by Calculated Risk on 6/04/2008 12:57:00 PM

Wednesday, June 04, 2008

Moody's may Downgrade Ambac, MBIA

From AP: Moody's may downgrade Ambac, MBIA ratings (hat tip Nemo, Juan)

Haven't we been here before?

Cancellations, Yet Again

by Calculated Risk on 6/04/2008 12:04:00 PM

First, the outlook for housing is negative. Just because I mention a few minor shreds of good news for housing, doesn't mean my view has changed. It hasn't, especially for existing home sales and prices.

OK, for those hoping to buy at lower prices, the outlook is rosy. Now that we’ve gotten the semantics out of the way, the overall outlook remains negative for house sales and prices. With tighter lending standards, demand will remain weak, and supply is already at record levels and still rising - especially the supply of distressed homes. This record supply, combined with continuing weak demand, will put pressure on house prices, probably for several years, in real terms, in many areas.

Now let’s return to cancellations. The cancellation issue can be confusing.

When looking at new home sales, we are interested in net sales, but the Census Bureau reports gross new sales. A simple equation would be:

Sales (net) = Sales (gross) – Cancellations + Sales of earlier cancellations.In the long run, the cancellation terms balance out, and the Census Bureau numbers are what we want. In other words, Sales(net) = sales(gross). But in the short run, with cancellations increasing, the Census Bureau probably overestimates sales; and with cancellations decreasing, the Census Bureau underestimates sales.

We don’t have the raw data for cancellations and sales of earlier cancellations. However the public builders typically report net sales and cancellation rates. Using the public data, we can estimate net vs. gross sales for the industry, and adjust the Census Bureau estimates accordingly. Luckily the analysis isn’t too difficult: when cancellations rates are rising, net sales are typically below gross sales, and when the cancellation rates are falling, net sales are usually above gross sales. Right now cancellation rates are falling and the builders are reporting they are reducing their inventory of “unintended spec homes”, and net sales are above gross sales.

Currently cancellation rates are still significantly above normal for the home builders. As an example, Toll Brothers just announced a cancellation rate of 24.9%, far above their historical rate of 7%. But the key for adjusting the Census Bureau numbers is that the cancellation rate has declined from 38.9% two quarters ago. What matters for this calculation is the change in cancellation rate over the previous six months since that is the time it typically takes to build a home.

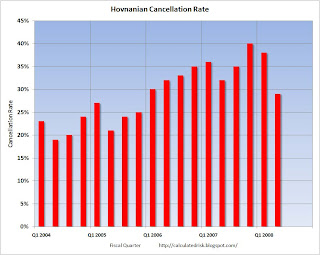

The same is true for other builders. Another example is Hovnanian: they reported a cancellation rate of 29%, down from 40% two quarters ago. Hovanian averaged 23% cancellation rate in 2004 and 2005 (cancellation rates are builder specific because of their downpayment and pre-qualification requirements).

Since cancellations rates are now falling, this suggests that the Census Bureau is currently underestimating sales for new homes. This is not a positive comment about these individual builders, but this helps analyze the entire market.

Possible Casual Dining Bankruptcy

by Calculated Risk on 6/04/2008 09:25:00 AM

From the WSJ: Bennigan's Owner In Crucial Credit Talks (hat tip Geoffrey)

The owner of national casual-dining chains Bennigan's, Ponderosa and Steak and Ale is in talks with its major lender GE Capital Solutions in an effort to stave off a possible bankruptcy filing ...Casual dining is a discretionary expense and is frequently one of the first expenses that consumers reduce during hard times.

The problems at Metromedia show just how difficult life has become for casual-dining chains. Consumers are cutting back on discretionary spending. That comes as food prices for everything from corn to steak are on the rise. Many of the companies are also highly leveraged, which is pushing them to seek protection from creditors.

Earlier this year, the parent companies of the Bakers Square, Village Inn and Old Country Buffet filed for Chapter 11 bankruptcy protection, citing fall sales and rising food costs. A host of other chains -- from Outback Steakhouse to Ruby Tuesday's -- are also struggling.

MBA: Purchase Applications Decline

by Calculated Risk on 6/04/2008 09:05:00 AM

It appears the MBA Purchase Index might be useful again. Note: the index wasn't useful when lenders were going out of business because of the method used to calculated the index.

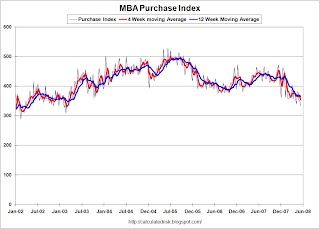

The MBA reports that the Purchase Index fell to 333.6, the lowest level since early 2003. Because of the changes to the index, we can't compare directly to 2003. Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows the MBA Purchase Index, and four week and twelve week moving averages.

Although we can't compare directly to earlier periods because of the changes in the index, this does suggest that sales of homes are continuing to decline.

Ed McMahon Receives Notice of Default

by Calculated Risk on 6/04/2008 12:15:00 AM

From the WSJ: Ed McMahon May Lose Beverly Hills Home

ReconTrust, a unit of mortgage lender Countrywide Financial, on Feb. 28 filed a notice of default on a $4.8 million Countrywide loan backed by Mr. McMahon's home. ... According to the filing, Mr. McMahon was then about $644,000 in arrears on the loan. It isn't clear whether Countrywide still owns the loan or is acting on behalf of investors who acquired it.We are all subprime now.

Mr. McMahon broke his neck in a fall about 18 months ago and hasn't been able to work, [Howard Bragman, a spokesman for Mr. McMahon] said. That health problem, along with the weak housing market and economy, has forced Mr. McMahon into foreclosure proceedings ...

Tuesday, June 03, 2008

Hovnanian Reports Huge Loss

by Calculated Risk on 6/03/2008 10:01:00 PM

Here are some words that shareholders hate:

"We expect to persevere ..."Expect? Oh yeah, that inspires confidence.

CEO Ara K. Hovnanian, June 3, 2008

From Reuters: Hovnanian reports 2Q loss grows tenfold (hat tip barely)

[T]he company reported a net loss of $340.7 million, or $5.29 per share, for the quarter that ended April 30. This compared with a loss of $30.7 million, or 49 cents per share, for the same period a year ago.Ouch. That is much worse than expected.

And the little bit of good news:

Hovnanian's contract cancellation rate, excluding the joint ventures, improved to 29 percent from 38 percent last quarter and 32 percent in last year's second quarter.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the Hovnanian cancellation rate by quarter since 2004 (note that Hovnanian just finished fiscal Q2 2008).

The cancellation rate is now declining after peaking last year at 40%. One of the key reasons to track cancellation rates is to estimate the error in the Census Bureau numbers. Since it takes about 6 months to build a home, the usual comparison is current quarter vs. 6 months ago. The cancellation rate is declining (from 40% to 29%) and that suggests that the Census Bureau is currently underestimating sales.

Note that Hovnanian's cancellation rate was in the 20% range during the boom years (Toll Brothers' cancellation rate was running around 4.5% in 2004). The cancellation rate tends to be builder specific because of different down payment and pre-qualification requirements.

Northern Ireland: Bursting the Bubble

by Calculated Risk on 6/03/2008 06:22:00 PM

Here is an update on the Ireland housing market from UTV Insight:

Part I: (8 minutes)

Part II: (8 minutes)

Part III: (8 minutes):

A "Tsunami of REOs"

by Calculated Risk on 6/03/2008 04:11:00 PM

From Peter Tong at the LA Times: Foreclosures lead a town's downturn

It wasn't long ago that Andy Krotik was selling houses to out-of-town investors who would sometimes buy two at a time.For some of these fairly isolated communities, it will probably take years to absorb all the excess inventory built during the boom.

Now, Krotik spends his days warily entering abandoned houses, checking for angry holdouts or startled squatters. He wants to make sure the properties are empty and secure so he can sell them for the banks that have repossessed them.

"We're experiencing a tsunami of bank-owned properties," said Krotik, who has been selling real estate in this Central Valley town since 1989.

Few places in California flew as high in the real estate boom and crashed as hard as Merced.

The lead in this story reminds me of commercials on TV (circa 2005) urging homeowners to take equity out of their homes and "build an empire". I can just imagine these equity rich homeowners as "out-of-town investors", driving to Yosemite, and stopping at Merced to buy "two at a time". Ouch.

Ford, Toyota Report Lower Sales

by Calculated Risk on 6/03/2008 02:35:00 PM

This is a followup to the post this morning about GM significantly cutting production.

From the WSJ: GM, Ford Sales Plunge As Truck Demand Wanes

In May, GM sales of cars and light trucks totaled 268,892, down from 371,056 a year earlier. There were 27 selling days in May, compared with 26 a year ago. ...There is some good news: people are buying more fuel efficient cars - and the roads are noticeably less crowded where I live in SoCal.

Toyota sold 257,404 vehicles in May, compared with 269,023 a year earlier. Toyota's passenger car sales inched up 0.4% to 168,942 while light-truck sales slid 12% to 88,462. ...

Ford reported May sales of 217,268 light vehicles, compared with 258,123 a year earlier. Sales of Ford trucks and sport-utility vehicles were down 26% to 126,364, with F-series truck sales tumbling 31%.

Soros Warns on "commodity bubble"

by Calculated Risk on 6/03/2008 01:12:00 PM

From MarketWatch: Soros says commodity bubble echoes '87 climate

The investment flood into commodity indexes bears eerie similarities to the craze for portfolio insurance which led to the stock market crash of 1987, said hedge fund investor George Soros, who warned the rush into commodities has created a "bubble."

"In both cases, the institutions are piling in on one side of the market and they have sufficient weight to unbalance it," said Soros in testimony prepared for a Senate panel on energy manipulation.

"If the trend were reversed and the institutions as a group headed for the exit as they did in 1987, there would be a crash," he said.