by Calculated Risk on 5/15/2008 11:49:00 AM

Thursday, May 15, 2008

Recessions and Industrial Production

"[A] recession is a significant decline in economic activity spread across the economy, lasting more than a few months, normally visible in real GDP, real income, employment, industrial production, and wholesale-retail sales."The Federal Reserve reported this morning that industrial production declined 0.7% in April. From the WSJ: Industrial Output Fell Last Month

National Bureau of Economic Research (NBER)

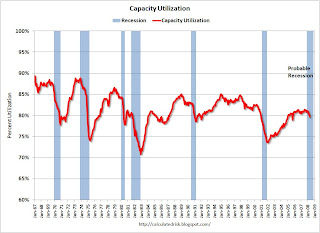

U.S. industrial production plunged in April, suffering a broad decline in output ranging from cars to furniture and business equipment.A decline in industrial production is one of the indicators of a recession (see quote at top). The following graph shows capacity utilization and recessions for the last 40 years.

Industrial production decreased 0.7%, following a revised 0.2% climb in March, the Federal Reserve said Thursday. Originally, production in March was seen up 0.3%.

Capacity utilization receded sharply to 79.7% in April, a sign of easing inflationary pressure. March capacity use was 80.4%, revised down from an originally reported 80.5%. The 1972-2007 average is 81.0%.

Click on graph for larger image.

Click on graph for larger image.The decline in capacity utilization suggests that the economy could be in recession.

Even more important is that industrial production is a key to the depth of the economic slowdown. So far exports have been strong, and the decline in industrial production has been mild. If the global economy slows significantly ("recoupling"), then industrial production and capacity utilization could fall sharply leading to a deeper recession.

Also, with capacity utilization below average, this probably means less investment in non-residential structures in the near future.