by Calculated Risk on 3/18/2008 10:12:00 PM

Tuesday, March 18, 2008

OFHEO to Announce Change in Fannie, Freddie Capital Requirements

From the WSJ: Fannie, Freddie Regulator Plans Capital Announcement

Ofheo for the past several years has required Fannie and Freddie to hold 30% more capital than their usual minimum while they have worked to resolve lapses in their accounting and internal risk controls, a process now viewed as largely complete. Ofheo is expected to reduce that capital "surcharge" initially to 20%.It wasn't that long ago when Fannie and Freddie were the problem, now they are the solution. The press conference is Wednesday at 9 AM.

The move should reduce Freddie's capital requirement by about $2.6 billion and Fannie's by $3.2 billion.

Housing Starts, New Home Sales and Cancellations

by Calculated Risk on 3/18/2008 04:58:00 PM

It appears starts of single family homes (built for sale) have fallen below the current new home sales rate. This would imply that the inventory for new homes has started to decline (my quick estimate is that new home inventory is currently declining at about a 100 thousand annual rate).

But how high is inventory? Click on graph for larger image.

Click on graph for larger image.

This graph shows the inventory level as reported by the Census Bureau. The Census Bureau reported there were 482,000 units in inventory at the end of January.

From the graph, it appears that inventory has already been falling. However, inventory numbers from the Census Bureau do not include cancellations - and cancellations are once again near record levels. Actual New Home inventories are probably much higher than reported - my estimate is about 108 thousand higher. The second graph shows my adjusted inventory estimate using cancellation rates from several of the large public builders.

The second graph shows my adjusted inventory estimate using cancellation rates from several of the large public builders.

This suggests that inventory levels have been declining slightly (as of Q4 2007), but are still near record levels. Unfortunately this number can only be calculated on a quarterly basis, and not until the homebuilders file their quarterly reports with the SEC.

Also note that most condominiums are not included in new home inventory (or new home sales) from the Census Bureau. Areas with significant condominium developments probably have higher levels of inventory. Another method of looking at inventory is to consider the "months of supply". This graphs shows the month of supply based on the data from the Census Bureau (does not include cancellation adjustment). At the end of January, the months of supply was 9.9 months; significantly above the normal range of 4 to 6 months.

Another method of looking at inventory is to consider the "months of supply". This graphs shows the month of supply based on the data from the Census Bureau (does not include cancellation adjustment). At the end of January, the months of supply was 9.9 months; significantly above the normal range of 4 to 6 months.

If sales hold at steady at 600 thousand Seasonally Adjusted Annual Rate (SAAR), a six months supply would be an inventory of 300 thousand units. Based on the Census Bureau reported inventory level, this would mean a decline of 182 thousand units. (Based on the cancellation adjusted levels, add another 108 thousand units or so).

So even though the homebuilders appear to be working off inventory, it is at a very slow pace compared to the number of excess units. Even if sales hold steady, starts of single family homes (built for sale) probably will decline further as builders work to reduce inventory.

Of course homebuilders are providing incentives and cutting prices to move inventory. As an example, this is from DR Horton:

Click on image to visit Horton site. (hat tip Ramsey Su)

UPTO 50% OFF. I'm sure the previous home buyers are excited to see a half off sale.

Fed cuts rate 75 bps to 2.25%

by Calculated Risk on 3/18/2008 01:58:00 PM

The Federal Open Market Committee decided today to lower its target for the federal funds rate 75 basis points to 2-1/4 percent.

Recent information indicates that the outlook for economic activity has weakened further. Growth in consumer spending has slowed and labor markets have softened. Financial markets remain under considerable stress, and the tightening of credit conditions and the deepening of the housing contraction are likely to weigh on economic growth over the next few quarters.

Inflation has been elevated, and some indicators of inflation expectations have risen. The Committee expects inflation to moderate in coming quarters, reflecting a projected leveling-out of energy and other commodity prices and an easing of pressures on resource utilization. Still, uncertainty about the inflation outlook has increased. It will be necessary to continue to monitor inflation developments carefully.

Today’s policy action, combined with those taken earlier, including measures to foster market liquidity, should help to promote moderate growth over time and to mitigate the risks to economic activity. However, downside risks to growth remain. The Committee will act in a timely manner as needed to promote sustainable economic growth and price stability.

Voting for the FOMC monetary policy action were: Ben S. Bernanke, Chairman; Timothy F. Geithner, Vice Chairman; Donald L. Kohn; Randall S. Kroszner; Frederic S. Mishkin; Sandra Pianalto; Gary H. Stern; and Kevin M. Warsh. Voting against were Richard W. Fisher and Charles I. Plosser, who preferred less aggressive action at this meeting.

In a related action, the Board of Governors unanimously approved a 75-basis-point decrease in the discount rate to 2-1/2 percent. In taking this action, the Board approved the requests submitted by the Boards of Directors of the Federal Reserve Banks of Boston, New York, and San Francisco.

More on Housing Starts

by Calculated Risk on 3/18/2008 11:20:00 AM

It appears from the Census Bureau's Housing Starts report released this morning that the home builders are finally starting fewer homes than they are selling. If correct, the inventory of new homes for sale will start to decline.

A couple key points:

1) if sales fall further, then obviously starts will have to fall further too.

2) The huge overhang of existing home inventory, especially distressed sales, will pressure new home sales for some time.

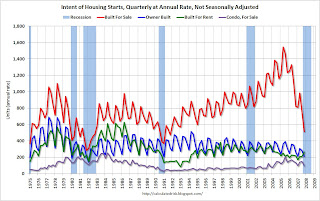

It is difficult to compare starts directly to sales. Starts includes apartments, owner built units and condos that are not included in the new home sales report. However, every quarter, the Census Bureau releases Starts by Intent, and it is possible to compare "Single Family Starts, Built for Sale" to New Home sales. Click on graph for larger image.

Click on graph for larger image.

This graph shows the quarterly starts by intent (through Q4 2007). This shows 1) Single Family starts built for sale, 2) Owner built units, 3) Units built for rent, and 4) Condos built for sale.

As of Q4, Single Family starts built for sale, had declined to about 500 thousand on a non seasonally adjusted annual rate.

The second graph show starts of single family units, built for sale, on a quarterly basis (now in green) vs. new home sales (monthly). Based on the housing starts report released this morning, it appears that Single Family starts, built for sale, have fallen below 500 thousand (annual rate) in Q1 2008.

New home sales have fallen just below 600 thousand (SAAR) in February 2008. This suggests that new home inventory is currently declining at about a 100 thousand per year rate (25+ thousand unit decline in Q1).

Goldman, Lehman Report Net Income Declines

by Calculated Risk on 3/18/2008 08:57:00 AM

From the WSJ: Lehman Brothers Net Falls 57% On Weakness in Fixed Income

For the quarter ended Feb. 29, the investment bank posted net income of $489 million, or 81 cents a share, down from $1.15 billion, or $1.96 a share, a year earlier. Net revenue fell 31% to $3.51 billion.And on Goldman: Goldman Sachs Net Slides 53%

Goldman Sachs Group Inc.'s fiscal first-quarter net income dropped 53% on $2 billion in losses on residential mortgages, credit products and investments ...Although these net income declines suggest a recession, overall these are not horrible reports.

...

The biggest Wall Street investment bank by market value reported net income of $1.51 billion, or $3.23 a share, for the quarter ended Feb. 29, compared to $3.2 billion, or $6.67 a share, a year earlier.

Results included $1 billion in losses on residential mortgage loans and securities, and nearly $1 billion in losses on credit products and investment losses ...

Single Family Housing Starts Lowest Since Jan 1991

by Calculated Risk on 3/18/2008 08:39:00 AM

The Census Bureau reports on housing Permits, Starts and Completions.

Some key points on permits:

Housing permits in February were below 1 million Seasonally adjusted annual rate (SAAR). This is the lowest since 1991.

Single family housing permits were at 639 thousand SAAR. This is also the lowest since 1991. Click on graph for larger image.

Click on graph for larger image.

Here is a long term graph of starts and completions. Completions follow starts by about 6 to 7 months.

Privately-owned housing starts in February were at a seasonally adjusted annual rate of 1,065,000. This is 0.6 percent below the revised January estimate of 1,071,000 and is 28.4 percent below the revised February 2007 rate of 1,487,000.

Single-family housing starts in February were at a rate of 707,000; this is 6.7 percent below the January figure of 758,000.

The second graph shows Single family housing starts vs. New Home sales. Single family starts also include homes built directly by owners, in addition to homes built for sale (and some other minor differences).

This graph indicates the difference between single family starts and new home sales has narrowed recently, possibly indicating: 1) that fewer homes are being built by owners, and 2) that single family starts are now low enough to begin to reduce the inventory of new homes for sales.

Monday, March 17, 2008

Is Bernanke Running out of Ammunition?

by Calculated Risk on 3/17/2008 11:42:00 PM

From Bloomberg: Bernanke May Run Low on `Ammunition' for Loans, Rates (hat tip jsdg)

The Fed has committed as much as 60 percent of the $709 billion in Treasury securities on its balance sheet to providing liquidity and opened the door to more with yesterday's decision to become a lender of last resort for the biggest Wall Street dealers. The central bank has cut short-term rates by 2.25 percentage points since September and will probably reduce them again tomorrow.These are two separate issues. The Fed isn't constrained by their balance sheet; they can just keep on lending. My understanding is their balance sheet limits the amount of sterilized lending (non-inflationary); further lending would increase the money supply and be inflationary.

On interest rates, the Fed is clearly running out of ammunition, and the street is expecting another rate cut tomorrow of between 50 bps and 100 bps. This raises the question of a liquidity trap (see Krugman: How close are we to a liquidity trap?). For those that want to understand the Japanese experience, I recommend a series of articles written by Professor Krugman in the '90s (those with asterisks are technical for all you Econ UberNerds!)

OK, some people might be asking what is sterilization? Sterilization means intervention that does not increase the money supply, like exchanging treasuries for mortgage backed securities (MBS). Say a bank needs cash, it puts up MBS as collateral (the Fed doesn't actually swap ownership), and the Fed loans the bank treasuries (that they are holding on their balance sheet). The bank can sell the treasuries, and raise cash, but the money supply doesn't increase.

FDIC Stresses Importance of CRE Concentrations

by Calculated Risk on 3/17/2008 05:31:00 PM

From the FDIC: Federal Deposit Insurance Corporation Stresses Importance of Managing Commercial Real Estate Concentrations

The Federal Deposit Insurance Corporation (FDIC) has issued a letter re-emphasizing the importance of strong capital and loan loss allowance levels, and robust credit risk-management practices for state nonmember institutions with significant concentrations of commercial real estate (CRE) loans, and construction and development loans. The Financial Institution Letter, Managing Commercial Real Estate Concentrations in a Challenging Environment, complements the principles articulated in the December 6, 2006, interagency statement titled Concentrations in Commercial Real Estate Lending, Sound Risk Management Practices.My prediction is that most of the coming bank failures will be related to high concentrations of CRE and C&D (construction and development) loans.

FDIC Chairman Sheila C. Bair said, "Although commercial real estate lending can be a profitable business line for banks, it is a good time to re-emphasize the 2006 guidance because a number of banks have significant CRE concentrations, and the weakness in housing across the country may have an adverse effect on those institutions. Banks with CRE concentrations should take steps to strengthen their overall risk-management framework and maintain strong capital and loan loss allowances. We encourage institutions to continue making commercial real estate and construction and development loans available in their communities using prudent, time-tested lending standards that rely on strong underwriting and loan administration practices."

The Letter recommends that state nonmember banks with significant CRE loan concentrations increase or maintain strong capital levels, ensure that loan loss allowances are appropriately strong, manage portfolios closely, maintain updated financial and analytical information, and bolster loan workout infrastructures.

Mayo: Lehman is not Bear

by Calculated Risk on 3/17/2008 02:14:00 PM

Henry Blodget (yes ... Blodget!) provides an excerpt from Deutsche Bank's Mike Mayo on Lehman: Lehman: We're Not Bear, and We're Not Screwed (hat tip Interesting Times)

Deutsche Bank's Mike Mayo writes:

"Lehman is Not Bear. 1) It has more liquidity, 2) It has support among its major counterparties, evidenced by an extension on Friday of a $2B working capital line with 40 banks (one issue w/Bear Stearns [BSC] seems to be that counterparties pulled in lines). 3) Its franchise is more diversified given almost half outside the US and an asset management business that is more than twice as large relative to its size (BSC was more plain vanilla). 4) It has a seasoned and experienced CEO (Bear's CEO was new). We maintain our Buy rating given a belief that LEH will weather this storm and our estimate of a price to adj. book value ratio of 83%.Mike Mayo has been ahead of his peers on the mortgage related losses.

"The industry issue seems more liquidity than solvency, and LEH protected itself more fully after it's problems similar to BSC in 1998. At year-end, it had $35B of excess liquidity combined with $63B of free collateral, implying $98B available for liquidity, or $70B more than needed for $28B of unsecured short-term debt (which includes the current portion of long-term debt). While it also has $180B of repo lines, we take comfort that 40 banks extended credit on Friday and believe that some of the repos are likely to be termed at least to some degree."

Bear Stearns Building Today

by Calculated Risk on 3/17/2008 01:50:00 PM

I don't know the source to give credit.

A second photo (hat tip BR)