by Calculated Risk on 8/19/2008 01:29:00 PM

Tuesday, August 19, 2008

Single Family Homes: Quarterly Data on Starts and Sales

It is difficult to compare monthly housing starts directly to sales. The monthly housing starts report from the Census Bureau includes apartments, owner built units and condos that are not included in the New Home sales report. However, every quarter, the Census Bureau releases Starts by Intent, and it is possible to compare "Single Family Starts, Built for Sale" to New Home sales. Click on graph for larger image in new window.

Click on graph for larger image in new window.

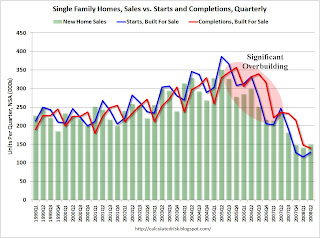

This graph compares quarterly starts of single family homes built for sale (and completions of single family homes built for sale in red) with New Home sales.

This data is not seasonally adjusted for any series. There are clear seasonal patterns for all series, and completions lag starts by about 6 months.

The period of significant overbuilding in recent years is highlighted. It now appears that starts and completions are running below sales. Note that most new home sales occur before a housing unit is started, so completions lag sales. The second graph shows the quarterly starts by intent at an annual rate through Q2 2008. This shows 1) Single Family starts built for sale, 2) Owner built units, 3) Units built for rent, and 4) Condos built for sale.

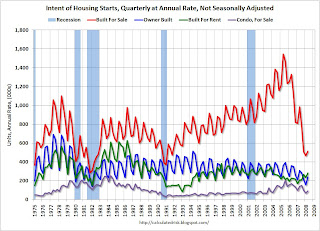

The second graph shows the quarterly starts by intent at an annual rate through Q2 2008. This shows 1) Single Family starts built for sale, 2) Owner built units, 3) Units built for rent, and 4) Condos built for sale.

As of Q2, Single Family starts built for sale, had rebounded slightly to 512 thousand on a non seasonally adjusted annual rate. As noted above, this level of starts is below the current level of New Home sales.

Note the minor seasonal rebound for Single family starts built for sale. There was no Spring for housing in 2008.

Also, starts for condos has fallen significantly - just slightly above the average level of the '90s.

Rental units are the lone bright spot (other than minor seasonal upswings), and it was rental units that accounted for the increase in overall starts for June (somewhat because of the changes in the NY construction code). With the rental vacancy rate at 10.0%, the rental construction will probably decline in Q3.

There is still a huge overhang of existing home inventory for sale (especially distressed inventory including short sales and REOs), and until that inventory declines significantly, starts and housing prices will remain under pressure. However this report does provide some evidence that the home builders are starting fewer homes than they are selling.

Mortgage Fraud News From Orange County, Nigeria

by Anonymous on 8/19/2008 09:02:00 AM

Here we have a detailed two-parter (part one and part two) on a sorry case of mortgage fraud from the OC Register. Dogged local cop pursues small-balance fraud case, nails crook, unveils huge regulatory failure. But . . .

*********

I have to confess to being as fascinated by the victims in this case as by the perp. Before everybody starts in on me about "blaming the victim," let me point out that yes, fraud is fraud, even when the victim is so lacking in common sense and elementary skepticism as to pass into Darwin Award territory. I do not excuse anyone who preys on the vulnerable, the foolish, or the ignorant.

Nonetheless, it's hard to prevent certain kinds of fraud against homeowners if you do not deal with the extent to which they "work" only because the victim colludes with them, up to and beyond the point where they become so outlandish as to defy belief. The case before us seems to me less a case of "mortgage fraud" than a classic confidence scam that simply takes as its incidental starting point a dubious mortgage offer. In other words, it's like a Nigerian scam email. From part one:Nobody believed in Osborn more than Steve Ryancarz.

My sense is that there will always be someone--a customer of his business who is allowed to rack up a $1.2MM receivable, a mortgage broker, somebody else--able and willing to part Mr. Ryancarz from his money. I am all in favor of prosecuting fraud and tightening up mortgage broker regulations, but I suspect we're kidding ourselves if we think there is any kind of workable law or regulation that will assure that the Ryancarzes of the world are protected from scammers.

Ryancarz, 62, an Ohio businessman, wanted to refinance his 5,000-square-foot luxury house on a 5-acre lot to get some cash out for his refrigeration company. A major customer had gone belly up, owing Ryancarz's firm $1.2 million, he said.

Ryancarz wasn't just trying to get a loan for himself. He also was trying to do a favor for a friend, Kim Koslovic.

Ryancarz was engaged to Koslovic's mother. Koslovic, 38, and her husband had filed for Chapter 13 bankruptcy protection while he was unable to work because of an injury. In order to keep her modest, $107,000 house, she needed to refinance, but she couldn't find a lender in Ohio who would take a chance on her.

Ryancarz said he found Osborn online in 2003 through HomeLoanAdvisors.com. Ryancarz, who had good credit, figured that by bundling a loan for himself with one for Koslovic, Osborn might find a lender willing to take both.

"No matter how much money I had, I always help people out," Ryancarz said. "That's just how I am. Everybody needs a break. What I could do to help them – could help them get to a point where they turn their lives around, it's worth it."

There were warning signs, even early on. The first loan Osborn delivered for Ryancarz was bungled, resulting in much higher payments than Ryancarz had expected. Osborn blamed the problem on his boss.

Ryancarz said he called Osborn's boss, but the man wouldn't speak to him, so Ryancarz believed Osborn.

"It just snowballed after that," Ryancarz said.

Osborn said he would help Ryancarz sue the first lender, but he wanted money up front to pay for the lawsuit. Ryancarz sent thousands in fees.

Here's how much sway Osborn was able to exert over his victim: Ryancarz sent Osborn money to bail him out of jail when he was arrested for driving without a license. He also sent Osborn money to pay off a purported fine from the Department of Real Estate, according to records Ryancarz provided.

Ryancarz even sent $5,000 to pay for Osborn, his girlfriend and their children to take mini-vacations at the Loews Coronado Bay Resort.

"He said, 'I've done all this work for you. You owe me a favor. How about putting us up for the weekend?'" Ryancarz recalled.

Ryancarz said he believed that Osborn was working very hard trying to get loans for him and Koslovic, and if these loans didn't come through, well, that was understandable.

"I just thought they were axing the loans because of Kim's credit," he said.

Ryancarz never met Osborn in person. Over the phone, he sometimes heard Osborn use abusive language to office assistants, calling them nasty names if they made a mistake or didn't have the right paperwork.

"He was smooth to the clients, but as far as the people that done his work for him, he wasn't too kind," Ryancarz said.

To dispel any doubts about Osborn, Ryancarz would call the lenders that Osborn said he was working with.

Each time, Ryancarz said, he got confirmation.

"You gotta figure he's gotta be on the up and up. He's not going to be jeopardizing his reputation talking to these people or lying to you and saying he did," Ryancarz said. "You fall back on the sense of well, he's doing his job, it's just a little tougher than you thought it would be and blah blah blah."

Or, as Koslovic put it, "It's easy to push time away with the excuse of paperwork and glitches and technicalities, with all those words that everyone uses."

Ultimately, Ryancarz and Koslovic lost their houses.

It turned out that Ryancarz could have done a much better deed for Koslovic if he'd simply paid off her mortgage rather than trying to get her a new loan through Osborn.

Her house was worth $107,000. Ryancarz paid Osborn more than $370,000, court records show.

"I almost done it and I decided, no, that's not getting them where they want to be," Ryancarz said. "So I didn't do that. Hindsight indicates I should have."

I argued last year in this post, Unwinding the Fraud for Bubbles, that it was getting a bit difficult during the boom to tell the difference between the victimizers and the victims in a lot of cases. Now that we're deep into the horrors of the unwind, it is becoming increasingly fashionable in a lot of quarters to accept at face value many people's claims to have been nothing but innocent victims of the mortgage industry, and certainly with poster children like this Osborn character, the mortgage industry doesn't have much of a case for the defense. But some frauds just won't work without the greed, irresponsibility, or outright collusion of the mark. And not all of these cases are as blatantly clear as the Osborn-Ryancarz debacle. Reader Gary sent me this one, from Crain's New York Business: Noel, a 28-year-old math teacher from Harlem who asked that his last name not be used, always thought it would be smart to invest in real estate. So when his cousin introduced him to a mortgage broker who promised he wouldn't have to put a penny down on a $1 million piece of property in New Rochelle, he jumped at the chance. Then, the same broker told him about a home in Yonkers. Again, he didn't have to put any money down.

I agree that Noel should never have been approved for the loan. I am perfectly willing to believe that the broker misrepresented Noel's income without his knowledge. But I am not quite willing to believe that Noel did not realize that mortgage loans have to be paid back. How did he think he was going to make payments on $1.5MM in loans out of a $50,000 salary? I mean, the lender probably didn't know what Noel's actual income was, but surely Noel did. Noel is a math teacher.

Before he realized what he was getting into, Noel says, he was scammed into signing two mortgages totaling more than $1.5 million. The mortgage broker even provided a lawyer for the closing.

"I make $50,000 as a schoolteacher," he says. "There's no way I should have been approved for loans that big."

Hemmed in by monthly payments totaling more than $10,000 and bills for maintaining a third property on Long Island, Noel had no choice but to file for bankruptcy, he says. He filed without the help of a lawyer—he couldn't afford one—and he plans to walk away from the three homes and get a fresh start, this time without dreams of making it big.

"I thought real estate was a good business," he says. "But I guess it's not for me. I'm not buying property again—ever again."

Noel could be scammed because Noel bought into the idea that real estate investing is a magical kind of business unlike any other kind of business in which you can put nothing down and make no loan payments and strike it rich. This does not excuse Noel's mortgage broker. It explains Noel's mortgage broker.

Single Family Housing Starts: Lowest Since 1991

by Calculated Risk on 8/19/2008 08:30:00 AM

First, the headline number was distorted by a change in the construction code in New York City that was effective July 1, 2008. Many builders filed for permits prior to this deadline, especially for multifamily construction. This boosted both permits and starts in June, and this distortion has been partially unwound in the July numbers.

So the key is to focus on single family starts.

Single-family starts were at 641 thousand in July; the lowest level since January 1991. Single-family permits were at 584 thousand in July, suggesting starts will fall even further next month.

Also employment in residential construction tends to follow completions. Completions will follow starts lower over the next few months. Single-family completions are still at 791 thousand - well above the level of single-family starts.  Click on graph for larger image in new window.

Click on graph for larger image in new window.

The graph shows total housing starts vs. single family housing starts.

Note that the current recession on the graph is not official.

Here is the Census Bureau reports on housing Permits, Starts and Completions.

Building permits decreased:

Privately-owned housing units authorized by building permits in July were at a seasonally adjusted annual rate of 937,000.The declines in single family permits suggest further declines in starts next month.

This is 17.7 percent (±1.3%) below the revised June rate of 1,138,000 and is 32.4 percent (±1.5%) below the revised July 2007 estimate of 1,386,000.

Single-family authorizations in July were at a rate of 584,000; this is 5.2 percent (±1.4%) below the June figure of 616,000. Authorizations of units in buildings with five units or more were at a rate of 318,000 in July.

On housing starts:

Privately-owned housing starts in July were at a seasonally adjusted annual rate of 965,000. This is 11.0 percent (±9.0%) below theAnd on completions:

revised June estimate of 1,084,000 and is 29.6 percent (±5.1%) below the revised July 2007 rate of 1,371,000.

Single-family housing starts in July were at a rate of 641,000; this is 2.9 percent (±10.9%)* below the June figure of 660,000. The July rate for units in buildings with five units or more was 309,000.

Privately-owned housing completions in July were at a seasonally adjusted annual rate of 1,035,000. This is 8.7 percent (±10.0%)*Notice that single-family completions are still significantly higher than single-family starts.

below the revised June estimate of 1,134,000 and is 31.7 percent (±6.6%) below the revised July 2007 rate of 1,515,000.

Single-family housing completions in July were at a rate of 791,000; this is 7.2 percent (±9.3%)* below the June figure of 852,000. The July rate for units in buildings with five units or more was 229,000..

Home Depot: Same Store Sales Off 7.9%

by Calculated Risk on 8/19/2008 08:18:00 AM

From Home Depot: The Home Depot Announces Second Quarter Results

Sales for the second quarter totaled $21.0 billion, a 5.4 percent decrease from the second quarter of fiscal 2007, reflecting negative comparable store sales of 7.9 percent, offset in part by sales from new stores.And the beat goes on ...

...

"We continue to see pressure on our market and the consumer, generally," said Frank Blake, chairman & CEO. ...

Given the continued softness in the housing and home improvement markets as well as the commitment to invest in its key retail priorities, the Company believes fiscal 2008 sales will decline by approximately five percent ... This is consistent with its previous guidance.

Monday, August 18, 2008

Shanghai: Gold Medal in Cliff Diving

by Calculated Risk on 8/18/2008 09:45:00 PM

Click on graph for larger image in new window.

Click on graph for larger image in new window.

The Shanghai SSE composite index is now below 2320, the lowest since the amazing run up started in 2006. The index is off over 60% from the peak.

This is a stunning stock market crash. Usually a stock market crash leads to less business investment, and an economic slowdown. The second graph compares the NASDAQ (as a percent from the peak) to changes in business investment in structures and software and equipment.

The second graph compares the NASDAQ (as a percent from the peak) to changes in business investment in structures and software and equipment.

This shows that business investment in both categories went negative about 3 quarters after the stock market peaked. Of course there are major differences between the U.S. and China, but I'd expect business investment to slow in China.

Leamer: U.S. Far From Recession

by Calculated Risk on 8/18/2008 06:23:00 PM

Abstract from Professor Leamer: What's a Recession, Anyway?

Monthly US data on payroll employment, civilian employment, industrial production and the unemployment rate are used to define a recession-dating algorithm that nearly perfectly reproduces the NBER official peak and trough dates. The only substantial point of disagreement is with respect to the NBER November 1973 peak. The algorithm prefers September 1974. In addition, this algorithm indicates that the data through June 2008 do not yet exceed the recession threshold, and will do so only if things get much worse.Real Time Economics blog at the WSJ has more: UCLA Professor Says U.S. Is Still Far From Recession

Leamer is a very good forecaster, and his presentation at the Jackson Hole Symposium last year is an excellent read on how housing impacts the economy: Housing is the Business Cycle. Here is an excerpt:

The temporal ordering of the spending weakness is: residential investment, consumer durables, consumer nondurables and consumer services before the recession, and then, once the recession officially commences, business spending on the short-lived assets, equipment and software, and, last, business spending on the long-lived assets, offices and factories. The ordering in the recovery is exactly the same.If we look at Professor Leamer's temporal road map for a recession, we are starting to see weakness in equipment and software investment (off 3.4% in the Q2 advance GDP report), and we can be very confident that investment in offices and other commercial real estate will decline in the 2nd half of 2008 and into 2009. This would argue that we are already in a recession.

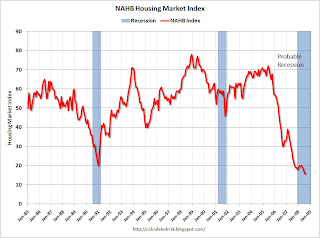

Also, Leamer is correct that housing usually leads the economy both into and out of a recession. Housing busts usually look like a "V" with a sharp decline, and a sharp recovery. This time housing will probably look like an "L" shape with little recovery for some time (until the huge overhang of inventory is reduced). We are already seeing this in the NAHB confidence report released today. And we will probably see the same pattern for single family housing starts and new home sales. No quick recovery.

So once again I disagree with Dr. Leamer: I think the economy is already in a recession (not severe), however we agree that the period of economic weakness will probably linger.

DataQuick: SoCal Home Sales Increase, Prices Decline

by Calculated Risk on 8/18/2008 03:16:00 PM

From DataQuick: Southland home sales post annual gain -- prices drop again

The number of Southern California homes sold last month edged up to its highest level in more than a year as bargain hunters swept up foreclosure properties in affordable neighborhoods, a real estate information service reported.

A total of 20,329 new and resale houses and condos sold in Los Angeles, Riverside, San Diego, Ventura, San Bernardino and Orange counties last month. That was up 16.7 percent from 17,424 the previous month and up 13.8 percent from 17,867 for July a year ago, according to San Diego-based MDA DataQuick.

Last month's sales count was the highest since 21,856 homes were sold in March 2007, though it still fell 23 percent short of the average July sales total since 1988, when MDA DataQuick's statistics begin. From last September through June, sales for each month were at an all-time low for that particular calendar month, with the exception of April which was the next lowest. Last month's sales total was the first since September 2005 to rise above the year-ago level.

"What we're looking at is a fire sale of properties in newer affordable neighborhoods that were bought or refinanced near the price peak with lousy mortgages. What we're still not seeing is this level of distress spreading to more expensive or established neighborhoods," said John Walsh, MDA DataQuick president.

...

Foreclosure resales continue to be a dominant factor in today's Southern California market, accounting for 43.6 percent of all resales. That was up from a revised 41.8 percent in June, and up from 7.9 percent in July 2007. Foreclosure resales -- where a foreclosure had occurred at some point in the prior 12 months -- ranged from 22.2 percent of all resales in Orange County last month to 64.4 percent in Riverside County.

...

Foreclosure activity is at record levels ...

emphasis added

NAHB: Builder Confidence at Record Low

by Calculated Risk on 8/18/2008 01:20:00 PM

The NAHB reports that builder confidence was at 16 in August, unchanged from July. Usually housing bottoms look like a "V"; this one will probably look more like an "L". (this refers to activity like starts and sales, but will probably also be apparent in the confidence survey). Click on graph for larger image in new window.

Click on graph for larger image in new window.

Current sales activity is near a record low of 16. Traffic of Prospective Buyers

is at a record low of 12.

NAHB Press Release: Builder Confidence Holds Steady In August

Anticipating positive impacts of newly enacted housing stimulus legislation, single-family home builders registered some improvement in their outlook for home sales in the next six months, according to the National Association of Home Builders/Wells Fargo Housing Market Index (HMI) for August, released today. The overall confidence measure held even this month at 16, while the component gauging sales expectations rose two points to 25.

...

“While our overall measure of builder confidence remains at a record low at this time, it is a good sign that two out of three of the HMI’s component indexes rose in August, and this may be an indication that we are nearing the bottom of the long downswing in new-home sales,” said NAHB Chief Economist David Seiders. “Our current forecast shows stabilization of sales during the second half of this year, followed by solid recovery in 2009 and beyond.”

U.S. Banks: Higher Borrowing Costs

by Calculated Risk on 8/18/2008 09:44:00 AM

From the Financial Times: US banks scramble to refinance maturing debt (hat tip AT)

Battered US financial groups will have to refinance billions of dollars in maturing debt over the coming months, a move likely to push banks’ funding costs higher ...Higher borrowing costs for banks probably means higher lending costs for customers, negatively impacting the economy.

Mohamed El-Erian, co-chief executive of Pimco, the asset management group, said: “If banks keep borrowing at these levels, you will get a repricing of credit for the whole economy.”

...

Adding together 10 of the biggest bank borrowers, Dealogic said that maturing bonds total $27bn in August, $52bn in September, $23bn in October, $20bn in November and $86bn in December. The extent of the scramble for funds became clear last week when banks tapped central lending facilities ... US commercial banks borrowed a record daily average of $17.7bn from the Fed last week.

Lowe's: Same Store Sales decline 5.3%

by Calculated Risk on 8/18/2008 09:16:00 AM

From MarketWatch: Housing malaise eats into Lowe's net

Lowe's said while big-ticket item purchases continued to be hurt by the housing downturn, it saw relative strength in seasonal sales as homeowners restored lawns and outdoor landscaping after last year's drought in much of the country. The company said it also benefited from the stimulus checks from the U.S. government.Last quarter, Lowe's same store sales declined 8.4%. The stimulus checks probably helped some this quarter, but I expect the 2nd half of '08 will be difficult for home improvement retailers. Home Depot reports tomorrow.

...

Sales rose 2.4% to $14.5 billion as the company opened in more locations. Same-store sales, or sales at stores open at least a year, dropped 5.3%.