by Anonymous on 7/22/2008 09:26:00 AM

Tuesday, July 22, 2008

Good For the Wall Street Journal!

Yes, boys and girls, I wish to say something complimentary about a media outlet. The WSJ, no less. Dog bites man.

Housing Wire directed my attention to this very interesting article about the FDIC and the crappy, fraudulent, and occasionally predatory loans it allowed Sterling Superior Bank [Duh! --ed.] to continue to originate and sell on the secondary market even after the FDIC took control of the institution and had FDIC staff at the bank supposedly providing grown-up supervision. It's an important story.

But look! On the online version of the story, there's this little box several paragraphs down, titled "From the Case Filings." And it in are links to the various court filings and internal FDIC documents on which the story is based. You can click on one of those links, if you feel the urge, and read the same primary written sources that the reporter used to write the story! If all you want is the short version, you can just read the article. But for once, we see the online media using the powers granted by the Internet to create a situation in which we're not forced to settle for just the short, breathless, over-simplified version! Not that I think this particular article is an offender in that regard. But I have spent a lot of blogging time on breathless, over-simplified articles--Hi, Gretchen!--based on great long complicated court filings that I had to go look up myself to get a clearer picture, if they were even available online.

I therefore drop a deep and graceful curtsy to the WSJ's online editor and the reporter, Mark Maremont. You probably don't want to get used to this yet, but it is still quite sincere.

Wachovia: $8.66 Billion Loss

by Calculated Risk on 7/22/2008 09:21:00 AM

From the WSJ: Wachovia Posts $8.66 Billion Loss, Slashes Dividend, Will Sell Assets

Wachovia ... posted a net loss of $8.66 billion ... Net charge-offs -- loans the company doesn't think are collectible -- soared to 1.10% of total loans from 0.14% a year earlier and 0.66% in the first quarter. Nonperforming loans -- those near default -- rose to 2.41% from 0.49% and 1.70%, respectively.The confessional business is booming.

Brooks on Morgenson on McLeod

by Anonymous on 7/22/2008 09:07:00 AM

UPDATE: Please see the end of the post for a marvelous blast from the Brooks past.

I have never actually gone out of my way to read a David Brooks column; this one was directed to my attention by a reader (thanks, Pat!).

It takes on the same Morgenson article I went after on Sunday. In the process of doing so it makes a series of claims that are, I think, way more preposterous than Morgenson's tendency to see borrowers as primarily hapless, passive victims of predatory lenders:

[W]hat happened to McLeod, and the nation’s financial system, is part of a larger social story. America once had a culture of thrift. But over the past decades, that unspoken code has been silently eroded.This nostalgia for the lost "culture of thrift" always gets on my nerves. America has always had both a "culture of thrift" and a "culture of conspicuous consumption." We have had our Gilded Ages before the year 1992. The "BankAmericard" (which became the Visa) was invented back in the "thrifty fifties," about ten years after economist James Duesenberry first popularized the phrase "keeping up with the Joneses." Collapsing the history of America into a lost golden age of thrift contrasted to a degenerate present of consumption excess is a reliable sign you're in the presence of ideology. Like this:

Some of the toxins were economic. Rising house prices gave people the impression that they could take on more risk. Some were cultural. We entered a period of mass luxury, in which people down the income scale expect to own designer goods. Some were moral. Schools and other institutions used to talk the language of sin and temptation to alert people to the seductions that could ruin their lives. They no longer do.Reactionaries and moral scolds have been carping about working people aspiring to "mass luxury" since at least the time of Adam Smith. Anyone who has ever read a nineteenth century novel has encountered the ubiquitous scenes of upper-class women bemoaning the increasing availability of inexpensive machine-made ready-to-wear clothing, which--horrors!--allowed the servant class to wear dresses and suits that were increasingly hard to distinguish from the clothing of their middle-class betters. Or the apocalyptic brooding over the sudden availability of affordable washing machines and gas ranges, which would lead to nothing but demands for female suffrage and public schools for the servant class. (Yep. They were right about that.)

Norms changed and people began making jokes to make illicit things seem normal. Instead of condemning hyper-consumerism, they made quips about “retail therapy,” or repeated the line that Morgenson noted in her article: When the going gets tough, the tough go shopping.

McLeod and the lenders were not only shaped by deteriorating norms, they helped degrade them.

And just when did the schools used to talk about the "sin and temptation" of shopping, and just when did they stop? Diane McLeod, the woman featured in Morgenson's story, is 47. She would have been only an impressionable teenager when Tammy Faye Bakker was all over the TV, preaching about sin and temptation and also appearing every week in a different outfit and shoes, not to mention the make-up and hair. If Tammy Faye was mostly concerned with keeping young women out of the perdition of spending Saturdays at the mall, I don't remember that part. I do remember first hearing that stupid line about the tough going shopping during the great moral awakening of the Reagan years.

Of course, "McLeod and the lenders" and those dratted secular schools weren't exactly the only parties involved in the rather complex dynamic of establishing the social respectability of recreational or "therapeutic" consumption. Brooks, writing in that influential arbiter of taste the New York Times, somehow fails to notice the role of the media in constructing popular standards for "risk" and "normal" consumption patterns. In Brooks' weird little world, Americans responded to "rising home prices" that they apparently directly perceived, without media intervention. It was those house prices that "gave people the impression that they could take on more risk," not the reporting on house prices or the columnists who solemnly opined that these prices meant that people weren't taking on more risk by buying or refinancing. How incredibly convenient that line is.

Some of us can have grave concerns about consumerist culture and excessive household debt without telling ourselves that "capitalism" is about to erase a couple hundred years of history and bring back Puritanism. We can also object to the way in which writers like Morgenson seem to want to erase the extent to which real people like McLeod are active participants in their own lives--in favor of seeing them as mere passive victims of lenders--without having to drag Calvinist notions of "sin and temptation" out of the cultural closet. But at least Morgenson's little secular morality plays do try to ground themselves in a set of empirical facts about lender practices as they exist today. Brooks' reductive fantasies about American history and the equation of spending and sin leave the world of empirical fact far, far behind.

Credit crunches and economic crises are bad enough, without having to put up with the endless cheap moralizing that always seems to accompany them. Unfortunately, we're going to have to put up with a lot of cheap moralizing from the media. At least this time around we've got the Internet and the blogs to make fun of it.

UPDATE: our 12th Percentile leaves us this jewel in the comments:

I would like to present David Brooks from 2004 arguing against David Brooks in 2008. From his NY Times article on suburbia, which has to be read to be believed:These criticisms don't get suburbia right. They don't get America right. The criticisms tend to come enshrouded in predictions of decline or cultural catastrophe. Yet somehow imperial decline never comes, and the social catastrophe never materializes. American standards of living surpassed those in Europe around 1740. For more than 260 years, in other words, Americans have been rich, money-mad, vulgar, materialistic and complacent people. And yet somehow America became and continues to be the most powerful nation on earth and the most productive. Religion flourishes. Universities flourish. Crime rates drop, teen pregnancy declines, teen-suicide rates fall, along with divorce rates. Despite all the problems that plague this country, social healing takes place. If we're so great, can we really be that shallow?The internet really does make it easy to show what idiots these people are.

Monday, July 21, 2008

AmEx: "Super Prime" Problems

by Calculated Risk on 7/21/2008 08:11:00 PM

A few comments from the American Express conference call: (hat tip Brian)

“Over the past month or so, we have seen clear signs that the US economy is weakening. Unemployment rates, as we know, took the largest jump in over 20 years. Home prices declined at the fastest rate in decades, and consumer confidence is at one of its all-time low points. Card member spending particularly among consumers slowed sharply during the latter part of the quarter. Credit indicators as we signaled a few weeks ago deteriorated beyond our expectations, and by almost any measure the US economy and business environment are much weaker than the assumptions we first spoke to you about back in January and the conditions that existed in early June. Now this fallout was evident across all consumer segments, even our longer-term super prime card members.”We are all subprime now!

Here are the AmEx slides. Several are interesting and show the credit deterioration.

Click on graph for larger image in new window.

Click on graph for larger image in new window.“Affluent customers in some situations are cutting back on discretionary spending…we’re seeing a slowdown in spend across the board”U.S. Card Services billing only increased 2% year-over-year in June - less than inflation.

And AmEx expects the economy to worsen:

“The severe decline in home prices and the marked rise in oil prices have had a fundamental impact on consumer budgets and behavior. Not just as it relates to mortgages and home-related spending, but also across the full spectrum of the consumer economy. We saw the first signs of weakness in our credit indicators at the end of last year and communicated this to you in January when we reported our fourth-quarter results. At that time we took a credit-related charge in order to recognize the deterioration by strengthening our lending and charge card reserves, coverage ratios and levels. In the first quarter, US lending write-off rates rose further, and at that time we indicated that the second-quarter loan-loss rate would be higher than the first quarter, which has proven to be the case. In April and May US lending write-off rates were generally consistent with the 4% to 6% EPS growth plan that we discussed with you in early June. However, as I showed you on the slide package, we saw our credit deteriorate in June beyond our expectations as the write-off rates rose and roll rates within the portfolio deteriorated versus prior months. In other words, more and more consumers who are falling behind in their payments are remaining delinquent. This causes us to assume that a greater percentage of past-due loans will not be repaid. In light of the magnitude of the negative economic trends and our experience, we now believe the economic weakness in the US will likely worsen throughout the remainder of the year and negatively impact credit and business trend ... we now expect that our lending write-off rate in the third and fourth quarter will be higher than June levels.”

Confessional: Quote of the Day

by Calculated Risk on 7/21/2008 06:20:00 PM

Several companies visited the confessional today, but the quote of the day goes to Texas Instruments:

"If demand strengthens as quickly as it slowed, we are well-positioned to meet it."Tell that to the homebuilders ...

Wachovia Halts Wholesale Lending

by Calculated Risk on 7/21/2008 05:27:00 PM

From Reuters: Wachovia mortgage unit halting loans via brokers (hat tip crispy&cole)

Wachovia Corp ... said its main mortgage unit will stop offering home loans through brokers this week ...

American Express: "No Longer Tracking to Prior Forecast"

by Calculated Risk on 7/21/2008 04:29:00 PM

From American Express:

The second quarter results included a $600 million ($374 million after-tax) addition to U.S. lending credit reserves that reflects a deterioration of credit indicators beyond our prior expectation, and a $136 million ($85 million after-tax) charge to the fair market value of the Company’s retained interest in securitized Cardmember loans.

...

“Fallout from a weaker U.S. economy accelerated during June with consumer confidence dropping, unemployment rates moving sharply higher and home prices declining at the fastest rate in decades,” said Kenneth I. Chenault, chairman and chief executive officer. “Consumer spending slowed during the latter part of the quarter and credit indicators deteriorated beyond our expectations.

“In light of the weakening economy, we are no longer tracking to our prior forecast of 4-6 percent earnings per share growth. That outlook was based on business and economic conditions in line with, or moderately worse than, January 2008. The environment has weakened significantly since then, particularly during the month of June.

emphasis added

Report: Wachovia Exiting Wholesale

by Calculated Risk on 7/21/2008 03:05:00 PM

The Implode-O-Meter is reporting Wachovia will be exiting wholesale lending and will have a conference call at 1 PM (I think this is Pacific time).

Office Investment

by Calculated Risk on 7/21/2008 02:20:00 PM

Recently I've posted articles on office vacancies in Orange County and San Diego. Click on graph for larger image in new window.

Click on graph for larger image in new window.

Here is a photo from lunatic fringe in Orange County, CA:

[I drove] down the street and [to see] how leasing was going at the new office park at Jeffrey and the 5. It doesn't look too good, I think maybe 6-7 of the buildings were partially or fully leased and the remaining 15 or so were empty as can be. ... What's sad is this complex has been open for leasing since late 2007.The other photos showed mostly see through buildings too. And these are some of the smaller building for lease - along the 405 there are several much larger see throughs.

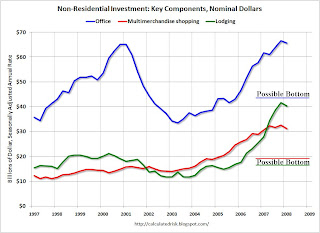

Office investment is one of the three key components of non-residential investment in structures that will probably decline in the 2nd half of 2008 (and into 2009). The three key areas are: office buildings, multimerchandise shopping, and lodging.

This graph shows the investment in each of the categories in nominal dollars. See here for investment as percent of GDP. My estimate for a possible investment bottom are marked in red, green and blue and labeled "possible bottom".

This graph shows the investment in each of the categories in nominal dollars. See here for investment as percent of GDP. My estimate for a possible investment bottom are marked in red, green and blue and labeled "possible bottom". Note: data from the BEA. The BEA started breaking out office and multimerchandise shopping in 1997.

This is why I keep posting on offices, malls, and hotels. Of these three categories, office investment is the largest, but was also the least overbuilt during the recent boom. Offices were overbuilt during the late '90s because of the stock bubble, so it took some time to get the current office boom started.

The second graph shows office investment as a percent of GDP since 1972.

The second graph shows office investment as a percent of GDP since 1972.NOTE: In 1997, the Bureau of Economic Analysis changed the office category. In the earlier years, offices included medical offices. After '97, medical offices were not included (The BEA presented the data both ways in '97).

This shows the huge over investment in offices in the '80s due to the S&L lending (and eventual crisis). This graph also shows the office building boom associated with the stock market bubble.

The most recent office boom was smaller as a percent of GDP than the late '90s boom. However the booms for malls and lodging were larger this time - and the busts, on a percentage basis, will probably be larger for malls and lodging too. All three categories will see declines in investment later this year.

San Diego Office Vacancy Rates Highest Since 1995

by Calculated Risk on 7/21/2008 12:13:00 PM

From the San Diego Union-Tribune: 16% office vacancy rates seen in county

San Diego County's office market continued to soften in the second quarter, with vacancy rates reaching 16.1 percent, thanks to tepid demand and new construction adding to supply.Meanwhile the net absorption is negative:

...

Last year at this time, office vacancy in the county was 12.2 percent. ... The last time the county's overall office vacancy topped 16 percent was in 1995 ...

CB Richard Ellis reported that net absorption – which measures the amount of space leased versus the amount vacated – is negative 430,000 square feet so far this year.And more space is coming on line:

Some 1.3 million square feet of for-lease buildings remain under constructionNegative demand. And more and more new supply. Not the best fundamentals for the office market.