by Anonymous on 4/19/2008 07:57:00 AM

Saturday, April 19, 2008

We're All Busta Now

Our Brian forwarded this email to me yesterday, and I haven't stopped chuckling yet. It's very well done and certainly appears to be a legitimate "memorandum" from Accredited. Apparently no one has yet managed to get it posted on Accredited's website, which would formalize the joke nicely, but that's no reason not to share it:

April 18, 2008 - San Diego , CAWelcome to the world wide wacky web, Miss Busta. We do look forward to your Relevant and Interesting posts.

Accredited Home Lenders is pleased to announce the promotion of Miss Helen Busta to the newly created position of Chief Advisor of Things Both Relevant and Interesting in the Non-Conforming Loan Market.

The position was created to help set the record straight in a market that's been turned upside down. Miss Busta will apply her vast knowledge and years of industry experience to bust the subprime myths that are so prevalent today.

As a young woman, Miss Busta arrived in San Diego from the Midwest and took a job in the mortgage industry as a temp. She was soon hired by Accredited to help out in the company's first office above an auto repair shop. Miss Busta earned her B.A. in History from San Diego State University while working full-time at Accredited.

Her duties will include advising Accredited staff and helping brokers build their non-conforming business. Miss Busta will soon launch her own Web site, where she will answer any and all questions regarding the mortgage industry. Her long-standing service to Accredited and wealth of knowledge from 20 years in home lending have made Miss Busta a solid performer in any type of economic climate.

Please extend your congratulations to Miss Helen Busta on her significant achievement.

Friday, April 18, 2008

Roubini Interview on Canadian TV

by Calculated Risk on 4/18/2008 08:07:00 PM

Professor Nouriel Roubini was interviewed by Steve Paikin, the anchor of The Agenda, a public affairs program on Canadian TV (three parts, about 25 minutes total).

Part 1:

Part 2:

Part 3:

OFHEO Settles with former Fannie Mae CEO Raines for $24.7 million

by Calculated Risk on 4/18/2008 06:23:00 PM

OFHEO Issues Consent Orders Regarding Former Fannie Mae Executives

OFHEO Director James B. Lockhart today announced the issuance of three Consent Orders dealing with former Fannie Mae Board Chairman and Chief Executive Officer (CEO) Franklin D. Raines, former Chief Financial Officer (CFO) J. Timothy Howard and former Controller Leanne Spencer. The orders require certain actions by the individuals and settles OFHEO’s administrative enforcement actions against them for events related to the accounting and internal control problems at Fannie Mae uncovered by OFHEO and detailed in two Special Examination Reports.For Raines:

The three respondents consented to the Orders in settlement of an OFHEO administrative Notice of Charges filed against them on December 18, 2006. The administrative action alleged that the respondents, among other charges, undertook inappropriate earnings management, failed to ensure that adequate internal controls were put in place, released misleading financial reports and permitted the accounting function to operate without adequate resources. The charges concluded that such allegations represented misconduct and unsafe and unsound practices that led to losses suffered by Fannie Mae.

In satisfaction of the Notice of Charges, the Consent Orders place several requirements upon the parties as follows:

From Mr. Raines, a total of $24.7 million comprised of:

The proceeds from the sale of Fannie Mae stock, valued at $1.8 million to be donated to programs and initiatives to assist homeowners threatened with the loss of their homes or related initiatives to assist homeownership, as approved by OFHEO.

Payment of $2 million to the United States Government.

Surrender and relinquishment of claims related to stock options with a value of $15.6 million when they were issued.

Other benefits lost in association with the above estimated at $5.3 million.

California Unemployment Increases Sharply

by Calculated Risk on 4/18/2008 03:37:00 PM

From the LA Times: California unemployment hits 6.2%; worse than Ohio, Pennsylvania

California's unemployment rate rose by a whopping half a percentage point in March, reaching 6.2% as a weakening economy shed jobs in the ailing construction and financial activities sectors. In all, 1.13 million were unemployed.And on the Inland Empire, it was almost two years ago I wrote Housing: Inverted Reasoning?

...

California is doing worse than Pennsylvania and Ohio ... the two Rust Belt states that have figured prominently in the presidential primary elections because of their lost manufacturing jobs.

As the housing bubble unwinds, housing related employment will fall; and fall dramatically in areas like the Inland Empire. The more an area is dependent on housing, the larger the negative impact on the local economy will be.That seemed obvious to most of us! And now from the LA Times on unemployment in the Inland Empire:

The rise in unemployment during March affected all of Southern California, with the worst effects in the Inland Empire. The rate in Riverside County -- not seasonally adjusted -- rose to 7.4% from 7.0%, while in San Bernardino County it rose to 6.7% from 6.3%.

PIMCO's McCulley: Fed Should Regulate Investment Banks

by Calculated Risk on 4/18/2008 02:43:00 PM

"Minsky’s insight that financial capitalism is inherently and endogenously given to bubbles and busts is not just right, but spectacularly right. And when the financial regulators are not only asleep but actively cheerleading financial innovation outside their direct purview, a disaster is in the making, as the last year has taught us."From Paul McCulley at PIMCO: Credit, Markets, and the Real Economy: Is the Financial System Working? A Reverse Minsky Journey

Paul McCulley, April 17, 2008

[E]lementally, all institutions that have access to the Fed’s discount window must have pari passu regulatory oversight. It really is that simple. Access to the window is unambiguously a public good ... Accordingly, access to the window must – as it does in the case of conventional banks – carry the quid pro quo of prudential regulatory oversight, complete with enforcement powers.

... What I’m laying out is simply a bedrock principle: if you have access to the Fed’s discount window, the Fed should – and will, I strongly believe – have the power to supervise and regulate your business – core capital requirements, risk management, liquidity management, et al.

Home Builder NVR: Cancellation Rate Declines in Q1

by Calculated Risk on 4/18/2008 02:07:00 PM

Press Release: NVR, Inc. Announces First Quarter Results

The cancellation rate in the first quarter of 2008 was 22% compared to 16% in the first quarter of 2007 and 32% in the fourth quarter of 2007.The following graphs shows NVR's reported cancellations rates by quarter since the beginning of 2005.

Click on graph for larger image.

Click on graph for larger image.Although the current cancellation rate is still historically high, it is below the previous two quarters. This probably means that the Census Bureau is now under reporting new home sales. I discussed this in our recent newsletter:

[I]t appears cancellation rates have peaked for the homebuilders. This makes sense for two reasons: the new home cycle is typically just over six months from signed contract to the buyer taking occupancy of the home, so new home buyers who bought before August 2007 were hit by the credit crisis, and cancelled in large numbers. But now we are starting to see the cancellation rate decline because those who bought after August of last year were probably aware of the credit crisis. Also, the home builders have responded to the high cancellation rates by requiring larger deposits, actually qualifying buyers, and in some cases guaranteeing the house price (if the price declines further, the builder will rebate the difference to the buyer).

...

During periods of rising cancellation rates, the Census Bureau overstates New Home sales and understates the increase in inventory. Conversely, during periods of declining cancellation rates, the Census Bureau understates sales. For more on cancellations, see the Census Bureau statement.

By my calculations, the inventory of new homes is currently understated by about 108K. See this blog post.

The good news is cancellations appear to have peaked, and several builders have reported slightly declining cancellation rates. For example, KB Home reported that their cancellation rate improved to 53% in fiscal Q1 2008, from 58% in Q4 2007, and Lennar reported their cancellation rate declined to 26% in fiscal Q1 2008, from 33% in Q4 2007.

This improvement in cancellation rates (if it continues) means that the Census Bureau will understate sales—and also understate the decline in inventory.

The foreclosure 'discount'

by Calculated Risk on 4/18/2008 12:01:00 PM

Peter Viles at the LA Times has put together a collection of foreclosure listings in LA.

Viles features one house on his blog L.A. Land: The foreclosure 'discount': 45% in Glassel Park. Check it out! Here is another:

Source: LA Times.

FORECLOSED: GLENDALENote that the discount is to the asking price for the REO.

3732 Mayfield Ave., Glendale 91214

Agent's description: Bank-owned. Sold for $640,000 in 2007. Beautiful remodeled house on zero traffic tree lined street. Raised foundation, refinished hardwood floors, newer roof ... private yard.

• Sales history (from PropertyShark.com): Sold for $640,000 in February 2007.

• Current listing price: $449,900

• Discount from sales price: 29.7%

Here is the listing at Realtor.com. This is a 2 Bed, 1 Bath, 1,054 Sq. Ft. house, on a 5,000 sq ft. lot built in 1951.

What the heck were people thinking in Feb 2007? $640K? Ouch.

WSJ on Citi Conference Call

by Calculated Risk on 4/18/2008 10:03:00 AM

The WSJ MarketBeat Blog is Live-Blogging the Citigroup Earnings Call. Here are a few excerpts:

On headcount reductions ...

9:41 a.m.: Jason Goldberg of Lehman Brothers wants to know about the head count reductions. ... Mr. Crittenden [Citi CFO] ... notes that about 7,000 of the 9,000 eliminated comes from the consumer business. Mr. Goldberg wants to know about total headcount reductions — including attrition and job losses. Mr. Crittenden estimates it in the 16,000 range.On Earnings Visibility:

9:48 a.m.: [Meredith Whitney of Oppenheimer & Co.] wants to know about “earnings visibility” for the rest of the year, noting that the firm is going to have “persistent restructuring charges and sort of more moving parts than less moving parts.” She wants to know when “you think you’re going to turn the corner.” Mr. Crittenden first notes that if reduced values on certain assets were removed, “revenues would have been roughly flat.” He notes that the environment is rough — increases in credit-card losses, poor housing fundamentals and rising unemployment. “We are in unprecedented territory from a real-estate standpoint,” he says.

Mr. Crittenden continues. “We could, in fact, be facing head winds ... and we are dedicated to ongoing reengineering ... we’re going to try and operate the business in such a way that provides some consistency going forward but nonetheless you’re right in what you said about noise. Operating leverage is going to be a difficult thing to measure us on for awhile.” He says that difficulty will come from the continued divesture of businesses, and “that’s a lumpy process almost by definition.

“There’s no assurance that the amount of marks that we have taken in this quarter are finished. We’re three quarters into this. I think we have substantially reduced our amount of risk but there’s also the prospect that you could have additional marks, and that throws the calculation of that number pretty much out the window. What I would say is that I think you should hold us accountable for a couple things that we make significant progress on headcount and that we make significant progress that is discernible in our numbers on expenses.”

Citi: $13 billion in write-downs

by Calculated Risk on 4/18/2008 08:44:00 AM

From the WSJ: Citigroup Swings to Loss On Hefty Write-Downs

Citigroup Inc. said Friday ... it booked more than $13 billion in write-downs amid surging credit costs, results that "reflect the continuation of the unprecedented market and credit environment."Wasn't last quarter the "kitchen sink" write down quarter?

...

The latest results included $6 billion in write-downs and credit costs on subprime-related exposures, $3.1 billion on leveraged loans, $1.6 billion on Alt-A mortgages and commercial real estate and $1.5 billion each on auction-rate securities and Citigroup's exposure to monoline insurers.

Thursday, April 17, 2008

Study: Home-Remodeling Spending To Fall 4.8% through 2008

by Calculated Risk on 4/17/2008 05:07:00 PM

From Dow Jones: Home-Remodeling Spending To Fall 4.8% Through '08 - Study

Home-improvement spending is unlikely to improve until 2009, and the second half of 2008 is shaping up to be weaker than the first, according to Harvard University's Joint Center for Housing Studies.I think this might be optimistic. First, falling house prices and the inability for homeowners to borrow against their homes (mortgage equity withdrawal) are probably "inhibiting remodeling spending" more than the weakening economy and consumer confidence.

Falling consumer confidence and a weakening economy are inhibiting remodeling spending, which is expected to fall by an annual rate of 4.8% through the end of 2008, the center said Thursday. That is steeper than the 2.6% annualized decline the center projected through the third quarter when it last updated its Leading Indicator of Remodeling Activity in January.

Second, we have recently seen warnings from Home Depot and Lowe's that suggest same store sales are falling off a cliff (about 8% year-over-year).

And third, the Joint Center for Housing Studies forecast is mild compared to declines in home improvement spending during previous housing busts.

Click on graph for larger image.

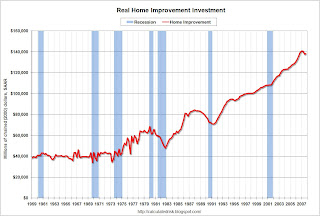

Click on graph for larger image.This graph shows real home improvement investment (2000 dollars) since 1959. Recessions are in light blue (source: BEA)

As of Q4 2007, real spending on home improvement had held up pretty well (only off 2% in real terms from the peak). If this housing bust is similar to the early '80s or '90s, real home improvement investment will slump 15% to 20%.

Yes, the Joint Center for Housing Studies forecast is in nominal terms, but it appears they believe this slump in home improvement will be milder than the downturns during the previous two housing busts (early '80s and early '90s).