by Calculated Risk on 8/11/2008 12:03:00 AM

Monday, August 11, 2008

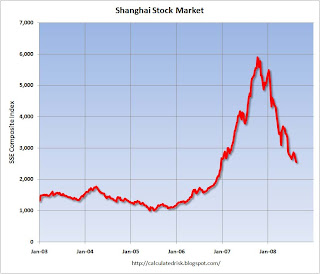

Shanghai Cliff Diving

Sunday, August 10, 2008

WSJ: Euro Banks Tighten Lending Standards

by Calculated Risk on 8/10/2008 09:38:00 PM

From the WSJ: Banks in Euro Zone Tighten Lending Again

Banks in the euro zone continued to tighten lending standards during the second quarter amid a deteriorating economic outlook, and criteria could become even tighter, according to the European Central Bank's July Bank Lending Survey.The Fed's July Senior Loan Officer survey should be released soon - and will probably show banks tightened lending standards in the U.S. too.

...

"The ongoing tightening of bank credit standards and the further weakening in demand for bank loans strengthens our belief that the euro-zone credit cycle is turning sharply lower," said Martin van Vliet, an economist at ING Bank.

The Credit Crunch continues. And the 2nd half recovery - projected by many economists - has been cancelled. From Kelly Evans at the WSJ: Economists Expect 2008's Second Half to Be Worse Than First. Here is a video of the WSJ's Evans summarizing the article:

Off Topic: Hiking Trip

by Calculated Risk on 8/10/2008 06:56:00 PM

It seems every time I leave town, banks fail, huge write-downs are announced or some major new Fed facility is unveiled ... so just to let everyone know, I'll be in the Sierra again next Friday and Saturday (Aug 15th and 16th), and I'll be hiking the John Muir Trail from August 31st through September 8th (from Yosemite Valley to Mt Whitney). I suspect some major news stories will break!

While I'm gone, Tanta will be posting more frequently - and to help her out, Paul Jackson of Housing Wire will be posting news stories. And there will be a surprise post or two too.

Yes, I've been training several hours a day, and this has limited my analysis posts. I apologize. Oh well, the extra training has been great for my weight.

Best to all, CR

Paulson Interview: No Plans to Insert Money in Fannie and Freddie

by Calculated Risk on 8/10/2008 04:10:00 PM

Paulson interview starts at about 1 min 30 secs and runs to about 28 minutes. Brokaw ask him what happened to "containment" and about President Bush's comment about Wall Street getting drunk.

UK: House Repossessions Hit 12-year-high

by Calculated Risk on 8/10/2008 10:41:00 AM

From the Independent: House repossessions soar to 12-year-high

The number of UK house repossessions jumped by 48 per cent in the first half of the year to its highest level for 12 years, figures showed today. ... The [Council of Mortgage Lenders] said the rate of repossession, at 0.16 per cent, was now the highest seen for 10 years.Part of the problem (in addition to the house price bubble bursting in the UK) is that mortgage rates have increased, from The Times: Bank customers hit for £3.8 billion

But it stressed this was still low in the context of the entire mortgage market and less than half that experienced amid the housing market crash of the early 1990s.

Today's figures also reveal that the number of mortgages three months or more in arrears has risen ... to 1.33 per cent of all home loans, although the number of mortgages more than six months in arrears was 0.58 per cent of all loans.

Over the past 12 months HSBC has increased the cost of its two-year fix for borrowers with 25% equity in their home by half a percentage point, from 6.34% in July 2007 to 6.84% last month, according to figures from the data firm Defaqto.

...

A year ago, [Cheltenham & Gloucester] was charging an average interest rate of 6.28% on a two-year fixed-rate deal for those with a 25% deposit compared with an average 6.61% in July this year

Saturday, August 09, 2008

ARS Mess: Banks Agree to Buyout Investors

by Calculated Risk on 8/09/2008 05:55:00 PM

In February the Auction Rate Securities (ARS) market froze. Auction-rate securities are a borrow short, lend long (or invest long) strategy used by cities and student-loan organizations to lower their borrowing costs.

It has been alleged that many banks marketed ARS to investors as "safe as money markets". Since the markets froze, many investors have been unable to withdraw their funds. Now the banks, to avoid legal action, are having to buyout those investors.

From the WSJ: UBS to Pay $19 Billion As Auction Mess Hits Wall Street

On Friday, facing allegations of wrongdoing over its sales of so-called auction-rate securities, UBS AG agreed to buy back from investors nearly $19 billion of the investments as part of a settlement with federal and a group of state regulators. It will start buying from individuals and charities in October and from institutional clients in mid-2010.This isn't a loss for the banks - although there may be some losses in the future - because the Auction Rate Securities are still paying interest. However this does tie up the banks' capital and contributes to the credit crunch.

UBS was the third major firm this week to vow to buy back the securities, which allegedly were improperly sold as higher-rate equivalents for super-safe money-market funds.

UBS, Merrill Lynch & Co. and Citigroup Inc. have committed to taking back a total of more than $36 billion of the instruments. Other financial firms are expected to follow suit.

...

Wall Street sold more than $330 billion of these securities to more than 100,000 individuals and other investors.

Lansner: Tax Twists in Housing Bill

by Calculated Risk on 8/09/2008 01:17:00 PM

From Jon Lansner at the O.C. Register: Insider Q&A hears tax twists in housing bailout bill. Lansner interviews Leonard Wright, a San Diego-based CPA and chair of CalCPAs state personal financial planning committee:

Us: The new law has some downside for vacation or rental home owners who subsequently make the property their primary residence. Let’s say a couple buys a rental property in 2008 for $500,000. After 10 years, they move in making it their primary residence. Fifteen years later they sell it for $1.2 million, a $700,000 profit. How much could they exclude from capital gains under the new law?This is the issue we discussed earlier. Lansner and Wright have more.

Wright: Basically this affects the capital gains tax exclusion — normally $250,000 for a single filer, $500,000 for a couple — from the sale of your primary residence. The new law for the sale of a principal residence introduces the concept of non-qualified use. Essentially, non-qualified use is any period of time that the property is not occupied as the principal residence. The law now requires us to look back at the cumulative use of the property. In this case, 10 years of rental use was non-qualified use and 15 years use as a principal residence was qualified use. Since it was a principal residence 60 percent of the time (15 years/25 years), you can exclude from income $300,000 of the $700,000 profit rather than $500,000. Depreciation is also recaptured and is included in income.

For some taxpayers, there may be a break on non-qualified use. If the taxpayer was away from the residence due to official extended duty for up to a total of 10 years, or a temporary absence up to two years occurred because of an employment or health condition change, those years are excluded from non-qualified use.

Friday, August 08, 2008

Bank United: Non-Performing Assets Increase Sharply

by Calculated Risk on 8/08/2008 06:24:00 PM

Press Release: BankUnited Announces Fiscal 2008 Third-Quarter Results

The ratio of non-performing assets as a percentage of total assets increased to 7.73% at June 30, 2008, from 4.75% at March 31, 2008, and 0.86% at June 30, 2007.Fiscal 2009 will be interesting with so many more Option ARMs reaching the 115% limit. Fiscal 2010 will probably be even worse (based on industry data, not BankUnited data).

...

Net charge-offs for the quarter ended June 30, 2008, were $22.7 million, or an annualized rate of 0.73% of average total loans. This compares to $13.3 million, or an annualized rate of 0.42% of average total loans, for the quarter ended March 31, 2008, and $1.1 million, or an annualized rate of 0.04% of average total loans, for the quarter ended June 30, 2007.

...

BankUnited’s option ARM loans are re-amortized over the remaining term at the earlier of five years from inception of the loan or upon reaching 115% of the original principal balance. As of June 30, 2008, a total of 128 loans had reached the maximum 115% of the original loan amount. These 128 loans had an aggregate balance of $42.9 million, or 0.41% of the total residential loan balance as of June 30, 2008. ...

The company estimates that approximately $48 million of option ARM loans will reach the 115% limit during the remaining quarter of fiscal 2008, and that $686 million will reach the 115% limit during fiscal year 2009.

emphasis added

ACA: Cram-Down

by Calculated Risk on 8/08/2008 05:45:00 PM

From Bloomberg: ACA Terminates $65 Billion of Credit-Default Swaps (hat tips Sam & Brian)

ACA Capital Holdings Inc. ... terminated $65 billion in credit-default swap contracts and turned over most of the company to creditors.

Counterparties now own a 95 percent residual interest in New York-based ACA Capital's insurance unit through surplus notes, the company said in a statement today.

Ford to Reduce Leasing

by Calculated Risk on 8/08/2008 04:28:00 PM

From the WSJ: Ford Credit to Cut Back On Leasing, Citing Risks

The lending arm for Ford Motor Co. told investors it is substantially scaling back the number of vehicles it expects to lease and warned that if market conditions continue to deteriorate, further losses could place Ford Credit's lending plan at further risk.From the SEC filing:

The recent, rapid decline in auction values for used full-size trucks and traditional SUVs, together with difficult credit market conditions, has made leasing vehicles less economical than in the past. Accordingly, Ford Credit is planning to reduce lease originations, while still offering leasing to consumers who prefer this product.

...

Consistent with the overall market, Ford Credit has been impacted by volatility in the asset-backed securities markets that began in August 2007. Since then, Ford Credit has experienced higher credit spreads and, in certain circumstances, shorter maturities in its public and private securitization issuances. In addition, committed liquidity program renewals have come at a higher cost. Given present market conditions, Ford Credit expects that its credit spreads and the cost of renewing its committed liquidity programs will continue to be higher in 2008 than prior to August 2007. About 25% of Ford Credit's committed capacity is up for renewal during the remainder of 2008. Given the nature of its asset-backed committed facilities, Ford Credit has the ability to obtain term funding up to the time that the facilities mature. Any outstanding debt at the maturity of the facilities remains outstanding through the term of the underlying assets.

Ford Credit's funding plan is subject to risks and uncertainties, many of which are beyond its control. If auction values for used vehicles continue to weaken or further reductions occur in the market capacity for the types of asset-backed securities used in Ford Credit's asset-backed funding, there could be increased risk to Ford Credit's funding plan. As a result, Ford Credit may need to reduce the amount of receivables and operating leases it purchases or originates. A significant reduction in Ford Credit's managed receivables would reduce its ongoing profits, and could adversely affect its ability to support the sale of Ford vehicles.

emphasis added