of 11.5 months of supply).

My forecast was for Months of Supply to peak at about 12 months this year and this metric was pretty close.

I expect sales to fall further over the next few months, although I think inventory has peaked for the year.

TED Spread: Back in "Credit Hell"

by Calculated Risk on 9/24/2008 09:39:00 AM

Here is the TED Spread from Bloomberg. The TED spread has increased to 3.02% (after falling to just over 2.5% yesterday). This suggests the credit markets are still in "credit hell" as reader BR put it this morning.

Most of the increase in the TED spread is because the three month T-bill is trading back down to 0.47%.

Note: the TED spread is the difference between the three month T-bill and the LIBOR interest rate. Usually the TED spread is less than 0.5%. The higher the spread, the greater the perceived credit risks (compared to "risk free" treasuries).

Buffett: Paulson Plan "Absolutely Necessary"

by Calculated Risk on 9/24/2008 09:07:00 AM

Warren Buffett was interviewed on CNBC this morning.

From Bloomberg: Buffett Calls Crisis an `Economic Pearl Harbor,' Backs Paulson

Billionaire investor Warren Buffett, calling the market turmoil ``an economic Pearl Harbor,'' said Treasury Secretary Henry Paulson's $700 billion proposal to prop up the U.S. financial system is ``absolutely necessary.''On his investment in Goldman, Buffett said:

``I am betting on the Congress doing the right thing for the American public and passing this bill,'' Buffett said.

"If I didn't think the government was going to act I wouldn't have done anything."

The Fed Never Sleeps: $30 Billion in Swaps for Overseas Markets

by Calculated Risk on 9/24/2008 02:56:00 AM

From the Fed:

Today, the Federal Reserve, the Reserve Bank of Australia, the Danmarks Nationalbank, the Norges Bank, and the Sveriges Riksbank are announcing the establishment of temporary reciprocal currency arrangements (swap lines) to address elevated pressures in U.S. dollar short-term funding markets. These facilities, like those already in place with other central banks, are designed to improve liquidity conditions in global financial markets. Central banks continue to work together during this period of market stress and are prepared to take further steps as the need arises.

Federal Reserve Actions

The Federal Open Market Committee has authorized the establishment of new swap facilities with the Reserve Bank of Australia, the Sveriges Riksbank, the Danmarks Nationalbank, and the Norges Bank. These new facilities will support the provision of U.S. dollar liquidity in amounts of up to $10 billion each by the Reserve Bank of Australia and the Sveriges Riksbank and in amounts of up to $5 billion each by the Danmarks Nationalbank and the Norges Bank.

In sum, these new facilities represent a $30 billion addition to the $247 billion previously authorized temporary reciprocal currency arrangements with other central banks: European Central Bank ($110 billion), Bank of Japan ($60 billion), Bank of England ($40 billion), Swiss National Bank ($27 billion), and Bank of Canada ($10 billion).

These reciprocal currency arrangements have been authorized through January 30, 2009.