by Calculated Risk on 8/26/2008 10:00:00 AM

Tuesday, August 26, 2008

July New Home Sales

According to the Census Bureau report, New Home Sales in July were at a seasonally adjusted annual rate of 515 thousand. Sales for June were revised down to 503 thousand.  Click on graph for larger image in new window.

Click on graph for larger image in new window.

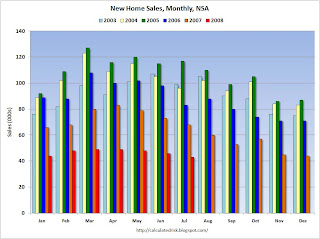

The first graph shows monthly new home sales (NSA - Not Seasonally Adjusted).

Notice the Red columns for 2008. This is the lowest sales for July since the recession of '91. (NSA, 43 thousand new homes were sold in July 2008, the same as in July '91).

As the graph indicates, there was no spring selling season in 2008.

********************************  The second graph shows New Home Sales vs. recessions for the last 45 years. New Home sales have fallen off a cliff.

The second graph shows New Home Sales vs. recessions for the last 45 years. New Home sales have fallen off a cliff. Sales of new one-family houses in July 2008 were at a seasonally adjusted annual rate of 515,000, according to estimates released jointly today by the U.S. Census Bureau and the Department of Housing and Urban Development. This is 2.4 percent (±11.6%)* above the revised June rate of 503,000, but is 35.3 percent (±7.3%) below the July 2007estimate of 796,000.

And one more long term graph - this one for New Home Months of Supply. "Months of supply" is at 10.1 months.

"Months of supply" is at 10.1 months.

Note that this doesn't include cancellations, but that was true for the earlier periods too. The months of supply is down from the peak of 11.2 months in March 2008.

The all time high for Months of Supply was 11.6 months in April 1980.

And on inventory:

The seasonally adjusted estimate of new houses for sale at the end of July was 416,000. This represents a supply of 10.1months at the current sales rate.

Inventory numbers from the Census Bureau do not include cancellations and cancellations are falling, but still near record levels. Note that new home inventory does not include many condos (especially high rise condos), and areas with significant condo construction will have much higher inventory levels.

I now expect that 2008 will be the peak of the inventory cycle (in terms of months of supply) and could be the bottom of the sales cycle for new home sales. But the news is still grim for the home builders. Usually new home sales rebound fairly quickly following a bottom (see the 2nd graph above), but this time I expect a slow recovery because of the overhang of existing homes for sales (especially distressed properties). If the recession is more severe than I currently expect, new home sales might fall even further.

Looking forward, I'm much more pessimistic about existing home sales, and existing home prices, than new home sales.

More Advice on Hardship Letters

by Anonymous on 8/26/2008 09:43:00 AM

Loyal readers, or just people with too little mental stimulation in their lives, will remember a post I did way back in May on how not to write a hardship letter. In that post, I suggested, quite explicitly, that anyone writing a hardship letter to a servicer in aid of getting a workout proposal approved should:

*Focus on establishing that a workout is necessary, meaning establishing that you cannot afford to pay your mortgage under its original terms.

*Not focus on explaining why all this happened or seeking sympathy, since it doesn't matter why it happened--servicers do workouts when they make sense for the servicer, not when they are moved to feel sorry for anyone.

*Write in your own voice about your own situation, rather than relying on elegant form letters or rhetorical flourishes. Nobody cares about polish; they care about your verified monthly budget and the terms of the workout you are requesting. If the math is correct there, you can misspell most of the words and dangle all the modifiers and you'll still get your workout. This is not an essay contest.

*Present a proposal that will work. You may be the most sympathetic borrower ever to cross Loss Mit's desk, but if your proposal does not work out, it is not a "workout" (did you wonder where that term came from?).

So what did I find in my inbox this morning?

The following missive:Hi, Tanta.

As I am committed to the notion that names should be changed to protect the unwary, I left that part off. We shall refer to my correspondent as Ms. Short Sale. Sure, I could have written the following to Ms. Short Sale personally, but apparently the public service message I was trying to get across in the original post didn't work for everyone, so as a public service I shall repeat some of it again in hopes that it will take this time.

I read your article "How Not to Write a Hardship Letter" on the website Calculated risk. I am finding writing my hardship letter to be the most challenging part of my short-sale package. I can't help but laugh at that things that have led up to my hardship, and it seems that one thing leads to another and it's just a big can of messy worms that I've somehow opened and can't get cleaned up to figure out how to articulate concisely in the letter in a way that will make an impact in my favor to get the short-sale approved.

I need help, and am wondering if I could hire you to hear out my story and write mine? If not, do you have any advice on how I can go about finding someone to write it?

Thank you very much!!!

Dear Ms. Short Sale:

I am happy to hear that you are in one of those hardship situations that is actually pretty amusing. Most people who write to Loss Mit aren't exactly chuckling.

However, if you had read my post with a bit more attention, you would have noticed that my advice is not to spend any time "explaining" your circumstances. Whether they are funny or not. I pointed out that your purpose in a hardship letter is to 1) document the financial necessity of a workout and 2) propose a plan that will work. You are caught up in the idea of making an "impact" on your servicer. You need to ditch that idea right now. This is not a resume cover letter. It is not a sales pitch. It is not an essay-writing contest. It is a business letter that needs to be concise and to the point.

Sadly, you could not possibly afford what I would charge to hear your story and write your letter. If you could, I suspect you could bring cash to closing to settle your loan for the full amount due. Since you are requesting a short sale, I must believe that you don't have that kind of money sitting around.

I will, however, once again give you some good free advice. It may not be what you want to hear, but this is a chronic problem in the advice-giving gig.

You want the servicer to approve a short sale. You therefore need to establish that:

1. You cannot afford to keep the home or you must move for some good reason and cannot afford to pay the difference between the sales proceeds and your loan amount. It does not really matter at this point why this situation has arisen. You simply need to document that it is what it is. Explain what your income is, what your expenses are, what savings you have, why you have to move, etc. If you are asking for a short sale because you have to move, simply say that. For example, say that you have been relocated by your employer or you need to move closer to family in order to reduce your expenses. This is not an invitation to open your funny can of worms and tell everyone all about your situation that is totally unique and high-impact and all that. If you cannot document that you cannot afford to repay your loan--and you don't actually have to move--then I don't know what business you have asking for a short sale.

2. Provide evidence that you have attempted to list your property at a price at least equal to your indebtedness, and that this has not been possible. Your realtor can supply your listing history, a price opinion, or other information to establish that you will have to list the property for less than the loan amount in order to get it sold. If you are not working with a realtor, your servicer will question how hard you are trying to sell this house.

3. Propose a sales price that you wish the servicer to approve. No one will give you "blanket approval" for a short sale as such; you will only get approved to sell at a specified minimum price. The servicer will not suggest this price; you have to. That is how negotiations work in this case. Do not expect the servicer to put any cards on the table until you have. They are not that stupid. Your requested price should be backed up by a broker price opinion. The servicer will probably get one, too, if it takes your request seriously.

4. If you already have an offer on your property, as long as this offer came out of some good-faith effort to market the property for as high a price as the market will bear, then request approval to execute a sales contract at this price. If you have never listed the property and the offer is from your brother-in-law, you are not likely to be approved. You need to demonstrate that you have made all practical attempts to fetch the highest sales price possible, in order to protect the lender's interests as much as possible. If you cannot demonstrate that, there's no point in writing your letter at all.

5. Explain clearly that either you have no subordinate liens on this property, or you are seeking approval from any second mortgage holder for the short sale as well. If the existence of a second lien is part of your "can of worms," you will have to address that. If you want your first mortgage servicer to negotiate on your behalf with your second mortgage servicer, you will need to say so. You will need to bear in mind that this negotiation may not be very successful if you are simply asking the second lien lender to wipe out its entire loan with no cost to you. Offering to pay the second lien lender a couple thousand dollars for its trouble--or to sign a note so that you can pay a couple thousand in installments--would be appropriate. If you cannot possibly afford to contribute anything to the junior lien, your first mortgage servicer may have to do that in order to get the deal approved. This will increase the first servicer's loss. You will have to take that into account when you propose your sales price.

6. If you must use exclamation points, one is sufficient.

It is possible that you are having trouble drafting your letter simply because you are not clear about the purpose of the letter. The above advice should help you get clear on that. It is also possible, of course, that you are having trouble drafting your letter because what you want doesn't actually make much sense or because you haven't actually tried listing your property or talking to a realtor and are just trying to float a trial balloon to see what the servicer will do. You want to be very honest with yourself if this is the case, because you won't get anywhere with your servicer if it is. As I said in my original post, you are writing a business letter with a business proposition in it, and you need to demonstrate that you are doing your part to resolve this situation.

Sadly, the world is full of people who would take your money to write a letter for you. You are actually probably quite fortunate that you asked someone who won't. If you have money to spend, get yourself an appraisal or a broker price opinion from a reputable RE agent who has experience with short sales. Once you have that, you'll know how to write your letter because you will have the basis for a concrete proposal. And that is all the "impact" you need to have on your lender.

Good luck and best wishes,

Tanta

Case-Shiller: House Prices Decline in June

by Calculated Risk on 8/26/2008 09:24:00 AM

S&P/Case-Shiller released their monthly Home Price Indices for June this morning. This includes prices for 20 individual cities, and two composite indices (10 cities and 20 cities). Note: This is not the quarterly national house price index - I'll have more on that later. Click on graph for larger image in new window.

Click on graph for larger image in new window.

The first graph shows the nominal Composite 10 and Composite 20 indices (the Composite 20 was started in January 2000).

The Composite 10 index was off 7.0% annual rate in June (from May), and is off 20.3% from the peak.

The Composite 20 index was off 5.9% annual rate in June (from May), and is off 18.8% from the peak.

Prices are still falling, but the rate of monthly price declines has slowed a little. Some of this may be seasonal, and prices will probably continue to decline for some time. The second graph shows the Year over year change in both indices.

The second graph shows the Year over year change in both indices.

The Composite 10 is off 17.0% over the last year.

The Composite 20 is off 15.9% over the last year.

More on prices later ... including Q2 data, selected cities, and real prices.

Monday, August 25, 2008

WSJ: Regulators Step Up Bank Actions

by Calculated Risk on 8/25/2008 10:07:00 PM

From the WSJ: Regulators Step Up Bank Actions

The Federal Reserve and the Office of the Comptroller of the Currency, two of the nation's primary bank regulators, have issued more ... memorandums of understanding so far this year than they did for all of 2007 ...It will be interesting to see how many banks are on double secret probation!

The depth of problems in the banking sector will become clearer Tuesday when the Federal Deposit Insurance Corp. updates its list of "problem" institutions. ...

Take A Load Off Fannie

by Calculated Risk on 8/25/2008 06:05:00 PM

"The story of Fannie Mae, as narrated by The Band"

WaMu Offering 5% 12 Month CDs

by Calculated Risk on 8/25/2008 03:50:00 PM

From WaMu: a 5% 12 month FDIC insured CD. (hat tip Anthony)

Just saying ... WaMu is paying 5% in an environment when few banks are paying over 4.25% and most banks are under 4% for one year CD.

JPMorgan: Fannie & Freddie Investments Decline by Half

by Calculated Risk on 8/25/2008 02:55:00 PM

From the JPMorgan SEC 8-K filing today:

JPMorgan Chase & Co. disclosed today that it held approximately $1.2 billion par value of Fannie Mae and Freddie Mac perpetual preferred stock. Such securities are held in the Firm's investment portfolio and are marked to market through the Firm's earnings. The Firm estimates that such preferred stocks have declined in value by approximately an aggregate $600 million in the third quarter to date, based on current market values. The precise amount of losses that may be incurred on these securities for the third quarter is difficult to determine, given the significant volatility being experienced in the market values of these securities.Many banks hold preferred shares in Fannie and Freddie, and the impact could be widespread.

OTS Expresses Concerns about BankUnited Financial

by Calculated Risk on 8/25/2008 12:22:00 PM

From the BankUnited Financial Corporation 10-Q filed with the SEC today (see page 22 for more):

BankUnited has been advised by the OTS of certain concerns that BankUnited has agreed to address. ... These measures include efforts to seek to raise at least $400 million of capital and to submit an alternative capital plan to be applicable if the Company is unable to raise the $400 million; termination of the option ARM loan program (other than in the wealth management area and, in certain limited circumstances, for loan modifications); termination of reduced and no documentation loan programs; reduction of the portfolio of negative amortization loans; and enhanced monitoring and internal reporting, as well as reporting to regulators on option ARM loan reduction efforts, preservation and enhancement of capital, mortgage insurance and liquidity strength. The Bank also agreed to enhance its policies and procedures regarding the Bank’s allowance for loan losses, including increasing the allowance to a level which has already been attained. The Bank has also agreed to maintain capital ratios substantially in excess of the minimum required ratios to be deemed well-capitalized upon raising the agreed upon amount of capital. The OTS has advised that the Bank must limit its asset growth and notify it prior to: adding directors or senior executive officers; making certain kinds of severance and other forms of payments; entering into, renewing, extending, or revising any compensatory or benefits arrangements with any director or officer; entering into any third-party contracts out of the normal course of business; and issuing any capital distribution, such as dividends. Based on a recent notification, BankUnited believes that, unless it raises significant capital, the OTS will reclassify the Bank to adequately capitalized primarily due to the deterioration in the Bank’s non-traditional mortgage loan portfolio, the concentration of risk associated with that portfolio, and a resultant need for significant additional capital. The Company has continued its efforts to raise capital. Management believes that the Bank will maintain its well-capitalized status if the Company’s capital raising efforts are successful. There can be no guarantee that any of the measures already taken or in progress will be successful or satisfy the concerns of the OTS, and additional restrictions may be imposed on BankUnited’s activities in the future that could have a material adverse effect on BankUnited’s financial position and operations.

Subsequent to June 30, 2008, the FHLB commenced a review of our borrowing capacity, which is ongoing. The FHLB has advised us that it has changed its position regarding collateral held by affiliates, and that $736 million of pledged collateral from our affiliated REIT may not be fully eligible to support borrowings. Management is assessing alternatives for addressing this issue. Additionally, during the quarter ended June 30, 2008, we instituted the use of brokered deposits. The Bank had $268 million of brokered deposits at June 30, 2008 and $774 million as of August 15, 2008. OTS and FDIC regulations limit the use of brokered deposits in certain situations, including requiring a prior waiver from the FDIC if the Bank were reclassified as adequately capitalized.

emphasis added

July Existing Home Sales: Record Inventory

by Calculated Risk on 8/25/2008 10:00:00 AM

From NAR: July Existing-Home Sales Show Gain

Existing-home sales – including single-family, townhomes, condominiums and co-ops – increased 3.1 percent to a seasonally adjusted annual rate¹ of 5.00 million units in July from a downwardly revised level of 4.85 million in June, but are 13.2 percent lower than the 5.76 million-unit pace in July 2007.

...

Total housing inventory at the end of July rose 3.9 percent to 4.67 million existing homes available for sale, which represents an 11.2.-month supply at the current sales pace, up from a 11.1-month supply in June.

Click on graph for larger image in new window.

Click on graph for larger image in new window.The first graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1993.

Sales in July 2008 (5.00 million SAAR) were the weakest July since 2000 (4.82 million SAAR).

It's important to note that a large percentage of these sales were foreclosure resales (banks selling foreclosed properties). The NAR suggested last month that "short sales and foreclosures [account] for approximately one-third of transactions". Although these are real transactions, this means that normal activity (ex-foreclosures) is running around 3.3 million SAAR.

The second graph shows nationwide inventory for existing homes. According to NAR, inventory increased to an all time record 4.67 million homes for sale in July. Usually inventory peaks in mid-Summer, so this could be the peak for inventory this year (although it might happen in August or September).

The second graph shows nationwide inventory for existing homes. According to NAR, inventory increased to an all time record 4.67 million homes for sale in July. Usually inventory peaks in mid-Summer, so this could be the peak for inventory this year (although it might happen in August or September). Most REOs (bank owned properties) are included in the inventory because they are listed - but not all. Some houses in the foreclosure process are listed as short sales - so those would be counted too.

But there is some evidence lenders are holding off foreclosing, perhaps trying for workouts, or maybe the lenders are just overwhelmed - and many of these units are probably not included in inventory. And there are definitely homeowners waiting for a "better market" - and those homeowners will probably keep the supply high for a few years.

The third graph shows the 'months of supply' metric for the last six years.

The third graph shows the 'months of supply' metric for the last six years.Months of supply increased to 11.2 months.

This follows the highest year end months of supply since 1982 (the all time record of 11.5 months of supply). Even if inventory levels have peaked for the year, the months of supply could continue to rise - and possibly rise significantly - if sales decline later this year.

My forecast was for Months of Supply to peak at about 12 months this year and this metric is pretty close.

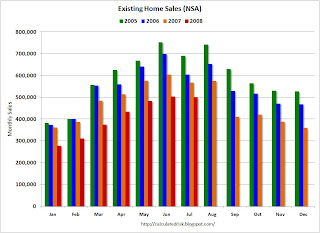

The fourth graph shows Not Seasonally Adjusted (NSA) existing home sales for 2005 through 2008. Sales are lower in July 2008 compared to the previous three years.

The fourth graph shows Not Seasonally Adjusted (NSA) existing home sales for 2005 through 2008. Sales are lower in July 2008 compared to the previous three years.NSA sales were reported at 501 thousand in July, however about one-third of those were foreclosure resales. This means regular sales are less than half the level of July 2005 and 2006.

NYT: The GSEs Invent the Risk Premium

by Anonymous on 8/25/2008 09:59:00 AM

Either I've finally lost what passes for my mind, or business press's increased fixation on blaming every problem in the mortgage market on Fannie Mae and Freddie Mac has just about jumped the shark. I don't know how else to explain this, from the NYT:

MORTGAGE rates are typically driven by the financial market’s outlook for long-term interest rates, but not always. Policy changes at Fannie Mae and Freddie Mac, the two government-sponsored companies that buy most mortgages issued by United States lenders, recently helped drive that point home.Um, what kind of profound mental confusion could make someone write those first two sentences? Mortgage rates have always been driven by the market "outlook for long-term interest rates," they still are, and they always will be. So have Treasury rates and the yield the local bank offers you on your certificate of deposit. That yield curve thingy. You've heard of it, maybe.

This month, Fannie and Freddie increased the fees they charge lenders for many loans, effectively bumping up interest rates for many borrowers who have marginal credit. The companies also tightened their policies on refinance loans that enable an owner to take cash out of a home.

But mortgage rates have never been "purely" about the bond market's outlook for benchmark yields, since the benchmarks, like U.S. Treasuries, are credit risk-free investments. Treasuries are backed by the full faith and credit of the U.S. Government, which has financial resources that Joe Blow the homebuyer doesn't have. Mortgage loans, like corporate bonds, have credit risk: the borrower might default and you might not get all your money back.

This is why interest rates on home mortgages are always higher than the rate on risk-free bonds of equivalent duration, like Treasury notes. If they weren't, nobody would invest in mortgages, they'd just buy the risk-free bonds. Are you still with me, everyone?

So there are always two main ingredients of mortgage rates, comparable-duration bond yields and the credit risk premium. And the credit risk premium, theoretically as well as practically, can fluctuate pretty widely, depending on, well, one's "outlook" for credit risk.

Fannie and Freddie have always guaranteed the credit risk of the mortgage-backed securities they issue. That is what they do and why they're here. In the "required yields" they establish for the loans they securitize, there has always been this little extra bit that they do not pass through to investors; it's the part they keep for themselves to cover credit losses, because they do not pass credit losses on to investors. You can call it a guarantee fee or a loan-level pricing adjustment or a post-settlement fee, if you want to be technical, or you can just call it a "credit risk premium."

One possibility here is that the GSEs are increasing their credit risk premium--which, in the absence of marked changes in required net yield to the end investor, will appear to make mortgage rates rise "independently" of other long-term interest rates--because, well, current conditions in the housing and mortgage market suggest that mortgages are pretty risky right now, credit-wise. One thing that indicates the extent of this risk, of course, is that by and large nobody but the GSEs are buying mortgage loans right now. Perhaps this is what is confusing the Times reporter: if Fannie and Freddie had any competition right now--if there were anyone else out there buying loans--it might be more obvious that everyone increases risk premiums when perceived credit risk rises. But really, you know. When nobody else but the government-chartered investors are in the market, that can be understood to mean that risk is so high that nobody else is even feeling strong enough to be willing put a price on it. The absence of competitors in a market often suggests that risk has risen in that market. If you've ever tried to get flood insurance, you may have noticed this phenomenon.

Of course, there's another way to look at this, which is that in the last five to seven years it did not "appear" that there was much of a risk premium in mortgage rates because, well, there wasn't much of one. Since we cannot actually open a newspaper or get on the internet without another story of horrible losses taken by investors in mortgages whose "cushion" for defaults--their credit risk premium--was ludicrously low given the riskiness of the mortgages they were investing in, we might have concluded by now that things like the increased risk premiums that the GSEs are now charging are something along the lines of a return to "normal" interest rates. Normal rates being ones that have a realistic risk premium in them.

These two issues do, actually, converge: if the GSEs are the only ones buying loans right now, then they are likely to be buying more of the kinds of loans that private investors used to buy before they quit buying anything. Unless they want to go the same way their private competitors have gone, they have to either tighten standards or raise risk premiums or a combination of both, since it's pretty obvious that the private investor loans of the last few years--mostly subprime, Alt-A, and jumbo--were pretty seriously underpriced. Mortgage markets really aren't that weirder than any other market: you can't make up a negative margin on volume.

This Times piece strikes me as just a somewhat subtler version of the "GSEs Refuse to Save the Day" rhetoric we've seen expressed somewhat more stridently before. What else can we make of this:

Those buying homes will have little choice but to absorb the cost. But the new policies will be felt more by those thinking of refinancing mortgages.Ohhh-kaaay. If you have to buy--apparently people do "have to" buy--you just have to pay a higher interest rate than buyers did until recently. But if you already have a mortgage and refinancing doesn't look promising right now because the rate you have is lower than the rate on a new loan--you're really suffering? Well, OK, what we seem to mean is that if you "have to" refinance--to get cash or to get out of some crazy high-risk ARM--then you will feel some pain. Because apparently Fannie and Freddie aren't willing to take borrowers who "have to" supplement their income with cash-outs or bail out of loans that let them buy too much house without charging extra for it.

Strangely enough, the Times piece makes pretty clear that this "charging extra" doesn't really amount to all that much, relatively speaking. Another eighth of a percent on the annual interest rate isn't exactly going to hit the usury ceiling any time soon. It also provides a nifty little chart showing that one-year ARM rates are still out there with a pretty decent discount. If you don't like paying 6.93% (in New York) for a 30-year fixed, you can always get an ARM for 6.01%. What? You don't want an ARM because you're afraid rates will rise in the future? And we thought rates no longer had anything to do with such expectations . . .