by Calculated Risk on 9/05/2008 05:12:00 PM

Friday, September 05, 2008

OTS Reclassifies BankUnited Regulatory Capital Status

Press Release: BankUnited FSB Receives Notification from the Office of Thrift Supervision

BankUnited Financial Corporation (NASDAQ:BKUNA - News), parent company of BankUnited FSB, announced that it received notification today that the Office of Thrift Supervision has reclassified the Bank’s regulatory capital status from well-capitalized to adequately capitalized although the Bank’s capital ratios exceed the statutory threshold for well-capitalized institutions. As a result, the Bank is subject to restrictions on accepting brokered deposits.Just last week, in a SEC 10-Q filing, BankUnited expressed concern that the OTS might impose additional restrictions on BankUnited, and that these restrictions might have "a material adverse effect on BankUnited’s financial position and operations".

OTS Issues Cease-and-Desist Order to Downey Financial

by Calculated Risk on 9/05/2008 05:06:00 PM

From the WSJ: Regulators Tell Downey Financial To Raise Capital, Hire CEO

The Office of Thrift Supervision ... has issued a cease-and-desist order that formally requires the [Downey] to raise capital, name a new chief executive, and take other actions aimed at shoring up its operations, these people said.Looks grim for Downey.

...

The bank has $13.4 billion of assets, with 169 branches in California and five in Arizona. It is the nation's 10th-largest thrift as measured by assets.

WSJ: Treasury Close to Final Fannie & Freddie Plan

by Calculated Risk on 9/05/2008 04:55:00 PM

From the WSJ: Treasury Is Close to Finalizing Plan to Backstop Fannie, Freddie

Precise details of Treasury's plan couldn't be learned. The plan is expected to involve a creative use of Treasury's new authority to make a capital injection into the beleaguered giants.Another Sunday announcement (like for Bear Stearns)?

...

An announcement could come as early as this weekend.

MBA: Prime ARMs to Dominate Foreclosures

by Calculated Risk on 9/05/2008 01:45:00 PM

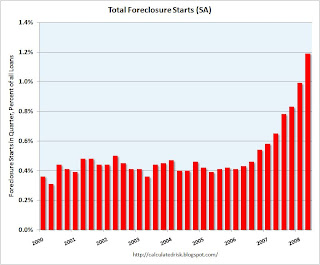

“Subprime ARM loans accounted for 36 percent of all foreclosures started and prime ARMs, which include option ARMs, represented 23 percent. However, the increase in prime ARMs foreclosure starts was greater than the combined increase in fixed-rate and ARM subprime loans. Thus the foreclosure start numbers will likely be increasingly dominated increasingly by prime ARM loans."Here is the MBA press release: Delinquencies and Foreclosures Increase in Latest MBA National Delinquency Survey

Jay Brinkmann, MBA’s Chief Economist, Sept 5, 2008

Click on graph for larger image.

Click on graph for larger image.This graphs shows the seasonally adjusted rate of all loans entering the foreclosure process each quarter.

This includes all loans, and the graph masks the underlying shift from foreclosures being dominated by subprime loans to foreclosures being dominated by Prime ARMs. See Tanta's: Subprime and Alt-A: The End of One Crisis and the Beginning of Another

This is one of the key housing themes for the next year or more.

MBA: Record Foreclosures, Delinquencies

by Calculated Risk on 9/05/2008 10:17:00 AM

From MarketWatch: Homes in foreclosure process set another record

The rate of mortgages entering foreclosure hit another record high in the second quarter, as did the percentage of loans somewhere in the foreclosure process, the Mortgage Bankers Association reported on Friday.Update: There are problems everywhere (as I've pointed out numerous times), but there are several states that stand out (California and Florida top the list). A key question is subprime vs. Alt-A and Prime delinquencies - I don't have an answer yet.

The delinquency rate, which measures mortgages that aren't in foreclosure but have at least one overdue payment, also was the highest ever recorded in the MBA's quarterly survey.

...

The percentage of loans that entered the foreclosure process in the second quarter was 1.08%, up from 1.01% in the first quarter and 0.59% a year ago. Meanwhile, 2.75% of loans in the survey were somewhere in the foreclosure process, up from 2.47% last quarter and 1.4% in the second quarter of 2007.

The delinquency rate was 6.41% of all loans outstanding, according to the survey. The rate was 6.35% in the first quarter, and 5.12% a year ago.

Unemployment Rate Jumps to 6.1%

by Calculated Risk on 9/05/2008 08:40:00 AM

Click on graph for larger image.

Click on graph for larger image.

This graph shows the unemployment rate and the year over year change in employment vs. recessions.

Nonfarm payrolls decreased by 84,000 in August.

The unemployment rate has risen to 6.1 percent.

Year over year employment is now negative (fewer American were employed in Aug 2008 than in Aug 2007). This is a very weak report - more to come.

We're All Fraudulently Induced Now

by Anonymous on 9/05/2008 08:24:00 AM

Well, actually, it appears we've all been fraudulently induced for a long time but just didn't catch on until recently. Dear reader East Northport Slob sent me the link to this Village Voice article, which you think when you start reading it is just another one of those "lenders hose up foreclosure paperwork" things we've been reading for a long time, but then suddenly gives you this:

Catherine Austin Fitts, former Assistant Secretary of Housing and Urban Development, adds a new twist: She believes that borrowers can fight foreclosure because "most mortgages issued in this country from 1996 on were fraudulently induced."I'm sure we all have the same questions here: Who the hell is Catherine Austin Fitts? Why 1996? And how do you fraudulently induce people to sign a mortgage by failing to disclose to people some fact about their own financial situation?

Fitts said in cases of fraudulently induced loans lenders "knew they were issuing mortgages that were not affordable to the borrower," and the borrower "may not owe the money back because they essentially failed to disclose something about [the borrowers]' financial situation that they knew and the borrower didn't."

I don't think I can help you with the last two, but I did some checking with Dr. Google on the first one. Let's let Ms. Fitts introduce herself:

In 1989, I was serving as Assistant Secretary of Housing. The housing bubble of the 1990’s had burst, and foreclosures were rising.The "housing bubble of the 1990's" burst in 1989? Is there a wrinkle in the time-space continuum? Is The Truth Out There?

The mortgage insurance funds of the Federal Housing Administration (FHA) were experiencing dramatic losses. We were losing $11 mm a year in the single-family fund. All funds had lost $2 billion in the southwest region the year before.This seems to imply that if we could just cheer up our shrubberies, real estate values would improve substantially. I confess to wondering what could cause a "bubble" under this conception of things, but this may be because I'm still stuck in the wrong paradigm:

My staff and I did an analysis of what had caused the losses. What were the actions that we could take?

Fraud aside, the single biggest cause of losses in the FHA portfolio was a falling Popsicle Index – an index that we coined as a rule of thumb to express the health of the living equity within a place.

The Popsicle Index is the percent of people who believe that a child can leave their home, go to the nearest place to buy a popsicle, and come home alone safely. It’s an expression of the sense of intimacy and well being in a place.

Not surprisingly, there is a correlation between the financial equity or wealth in a place and the living equity or human and natural wealth. Where the people, living things and land are happy, businesses thrive, and the value of real estate is good.

The Popsicle Index is the % of people who believe a child can leave their home, go to the nearest place to buy a popsicle or snack, and come home alone safely. For example, if you feel that 50% of your neighbors believe a child in your neighborhood would be safe, then your Popsicle Index is 50%. The Popsicle Index is based on gut level feelings of the people who have intimate knowledge of a place, rather than facts and figures.I'm pretty sure that I feel that at least 50% of my neighbors believe that granite countertops are like a retirement account you can put hot pans on, but certain ugly facts and figures keep intruding on the conversation. Or, well, maybe not, given that since 1996 most of us weren't told the facts and figures about our financial situation in order to fraudulently induce us to buy homes with borrowed money. Or something like that.

Frankly, the Village Voice reporter should have hung up the phone here and gone out for a Popsicle. In fact, I suggest we all go out for a Popsicle. I for one feel safer out on the streets than indoors reading the news some days.

Cathedral Lake

by Calculated Risk on 9/05/2008 12:06:00 AM

Some people asked for photos of my hike along a portion of the John Muir Trail. This photo is of Cathedral Lake, about 18 miles from Yosemite Valley. It is quite a climb to this point - about 5,700' of elevation gain from Yosemite Valley over Cathedral Pass. Click on photo for larger image in new window.

Click on photo for larger image in new window.

Unfortunately one of my friends had to drop out at Tuolumne Meadows, and I wasn't able to continue (minor foot injury) after reaching Red's Meadow near Mammoth the second day.

It was still great fun. Hopefully I'll have more photos of my next trip.

For those wanting more, here are some photos I posted from my Yellowstone trip in 2005.

Thursday, September 04, 2008

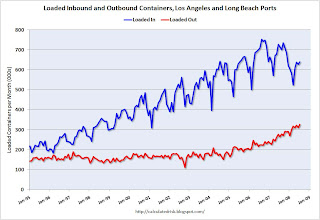

The Import Slowdown: Los Angeles Area Ports

by Calculated Risk on 9/04/2008 07:47:00 PM

This is an update to an earlier post in April. Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows the loaded containers per month - inbound and outbound - for the ports of Los Angeles and Long Beach combined.

Note: container traffic doesn't tell us about value, but it gives us a general idea on import and export volumes. We have to wait for the monthly trade deficit report for dollar values.

Imports have been surging for years, but import traffic started to decrease last year. For the last two month, import traffic averaged a decrease of 12.1% year-over-year.

Recently exports have picked up, and for the last two months export traffic has increased an average of 17.8% year-over-year.

Although this is just two Los Angeles area ports, this fits with the declining trade deficit (see 2nd graph). For export businesses in the U.S., these have been good times. However, as San Francisco Fed President Dr. Yellen noted this morning, the global slowdown might start to impact exports:

"[E]xport growth alone contributed one-half of the total real GDP growth registered in the second quarter. This element has been an important source of strength in our economy for over a year, being buoyed by strong growth abroad and by the weakening of the dollar. However ... in recent months the dollar has risen somewhat and economic growth in many of our industrialized trading partners has slowed or even turned negative, suggesting that we can no longer count on exports as an important source of strength."

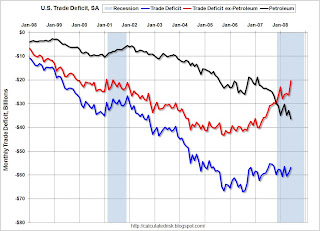

Here is a graph of the trade deficit (June is the most recent data).

Here is a graph of the trade deficit (June is the most recent data).The red line is the trade deficit excluding petroleum products. (Blue is the total deficit, and black is the petroleum deficit). The oil deficits in July and probably August will be ugly, but it now looks like the oil deficit will decline sharply later this year. Note: import oil prices are calculated when oil is delivered, so there is a lag between future prices and import prices.

The ex-petroleum deficit is already falling fairly rapidly with weak imports and strong exports.

Back in April I asked what would be the impact of slowing imports on China and on oil prices? I noted the dramatic decline in the Shanghai index:

The Shanghai SSE composite index is now below 2,277, the lowest since the amazing run up started in 2006. The index is off over 61% from the peak. This suggests a slowdown in the Chinese economy, and probably less business investment in China.

The Shanghai SSE composite index is now below 2,277, the lowest since the amazing run up started in 2006. The index is off over 61% from the peak. This suggests a slowdown in the Chinese economy, and probably less business investment in China.And the SSE index will probably fall further tonight after the 344 decline in the DOW today.

And as far as oil prices, the decline has been sharp, with prices now down by about one third from the peak. This could have serious implications for OPEC, see the NY Times: As Oil Prices Fall, OPEC Faces a Balancing Act and my speculation back in March: Petroleum Prices and GCC Spending

There is no longer any discussion of decoupling of the U.S. and world economies (something that never made sense to me). Now the questions are: Will U.S. exports continue to grow as economic growth slows or turns negative for U.S. trading partners? And will a combination of some U.S. export growth and lower oil prices provide enough of a cushion to keep the U.S. out of a severe recession? I think so, but the next several quarters will be especially ugly in the U.S. with rising unemployment, less business investment, and probably negative Personal Consumption Expenditures (PCE), or in Dr. Yellen's words "decidedly subpar" (and she wasn't discussing golf).

Ike and South Florida

by Calculated Risk on 9/04/2008 05:56:00 PM

Tropical Storm Hanna is threatening the Carolinas (and the eastern seaboard), but Hurricane Ike might be a more serious concern for Miami and South Florida. It's still early, and Ike could stay at sea - but this reminds me that the 1920s Florida housing bust had just begun when the Great Miami Hurricane of 1926 struck ... from Wikipedia:

The 1926 Miami Hurricane (or Great Miami Hurricane) was an intense hurricane that devastated Miami, Florida in September 1926. The storm also caused significant damage in the Florida Panhandle, the U.S. state of Alabama, and the Bahamas. The storm's enormous regional economic impact helped end the Florida land boom of the 1920s ...