by Calculated Risk on 9/24/2008 11:22:00 AM

Wednesday, September 24, 2008

Bernanke Live Video

For those that want to watch online, here is a live video from CNBC. (hat tip NoVAOnlooker)

Update: Over now.

Existing Home Sales, NSA

by Calculated Risk on 9/24/2008 10:43:00 AM

Here is a look at Not Seasonally Adjusted existing home sales: Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows Not Seasonally Adjusted (NSA) existing home sales for 2005 through 2008. Sales are lower in August 2008 compared to the previous three years.

NSA sales were reported at 489 thousand in August, about 15% less than August 2007. Usually NSA sales in August are higher than July, but not this year.

There have been 3.38 million sales so far in 2008, and sales are currently on pace for about 4.9 million total this year.

August Existing Home Sales Decline

by Calculated Risk on 9/24/2008 09:47:00 AM

From NAR: Existing-Home Sales Slide on Tight Mortgage Availability

Existing-home sales were down in August following a healthy gain in July as tight mortgage credit curtailed activity, according to the National Association of Realtors®. Sales rose in the Midwest and South but fell in the Northeast and West.

Nationally, existing-home sales – including single-family, townhomes, condominiums and co-ops –declined 2.2 percent to a seasonally adjusted annual rate1 of 4.91 million units in August from an upwardly revised pace of 5.02 million in July, but are 10.7 percent below the 5.50 million-unit pace in August 2007.

Total housing inventory at the end of August fell 7.0 percent to 4.26 million existing homes available for sale, which represents a 10.4-month supply at the current sales pace, down from a revised 10.9-month supply in July.

Click on graph for larger image in new window.

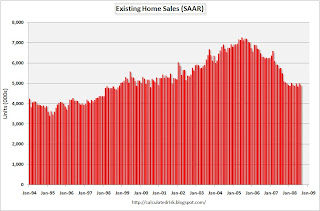

Click on graph for larger image in new window.The first graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1993.

Sales in August 2008 (4.91 million SAAR) were the weakest August since 1998 (4.74 million SAAR).

It's important to note that a large percentage of these sales were foreclosure resales (banks selling foreclosed properties). The NAR suggested two months ago that "short sales and foreclosures [account] for approximately one-third of transactions". Although these are real transactions, this means activity (ex-foreclosures) is running around 3.3 million SAAR.

The second graph shows nationwide inventory for existing homes. According to NAR, inventory decreased to 4.26 million in August, from an all time record 4.67 million homes for sale in July. Usually inventory peaks in mid-Summer, so July was probably the peak for inventory this year.

The second graph shows nationwide inventory for existing homes. According to NAR, inventory decreased to 4.26 million in August, from an all time record 4.67 million homes for sale in July. Usually inventory peaks in mid-Summer, so July was probably the peak for inventory this year. This decline was the normal seasonal pattern.

Most REOs (bank owned properties) are included in the inventory because they are listed - but not all. Some houses in the foreclosure process are listed as short sales - so those would be counted too.

The third graph shows the 'months of supply' metric for the last six years.

The third graph shows the 'months of supply' metric for the last six years.Months of supply declined to 10.4 months.

This follows the highest year end months of supply since 1982 (the all time record of 11.5 months of supply).

My forecast was for Months of Supply to peak at about 12 months this year and this metric was pretty close.

I expect sales to fall further over the next few months, although I think inventory has peaked for the year.

TED Spread: Back in "Credit Hell"

by Calculated Risk on 9/24/2008 09:39:00 AM

Here is the TED Spread from Bloomberg. The TED spread has increased to 3.02% (after falling to just over 2.5% yesterday). This suggests the credit markets are still in "credit hell" as reader BR put it this morning.

Most of the increase in the TED spread is because the three month T-bill is trading back down to 0.47%.

Note: the TED spread is the difference between the three month T-bill and the LIBOR interest rate. Usually the TED spread is less than 0.5%. The higher the spread, the greater the perceived credit risks (compared to "risk free" treasuries).

Buffett: Paulson Plan "Absolutely Necessary"

by Calculated Risk on 9/24/2008 09:07:00 AM

Warren Buffett was interviewed on CNBC this morning.

From Bloomberg: Buffett Calls Crisis an `Economic Pearl Harbor,' Backs Paulson

Billionaire investor Warren Buffett, calling the market turmoil ``an economic Pearl Harbor,'' said Treasury Secretary Henry Paulson's $700 billion proposal to prop up the U.S. financial system is ``absolutely necessary.''On his investment in Goldman, Buffett said:

``I am betting on the Congress doing the right thing for the American public and passing this bill,'' Buffett said.

"If I didn't think the government was going to act I wouldn't have done anything."

The Fed Never Sleeps: $30 Billion in Swaps for Overseas Markets

by Calculated Risk on 9/24/2008 02:56:00 AM

From the Fed:

Today, the Federal Reserve, the Reserve Bank of Australia, the Danmarks Nationalbank, the Norges Bank, and the Sveriges Riksbank are announcing the establishment of temporary reciprocal currency arrangements (swap lines) to address elevated pressures in U.S. dollar short-term funding markets. These facilities, like those already in place with other central banks, are designed to improve liquidity conditions in global financial markets. Central banks continue to work together during this period of market stress and are prepared to take further steps as the need arises.

Federal Reserve Actions

The Federal Open Market Committee has authorized the establishment of new swap facilities with the Reserve Bank of Australia, the Sveriges Riksbank, the Danmarks Nationalbank, and the Norges Bank. These new facilities will support the provision of U.S. dollar liquidity in amounts of up to $10 billion each by the Reserve Bank of Australia and the Sveriges Riksbank and in amounts of up to $5 billion each by the Danmarks Nationalbank and the Norges Bank.

In sum, these new facilities represent a $30 billion addition to the $247 billion previously authorized temporary reciprocal currency arrangements with other central banks: European Central Bank ($110 billion), Bank of Japan ($60 billion), Bank of England ($40 billion), Swiss National Bank ($27 billion), and Bank of Canada ($10 billion).

These reciprocal currency arrangements have been authorized through January 30, 2009.

Report: FBI Investigates Four Companies in Credit Crisis

by Calculated Risk on 9/24/2008 01:07:00 AM

From the WSJ: FBI Investigates Four Firms at Heart of the Mess

The Federal Bureau of Investigation's preliminary inquiries are focusing on whether fraud helped cause some of the troubles at Fannie Mae, Freddie Mac, Lehman Brothers Holdings Inc. and American International Group Inc., according to senior law-enforcement officials.

...

Pressure is building for the FBI and regulators to hold top executives accountable for the crisis that has crippled the nation's finance sector. ... Investigators say that despite calls from some quarters to prosecute wealthy bankers who helped fuel the mortgage bubble, it is unclear what crimes they will find at the root of the exotic financial vehicles that have sickened banks around the world.

Tuesday, September 23, 2008

Paulson: "I Want Oversight!"

by Calculated Risk on 9/23/2008 09:44:00 PM

Update to make this clear: I never focused on Section 8 (oversight) of the Paulson Proposal because I felt this was obviously going to be changed. To be fair, sometimes people put an offensive clause in a proposed agreement as a negotiating ploy. I think Paulson learned that negotiating ploys don't go over very well with Senators!

From Paulson's proposal:

Sec. 8. Review.

Decisions by the Secretary pursuant to the authority of this Act are non-reviewable and committed to agency discretion, and may not be reviewed by any court of law or any administrative agency.

Paulson today:

If Paulson really wants transparency, give us a website, updated daily, with the details of all transactions!

Predictions and Emails

by Calculated Risk on 9/23/2008 09:08:00 PM

Predictions:

Hopefully there will be some questions about pricing tomorrow, and maybe transparency (a website with all transactions!).

If you want to have an impact - call your Congressman - the vote will be closer in the House.

Emails: I've been swamped with emails this week and especially today. Many of the emails contained detailed questions or thoughtful alternative plans. I apologize that I'm unable to answer all the emails, and I sincerely appreciate the thoughts and questions. Best to all.

Hold-to-Maturity Pricing

by Calculated Risk on 9/23/2008 06:11:00 PM

An interesting question is why do Bernanke and Paulson believe the Hold-to-Maturity price is higher than the current market price for MBS?

One possible explanation is market failure based on information asymmetry. Mark Thoma explores this question: "Hold to Maturity" versus "Fire Sale" Prices

Let me try to give a defense of paying above current market prices (in a devil's advocate sense). For markets to function according to competitive ideals, full information must be available to all market participants. When information is lacking, or when it is asymmetric, the outcome is inefficient relative to the full information outcome.In this case, I don't think the information is asymmetric because both buyer and seller are aware of the characteristics of the MBS. There is uncertainty regarding future house prices (and MBS performance is related to house prices), but that isn't a market failure.

The nature of these assets - their opacity as it has come to be called - makes full information unavailable. I'm not sure how asymmetric information is, people holding the assets don't know themselves whether a particular asset might blow up and lose it's value or not, but there is some degree of asymmetric information in these markets (a standard lemons problem).

This is market failure due to lack of full information, and asymmetric information to the extent it does exist, is depressing prices.

Professor Thoma also links to Professor Kling: Hold-to-Maturity Pricing

Suppose that you owe $110,000 on your mortgage, due in one payment a year from now. The "hold to maturity price" is that $110,000, discounted back to the present. At an interest rate of 10 percent, the price is $100,000.....NOT!First, this analysis assumes 100% loss severity in the event of default. If there is a 50% chance of default, half the time the mortgage will be worth $110K discounted back to the present. But if the borrower defaults, the value will not be zero since there is a recovery value on most mortgages. Kling apparently assumes a loss severity of 100% in the event of default (perhaps he was thinking of a 2nd mortgage), but a more normal severity would be around 50% or $55K discounted back to the present. So in this example, and using a 10% discount rate, the mortgage would be worth $100K * 0.5 + $50K * 0.5 or $75K at present.

The fair price depends on the probability that you will default. If there is a 50 percent chance that you will default, the fair price is more like $50,000.

The probability that you will default depends on the distribution of possible paths of future home prices. Along paths of falling home prices, defaults are much more likely than along paths of stable or rising prices.

It's hard to know how home prices will behave, but right now if I were pricing the risk (something I used to do for a living, unlike the key decision-makers in this bailout), I would include a lot of paths where prices go down. That would make the "hold-to-maturity" prices of the mortgage securities, properly calculated, pretty low in many cases.

But I think this might provide a clue to the pricing disparity: because of the uncertainty in future house prices (and MBS performance) potential buyers are probably using a higher discount rate than Bernanke / Paulson. Typically the higher the standard deviation of the potential outcomes (higher risk), the higher the discount rate. So even if investors view the future price the same as Bernanke/Paulson, they might view the NPV as much lower. In addition, the cost of capital is higher for private investors - also impacting their discount rate.

Perhaps Bernanke / Paulson believe that aggregating assets will lower the risk. Usually when you aggregate assets, the overall volatility decreases. This is almost always true for holding a group of stock (the beta on the S&P 500 is lower than the beta on most stocks in the S&P 500). But if the assets are all impacted by one parameter - in this case future house prices - aggregating assets does not lower the risk.

This would make a great question for Bernanke tomorrow. Why does he believe the Hold-to-Maturity price is higher than the current market price? Is this because of some market failure? Or because of different discount rates? Or some other reason?