by Calculated Risk on 9/17/2008 09:45:00 PM

Wednesday, September 17, 2008

Report: Morgan Stanley CEO: Quote Corrected

UPDATE: The NY Times has corrected this story:

Editors’ NoteThis NY Times article has an explosive quote attributed to Morgan Stanley CEO John Mack: As Fears Grow, Wall St. Titans See Shares Fall

An earlier version of this article cited two sources who were said to have been briefed on a conversation in which John J. Mack, chief executive of Morgan Stanley, had told Vikrim S. Pandit, Citigroup’s chief executive, that “we need a merger partner or we’re not going to make it.” On Thursday, Morgan Stanley vigorously denied that Mr. Mack had made the comment, as did Citigroup, which had declined to comment on Wednesday.

The Times’s two sources have since clarified their comments, saying that because they were not present during the discussions, they could not confirm that Mr. Mack had in fact made the statement. The Times should have asked Morgan Stanley for comment and should not have used the quotation without doing more to verify the sources’ version of events.

Seeking to avoid the kind fate that led Lehman and Bear Stearns to collapse, John J. Mack, Morgan Stanley’s chief executive, made an unsuccessful attempt Tuesday evening to convince Citigroup chief executive Vikram S. Pandit to enter into a combination, according to people briefed on the talks.Also according to the article, Mr. Mack has been complaining to regulators about short sellers spreading rumors. If that quote is accurate, then Mr. Mack has just given short sellers plenty of ammunition.

“We need a merger partner or we’re not going to make it,” Mr. Mack told Mr. Pandit, according to two people briefed on the talks. Mr. Pandit, a former senior investment banker at Morgan Stanley, said Citigroup was not interested. [Citi] is thinking of deals it can strike with consumer banks, like buying Washington Mutual out of bankruptcy, that would provide it with cheaper deposit funding.

emphasis added

Orange County: Record Foreclosures

by Calculated Risk on 9/17/2008 07:26:00 PM

From Mathew Padilla at the Mortgage Insider: Banks seize record number of O.C. homes

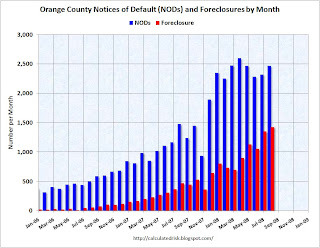

Banks foreclosed on 1,427 houses and condos in Orange County in August, surpassing the record set in July by 6% and up 204% from a year ago, reports DataQuick today.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the number of Notices of Default and Foreclosures per month in Orange County according to DataQuick.

The problem is continuing to get worse. The data isn't broken out by subprime, Alt-A and Prime loans, but my guess is Alt-A and Prime NODs and foreclosures are increasing rapidly.

WaMu: For Sale

by Calculated Risk on 9/17/2008 04:43:00 PM

From the NY Times: Washington Mutual Begins Efforts to Sell Itself

Goldman Sachs, which Washington Mutual has hired, started the auction several days ago, these people said. Among the potential bidders that Goldman has talked to are Wells Fargo, JPMorgan Chase and HSBC.

S&P 500: 25% Off Sale

by Calculated Risk on 9/17/2008 04:27:00 PM

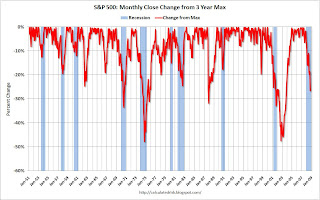

The S&P 500 closed 26.6% below the peak of last year.

The following graph shows the monthly closing change in the S&P 500 from the peak of the previous 3 years. This is a little unusual way to look at stock market correction. Since this uses monthly closing data, the worst declines aren't captured, but it gives an idea of the relative percentage losses in each bear market.  Click on graph for larger image in new window.

Click on graph for larger image in new window.

Currently the market decline is the fifth worst on a percentage basis since 1950.

The worst sell-offs were the decline during the '73-'75 recession, and the recent bust of the stock bubble. The next worst percentage declines happened during the '69-'70 recession, and the 1987 stock market correction (with no recession). This is clearly a significant bear market.

DataQuick: Almost Half of SoCal House Sales are Foreclosure Resales

by Calculated Risk on 9/17/2008 02:09:00 PM

From DataQuick: Southland home sales post second annual gain; another record price drop

Southern California home sales downshifted slightly in August from July, but were higher than a year ago for the second consecutive month. The median sales price continued to tumble, declining the most where buyers were the most active, a real estate information service reported.We have to careful with the median house price because that can be impacted by the mix of homes sold. Most of the foreclosure activity is at the low end, and this pushes down the median. A better measure of prices are repeat sale indices.

The median price paid for all new and resale houses and condos sold in Los Angeles, Riverside, San Diego, Ventura, San Bernardino and Orange counties was $330,000 last month, down 5.2 percent from $348,000 in July and down a record 34 percent from $500,000 in August 2007, according to San Diego-based MDA DataQuick.

Last month's median stood at the lowest point since November 2003 when it was also $330,000. The median peaked at $505,000 in the spring and summer of last year.

Sales have picked up most - sometimes at double or more last year's pace - in inland communities where home values have plummeted and foreclosures have soared. Foreclosure resales made up 45.5 percent of all Southland resales last month, up from 43.7 in July and 10 percent a year ago. The figure represents the percentage of homes resold in August that had been foreclosed on at some point in the prior 12 months.Almost half the sales in SoCal are foreclosure resales. Wow.

Foreclosure resales were highest in Riverside County, at 65.2 percent of resales, and lowest in Orange County, at 33.4 percent.

Money Market Funds Try to Calm Investors

by Calculated Risk on 9/17/2008 01:52:00 PM

After The Reserve Primary Fund shocked investors yesterday by halting redemptions and "breaking the buck", other money market funds are releasing information to calm investors.

Charles Schwab posted a notice on their web site:

Schwab Money Market Funds UpdateMarketWatch has more: Firms rush to keep money market investors calm

We want to reassure our Schwab clients that Schwab's Money Funds continue to maintain the $1 net asset value for your cash investments. Our first priority in managing these funds has been and will continue to be maintaining that $1 Net Asset Value.

In addition, we can confirm that Schwab Money Funds do not own any Lehman securities.

Three other money market fund companies have been identified as holding Lehman paper: Wachovia Corp. subsidiary Evergreen Investments, Northerwestern Mutual Life Insurance Co.'s Russell Investments and RiverSource Investments, the fund arm of Ameriprise Financial Inc.I'm sure WaMu enjoys being grouped with the dead and dying.

All three said they will support their funds to maintain the $1 net asset value of the funds' shares.

...

Fidelity Investors, Vanguard Group and BlackRock Inc. had already stressed their money market funds didn't hold any Lehman paper.

...

"None of our U.S. money market portfolios has any exposure to Lehman, American International Group Inc. or Washington Mutual Inc.", said Invesco in statement released on Wednesday.

Senators Gregg and Dodd: No More Shoes About to Drop

by Calculated Risk on 9/17/2008 12:45:00 PM

From NPR: Sens. Dodd, Gregg: No More Bailouts On The Horizon

Senator Gregg: “I don’t see any shoes out there that meet the standards of Freddie Mac, Fannie Mae or AIG.Audio is at NPR.

Senator Dodd: “I agree with that.”

NPR: "Meaning there won't be another huge huge bailout of this kind? You don't see one on the horizon?

Gregg: “I don’t see any entities out there that appear to be in trouble that meet this type of standard--that they would melt down the entire system if they went under.”

Dodd: "Some banks. Some banks, some regional banks, but nothing of the size of AIG, Lehman Brothers or Merrill Lynch."

More Cliff Diving: Goldman, Morgan Stanley, Wachovia

by Calculated Risk on 9/17/2008 11:41:00 AM

This isn't a stock blog, but it's hard to ignore the cliff diving today:

Morgan Stanley off 32%.

Goldman Sachs off 21%.

Wachovia is off 25%.

WaMu is only off 10%.

Even GE is off 9%.

Brady, Volcker, Ludwig: Resurrect the RTC

by Calculated Risk on 9/17/2008 11:00:00 AM

Former U.S. Treasury Secretary (from 1988-1993) Nicholas Brady, former comptroller of the currency Eugene Ludwig (1993-1998), and former Fed Chairman (1979-1987) Paul Volcker argue in the WSJ: Resurrect the Resolution Trust Corp.

The fact is that the financial system needs basic, long-term reform, but right now the system is clogged with enormous amounts of toxic real-estate paper that will not repay according to its terms. This paper, in turn, is unable to support huge quantities of structured financial instruments, levered as much as 30 times.This proposal is picking up momentum.

Until there is a new mechanism in place to remove this decaying tissue from the system, the infection will spread, confidence will deteriorate further, and we will have to live through the mother of all credit contractions.

... We should move decisively to create a new, temporary resolution mechanism. There are precedents -- such as the Resolution Trust Corporation of the late 1980s and early 1990s, as well as the Home Owners Loan Corporation of the 1930s. This new governmental body would be able to buy up the troubled paper at fair market values, where possible keeping people in their homes and businesses operating. Like the RTC, this mechanism should have a limited life and be run by nonpartisan professional management.

TED Spread Blowout

by Calculated Risk on 9/17/2008 09:50:00 AM

Here is the TED Spread from Bloomberg. The TED spread has increased to 2.76% (from just over 2% yesterday). This is far above the highs reached in August 2007, late 2007 and in the spring of 2008.

Note: the TED spread is the difference between the three month T-bill and the LIBOR interest rate. Usually the TED spread is less than 0.5%. The higher the spread, the greater the perceived credit risks (compared to "risk free" treasuries).

Much of the increase in the TED spread is because of the flight to safety. From Bloomberg: Treasury 3-Month Bill Rates Drop to Lowest Since at Least 1954

U.S. Treasury three-month bill rates dropped to the lowest since at least 1954 ... Investors pushed the rate as low as 0.233 percent as the loss of confidence in credit markets deepened.The article points to concerns about the Reserve Primary Fund money market freezing redemptions (and "breaking the buck").