by Calculated Risk on 5/15/2008 11:49:00 AM

Thursday, May 15, 2008

Recessions and Industrial Production

"[A] recession is a significant decline in economic activity spread across the economy, lasting more than a few months, normally visible in real GDP, real income, employment, industrial production, and wholesale-retail sales."The Federal Reserve reported this morning that industrial production declined 0.7% in April. From the WSJ: Industrial Output Fell Last Month

National Bureau of Economic Research (NBER)

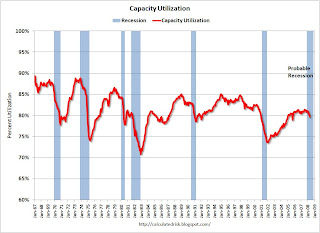

U.S. industrial production plunged in April, suffering a broad decline in output ranging from cars to furniture and business equipment.A decline in industrial production is one of the indicators of a recession (see quote at top). The following graph shows capacity utilization and recessions for the last 40 years.

Industrial production decreased 0.7%, following a revised 0.2% climb in March, the Federal Reserve said Thursday. Originally, production in March was seen up 0.3%.

Capacity utilization receded sharply to 79.7% in April, a sign of easing inflationary pressure. March capacity use was 80.4%, revised down from an originally reported 80.5%. The 1972-2007 average is 81.0%.

Click on graph for larger image.

Click on graph for larger image.The decline in capacity utilization suggests that the economy could be in recession.

Even more important is that industrial production is a key to the depth of the economic slowdown. So far exports have been strong, and the decline in industrial production has been mild. If the global economy slows significantly ("recoupling"), then industrial production and capacity utilization could fall sharply leading to a deeper recession.

Also, with capacity utilization below average, this probably means less investment in non-residential structures in the near future.

Foreclosures moving up the Housing Chain

by Calculated Risk on 5/15/2008 09:20:00 AM

A "Foreclosure Magazine" arrived on my doorstep yesterday. There were close to 200 homes offered for sale as distressed properties, mostly in Orange County, CA with some in the Inland Empire.

Although most of the listing in Orange County are in the $400 to $800 thousand range, there are a number of higher end homes. For example:

Huntington Harbor Pre-Foreclosure (on the water), $1,750,000

Irvine, Giant 5 BD View Home, "Beat the Bank", $1,199,000

Corona, 5 BD Gated, Views, Bank Owned, $999,999

Orange, Custom Home, Gated Community, Short Sale, $1,875,000

It appears foreclosures are moving up the housing chain ...

From the WaPo: Luxury Foreclosures

The foreclosure signs that have been sprouting up in less-affluent communities since 2006 are beginning to appear in the well-off suburbs, attached to houses that once cost $1 million or more. Although those kinds of homes are in the minority now, real estate agents predict the numbers will swell.

In Loudoun County, 60 houses priced over $750,000 are among the 932 foreclosures and short sales -- an exit strategy of selling the house at a loss with the bank's blessing to avoid foreclosure.

Affluent neighborhoods have been able to stave off foreclosure longer, but the effects of once-popular loans, such as adjustable-rate and interest-only mortgages, are beginning to take their toll, economists and real estate agents said.

Wednesday, May 14, 2008

Downtown Chicago Condo Numbers

by Calculated Risk on 5/14/2008 07:58:00 PM

As I mentioned in the previous post, most condos are not included in the new home sales and inventory numbers from the Census Bureau (they are included in housing starts).

Here are some numbers for the Chicago market from the Chicago Tribune: Record condo numbers to saturate downtown (hat tip Lee)

Gail Lissner, vice president of Appraisal Research Counselors, said 2008 is the biggest year so far for downtown condos. Her firm says 5,984 units will come on the market this year. That compares with 4,794 last year and a projected 4,160 next year.Those sales numbers are quarterly, so 1,200 sales in Q1 2007 was reasonable compared to the 4,794 new condos added last year. But with close to 6,000 units being added this year, and sales of only 201 units in Q1, there is a serious oversupply - with more units coming in 2009.

Yet buyers are not showing up.

Sales of newly built downtown condominiums plummeted by about 83 percent during the first quarter, to 201 units from 1,207 units a year earlier, according to a report to be released Wednesday by Appraisal Research Counselors.

There are probably many areas with similar or worse numbers for new condos - like San Diego, Miami, Las Vegas, Orange County and more.

Condo Stats and Negative Externalities

by Calculated Risk on 5/14/2008 05:29:00 PM

The NY Times has an article on the negative externalities of some Condo Life: Foreclosures, Higher Fees and Mowing the Lawn

When people buy condos, they expect their monthly fees will cover many of the responsibilities that they would otherwise have as single-family homeowners, like cutting the grass and paying the water bills. Now many find themselves nagging each other in the hallways to pay their assessments and adding special fees while haggling over chores. In Miami, Chicago and San Diego, condo owners are adjusting to the economic woes, sometimes by mowing themselves and working shifts for building security — all while lamenting their lost community.The article also mentions that condos are not included in some of the housing stats - something I've mentioned several times. Many condos (especially high rise) are not included in the new home sales and inventory report from the Census Bureau (they are included in housing starts).

Many of the numbers compiled on home sales specifically exclude condos, which account for one out of eight homes in the nation, and that missing data may be masking just how weak the housing market really is. Sales of existing condo units were down 26 percent in March from a year earlier, compared with an 18 percent decline for single-family homes, according to the National Association of Realtors.For those areas with a large number of high rise condos, the supply of housing units could be much higher than the Census Bureau statistics would indicate.

The pain in the condo market, mostly urban areas, may not only be deeper than the rest of the housing market during this downturn but more prolonged.

On Freddie Mac Accounting Change

by Calculated Risk on 5/14/2008 02:55:00 PM

From Bloomberg: Freddie Mac Accounting Changes Reduce Losses By $2.6 Billion (hat tip SC)

A change in the way the company values some assets that aren't traded reduced credit losses by $1.3 billion, while a separate rule that lets the company pick and choose which assets to measure contributed an equal amount as well, Freddie Mac said.So much for transparency.

...

Financial Accounting Standard 157 allows companies to estimate a value on holdings that aren't traded. Freddie Mac increased its Level 3 assets under FAS 157 to $156.7 billion, or 23 percent of its assets, from $31.9 billion as of December. The company also adopted FAS 159, which lets it pick which financial assets and liabilities to measure at fair value through earnings.

...

Chief Executive Officer Richard Syron said the new accounting better reflects ``the underlying performance of our business'' as the market continues to deteriorate.

Also, from the WSJ: Freddie Mac Posts $151 Million Loss

Freddie also reported that the "fair value," or estimated market value, of its net assets was a negative $5.2 billion as of March 31, compared with a positive $12.6 billion three months earlier. That means the estimated market value of assets falls short of estimated liabilities, largely stemming from the costs of mortgage defaults. [Chief financial officer] Mr. Piszel said the negative fair value reflects current distressed prices for mortgage securities and has "no impact" on the operations of a company like Freddie that is a long-term holder of mortgages.

Freddie Mac on Walking Away

by Calculated Risk on 5/14/2008 01:21:00 PM

More from the conference call:

Analyst: Quick question on your direction in terms of housing price declines and the impact on credit costs. Have you looked at the impact of rising LTV's have on the projected credit cost. In other words, if people get close to and then get under water, does the propensity for them to default, does that go up geometrically, and is that captured in your numbers?

Freddie Mac: Yes, clearly it is. And you know you have identified one of the key attributes of the loans in '06 and '07 that are contributing to the higher defaults. As I said in that remarks it has caused us to look hard at what the maximum LTV we're willing to purchase, and it also results in our raising delivery fees to that portion of the population. So it clearly is contributing to higher default costs. It is captured in our numbers. And we have responded both with tightening of terms and raising prices.

Analysts: What do you see? Is it in line with historical default rates as they get underwater or does it ...

Freddie Mac: No, it is different. The rate of increase in defaults in that part of the population is much steeper. For those borrowers that bought a home based on rapid house price appreciation as a way to grow wealth, if they find themselves quickly underwater - you know we're even seeing it when we try to modify and renegotiate those loans - they are walking away. They're finding it not constructive. I do think the raft in defaults for that portion of the population is steeper than historical observations, and we are reflecting that in our expectations.

emphasis added

Freddie Mac Conference Call

by Calculated Risk on 5/14/2008 11:01:00 AM

A few notes (webcast here):

On house prices (added: map from Freddie of Year-over-year house price changes):  Click on graph for larger image.

Click on graph for larger image.

“Now previously we have said that we expect housing prices to fall at least 15% nationally, and today they [have fallen] about 9% through the measure we use which is relative to our market. We want to take a better look at the spring housing market to see whether or not the data is beginning to firm up. It is premature at this point from a data perspective to make a change in our formal estimate. However at this point we must say that the risk to the forecast are strongly weighted on the downside. Give the severity we have experienced, [we took] an increase in charge off in REO expenses associated with higher loan loss severities. As a result of this change, we raised our estimate for credit costs and increased our provision.”On increasing delinquencies and severity rates: (here are the slides)

Richard Syron, CEO, May 14, 2008 (emphasis added)

"If you turn to slide six as dick noted earlier, as a result of the housing in the first quarter, increasing delinquencies and higher severity rates, in the first quarter [credit costs] moved to -- of 11.6 basis points compared to 5 basis points in the fourth quarter. These same factors drove [us to] raise our guidance for full year 2008 provision. On slide six you can see that our estimated credit losses for '08 have increased to 16 basis points with our 2009 estimate increasing to a rage of 20-25 basis points respectively. Our total credit losses now include the effect of our expected 2008 new business. Finally, slide seven, shows that despite the continued high level of charge offs we remain adequately reserved -- as of March our ratio of reserves was 1.6 times, consistent with where we were at year end. Another way to think about reserve coverage is a ratio to period losses [the ratio of] annualized first quarter charge off is about three times."Fredde Mac moves entire ABS portfolio into level 3 given the “prices we were seeing in the market that didn’t make any sense.”:

Analyst: There is a headline out there that you have level 3 assets of $157 billion. I was just wondering is that true and is that related at all to the markups of the 1.2 billion gain?

Freddie Mac: No, it is not Paul. We made a determination in the first quarter that given how widely the pricing we were getting on the abs portfolio [varied] that it no longer made sense to leave that into level two. So we essentially moved the entire abs portfolio into level three. We were still using the mean pricing that we were getting from the dealers. So we're not using a model price. That is all that is. It has nothing to do with the trading portfolio.”

Foreclosures Filings Rise 65%

by Calculated Risk on 5/14/2008 09:51:00 AM

From Bloomberg: U.S. Foreclosures Rise 65 Percent as Vacated Homes Add to Glut

U.S. foreclosure filings climbed 65 percent and bank seizures more than doubled in April from a year earlier as rates on adjustable mortgages increased and vacated homes added to a glut of unsold homes, RealtyTrac Inc. said.The current pace of 1,000 foreclosures per day in California makes 60,000 per month nationally very likely.

...

Bank repossessions jumped 145 percent in April from a year earlier to 54,574, according to Irvine, California-based RealtyTrac. The company has database of more than 1.5 million properties and monitors foreclosure filings including defaults notices, auction sale notices and bank seizures.

Banks will seize about 60,000 properties a month through December, when about 1 million U.S. homes, or a quarter of all homes for sale, may be bank-owned ...

FBI 2007 Mortgage Fraud Report

by Anonymous on 5/14/2008 07:49:00 AM

I didn't think there was anything particularly earth-shattering in this report, but I did think some of you might be amused by this:

According to the FBI:

The above photos are from condos that were involved in a mortgage fraud. The appraisal described “recently renovated condominiums” to include Brazilian hardwood, granite countertops, and a value of $275,000.It does make you wonder whether some of these reports of pre-foreclosure "trash outs" don't involve a few properties that were trashed from the get-go.

Tuesday, May 13, 2008

Oil Refiners and Oil Prices

by Calculated Risk on 5/13/2008 11:36:00 PM

Occasionally I've read claims that the lack of refinery capacity was driving up the price of oil. As an example, here is an excerpt from an old Bloomberg article:

The shortage of refining capacity worldwide has contributed to the 57 percent rise in oil prices in the past year.Of course the opposite would be true - a lack of refining capacity would keep down the price of oil (because refineries are the demand side of the equation for crude oil), but increase the price of gasoline (refineries are the supply side of the equation for gasoline).

Click on graph for larger image.

Click on graph for larger image.But now the demand for gasoline in the U.S. is falling, while world demand for oil is still strong. So the price of oil has risen sharply (because of global supply and demand, probably not speculation), while the price of gasoline in the U.S. hasn't kept pace as shown on the graph. (tell that to U.S. consumers!)

The graph compares the price of oil and gasoline in the U.S. Source: EIA for oil and gasoline. Note that oil prices (blue) have risen much faster recently than gasoline prices (red).

Jad Mouawad at the NY Times gets it right: Oil Refiners See Profits Sink as Consumption Falls

American refiners are going through a traumatic period. In a time of record gasoline prices, some of them actually lost money in the first quarter, and for virtually all refiners, profits are down sharply.Note: if you are wondering what could lead to a decline in oil prices, then global oil demand would have to slow or decline. One possibility is that growth in China could slow later this year as the world economy recouples:

Experts say the refiners are caught in a double bind. The price of their raw material, oil, is rising because of strong global demand. At the same time, consumption of gasoline in the United States is falling as a result of slower economic growth and consumer efforts to conserve.

In China ... oil imports have surged in recent weeks, a signal that the government is stockpiling oil and diesel in anticipation of the Olympic Games. Beijing, the International Energy Agency report said, is seeking to avoid a repeat of the embarrassing fuel shortages and power disruptions that plagued the country last year.