by Calculated Risk on 3/10/2008 10:12:00 AM

Monday, March 10, 2008

Krugman: The Face Slap Theory

From Paul Krugman at the NY Times: The Face-Slap Theory

This column is a followup to Krugman's blog posts: What’s Ben doing? (Very wonkish) and Why sterilization matters

Note: It was reader BR who sent me the joke mentioned in the column. I like Tanta's version too: "Mr. Margin on line one"

Sunday, March 09, 2008

CDX Cliff Diving

by Calculated Risk on 3/09/2008 07:42:00 PM

From the WSJ: Fear Cycle Ensnares Structured Products

... investors ... are driving risk premiums on a closely watched derivative index -- the investment-grade Market CDX IG9 index -- to record weak levels ...

That, in turn, is creating a vicious cycle: the wider the risk premiums go on this index, the more of these complex structured products -- which are at the heart of the ongoing credit crunch -- get dragged into the maelstrom.

Click on graph for larger image.

Click on graph for larger image.Here is the CDX IG9 graph from Market.

The IG9 index reflects the cost of insuring against default by 125 U.S. and Canadian investment-grade companies. It widens when investors buy protection in anticipation of further troubles in corporate credit. Structured products also used the index, primarily selling protection, as part of elaborate money-making strategies.Just more cliff diving in the credit markets.

Is the U.S. in Recession?

by Calculated Risk on 3/09/2008 02:04:00 PM

This is a hot topic right now.

From Professor DeLong on Bloomberg TV: Are We in a Recession?

Lindsey:... Are we in a recession?From Professon Hamilton at Econbrowser: Has the recession started?

DeLong: Probably. If we are not in a recession we are teetering on the edge. The [q]uestion is: will there be a big recession or a small recession, or only a near-recession that feels like a recession to an awful lot of people. Those thousands of jobs that were not there that we thought would be.

...

Lindsey: At the conference [SIEPR 2008 Economic Summit], what is the mood? what are you in your colleagues talking about?

DeLong: That we might as well be in a recession and we should treat it as long as far as economic policy is concerned. hank paulson will be here this evening reassuring everybody, larry summers was here this morning scaring everyone.

It will still be many months before we would expect to see an "official" declaration that a recession has indeed begun from the Business Cycle Dating Committee of the National Bureau of Economic Research. Granted, the latest data look recessionary. But the Committee would be pondering the following: suppose these data are revised up or next month's numbers start to improve. Would what has happened so far be enough to characterize as a recession? The answer is pretty clearly no, and that is why no declaration from NBER will be forthcoming any time soon.And from The Times: Britain shivers as US hits recession

...

In the mean time, though, if you want to claim that the recession has begun, that now strikes me as quite a reasonable working hypothesis.

AMERICA’s economy is definitely in recession, economists say, amid growing fears that the credit crunch is entering its most dangerous phase.I think the economy is in recession, but Jim Hamilton is correct - we need several more months of negative numbers (that don't get revised away) to make it official. And DeLong is correct: the more important question is how severe the downturn will be.

Saturday, March 08, 2008

Financial Crisis: The Third Wave

by Calculated Risk on 3/08/2008 06:38:00 PM

Professor Krugman writes: What’s Ben doing? (Very wonkish)

The financial crisis seems to have entered its third wave. Panic in August, then partial recovery thanks to lots of money thrown at the system by the Fed. Renewed panic late fall, then partial recovery thanks to even more money thrown in, especially the Temporary Auction Facility. And panic has set in yet again: |

The second graph is the A2P2 spread from the Fed's Commercial Paper report. This also shows the 3rd wave of the financial crisis.

I recommend Krugman's piece for those that want to understand what the Fed is doing (and why it is sterilized). Also see Professor Hamilton's piece from December: Monetary policy using the asset side of the Fed's balance sheet

Several people have sent me this piece from interfluidity: Repurchase agreements and covert nationalization. Steve Randy Waldman does a good job of describing the situation, but I think he takes it too far. As Waldman notes, the Fed offers loans only against certain collateral, and requires that loans be overcollateralized. I've seen the lendable amount sheet, and I think the Fed is pretty well protected - so I think the author takes it one step too far to call this "covert nationalization".

JPMorgan Sees 30% House Price Declines

by Calculated Risk on 3/08/2008 05:54:00 PM

From Reuters: Banks face "systemic margin call," $325 billion hit: JPM (hat tip Anthony, RW)

The JPMorgan report included a revised bleaker forecast for subprime-related home prices. The bank now sees prices falling 30 percent, from its prior 25 percent forecast. Those prices have declined 14 percent since mid-2006, JPMorgan said.Is JPMorgan just talking about price declines for houses purchased with subprime loans? Or is the Reuters story adding "subprime" to the story line?

Note: Case-Shiller shows national prices have declined 10.1% through Q4 2007, so my guess is the JPMorgan estimate is for all houses and includes the decline through the beginning of March 2008.

The Feldman Plan: Just Get Yourself a Latte

by Anonymous on 3/08/2008 04:25:00 PM

Via Housing Wire, I just read Teh Dumbest mortgage-related proposal I think I have yet seen.

The federal government would lend each participant 20% of that individual's current mortgage, with a 15-year payback period and an adjustable interest rate based on what the government pays on two-year Treasury debt (now just 1.6%). The loan proceeds would immediately reduce the borrower's primary mortgage, cutting interest and principal payments by 20%. Participation in the program would be voluntary and participants could prepay the government loan at any time.OK, so we are going to ignore piggybacks (people do have more than one mortgage, you know), so we don't have to ask whether the second lien lender gets all the repayment, or what. We are going to ignore prepayment penalties that apply to substantial partial prepayments. We are going to ignore those sacred contractual rights lenders have to require you to continue to make the payment specified in your loan documents even if you make a partial prepayment (it takes a modification agreement to change the contractual payment). We are going to ignore the lack of a credit risk premium.

The legislation creating these loans would stipulate that the interest payments would be, like mortgage interest, tax deductible. Individuals who accept the government loan would be precluded from increasing the value of their existing mortgage debt. The legislation would also provide that the government must be repaid before any creditor other than the mortgage lenders.

Although individuals who accept the loan would not be lowering their total debt, they would pay less in total interest. In exchange for that reduction in interest, they would decrease the amount of the debt that they can escape by defaulting on their mortgage. The debt to the government would still have to be paid, even if they default on their mortgage.

Participation will therefore not be attractive to those whose mortgages that already exceed the value of their homes. [sic] But for the vast majority of other homeowners, the loan-substitution program would provide an attractive opportunity.

Although home owners may recognize that the national average level of house prices has further to fall, they do not know what will happen to the price of their own home. They will participate if they prefer the certainty of an immediate and permanent reduction in their interest cost to the possible option of defaulting later if the price of their own home falls substantially.

The loan-substitution program would decrease the number of homeowners who would come to have negative equity as house prices decline. That reduces the number of homeowners who will have an incentive to default, thereby limiting the risk of a downward spiral of house prices.

Since individuals now have the right to prepay any part of their mortgage debt, the 20% reduction in the mortgage balance would not violate mortgage creditors' rights. Creditors should welcome the mortgage paydowns, because they make the remaining mortgage debt more secure. The 20% repayments to creditors would also create a major source of funds that should stimulate all forms of lending.

The simplest way to administer the new loans would be for the current mortgage servicer to collect on behalf of the government and remit those funds to Washington. There would be no need for a new government bureaucracy, for new appraisals, or for negotiations in bankruptcy. The program could be up and running within months after the legislation is passed.

We are not going to ignore the elementary math of amortization. Not today.

Let's just pretend we have a single lien mortgage loan. The original loan amount was $200,000 at 8.5% for 30 years, and just for entertainment purposes we'll say the loan has been amortizing and it is now two years old. It's either a fixed rate or a "frozen teaser," so the rate is still 8.5% going forward. The original P&I was $1,537.83 and the current loan balance is $196,842.51.

We turn that into a 28-year 8.5% loan for $157,474.01, plus a 15-year 1.6% loan for $39,368.50. That gives us a first mortgage payment of $1,230.26 and a second mortgage payment of $246.15. Firing up my trusty 10-key, I see that totals to $1,476.42, or a 4% reduction in the total monthly payment.

A monthly savings of $61.41! Oh Lord, they'll flock to this! Non-dischargeable full recourse debt that prevents you from ever cashing out if home values do ever recover, until you've paid off that low-rate loan! Plus the new loan is an ARM, so it can get worse in two years! In fact, it only has to adjust up to 5.00% for the total payment to be higher than what you started with, given a 15-year amortization! But that's not a problem, because we know people will think about the lower interest costs over decades, not the higher monthly payment today! And besides that, when the hell has a 2-year Treasury note ever been five percent, huh? Oh, sure, if you're going to worry about some kind of a doomsday scenario . . .

Well, wait, you say. This proposal isn't aimed at those high-rate subprime borrowers who get so easily confused about the difference between the monthly payment and the total interest paid, because they're probably upside down anyway. This proposal is for us responsible types. Let's say we started with the $200,000 30-year at 6.00%, with a P&I of $1,199.10. Two years later we strip that into a $155,949.18 28-year loan at 6.00% ($959.28) and a $38,987.29 15-year loan at 1.6% ($243.77) giving us a new payment of $1,203.05! Cool! Economic stimulus! That $3.95 a month that would have been blown at Starbucks going to debt reduction! Just what we need in a recession!

Plus, we don't need any government agency to handle it! Servicers can do all the work, draw up the docs, execute them all, apply all the funds, modify the payments on the old loans, and then get that $243.77 check every month, which they can just mail to Washington! We don't need no steenkin' bureaucracy on the other side! The receptionist at the Treasury can probably handle it all in her spare time! Sure, she doesn't have any idea how much she's owed for what loan and when any given loan matures and what to do if the payment doesn't show up, but she doesn't have to! Countrywide will keep track of it all for her! There's nothing wrong with their bookkeeping ever! And you know they'll do all that for free, because they're good citizens! So there's no servicing fee eating into that 1.6% the government earns on these loans! No upfront fees to the borrower that offset the interest savings, because loan originators, like loan servicers, also work for nothing! Free lunch!

Sorry about the exclamation points. I should just be kept away from the Wall Street Journal.

UPDATE: Please note that "Marty Feldman" was a gifted comedian. "Marty Feldstein" is a gifted comedian who is also an economist.

End to the Mediocre Times

by Calculated Risk on 3/08/2008 12:11:00 AM

From David Leonhardt at the NY Times: End to the Good Times (Such as They Were) On household income:

The median household earned $48,201 in 2006, down from $49,244 in 1999, according to the Census Bureau. It now looks as if a full decade may pass before most Americans receive a raise.On a recession call from NBER:

The seven economists who sit on the bureau’s recession-dating committee ... said Friday that it remained too early to know.So we probably won't have the official recession call until late this year.

...

The committee did not announce the end of the last recession ... until more than a year-and a half later. ... any announcement about the start of a new recession was unlikely before the last few months of 2008 at the earliest.

For those with five minutes, Leonhardt does a nice job of discussing the economic problems in this podcast. I agree with his conclusion: House prices must fall.

Friday, March 07, 2008

FDIC: Hume Bank Fails

by Calculated Risk on 3/07/2008 08:21:00 PM

From the FDIC: FDIC Approves the Assumption of the Insured Deposits of Hume Bank, Hume, Missouri

Hume Bank, Hume, Missouri, was closed today by the Commissioner of Missouri's Division of Finance, and the Federal Deposit Insurance Corporation (FDIC) was named receiver. To protect depositors, the FDIC Board of Directors approved the assumption of Hume Bank's insured deposits by Security Bank, Rich Hill, Missouri.This is just another small bank.

The failed bank's sole office will reopen Monday as a branch of Security Bank. Depositors of Hume Bank will automatically become depositors of the assuming bank.

As of December 31, 2007, Hume Bank had total assets of $18.7 million and total deposits of $13.6 million. Security Bank has agreed to assume $12.5 million of the failed bank's insured deposits for a premium of 4.26 percent.

At the time of closing, Hume Bank had approximately $1.1 million in 33 deposit accounts that exceeded the federal deposit insurance limit. These customers will have immediate access to their insured deposits, and they will become creditors of the receivership for the amount of their uninsured funds.

Construction Employment

by Calculated Risk on 3/07/2008 04:25:00 PM

One of the mysteries in 2007 was why BLS reported residential construction employment didn't decline as much as expected based on housing starts and completions.

The first graph shows residential construction employment vs. real residential investment (minus broker's commissions). Click on graph for larger image.

Click on graph for larger image.

This shows the mystery in residential construction employment. Even though Residential Investment fell sharply, residential construction employment is only down 407.1 thousand, or about 11.8%, from the peak in February 2006.

There have been many explanations for this divergence, but part of the reason is that many construction employees shifted to commercial work, without being re categorized as non-residential employees. The second graph shows non-residential construction employment vs. real non-residential investment.

The second graph shows non-residential construction employment vs. real non-residential investment.

Even though investment surged through the end of 2007, reported employment lagged behind and even declined slightly in 2007. This was most likely because employees shifting to commercial construction were still being reported to the BLS as residential construction employees.

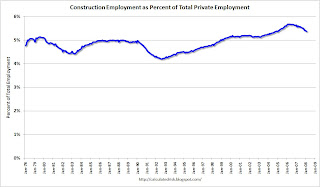

This is important in 2008 because investment in non-residential structures appears to be slowing sharply. The third graph shows total private construction employment as a percent of total private employment since 1978.

The third graph shows total private construction employment as a percent of total private employment since 1978.

Currently construction is about 5.4% of total employment, off the recent highs (5.7%), but well above the cycle lows in '92 (4.2%) and '82 (4.4%). A decline to 4.4% over the next year or two would mean the loss of approximately 1.3 million construction jobs.

This will probably be the key area of job losses in 2008.

Larry Summers: $400 Billion in Losses is "Substantially Optimistic"

by Calculated Risk on 3/07/2008 03:55:00 PM

Former Treasury Secretary Lawrence Summers spoke at the Stanford Institute for Economic Policy Research today. Here are a few excerpts from the WSJ: Summers Says Stresses Require More Action

Mr. Summers ... said federal housing and mortgage policy is "behind the curve." He said the focus on adjustable rate mortgages which are resetting is misplaced; lower interest rates ameliorate that. He estimated 30% of homes with mortgages -- about 15 million in all -- are likely to be worth less than their mortgages. He argued foreclosures are enormously costly and destroy value and thus should be prevented as much as possible.I'll post a video when it is available.

He also said estimates that the housing and mortgage bust will reach $400 billion are likely to be "substantially optimistic".