by Anonymous on 3/08/2008 04:25:00 PM

Saturday, March 08, 2008

The Feldman Plan: Just Get Yourself a Latte

Via Housing Wire, I just read Teh Dumbest mortgage-related proposal I think I have yet seen.

The federal government would lend each participant 20% of that individual's current mortgage, with a 15-year payback period and an adjustable interest rate based on what the government pays on two-year Treasury debt (now just 1.6%). The loan proceeds would immediately reduce the borrower's primary mortgage, cutting interest and principal payments by 20%. Participation in the program would be voluntary and participants could prepay the government loan at any time.OK, so we are going to ignore piggybacks (people do have more than one mortgage, you know), so we don't have to ask whether the second lien lender gets all the repayment, or what. We are going to ignore prepayment penalties that apply to substantial partial prepayments. We are going to ignore those sacred contractual rights lenders have to require you to continue to make the payment specified in your loan documents even if you make a partial prepayment (it takes a modification agreement to change the contractual payment). We are going to ignore the lack of a credit risk premium.

The legislation creating these loans would stipulate that the interest payments would be, like mortgage interest, tax deductible. Individuals who accept the government loan would be precluded from increasing the value of their existing mortgage debt. The legislation would also provide that the government must be repaid before any creditor other than the mortgage lenders.

Although individuals who accept the loan would not be lowering their total debt, they would pay less in total interest. In exchange for that reduction in interest, they would decrease the amount of the debt that they can escape by defaulting on their mortgage. The debt to the government would still have to be paid, even if they default on their mortgage.

Participation will therefore not be attractive to those whose mortgages that already exceed the value of their homes. [sic] But for the vast majority of other homeowners, the loan-substitution program would provide an attractive opportunity.

Although home owners may recognize that the national average level of house prices has further to fall, they do not know what will happen to the price of their own home. They will participate if they prefer the certainty of an immediate and permanent reduction in their interest cost to the possible option of defaulting later if the price of their own home falls substantially.

The loan-substitution program would decrease the number of homeowners who would come to have negative equity as house prices decline. That reduces the number of homeowners who will have an incentive to default, thereby limiting the risk of a downward spiral of house prices.

Since individuals now have the right to prepay any part of their mortgage debt, the 20% reduction in the mortgage balance would not violate mortgage creditors' rights. Creditors should welcome the mortgage paydowns, because they make the remaining mortgage debt more secure. The 20% repayments to creditors would also create a major source of funds that should stimulate all forms of lending.

The simplest way to administer the new loans would be for the current mortgage servicer to collect on behalf of the government and remit those funds to Washington. There would be no need for a new government bureaucracy, for new appraisals, or for negotiations in bankruptcy. The program could be up and running within months after the legislation is passed.

We are not going to ignore the elementary math of amortization. Not today.

Let's just pretend we have a single lien mortgage loan. The original loan amount was $200,000 at 8.5% for 30 years, and just for entertainment purposes we'll say the loan has been amortizing and it is now two years old. It's either a fixed rate or a "frozen teaser," so the rate is still 8.5% going forward. The original P&I was $1,537.83 and the current loan balance is $196,842.51.

We turn that into a 28-year 8.5% loan for $157,474.01, plus a 15-year 1.6% loan for $39,368.50. That gives us a first mortgage payment of $1,230.26 and a second mortgage payment of $246.15. Firing up my trusty 10-key, I see that totals to $1,476.42, or a 4% reduction in the total monthly payment.

A monthly savings of $61.41! Oh Lord, they'll flock to this! Non-dischargeable full recourse debt that prevents you from ever cashing out if home values do ever recover, until you've paid off that low-rate loan! Plus the new loan is an ARM, so it can get worse in two years! In fact, it only has to adjust up to 5.00% for the total payment to be higher than what you started with, given a 15-year amortization! But that's not a problem, because we know people will think about the lower interest costs over decades, not the higher monthly payment today! And besides that, when the hell has a 2-year Treasury note ever been five percent, huh? Oh, sure, if you're going to worry about some kind of a doomsday scenario . . .

Well, wait, you say. This proposal isn't aimed at those high-rate subprime borrowers who get so easily confused about the difference between the monthly payment and the total interest paid, because they're probably upside down anyway. This proposal is for us responsible types. Let's say we started with the $200,000 30-year at 6.00%, with a P&I of $1,199.10. Two years later we strip that into a $155,949.18 28-year loan at 6.00% ($959.28) and a $38,987.29 15-year loan at 1.6% ($243.77) giving us a new payment of $1,203.05! Cool! Economic stimulus! That $3.95 a month that would have been blown at Starbucks going to debt reduction! Just what we need in a recession!

Plus, we don't need any government agency to handle it! Servicers can do all the work, draw up the docs, execute them all, apply all the funds, modify the payments on the old loans, and then get that $243.77 check every month, which they can just mail to Washington! We don't need no steenkin' bureaucracy on the other side! The receptionist at the Treasury can probably handle it all in her spare time! Sure, she doesn't have any idea how much she's owed for what loan and when any given loan matures and what to do if the payment doesn't show up, but she doesn't have to! Countrywide will keep track of it all for her! There's nothing wrong with their bookkeeping ever! And you know they'll do all that for free, because they're good citizens! So there's no servicing fee eating into that 1.6% the government earns on these loans! No upfront fees to the borrower that offset the interest savings, because loan originators, like loan servicers, also work for nothing! Free lunch!

Sorry about the exclamation points. I should just be kept away from the Wall Street Journal.

UPDATE: Please note that "Marty Feldman" was a gifted comedian. "Marty Feldstein" is a gifted comedian who is also an economist.

End to the Mediocre Times

by Calculated Risk on 3/08/2008 12:11:00 AM

From David Leonhardt at the NY Times: End to the Good Times (Such as They Were) On household income:

The median household earned $48,201 in 2006, down from $49,244 in 1999, according to the Census Bureau. It now looks as if a full decade may pass before most Americans receive a raise.On a recession call from NBER:

The seven economists who sit on the bureau’s recession-dating committee ... said Friday that it remained too early to know.So we probably won't have the official recession call until late this year.

...

The committee did not announce the end of the last recession ... until more than a year-and a half later. ... any announcement about the start of a new recession was unlikely before the last few months of 2008 at the earliest.

For those with five minutes, Leonhardt does a nice job of discussing the economic problems in this podcast. I agree with his conclusion: House prices must fall.

Friday, March 07, 2008

FDIC: Hume Bank Fails

by Calculated Risk on 3/07/2008 08:21:00 PM

From the FDIC: FDIC Approves the Assumption of the Insured Deposits of Hume Bank, Hume, Missouri

Hume Bank, Hume, Missouri, was closed today by the Commissioner of Missouri's Division of Finance, and the Federal Deposit Insurance Corporation (FDIC) was named receiver. To protect depositors, the FDIC Board of Directors approved the assumption of Hume Bank's insured deposits by Security Bank, Rich Hill, Missouri.This is just another small bank.

The failed bank's sole office will reopen Monday as a branch of Security Bank. Depositors of Hume Bank will automatically become depositors of the assuming bank.

As of December 31, 2007, Hume Bank had total assets of $18.7 million and total deposits of $13.6 million. Security Bank has agreed to assume $12.5 million of the failed bank's insured deposits for a premium of 4.26 percent.

At the time of closing, Hume Bank had approximately $1.1 million in 33 deposit accounts that exceeded the federal deposit insurance limit. These customers will have immediate access to their insured deposits, and they will become creditors of the receivership for the amount of their uninsured funds.

Construction Employment

by Calculated Risk on 3/07/2008 04:25:00 PM

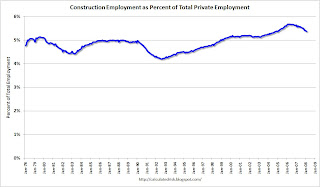

One of the mysteries in 2007 was why BLS reported residential construction employment didn't decline as much as expected based on housing starts and completions.

The first graph shows residential construction employment vs. real residential investment (minus broker's commissions). Click on graph for larger image.

Click on graph for larger image.

This shows the mystery in residential construction employment. Even though Residential Investment fell sharply, residential construction employment is only down 407.1 thousand, or about 11.8%, from the peak in February 2006.

There have been many explanations for this divergence, but part of the reason is that many construction employees shifted to commercial work, without being re categorized as non-residential employees. The second graph shows non-residential construction employment vs. real non-residential investment.

The second graph shows non-residential construction employment vs. real non-residential investment.

Even though investment surged through the end of 2007, reported employment lagged behind and even declined slightly in 2007. This was most likely because employees shifting to commercial construction were still being reported to the BLS as residential construction employees.

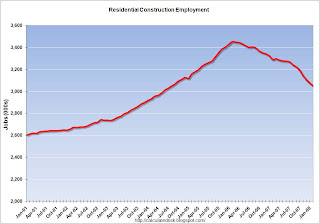

This is important in 2008 because investment in non-residential structures appears to be slowing sharply. The third graph shows total private construction employment as a percent of total private employment since 1978.

The third graph shows total private construction employment as a percent of total private employment since 1978.

Currently construction is about 5.4% of total employment, off the recent highs (5.7%), but well above the cycle lows in '92 (4.2%) and '82 (4.4%). A decline to 4.4% over the next year or two would mean the loss of approximately 1.3 million construction jobs.

This will probably be the key area of job losses in 2008.

Larry Summers: $400 Billion in Losses is "Substantially Optimistic"

by Calculated Risk on 3/07/2008 03:55:00 PM

Former Treasury Secretary Lawrence Summers spoke at the Stanford Institute for Economic Policy Research today. Here are a few excerpts from the WSJ: Summers Says Stresses Require More Action

Mr. Summers ... said federal housing and mortgage policy is "behind the curve." He said the focus on adjustable rate mortgages which are resetting is misplaced; lower interest rates ameliorate that. He estimated 30% of homes with mortgages -- about 15 million in all -- are likely to be worth less than their mortgages. He argued foreclosures are enormously costly and destroy value and thus should be prevented as much as possible.I'll post a video when it is available.

He also said estimates that the housing and mortgage bust will reach $400 billion are likely to be "substantially optimistic".

Judge Bohm and the Culture of Incompetence

by Anonymous on 3/07/2008 02:21:00 PM

I noted yesterday the Memorandum Opinion of U.S. Bankruptcy Judge Jeff Bohm in regards to a series of bankruptcy filings and testimony by Countrywide, its national law firm, and the local firm hired by the national firm, each of which involved a series of "negligent bungling" that rose right up to about an inch from "full-blown bad faith," if it didn't quite get there.

The Opinion is available online in two segments here and here. I very much recommend them as reading material for anyone with any connection to the mortgage business, and that would include you regulatory people. And reporters. Judge Bohm is asking the right questions, in my view, and he's done us all a public service.

The short summary of what went on:

A Countrywide-serviced borrower (the loan is actually owned by Fannie Mae) filed a Chapter 13 bankruptcy in October of 2006. A BK filing will place an automatic stay on foreclosure, which can only be lifted by the court if the lender files a motion to lift the stay. As a part of this process, the servicer is required to bring proof to the court of "pre-petition" and "post-petition" delinquency of the borrower. It is Fannie Mae's policy, to which CFC would have been expected to comply, that motions to lift stay are not filed unless the borrower is at least 60 days delinquent on the mortgage loan.

CFC submitted a "payment history" (this is a printout from a servicing system that shows all transactions on a loan, including payments, charges, fees, suspense and escrow account items, rate and payment adjustments, etc.) As CFC payment histories in general, not just in this case, are so complex and awkward as to be essentially meaningless not only to lay people but to courts and lawyers, CFC's national law firm had actually established, back in the spring of 2006, a separate corporate entity ("MR Default Services") which employs a bunch of "legal assistants" (not lawyers) to cut & paste information from the payment histories received from CFC into a more readable, simplified format; the new document is attached to the court filings. The new document is never, apparently, reviewed either by CFC or by the actual attorneys for quality-control or basic plausibility-check purposes. CFC is apparently just fine with the risk of going to court with a document that is a third-party prepared "version" of the actual official payment history. CFC's lawyers are also apparently cool with that.

In the specific case at hand, there was a series of errors: first, CFC for some reason got confused about when the borrower filed his original petition, and so included the payment made in November as a "pre-petition" payment, making it appear that the borrower had not made his first "post-petition" payment. (That's important; you are much less likely to get the stay lifted if the borrower continues to make mortgage payments after the petition.) Then, when "MR Default Services" went to "simplify" the payment history, the copy & paste process missed the first item on the top of one of the pages, and it turns out that item was a mortgage payment made way back in May. Also, this payment history was sent to the simplification factory on or around December 11, but the motion to lift stay wasn't filed with the court until December 29. The problem with that is that the borrower made a payment on December 13. Nobody requested an updated payment history from CFC, which is hard to believe: it is a simple fact of life in the business that a three-week-old payment history is "stale," especially if it was generated during the "grace period" in the beginning of a month, and in fact it appears (I'm not quite sure) that the actual payment history they used in the first place was prepared in early to mid-November.

The long and short of it was that the debtor's counsel pointed out that the payment history was simply wrong, and that (at worst) the debtor was only 30 days delinquent, not more than 60 days (and had made two payments post-petition that the motion ignored). CFC filed a motion to withdraw the motion to lift stay. The judge asked CFC's attorney (a local firm hired by the national firm, in this great game of legal "telephone") about it, and he basically lied about the reason for the motion to withdraw.

The whole thing snowballed from there into multiple lawyers from two different firms plus at least one person from CFC giving false testimony to the court about the whole thing to cover up the mistakes. If you read the entire Opinion, you have to conclude that Judge Bohm wouldn't have turned this into a high-powered series of hearings if someone originally had simply fessed up to a clerical error. Not only was the cover-up worse than the crime, but the cover-up exposed the whole wretched set of business arrangements and CFC operational practices that clearly do not function to prevent errors, and in fact seem prone to creating them.

One of the good Judge's intentions in investigating the reasons for the withdrawal of the motion to lift stay was, bless his heart, to assure that the debtor didn't get stuck with legal fees for the costs of the original motion and withdrawal motion, if this legal work was caused by CFC's or its attorney's errors. That opened up a whole can of worms about how CFC accounts for "non-recoverable" legal charges. It turns out that CFC's process is not to permanently remove non-recoverable costs (things you can't charge the debtor/borrower) from the loan records until the BK is discharged, which of course can take years and years for a Chapter 13 and which may never happen, if the Chapter 13 is dismissed rather than discharged. Whether or not the point of this idiotic practice is to let fees "lurk" in the system that can later "accidentally on purpose" be charged to the borrower some day in the future when the Court isn't looking, or whether the point is just another one of those famous "efficiencies" isn't clear. (You can easily imagine some moronic consultant telling CFC that "once through the process!" is a great slogan for the accounting department, and that it can save a lot of money by letting such things as non-recoverable fee entries pile up until the case is "done" and all work can be done once at the same time. Of course that's insane from a risk-management perspective, but I've heard consultants say even dumber stuff, myself.)

The other can of worms that got opened was the whole business of the two law firms and their relationship to CFC. It turns out that CFC--for "efficiency" reasons--wanted one and only one "official" law firm, who would parcel out filings to all the different local law firms all over the country. The contract with the national law firm explicitly stated that the local firms were not allowed to communicate directly with CFC. They could only talk to the national firm, who could only talk to CFC. Among other problems this creates, if the local firm, say, happens to notice at 4:45 p.m. that there seems to be something wrong with a payment history, that firm can't pick up the phone and call Eunice in CFC's bankruptcy servicing department to get it straightened out. The whole thing has to go through the national law firm, and as far as I can tell the best anyone ever expected was 48-hour turnaround.

And the loan in question being a Fannie Mae-owned loan, the legal work is required strictly to be on a flat-fee basis. Fannie Mae's position is that without that rule, debtors/borrowers would be facing a "running meter" of legal fees that would eat up all their equity and then some if you let it go on. However, it appears that the law firms' response to the flat-fee thing is to just not bother with following up on things like stale or incorrect payment histories, because apparently they don't think they get paid enough to do things right.

Here's Judge Bohm on the conclusions he drew in this whole ugly miserable tale of idiocy, which I think are worth quoting at length:

Over the past several years, attorney's fees and costs have risen steadily--some clients would doubtless say astronomically. Corporations in particular have reacted by demanding concessions such as flat fee pricing for each file. In the consumer bankruptcy field, many financial institutions--for example, Fannie Mae in the case at bar--have negotiated flat fee engagements with certain law firms to avoid large fees that can accrue under an hourly rate system. In theory, this arrangement seems appropriate: fixed fees minimize costs that are primarily passed on to consumer debtors. In practice, this arrangement has fostered a corrosive "assembly line" culture of practicing law.

As the case at bar shows, attorneys and legal assistants at Barrett Burke and McCalla Raymer are filing motions to lift stay without questioning the accuracy of the debt figures and other allegations in these pleadings and appearing in court without properly preparing for the hearings. These lawyers appear in court with little or no knowledge because they have been poorly trained. Indeed, the case at bar shows that the attorneys from Barrett Burke and McCalla Raymer often appear in court ill-prepared to think or effectively communicate.

This fixed-rate fee business model appears to have been an overwhelming financial success. In Allen, Bankruptcy Judge Steen noted that Barrett Burke's revenues totalled between approximately $9.7 million and $11.6 million per annum. . . . Based upon the testimony at the show cause hearings, this Court estimates that McCalla Raymer has generated revenues of approximately $28 million over the past decade from representing solely Fannie Mae. Meanwhile, the profession has suffered from the ever decreasing standards that firms like Barrett Burke and McCalla Raymer have heretofore promoted.

This demise must stop. The problems at Barrett Burke and McCalla Raymer are not limited to training lawyers; there are other aspects of these firms' culture that is disconcerting. What kind of culture condones a firm signing an engagement letter which prevents its attorneys from communicating with its client? What kind of culture condones its lawyers preparing, signing, and filing motions to lift stay without having the client review the final version for accuracy? What kind of culture condones its attorneys signing proofs of claims without even contacting the client to review and confirm the debt figures? What kind of culture condones attorneys testifying to basic facts and then, at the next hearing, recanting the testimony on the grounds that the attorney had not sufficiently prepared to testify? And above all else, what kind of culture condones its lawyers lying to the court and then retreating to the office hoping that the Court will forget about the whole matter?

Countrywide's corporate culture is no better. What kind of culture condones blockading personnel from communicating with outside counsel? What kind of culture discourages the checking of outside counsel's work? What kind of culture promotes payment histories that are so confusing to the vast majority of persons, including attorneys and judges--not to mention borrowers--that it becomes necessary for legal assistants to "simplify" them--leading to more error and confusion? . . .

With respect to Countrywide, this Court would hope that this entity would reevaluate its policies and procedures in order to improve upon the accuracy of payment histories and to ensure that its actions do not undermine the integrity of the bankruptcy system. Countrywide's business is directly tied to a quintessentially American aspiration--homeownership. If Countrywide does not properly maintain payment histories and effectively communicate with its counsel, the consequences can be very harmful. . . .

This Court trusts that Barrett Burke, McCalla Raymer and Countrywide will mend their broken practices. This Court will continue to verify that its trust is well-placed.

Hedge Fund Humor

by Calculated Risk on 3/07/2008 12:52:00 PM

Who is this guy Margin that keeps calling me???(hat tip BR)

More Default Notices for Carlyle

by Calculated Risk on 3/07/2008 12:37:00 PM

From the WSJ: Carlyle Capital Receives Additional Default Notices

Carlyle Capital Corp. Friday said lenders were liquidating some of its mortgage securities, painting an even bleaker picture of its already perilous situation.

In a short news release issued early Friday, the fund, which is managed by a unit of Washington, D.C., private-equity firm Carlyle Group, said it received "substantial additional margin calls and additional default notices from its lenders" and that "these additional margin calls and increased collateral requirements could quickly deplete its liquidity and impair its capital."

...

Carlyle Capital managed only $670 million in client money, but used borrowing to boost its portfolio of bonds to $21.7 billion, meaning it was about 32 times leveraged.

Fed Acts to Boost Liquidity

by Calculated Risk on 3/07/2008 09:16:00 AM

From the Federal Reserve:

The Federal Reserve on Friday announced two initiatives to address heightened liquidity pressures in term funding markets.

First, the amounts outstanding in the Term Auction Facility (TAF) will be increased to $100 billion. The auctions on March 10 and March 24 each will be increased to $50 billion--an increase of $20 billion from the amounts that were announced for these auctions on February 29. The Federal Reserve will increase these auction sizes further if conditions warrant. To provide increased certainty to market participants, the Federal Reserve will continue to conduct TAF auctions for at least the next six months unless evolving market conditions clearly indicate that such auctions are no longer necessary.

Second, beginning today, the Federal Reserve will initiate a series of term repurchase transactions that are expected to cumulate to $100 billion. These transactions will be conducted as 28-day term repurchase (RP) agreements in which primary dealers may elect to deliver as collateral any of the types of securities--Treasury, agency debt, or agency mortgage-backed securities--that are eligible as collateral in conventional open market operations. As with the TAF auction sizes, the Federal Reserve will increase the sizes of these term repo operations if conditions warrant.

The Federal Reserve is in close consultation with foreign central bank counterparts concerning liquidity conditions in markets.

Jobs: Nonfarm Payrolls Decline 63,000 in February

by Calculated Risk on 3/07/2008 08:39:00 AM

From the BLS: Employment Situation Summary

Nonfarm payroll employment edged down in February (-63,000), and the unemployment rate was essentially unchanged at 4.8 percent, the Bureau of Labor Statistics of the U.S. Department of Labor reported today. Employment fell in manufacturing, construction, and retail trade. Job growth continued in health care and in food services.

Click on graph for larger image.

Click on graph for larger image.Residential construction employment declined 25,700 in February, and including downward revisions to previous months, is down 407.1 thousand, or about 11.8%, from the peak in February 2006. (compared to housing starts off over 50%).

The second graph shows the unemployment rate and the year-over-year change in employment vs. recessions.

Although unemployment was slightly lower - as people leave the workforce - the rise in unemployment, from a cycle low of 4.4% to 4.8% is a recession warning.

Also concerning is the YoY change in employment is less than 1%, also suggesting a recession.

Overall this is a weak report.