by Calculated Risk on 9/11/2008 03:59:00 PM

Thursday, September 11, 2008

Hatzius: An Estimate of Mortgage Credit Losses

From Jan Hatzius, Goldman Sachs chief economist presented at the Brookings conference today: Beyond Leveraged Losses: The Balance Sheet Effects of the Home Price Downturn. Here is a short excerpt on estimating mortgage credit losses (note that Goldman is now forecasting prices to decline another 10%):

If nominal home prices remain at their 2008 Q2 level until mid-2009, before reverting to a +3% annualized trend, our model implies that mortgage credit losses realized in the 2007-2012 period will total $473 billion. If nominal home prices fall another 10% through the middle of 2009, the model projects losses of $636 billion. Finally, if prices drop another 20%, predicted losses increase to $868 billion. Moreover, the table suggests that losses peak in the third quarter of 2008 if home prices are flat going forward; in the fourth quarter of 2008 if prices drop another 10%; and in the second quarter of 2009 if prices drop another 20%.

Bloomberg: Senators Ask Fannie / Freddie to Freeze Foreclosures

by Calculated Risk on 9/11/2008 03:04:00 PM

From Bloomberg: Senators Ask Fannie, Freddie to Freeze Foreclosures

U.S. Senate Banking Committee members urged Fannie Mae and Freddie Mac, the mortgage lenders placed under federal control this week, to freeze foreclosures on loans in their portfolios for at least 90 days.I suppose the goal is work out more modifications ... nothing else will change in 90 days.

Lower Mortgage Rates, But More Lenders Require 15% Down Payment

by Calculated Risk on 9/11/2008 01:12:00 PM

Update: Here are the new guidelines from Fannie Mae (hat tip MaxedOutMama)

NOTE THAT THE 85% LTV applies to cash out refis. Purchase Money Mortgage (new purchase) is still 95% LTV (or 5% down payment).

From Peter Viles at L.A. Land: 10% down? Forget it, it's now 15%

Good news from the government takeover of Fannie and Freddie: Mortgage rates are falling. Bad news for borrowers short on cash: You need more cash to get a mortgage.Peter excerpts from an L.A. Times story by Scott Reckard: Mortgage rates are plunging -- for those who qualify

[L]enders spooked by free-falling home prices and surging foreclosures have imposed tougher lending standards. ... most banks this week immediately adopted new guidelines that Fannie Mae said it would implement next year.Here is the current mortgage product info from Fannie Mae. Does someone have a link to the guidelines for next year?

Among them: Home purchasers must put down at least 15% of the purchase price, up from 10%.

Bloomberg: Lehman Said to be in Talks with Potential Buyers

by Calculated Risk on 9/11/2008 12:38:00 PM

UPDATE: From Reuters: Goldman Sachs is not buying Lehman - sources

From Bloomberg: Lehman Said to Be in Talks With Potential Buyers as Shares Drop

Lehman Brothers Holdings Inc. entered into talks with potential buyers of the securities firm after Moody's Investors Service said the company must find a ``stronger financial partner'' and the shares plummeted.Yves Smith at Naked Capitalism broke this earlier: Lehman End Imminent

Bankers from other firms are reviewing Lehman's books today, people with knowledge of the situation said ...

I heard this rumor from two sources, that Lehman is in its final day or two and Goldman is willing to buy the firm, and the second source, who volunteered the information, is sufficiently well plugged in that I trust the reading. This came from a former senior employee:A couple friends of mine from LEH trading desk called me this a.m. to say that mgmt has taken employees aside to let them know that the end should come in next 24-48 hours. Ratings agencies apparently told them that the steps were not sufficient to prevent a d/g, and LEH mgmt asked them to hold off for a day or so to give them a chance to resolve situation (with sale of company).

Apparently GS is willing buyer, but is buyer of last resort from LEH's perspective, b/c they would keep very few LEH employees.

Lehman: Cliff Diving

by Calculated Risk on 9/11/2008 09:44:00 AM

Lehman is off 40% in early trading.

From the WSJ: Lehman Struggles To Shore Up Confidence

As Lehman Brothers Holdings Inc. stock teetered in recent weeks, Chairman and Chief Executive Richard Fuld Jr. called Wall Street executives to make sure they were still trading with his embattled firm and offering it credit. Rumors about the firm's health kept popping up, he groused to other executives.Probably more whack-a-mole today.

"I feel like I'm playing whack-a-mole every day," Mr. Fuld said, according to people familiar with the calls.

BTW, WaMu is off another 20%.

Unemployment: Continued Claims Over 3.5 Million

by Calculated Risk on 9/11/2008 09:05:00 AM

The DOL reports on weekly unemployment insurance claims:

In the week ending Sept. 6, the advance figure for seasonally adjusted initial claims was 445,000, a decrease of 6,000 from the previous week's revised figure of 451,000. The 4-week moving average was 440,000, an increase of 250 from the previous week's revised average of 439,750.

Click on graph for larger image in new window.

Click on graph for larger image in new window.The first graph shows weekly claims. The four moving average is at 440,000.

This is a very high level, and indicates continued weakness in the labor market.

Continued claims are now above 3.5 million for the first time since 2003.

The advance number for seasonally adjusted insured unemployment during the week ending Aug. 30 was 3,525,000, an increase of 122,000 from the preceding week's revised level of 3,403,000. The 4-week moving average was 3,429,000, an increase of 36,750 from the preceding week's revised average of 3,392,250.By these measures, the economy is clearly in recession.

Wednesday, September 10, 2008

Investment: Residential vs. Non-Residential

by Calculated Risk on 9/10/2008 09:55:00 PM

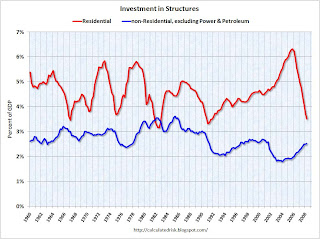

Since investment in non-residential structures is about to slow (especially malls, hotels, and offices), a key question is how did the commercial real estate (CRE) investment boom compare to the residential housing bubble?

The following graph shows residential investment compared to investment in non-residential structures (excluding Power and Petroleum exploration) as a percent of GDP since 1960. All data from the BEA.

Note: Residential investment is primarily single family structures, multi-family structures, commissions, and home improvement. Click on graph for larger image in new window.

Click on graph for larger image in new window.

The recent housing boom and bust is very clear (in red). But this shows that the recent boom in non-residential investment (ex power and petro) was not as excessive as the housing bubble.

Also, the recent boom for CRE was much less than the S&L related boom in the '80s, and even less than the late '90s office boom.

Some areas of non-residential investment have been overbuilt (especially hotels and malls, and offices somewhat). But those looking for a collapse in CRE investment of the same size as the current residential investment bust are wrong.

The CRE Bust: Quick Overview

by Calculated Risk on 9/10/2008 04:55:00 PM

This morning the WSJ and the NY Times had articles on Mall troubles. See WSJ: Mall Glut to Clog Market for Years and NY Times: A Squeeze on Retailers Leaves Holes at Malls

This should come as no surprise. Historically investment in non-residential structures lagged investment in residential by 5 to 8 quarters. The reasons are pretty clear - the commercial builders (for malls, offices, lodging, etc.) don't build until the residential is in place, and the commercial build cycles are usually longer than residential.

It appears we are now at the end of a Commercial Real Estate (CRE) boom based on the following:

"[W]e’ve seen a dramatic contraction in design activity in recent months. ... This weakness in design activity can be expected to produce a contraction in [commercial and multifamily] construction sectors later this year and into 2009.”

AIA Chief Economist Kermit Baker, June 18, 2008

Click on graph for larger image in new window.

Click on graph for larger image in new window.From the American Institute of Architects: Architecture Billings Index Continues in Negative Territory

As a leading economic indicator of construction activity, the ABI shows an approximate nine to twelve month lag time between architecture billings and construction spending.The key here is that the index fell off a cliff in early 2008, and that there is "an approximate nine to twelve month lag time between architecture billings and construction spending". We should expect weaker non-residential structure investment in the second half of 2008 and throughout 2009.

From the Fed: The July 2008 Senior Loan Officer Opinion Survey on Bank Lending Practices

Of particular interest is the increase in tighter lending standards for Commercial Real Estate (CRE) loans. This graph compares investment in non-residential structure with the Fed's loan survey results for lending standards (inverted) and CRE loan demand.

Of particular interest is the increase in tighter lending standards for Commercial Real Estate (CRE) loans. This graph compares investment in non-residential structure with the Fed's loan survey results for lending standards (inverted) and CRE loan demand.Note that any reading below zero for loan demand means less demand than the previous quarter. This is strong evidence of an imminent slump in CRE investment.

This graph based on data from the Federal Reserve shows the delinquency rates at the commercial banks for three key categories: residential real estate, commercial real estate, and consumer credit cards.

This graph based on data from the Federal Reserve shows the delinquency rates at the commercial banks for three key categories: residential real estate, commercial real estate, and consumer credit cards.Commercial real estate delinquencies are rising rapidly, and are at the highest rate since Q1 '95 (as delinquency rates declined following the S&L crisis).

It should be no surprise that investment in CRE will decline in the 2nd half of 2008 and in 2009.

Lehman on House Prices

by Calculated Risk on 9/10/2008 02:29:00 PM

From the Lehman conference call:

"[The Lehman] base case assumes national home prices drop 32% peak to trough, vs. 18% to date, with California down 50% vs 27% to date."The 18% corresponds to the reported decline in the S&P Case-Shiller U.S. National Home Price Index through Q2 (so I believe Lehman is using the Case-Shiller index or something very similar).

Ian T. Lowitt, Lehman CFO

In other words, Lehman's base case assumes that house prices have fallen just more than half way from the peak.

It was just last December that Ben Stein argued Goldman's projection of a 15% peak-to-trough decline in national home prices was implausible (Goldman is projecting another 10% decline now). And Professor Krugman responded to Ben Stein:

For what it’s worth, Goldman’s forecast of a 15 percent decline in home prices seems implausible to me, too — but on the low side. A 15 percent decline would bring prices back to their level in early 2005 — when the bubble was already well inflated. If prices fall back to their level in early 2003, that’s a 30 percent decline.Price declines still have a ways to go (see here for a discussion of real prices, price-to-rent ratio and price-to-income ratio).

BofA: Builder Portfolio "Not Pretty"

by Calculated Risk on 9/10/2008 12:40:00 PM

BofA Presentation material is here.

Webcast here.

BofA just concluded a presentation. No story yet, but here are some headlines (hat tip Joshua and Brian):

BofA sees some softening on Commercial Asset Quality

Q3 to be "a little choppy" in capital markets.

BofA sees higher loss rates.

BofA's $13B home builder portfolio "not pretty"

BofA home builder losses grew faster than expected.

BofA see elevated credit costs, no "major pain"

BofA other commercial / industrial loans show weakness.