by Calculated Risk on 5/02/2008 03:42:00 PM

Friday, May 02, 2008

Quote of the Day: "Mortgages + Insurance Policies = Flames"

Markel Corp. (insurance company) Q1 2008 Earnings Call Transcript: (hat tip CT)

Elizabeth Malone - KeyBanc: "Now, have you seen ... some companies have indicated that the increase in fire losses or the severity of fire losses is goes along with a slower economic environment? Have you seen that kind of pattern?"Funny quote, but they haven't seen any evidence yet.

Thomas S. Gayner - Executive Vice President and Chief Investment Officer: "I don't know that we've directly seen that yet, but I would agree with the idea that the friction caused by mortgages rubbing up against insurance policies causes flames."

REO / Short Sale Prevalence Reaches 63% in San Diego

by Calculated Risk on 5/02/2008 01:39:00 PM

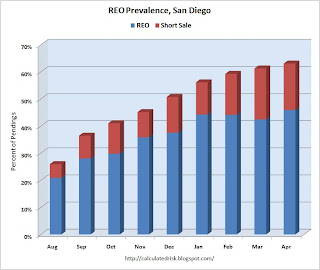

According to San Diego REO broker Ramsey Su, the percent of REOs and Short Sales reached 63% of all pending sales in San Diego in April. Click on graph for larger image.

Click on graph for larger image.

From Ramsey:

"I do not have historical data, [but] it would be reasonable to assume the percentage of REOs and SSs is unprecedented. ... Short sales are typically still occupied by sellers, enjoying their “free rent” period. That explains why vacant listings are not moving up."The percent of listings vacant has been steady for the last 6 months at about 38% - historically a very high level.

Update: Note that only a few of the pending short sales actually close. (hat tip Schahrzad)

Ramsey has just started tracking the percentage of Notice of Defaults (NODs) for higher priced homes (with original loan amounts above $500K in San Diego). In April, 21.3% of NODs were for homes with these larger loans. Ah yes, we're all subprime now!

Flawed House Price Indices, Flawed Reporting

by Calculated Risk on 5/02/2008 11:57:00 AM

In the comments, Jerome asks about this article at MarketWatch discussing the various measures of house prices: Home-price data has its flaws

The S&P/Case-Shiller index, which Tuesday posted a 12.7% decline for February, is skewed for two reasons of its own -- it tracks just 20 major markets, many among the hardest hit, and its "repeat sales" survey by design pulls in individual homes both bought and sold in the last few years.This is flawed reporting.

First, the article is referring to the S&P/Case-Shiller Composite 20 Index, not the S&P/Case-Shiller U.S. National Home Price Index (released quarterly). The media constantly confuses these indices. The National Index starts in 1987, and has a 20 year history of tracking price changes. The second part of the argument - that the price survey uses "repeat sales" and is capturing "homes both bought and sold in the last few years" - is a strength, and does not "skew" the data.

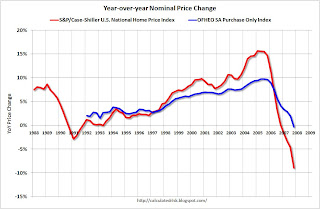

The following graph shows the year-over-year change for the S&P/Case-Shiller National Home Price Index, the Composite 20 (twenty large cities), the Composite 10 (10 large cities), and the OFHEO HPI (seasonally adjusted / purchase only).

Click on graph for larger image.

Click on graph for larger image.The composite 10 and 20 indices saw the most appreciation because they are only tracking large cities, mostly in "bubble" areas. Now that prices are falling, the declines are larger in these two indices.

The National Index is only released quarterly, and the data for Q1 will be released in late May. The Case-Shiller national index will probably be off close to 12% YoY. Currently (as of Q4) the national index is off 10.1% from the peak.

Instead of correcting each point in the article, let me excerpt from our March Newsletter with a discussion on the different house price methods: A Question of Price.

Probably the two most frequently asked questions about the housing market are 1) How far have prices fallen? And 2) how much further will prices fall?

Both questions are somewhat difficult to answer. First it helps to understand the differences between the various data sources.

The National Association of Realtors (NAR), DataQuick, and others, report the median house price; they take all the recent sales, and find the median price. This can be distorted by the mix of homes sold. When the bubble first burst, the median price continued to rise because fewer lower end houses were sold (the low end portion of the market with subprime loans slowed first). Now with jumbos being limited, the high end sales volume has fallen, and the median price has fallen quickly.

There is a better method of tracking house prices based on repeat sales of the same house, an idea developed by Professors Karl Case of Wellesley College and Robert Shiller of Yale University in the 1980s. Using repeat sales, and adjusting for several factors (improvements, sales to family members, and more), gives a much better picture of price changes.

There are two main house price indices that use the Case-Shiller repeat sales method; 1) the Office of Federal Housing Enterprise Oversight House Price Index (HPI), and 2) the S&P/Case-Shiller® U.S. National Home Price Index.

But Case-Shiller and OFHEO still give very different results as shown in the following graph.

When comparing the national Case-Shiller and OFHEO indices, there are a number of differences: OFHEO covers more geographical territory, OFHEO is limited to GSE loans, OFHEO uses both appraisals and sales (Case-Shiller only uses sales), and some technical differences on adjusting for the time span between sales.

The above graph shows the national indices from OFHEO (purchase only, no appraisals) and Case-Shiller. The Case-Shiller index shows a more dramatic rise in prices in early 2000s, and is now showing a more dramatic decline. All data is through the end of 2007; there is strong anecdotal evidence of further declines so far in 2008.

The second graph presents the same data on a year-over-year price change basis. Once again this shows that the Case-Shiller index was indicating more price appreciation in recent years, and is now showing a larger decline.

The Case-Shiller index suggests prices are off 8.9% over the last year, and 10.1% from the peak. OFHEO’s Purchase Only index shows prices are essentially flat year-over-year, and off 2.5% from the peak.Data Sources:

OFHEO economist Andrew Leventis’ research suggests that the main reason for the recent price difference between the Case-Shiller and OFHEO indices was that prices for low end non-GSE homes declined significantly faster than homes with GSE loans. This was probably due to the lax underwriting standards on these non-GSE subprime loans.

Note that Leventis' research focused on the differences in the indices for the period from Q3 2006 through Q3 2007. I suspect the Case-Shiller index will continue to see larger price declines than OFHEO as lending standards have now been tightened significantly for other non-GSE loans (especially jumbo loans).

What Leventis’ research suggests is to me is that the Case-Shiller index probably provides the best available estimate of house prices for selected cities, but might overestimate the national house price decline.

OFHEO 4Q 2007 Purchase-Only and Seasonally-Adjusted Purchase-Only U.S. Index

S&P: S&P/Case-Shiller® U.S. National Home Price Values

It's important to understand that even the S&P/Case-Shiller National index has limited geographical coverage. To understand the areas covered, see pages 27 through 32 of S&P/Case-Shiller® Home Price Indices Methodology. Basically the National index covers about 70% of the U.S. by value, and the missing 30% are rural areas (areas that probably had less appreciation, and prices are probably declining less now than in the major cities). As I stated in the article, the Case-Shiller index might overstate the national price declines. A reasonable approach might be to take 70% of Case-Shiller and 30% of OFHEO for national prices.

And finally, just ignore the NAR on house prices.

Fed Increases TAF, expands collateral for TSLF

by Calculated Risk on 5/02/2008 09:08:00 AM

From the Federal Reserve:

... The Federal Reserve announced today an increase in the amounts auctioned to eligible depository institutions under its biweekly Term Auction Facility (TAF) from $50 billion to $75 billion, beginning with the auction on May 5. ...The Fed is apparently still worried about the LIBOR, from the WSJ: Central Banks Ponder Dollar-Debt Rate

... the Federal Open Market Committee has authorized further increases in its existing temporary reciprocal currency arrangements with the European Central Bank (ECB) and the Swiss National Bank (SNB). These arrangements will now provide dollars in amounts of up to $50 billion and $12 billion to the ECB and the SNB, respectively, representing increases of $20 billion and $6 billion....

In addition, the Federal Open Market Committee authorized an expansion of the collateral that can be pledged in the Federal Reserve's Schedule 2 Term Securities Lending Facility (TSLF) auctions. Primary dealers may now pledge AAA/Aaa-rated asset-backed securities ...

Central banks on both sides of the Atlantic are debating causes of the surge in interest rates on commercial banks' dollar-borrowing in money markets and considering what they can do about it.The credit crisis continues.

A major source of stress has been the London interbank offered rate, or Libor, a benchmark for the rates banks pay on dollar loans in the offshore market. It remains unusually high compared with expected Federal Reserve interest rates...

Jobs: Nonfarm Payrolls Decline 20,000

by Calculated Risk on 5/02/2008 08:44:00 AM

From the BLS: Employment Situation Summary

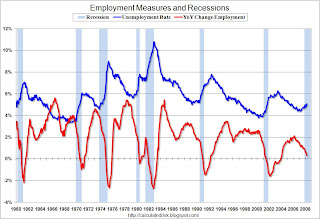

Nonfarm payroll employment was little changed in April (-20,000), following job losses that totaled 240,000 in the first 3 months of the year, the Bureau of Labor Statistics of the U.S. Department of Labor reported today. The unemployment rate, at 5.0 percent, also was little changed in April. Employment continued to decline in construction, manufacturing, and retail trade, while jobs were added in health care and in professional and technical services.The first graph shows the unemployment rate and the year-over-year change in employment vs. recessions.

Click on graph for larger image.

Click on graph for larger image.Unemployment was essentially unchanged, but the rise in unemployment, from a cycle low of 4.4% to 5.0% is a recession warning.

Also concerning is the YoY change in employment is barely positive (the economy has added only 460 thousand jobs in the last year), also suggesting a recession.

Note the current recession indicated on the graph is "probable", and is not official.

The second graph shows residential construction employment.

Note: graph doesn't start at zero to better show the change.

Note: graph doesn't start at zero to better show the change.Residential construction employment declined 31,100 in April, and including downward revisions to previous months, is down 478 thousand, or about 13.8%, from the peak in February 2006. (compared to housing starts off over 50%).

This is the fourth straight month of job losses.

A Real Live Walkaway

by Anonymous on 5/02/2008 07:32:00 AM

You all know I've been looking for evidence of this trend. And reader P.C. sent me a doozy.

Next up is 5015 Meadowlark Court in the Foxwood Forest neighborhood in northern Albemarle County. Here, the owner owes $500,000 on the first deed of trust. But this time there are two additional liens on the property-- $150,000 on a second deed of trust and $75,000 on a third note, a credit line, according to Albemarle County records. . . .Those of you with that sort of sense of humor might be interested in Carteret Mortgage's website. I enjoyed the tagline on the bottom of each page:

Lenders have allowed the owner to pile more than $725,000 in debt on a property assessed by the county at only $691,200. But the real shocker is the owner's vocation: he's Chris Prang, a mortgage broker.

"It was really bad timing for us," says Prang. "We had bought a house a Wintergreen and dumped a lot money in it. Then there was the news about mortgages--" news that affected Prang's own business.

Prang works out of his house for Carteret Mortgage; he says his mortgage consulting is geared toward the Christian community and home schoolers, which is what his wife does with their three children.

"I try to do things above-board," says Prang.

Their original loan was with American Home Mortgage, the once high-flying firm that flamed out last August with a sudden bankruptcy and put about 7,000 Americans out of work. Then things went bad for the Prangs after they used their equity-- or what they thought was their equity-- to finance another business venture: buying houses and fixing them up.

"I had another foreclosure," Prang admits. "I had perfect credit until recently."

He advises homeowners in over their heads to avoid late payments, but he admits that's easier said than done. He suggests that people unable to keep up with their payments try something called a "deed in lieu of foreclosure," in which, with approval, they simply give the house back to the bank.

"It's not as harmful to your credit as a foreclosure," he says, but concedes, "I'm in the business, and I didn't know about it." . . .

Prang is mortgage savvy, and yet he says, "There was nothing else I could have done."

He and his wife bought their house for $650,000 in 2005 and converted the garage to boost it to 5,000 square feet, the biggest house in the neighborhood. They listed it a year ago for $800,000, then $775,000, and finally, $699,000 a few weeks ago, less than what they owe on the three mortgages.

"I could have come current," confesses Prang. "I have the money. But that meant dumping a lot of money in a house losing value."

And he says if he had sufficient funds, he wouldn't pour them into buying a house now. "Why take the chance to buy something that a year from now could be worth a lot less?"

Prang isn't in favor of current plans for the government to bail people out of bad investments. He personally didn't want government help in avoiding foreclosure.

"In the long run, I'm going to be okay," he says. "I know my credit has been dinged, but I know how to repair it."

"He who walks with integrity, walks securely. He who perverts his ways, will become known." -Proverbs 10:9

Thursday, May 01, 2008

Jose Canseco Walks Away

by Calculated Risk on 5/01/2008 08:43:00 PM

From Peter Viles at L.A. Land: Celebrity foreclosure: Jose Canseco loses Encino home (hat tip Chris & James)

In comments to the TV show "Inside Edition," Canseco says, "It didn't make financial sense for me to keep paying a mortgage on a home that was basically owned by someone else."Is this really a "walk away"? Or was Jose having financial problems?

Sales Tax Collections Decline in Most States

by Calculated Risk on 5/01/2008 06:33:00 PM

From the Rockefeller Institute of Government: Sales Tax Collections Decline in Most States, Rockefeller Institute Survey Finds

State sales tax revenues delivered the weakest performance in six years during the first quarter of 2008, while growth in overall state tax revenues continued to deteriorate, according to preliminary data in a new report by the Rockefeller Institute of Government.

Click on map for larger image.

Click on map for larger image.Map Source: Rockefeller Institute Report.

With 36 of the 45 states that collect sales tax reporting, revenue from sales taxes declined both nationwide and in 21 states during January to March 2008, compared to the same period a year earlier. Southeastern states were hit the hardest: nine of the 21 states reporting sales tax declines were in that region. When adjusted for inflation, sales tax revenues declined in at least 27 states. For the states reporting so far, the overall level of sales tax collections fell slightly – the first time such revenues have not grown in six years.

“The widespread declines in the sales tax are a leading indicator of economic weakening, and a harbinger of further state budget troubles,” said Rockefeller Institute Senior Fellow Don Boyd, co-author of the study. “While the last recession hit states hard via a collapsing income tax, weak consumer spending and declining sales taxes may play a greater role this time around.”

Auto Sales Sharply Lower in April

by Calculated Risk on 5/01/2008 04:33:00 PM

From the WSJ: Detroit Auto Makers Post Sharply Lower April Sales

GM, hobbled by a strike at a major axle supplier, posted a 16% sales drop while Ford sales slid 12%. Chrysler reported a 23% decline. Japan's Toyota Motor Corp. ... managed to snap a fourth-month streak of weaker sales and post a 3.4% rise.Another ugly month ...

Centex: Cancellation Rate Falls

by Calculated Risk on 5/01/2008 02:54:00 PM

On cancellation rates:

"Our cancellation rate continues to fall at 29%, it's the lowest in over a year."It makes sense that cancellation rates are now falling. It takes about 6 months to build a new home, so anyone who bought after the August credit crisis was probably aware of the tighter lending standards and falling house prices, and made their plans accordingly. Still some buyers have probably been unable to sell their existing homes, and the cancellation rate remains high by historical standards.

Each builder has their own downpayment and cancellation policies. Some builders require much higher downpayments and therefore have lower cancellation rates. For Centex, a cancellation rate in the low 20s was normal during good times, and the cancellation rate increased to the mid to high 30s for most of the last couple of years.

Cancellation rates are important when analyzing the New Home data from the Census Bureau. What matters is the change in cancellation rates, not the absolute level. Falling cancellation rates mean the Census Bureau is probably underestimating sales, and underestimating the decline in inventory.

On land:

Analyst: I was wondering kind of bigger picture as you guys go to the asset-light model, and you think about that, in the near term, you're going to be buying more finished lots. How long is it going to take you to take those lots and make them buildable? Is there a delay to get final permitting on this stuff? I guess with that, when you think longer term who is going to be owning the land that's going to be delivering the land to you and what kind of returns are they going to require on that land, and do you think that's a sustainable model in, let's say, 50, 70, 80% of your markets, something like that?Centex believes these private developers are defaulting - "land and the lots are going back to banks" - and it will take some time for the banks to price the land correctly (and recognize their losses). It is interesting that Centex is going to an asset-light model - remember that nonsense about the builders being "land banks" a few years ago?

Centex: Those are good questions, and they don't have finite answers right at the moment. The land has not corrected yet. The land is largely in the hands of private developers, and those private developers have bank borrowings against that land, and we're finding now that the land and the lots are going back to banks. There's thousands and thousands of developed lots in virtually every market with the highest being Atlanta at about 145,000 vacant developed lots. Phoenix has nearly 90,000, or 60,000. Even Dallas/Fort Worth has as many as 90,000 vacant developed lots. So the supply will be there for sometime to come. We believe it needs to go back to the banks. We're already beginning to work with banks on securing some land positions for the future, but of course that's going to be a process that takes some time, and we expect the latter half of this year.

emphasis added

How times have changed!

Centex believes most of the price declines are behind them (for new homes), but they are still worried about tighter lending standards:

What's really unknown is the sales prices. While we're not trying to compete and don't try to compete with foreclosures, the credit markets are continuing to tighten. Credit underwriting standards are continuing to tighten. So as we focus on what's necessary to qualify our buyers, there may still continue to be pressure on prices from just the credit side. Again, I think we believe most of that is behind us. And much less in front of us.Overall this was a relatively positive conference call. Although they clearly stated "There are no markets improving", their markets aren't getting significantly worse - and they are making progress working down their inventory.