by Calculated Risk on 5/05/2008 03:37:00 PM

Monday, May 05, 2008

Fed: Lending Standards Tighten, Loan Demand Declines

From the Fed: The April 2008 Senior Loan Officer Opinion Survey on Bank Lending Practices

In the April survey, domestic and foreign institutions reported having further tightened their lending standards and terms on a broad range of loan categories over the previous three months. The net fractions of domestic banks reporting tighter lending standards were close to, or above, historical highs for nearly all loan categories in the survey. Compared with the January survey, the net fractions of banks that tightened lending standards increased significantly for consumer and commercial and industrial (C&I) loans. Demand for bank loans from both businesses and households reportedly weakened further, on net, over the past three months, although by less than had been the case over the previous survey period.

emphasis added

Click on graph for larger image.

Click on graph for larger image.Of particular interest is the increase in tighter lending standards for Commercial Real Estate (CRE) loans. This graph compares investment in non-residential structure with the Fed's loan survey results for lending standards (inverted) and CRE loan demand.

Note that any reading below zero for loan demand means less demand than the previous quarter, but the good news is demand in April wasn't falling quite as fast as in January!

This is strong evidence of an imminent slump in CRE investment.

More charts here for residential mortgage, consumer loans and C&I.

Non-Residential Investment: Key Components

by Calculated Risk on 5/05/2008 12:38:00 PM

If the imminent slowdown in non-residential structure investment is similar to the percentage declines during the '90/'91 and '01 recessions, then non-residential investment could decline as much as 15% to 20% over the next four quarters, from the $501 billion seasonally adjusted annual rate (SAAR) in Q4 2007, to about $400 billion to $425 billion in Q4 2008. (see: CRE Bust: How Deep, How Fast?)

Most of that possible decline will probably come from three key categories: office buildings, multimerchandise shopping, and lodging. Click on graph for larger image.

Click on graph for larger image.

This graph shows the investment in these three categories over the last ten years (as a percent of GDP). Note: data from the BEA. The BEA started breaking out office and multimerchandise shopping in 1997.

Lodging and multimerchandise shopping saw the largest booms, while office space was less than the office boom in the late '90s. If all three categories decline to the recent cycle lows (as a percent of GDP), this will be a decline of about $60 billion in non-residential investment (SAAR). This breaks down to a $22 billion decline for office investment, $13 billion for multimerchandise shopping, and $25 billion for lodging.

Multimerchandise shopping tends to be closely associated with residential investment (developers add strip malls and shopping centers as new communities are built), so the bust in shopping center and strip mall investment is the most predictable (strip mall vacancy rates have risen sharply). Also, a sharp decline in lodging investment also seems very likely given the significantly tighter lending standards for hotels. And office investment will probably slump too based on the recent Grubb & Ellis forecast: Big rise seen in unoccupied office space

Other areas of non-residential structure investment might hold up: such as hospitals, manufacturing (because of exports), and power and mining investment. But overall the decline in non-residential structure investment will probably be significant.

ResCap: May not Meet Debt Obligations

by Calculated Risk on 5/05/2008 11:32:00 AM

From Bloomberg: ResCap Says It May Not Be Able to Meet Debt Obligations in June

Residential Capital LLC, the mortgage- finance company owned by GMAC LLC, said it will still need to come up with $600 million by the end of June to meet its debt requirements even if its bond exchange offer is successful.

...

``There is a significant risk that we will not be able to meet our debt service obligations, be unable to meet certain financial covenants in our credit facilities, and be in a negative liquidity position in June 2008,'' ResCap said in a filing to the Securities and Exchange Commission today.

BofA to Walk Away from Countrywide?

by Calculated Risk on 5/05/2008 09:03:00 AM

From Reuters: BofA may renegotiate Countrywide deal price: Friedman

Bank of America Corp is likely to renegotiate its deal to buy Countrywide Financial Corp down to the $0 to $2 level or completely walk away from it, said Friedman, Billings, Ramsey, [analyst Paul Miller] ...Oh no, not negative equity! Hoocoodanode?

Countrywide's loan portfolio has deteriorated so rapidly that it currently has negative equity ...

"We estimate that if fair-value adjustments to the loan portfolio could exceed approximately $22 billion, this would increase the odds of Bank of America renegotiating the transaction or walking away," Miller said.

The Psychology of "Walking Away"

by Anonymous on 5/05/2008 09:02:00 AM

My attention was arrested by this story in today's Washington Post, which is not, actually, about "walk aways" at all. It's about borrowers getting mortgage modifications--that is, borrowers who are in fact making a real effort to stay in their homes. But one borrower's story here actually has more insight about the "walk away" meme, it seems to me, than any story I've read purportedly on that subject.

[The Ramseys] bought their Burtonsville home for $310,000 in June 2005 with two loans. The first, and larger, mortgage had a 6.4 percent interest rate due to increase after three years to as high as 12 percent. The second had a 10.2 percent rate. Their monthly payment was originally $2,000, not including homeowners association fees and taxes.Absorb that statement for a minute: in a short sale, you do "lose" your house. Whatever we're talking about here is psychological, not literal.

The rate jumped last summer. Eventually they were paying $3,050 a month. Her salary as a social worker and his as an insurance salesman wouldn't cover it. In July, they stopped paying.

Ramsey called her lender, Houston-based Litton Loan Servicing, but had trouble getting hold of anyone with decision-making authority. The company then scheduled foreclosure proceedings for Dec. 18. She called again to propose a short sale.

"I was willing to do whatever it took so that we didn't lose the house," she said.

Litton turned down the short sale bid--it was only $200,000. Eventually the Ramseys got Litton to agree to a modification:

It took several weeks, but Cipollone got both mortgages down to 7 percent, fixed for 30 years. Litton also dropped the balance to $302,000 after the Ramseys contributed $3,000 for a down payment.In a sense, Mrs. Ramsey understands what a foreclosure is much more clearly than people who talk about "walking away" do: a foreclosure is not "giving the house back to the bank." It is being forced to sell your property at public auction in order to satisfy a debt. To the Ramseys, it isn't actually "losing the house" that seems to be the real fear--they were willing, after all, to sell short. It's simply that a short sale "felt" voluntary; it felt like "a plan."

"I'm terribly excited," Ramsey said. "I wanted to pack up and leave my house because I want to, not because I'm going to go through a foreclosure situation, but because it's planned."

She doesn't plan on leaving anytime soon, but if she ever does, she said, it will be on her terms.

One of the reasons why nobody is really quantifying the "walk away" problem is that, in reality, there is no legal or logical distinction between a "walk away" and a "foreclosure," because they're both foreclosures. The only difference is that the former can be interpreted, psychologically, to mean that the borrower is "leaving my house because I want to," while the latter acknowledges that the sale of the home has been forced.

I'm guessing that we'll have a least a few commenters to this thread asserting that the Ramseys "should have just walked away." Their mortgage payment is back to its original level--around $2000 a month before taxes and insurance--but their mortgage is still seriously underwater and I for one wouldn't bet on how long it will take for its value to climb over the loan amount. Even in that part of Maryland, the Ramseys could probably cut their monthly housing expense in half by renting.

Such calculating advice, however, ignores the fact that to the Ramseys, foreclosure equals defeat, and they're realistic enough to realize that dressing it up in the euphemism of "walking away" doesn't change that. They are, in their own way, just as "ruthless" as the so-called walkers-away: they would, apparently, have been happy to see their lender take a $100,000-plus loss on a short sale to salve their pride. Human nature is like that; I have no real interest in heaping coals on the heads of the Ramseys. I am more interested in the way this story helpfully scrambles some confident assumptions about what motivates borrowers, and what really stigmatizes foreclosure in our current culture.

Servicers keep going on about a "sea change" in borrower attitudes about foreclosure. I just don't see that. I see borrowers whose actions suggest that foreclosure still carries a very powerful stigma, so much so that they are able to convince themselves that "walking away" is actually an "alternative" to foreclosure rather than a synonym for it. The Ramseys rather usefully remind us that "walking away" is not a financial strategy, it's a defense mechanism. If you can tell yourself that you are the one making the plan and executing the options, you avoid having to admit to being forced.

Sunday, May 04, 2008

Repeat: From Front Page to Short Sale

by Calculated Risk on 5/04/2008 11:06:00 PM

For those that missed it: In 2005, when the median house price in Orange County reached $603 thousand, the O.C. Register featured a house on the front page that had recently sold for $600 thousand. That house is now listed as a short sale for $439 thousand.

See: From Front Page to Short Sale

Note: the graph was made when the asking price was $559K, but the price was dropped to $439K on Saturday!). The graph shows how much further prices will probably decline in Orange County, CA.

Here is the July 2005 front page of the O.C. Register.

Here is the Redfin listing (see the 405 Freeway sign in the background).

Housing Bust Duration: Update

by Calculated Risk on 5/04/2008 02:46:00 PM

Note: This is an update to a previous post using the February Case-Shiller Price Indices.

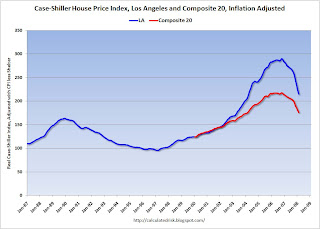

This first graph shows real Case-Shiller house prices for Los Angeles and the Composite 20 Index (20 large cities). The indices are adjusted with CPI less Shelter. Click on graph for larger image.

Click on graph for larger image.

The most obvious feature is the size of the current housing price bubble compared to the late '80s housing bubble in Los Angeles.

The Composite 20 bubble looks similar (although larger) to the previous Los Angeles bubble. (Note the Composite 20 index started in 2000).

Perhaps we can overlay the current Composite 20 bubble on top of the previous Los Angeles bubble and learn something about the possible duration of the current bust.

In the second graph, the real price peaks are lined up for late '80s bubble in Los Angeles, and the current Composite 20 bubble. Note that the real price peak for the Composite 20 was flat for several months, so the real peak was chosen as May '06. It could also be a few months later. The peak and trough for the Los Angeles bubble are marked on the graph.

The peak and trough for the Los Angeles bubble are marked on the graph.

Prices are falling faster this time, probably because the bubble was larger.

It might be reasonable to expect that the dynamics of the current bust will be similar to the previous bust. After another year (or two) of rapidly falling prices, it's very likely that real prices will continue to fall - but at a slower pace. During the last few years of the bust, real prices will be flat or decline slowly - and the conventional wisdom will be that homes are a poor investment.

The Los Angeles bust took 86 months in real terms from peak to trough (about 7 years) using the Case-Shiller index. If the Composite 20 bust takes a similar amount of time, the real price bottom will happen in early 2013 or so. (But prices would be close in 2010).

Condo Flipper Rental Woes

by Anonymous on 5/04/2008 06:59:00 AM

The Washington Post finds two fresh victims of the RE bust, condo owners whose mean, nasty condo boards won't let them rent out their units:

. . . said Moss, who also is a real estate agent. . . . said Gozen, a mortgage loan officer.Surely, if anyone understood the risk in trying to flip units in an owner-occupied project, it'd be these two, no? No.

Gozen:

"My idea was not to be a landlord. My idea was to flip them, but here I am. I am stuck with them," he said.Why is it we can't get reporters to just ask a couple of Econ 101 questions when they interview these people? Like, how much would you rent it for? Would that be enough to cover 2005-era mortgage payments? If so, how does that compare to what the unit would sell for? If not, would the "market rent" you set here also "drag down values for the entire building"? And what's your plan for making up the difference? What's a "particularly" low price, anyway? At the end of it, what's the net difference to your neighbors of turning the thing into a rental project, which lowers values, makes financing for resales hard to get, and uses up the "hardship quota" of allowable rentals, versus establishing a painful but accurate new comp for an owner-occupied sale?

Gozen is applying for hardship exemptions from both condo boards, arguing that without a renter he will not be able to keep the properties and will be forced into foreclosure or will have to sell at a particularly low price -- either of which would drag down values for the entire building.

"I can only afford to pay their mortgages for a few months, and then I will have to go to foreclosure," he said. "If they would ease up on this until the market gets better, that would be great."

And, finally: do you really expect the short sale-style negotiation tactic--"accommodate me or I default on you"--to go over as well with your neighbors as it does with your servicer? I'm truly curious about that question. At least, in a short sale, the servicer is free of you after taking the loss: from the servicer's side, the deal can't get any worse down the road once you sell. What are you offering your condo board? A guarantee that you'll never skim the rent and end up defaulting anyway? A guarantee from a self-described flipper who doesn't appear to have disclosed intended occupancy quite accurately up-front when he bought the units in the first place? (If they were purchased as officially non-owner-occupied, why were they not rented immediately? Did you try but fail to rent them immediately? What am I missing here?)

I am prepared to have some sympathy for bona-fide owner-occupants who have fallen on unforeseen hard times and must now battle recalcitrant condo boards to be allowed to rent. I rather wish the Post had found one or two. Perhaps I should be more charitable on a Sunday morning, but I'm having a hard time working up sympathy for a couple of industry insiders who bought at the top of the market for speculative purposes and now want the rules re-written in the name of "protecting the neighbors" from a sale at market prices.

Saturday, May 03, 2008

Microsoft Walks Away

by Calculated Risk on 5/03/2008 09:22:00 PM

Off-topic (but probably of interest): From the WSJ Microsoft Withdraws Yahoo Offer After Sweetened Bid Is Rejected

Microsoft Corp. said it abandoned its offer for Yahoo Inc., as the two companies failed to bridge a gap between them on price.Here is the Ballmer letter to Yahoo.

Orange County, CA Prices: From Front Page to Short Sale

by Calculated Risk on 5/03/2008 06:11:00 PM

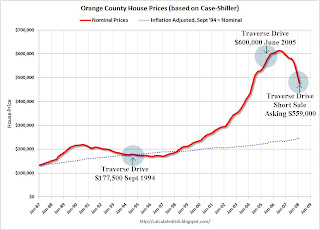

Update: Since I posted, the price has been slashed to $439K (hat tip DeathtoSpeculators). This is even a little below the February price according to Case-Shiller, but is still well above the likely eventual price.

This is an update to the story posted yesterday: From Front Page (in 2005) to Short Sale.

That house was featured on the front page of the O.C. Register - as a median priced home - when the median crossed $600,000 back in 2005. The same house is now offered for sale as a short sale.

There is no Case-Shiller index for Orange County alone (update: LA includes Orange County - hat tip sanity clause), for this graph I averaged the Los Angeles and San Diego indices: Click on graph for larger image.

Click on graph for larger image.

This graph shows the nominal prices for Orange County using the prices for the Traverse Drive house in 1994 as a reference.

Note: click here for front page story of Traverse Drive house in the July 19, 2005 O.C. Register.

It appears the price for the Traverse Drive house followed the Case-Shiller index pretty closely. It is now being offered as a short sale for $559 thousand, well above the $475 thousand that the Case-Shiller index would suggest for February 2008.

The dashed line shows the inflation adjusted prices, based on the Sept 1994 sales price. To reach the inflation adjusted price, the Traverse Drive house price would have to decline to $246 thousand - almost another 50% from the current Case-Shiller indicated price!

For areas with limited land and zoning restrictions (like Orange County), house prices might rise faster than inflation (depending on income growth). Even with a real annual price increase of 1% to 2% (on top of inflation), the Traverse Drive house would still only be selling for $280 to $320 thousand today (based on the '94 price)

Yes, nominal prices in Orange County are off about 22% from the peak, and real prices (inflation adjusted) are off about 26% from the peak - but prices will probably fall significantly from here.