by Anonymous on 6/12/2008 11:30:00 AM

Thursday, June 12, 2008

FBI Diverting Resources to Mortgage Fraud

Reports Bloomberg:

June 12 (Bloomberg) -- The U.S. Federal Bureau of Investigation, confronting a surge in mortgage fraud, has ordered more than two dozen of its field offices to stop probing some financial crimes so agents can focus on the subprime crisis. . . .If I weren't afraid of sounding cynical, I'd say there's a new career in mass marketing and environmental crimes for all those out-of-work mortgage bottom-feeders. So I'll just think it instead.

The 26 field offices were told to temporarily suspend opening new cases dealing with price fixing, mass marketing, wire fraud, mail fraud and environmental crimes, Carter said. Current cases aren't being dropped, he said. The FBI has 56 field offices and about 12,000 agents.

Real Retail Sales

by Calculated Risk on 6/12/2008 10:11:00 AM

Retail sales in April (ex-auto) were strong. From the WSJ: Stimulus Checks Bolster Retail Sales

Retail sales increased by 1.0%, the Commerce Department said Thursday. ... Sales in the previous two months were revised strongly upward. Sales in April increased 0.4%; originally, Commerce said April sales dropped 0.2%. March sales increased 0.5%; earlier, Commerce said March sales rose 0.2%.U.S. retail and food services sales for May were $385.4 billion, up from $381.6 billion in April. That is an increase of $3.8 billion - a small amount compared to the $48 billion in stimulus checks.

The healthy increase in May sales suggested consumers were putting to work some money the government kicked back to them in a plan to stimulate the foundering economy. ... $48 billion in payments were cut in May, Treasury Department numbers indicate.

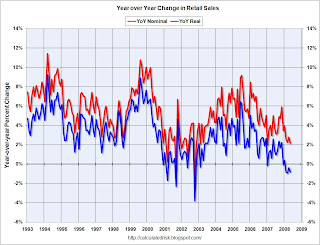

This graph shows the year-over-year change in nominal and real retail sales since 1993.

Click on graph for larger image in new window.

Click on graph for larger image in new window.To calculate the real change, the monthly PCE price index from the BEA was used (May PCE prices were estimated based on the increases for the last 3 months).

Although the Census Bureau reported that nominal retail sales increased 2.1% year-over-year (retail and food services increased 2.5%), real retail sales declined 0.8% (on a YoY basis).

So despite the strong sales in May, the YoY change in real retail sales is still negative.

Lehman President and CFO Step Down

by Calculated Risk on 6/12/2008 09:33:00 AM

From Bloomberg: Lehman's Callan, Gregory Step Down, Lowitt Named Finance Chief

Lehman Brothers Holdings Inc. replaced Chief Financial Officer Erin Callan and President Joseph Gregory ...

Shanghai Composite Falls Below 3000

by Calculated Risk on 6/12/2008 01:40:00 AM

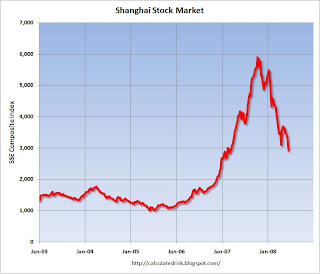

Remember when the Shanghai stock market declined 9% on Feb 27, 2007? That caused shock waves around the world, including a 400 points decline in the DOW index the following day. After falling to 2772 in Feb 2007, the SSE composite index more than doubled! Click on graph for larger image in new window.

Click on graph for larger image in new window.

Now the index has fallen back below 3,000 - still above the close after the one day sell off - but 50% below the peak.

This is some serious cliff diving.

This sell off could be in anticipation of a slowing Chinese economy, and I wouldn't be surprised to finally see a slowdown in China after the Olympics this summer. And a Chinese slowdown might lead to lower oil prices - something else to watch later this year.

Wednesday, June 11, 2008

MBIA Letter to Shareholders

by Calculated Risk on 6/11/2008 09:24:00 PM

Press Release: MBIA Issues Letter to Owners.

Most of the news stories today focused on MBIA's announcement that it won't make a planned $900 million capital contribution to MBIA Insurance Corporation. But I also found this comment in the letter interesting:

[B]ased on our discussions with the rating agencies and in trying to think about their challenges, what I believe has really changed in the past three months is that both Moody’s and S&P have far less comfort in forecasting a worst case housing-related stress case loss scenario ...I'm not surprised that Moody's and S&P feel less comfortable forecasting a worst case for housing - every time they've made a forecast, the housing market has surprised to the downside.

OCC Mortgage Metrics Report

by Anonymous on 6/11/2008 06:40:00 PM

The OCC has inaugurated a new report, which will be issued quarterly, on mortgage delinquency, loss mitigation, and foreclosure activity drawn from the servicing databases of nine large banks:

The report analyzes data submitted on each of the more than 23 million loans held or serviced by these nine banks from October 2007 through March 2008. The $3.8 trillion portfolio represents 90 percent of mortgages held by national banks and about 40 percent of mortgages overall. The participating national banks are Bank of America, Citibank, First Horizon, HSBC, JPMorgan Chase, National City, USBank, Wachovia, and Wells Fargo.Of this aggregated servicing portfolio, about 90% of loans are securitized either through the GSEs or private label issuers. The mix is 62% prime, 9% Alt-A, and 9% subprime, with the remaining 20% "other" being largely loans with insufficient or missing data that does not allow assignment into one of the three categories. The OCC indicates that data scrubbing will continue, and hopefully future reports will have a smaller "other" bucket.

It's a big database, and the OCC has made a real effort to standardize its own definitions, based on reported data elements rather than servicer descriptions, so that the credit and loss mitigation categories are consistent across all nine servicers.

The full report is available here. From the summary:

• The proportion of mortgages in the total portfolio that was current and performing remained relatively constant during the reporting period at approximately 94 percent.

• Serious delinquencies, defined as bankrupt borrowers who are 30 days delinquent and all delinquencies greater than 60 days, increased just one-tenth of a percentage point during the period, from 2.1 percent to about 2.2 percent.

• As in other studies, the report confirms that foreclosures in process are plainly on the rise, with the total number increasing steadily and significantly through the reporting period from 0.9 percent of the portfolio to 1.23 percent. Interestingly, the number of new foreclosures has been quite variable. While one month does not make a trend, new foreclosures in March declined to 45,696, down 21 percent from January’s high and down about 4.5 percent from the start of the reporting period last October.

• The majority of serious delinquencies was concentrated in the highest risk segment – subprime mortgages. Though these mortgages constituted less than 9 percent of the total portfolio, they sustained twice as many delinquencies as either prime or Alt-A

mortgages.

• Consistent with other reports, payment plans predominated, outnumbering loan modifications in March by more than four to one. But loan modifications increased at a much faster rate during the period.

• Although subprime mortgages constituted less than 9 percent of the total portfolio, subprime loss mitigation actions constituted 43 percent of all loss mitigation actions in March.

• The emphasis on loss mitigation for subprime mortgages corresponds to the nationwide focus on this higher risk sector. Total loss mitigation actions exceeded newly initiated foreclosure proceedings by a margin of nearly 2 to 1.

REOs make up almost 2/3 of Home Sales in Sacramento

by Calculated Risk on 6/11/2008 05:37:00 PM

From the WSJ: Foreclosures Make Up Majority of Sales in Sacramento

The Sacramento Association of Realtors says that a whopping 65.5% of 1,654 homes sold by Realtors in May were bank-owned, foreclosed, homes.Is it any wonder pending home sales clicked up a little?

...

In Las Vegas, for example, about half of recent sales have been lender sales.

WaMu Denies Rumors of Regulatory Action

by Calculated Risk on 6/11/2008 04:21:00 PM

You know it's bad when ... (hat tip Brian)

From WaMu: WaMu Statement Regarding Rumors of Regulatory Action

While it is the policy of Washington Mutual not to comment on speculation and market rumors, the company released the following statement to address recurring speculation about regulatory activity:We are in denial season.

"Neither our primary federal regulator, the OTS, nor any other bank regulatory agency has taken any enforcement action against WaMu that we have not previously disclosed. Further, the company is not currently in such discussions with any regulatory agency."

Merrill CEO: Economic environment 'tougher than we thought'

by Calculated Risk on 6/11/2008 03:07:00 PM

Record U.S. Government Budget Deficit in May

by Calculated Risk on 6/11/2008 02:44:00 PM

From AP: Economic stimulus payments push May budget deficit to an all-time high of $165.9 billion.

The economic slowdown is definitely impacting receipts.

A key question is how much those stimulus checks are boosting consumer spending in May and June. According to the Fed's beige book, consumer spending was weak in May.

And yet the WSJ reported last week: Some Chains Posts Strong Sales Despite Gas Prices, Low Confidence

Retailers posted stronger-than-expected same-store sales for May [despite a] surge in gasoline prices and tumbling consumer confidence.With the conflicting reports on consumer spending, the Census Bureau's retail sales for May might be interesting (to be released tomorrow).

It definitely appears the budget deficit will set a record this year - and this is the unified deficit - the General Fund deficit will be significantly worse (excludes the Social Security surplus).