by Calculated Risk on 2/27/2008 10:14:00 AM

Wednesday, February 27, 2008

Bernanke: Economic Situation Distinctly Less Favorable

From Chairman Bernanke's Semiannual Monetary Policy Report to the Congress

The economic situation has become distinctly less favorable ...Sounds like a recession to me!

Many of the challenges now facing our economy stem from the continuing contraction of the U.S. housing market. In 2006, after a multiyear boom in residential construction and house prices, the housing market reversed course. Housing starts and sales of new homes are now less than half of their respective peaks, and house prices have flattened or declined in most areas. Changes in the availability of mortgage credit amplified the swings in the housing market. During the housing sector's expansion phase, increasingly lax lending standards, particularly in the subprime market, raised the effective demand for housing, pushing up prices and stimulating construction activity. As the housing market began to turn down, however, the slump in subprime mortgage originations, together with a more general tightening of credit conditions, has served to increase the severity of the downturn. Weaker house prices in turn have contributed to the deterioration in the performance of mortgage-related securities and reduced the availability of mortgage credit.

The housing market is expected to continue to weigh on economic activity in coming quarters. Homebuilders, still faced with abnormally high inventories of unsold homes, are likely to cut the pace of their building activity further, which will subtract from overall growth and reduce employment in residential construction and closely related industries.

Consumer spending continued to increase at a solid pace through much of the second half of 2007, despite the problems in the housing market, but it appears to have slowed significantly toward the end of the year.

...

Slowing job creation is yet another potential drag on household spending, as gains in payroll employment averaged little more than 40,000 per month during the three months ending in January, compared with an average increase of almost 100,000 per month over the previous three months.

...

The business sector has also displayed signs of being affected by the difficulties in the housing and credit markets. Reflecting a downshift in the growth of final demand and tighter credit conditions for some firms, available indicators suggest that investment in equipment and software will be subdued during the first half of 2008. Likewise, after growing robustly through much of 2007, nonresidential construction is likely to decelerate sharply in coming quarters as business activity slows and funding becomes harder to obtain, especially for more speculative projects.

emphasis added

Frank: Bailout-As-You-Go

by Anonymous on 2/27/2008 09:06:00 AM

This is what the Financial Times is reporting:

A leading Democratic lawmaker on Tuesday called for $20bn in public funds to be made available to the Federal Housing Administration to purchase and refinance pools of subprime mortgages. . . .So far this morning, my attempts to find more details on the Frank plan have not succeeded. I did, however, find this recently published statement of priorities for the House Committee on Financial Services, of which Frank is the chair:

Mr Frank said “we can do it through an existing vehicle rather than a new vehicle”. But the underlying logic of the two proposals is similar.

Mr Frank said that under his plan, the FHA would “buy up packages of mortgages but at a substantial discount”. It would then refinance the loans.

This would require about $20bn up front, but Mr Frank stressed that “the FHA would be repaid” as the loans were refinanced. The ultimate cost of the scheme to US taxpayers, under Congressional scoring practices, would probably be about $3bn to $4bn.

Mr Frank also called for between $5bn and $10bn in loans to the states, which would be used to purchase and refurbish foreclosed homes, and extra funding for counselling services.

Mr Frank said the “lesser efforts” to tackle the mortgage crisis to date “have not been very successful”. The housing crisis was “getting worse not better”.

The externalities involved in foreclosures justified the commitment of public funds. “We are talking about terrible impact on society.”

The main difference between the Frank plan and some of the other proposals circulating is the scale of the intervention envisaged.

Alan Blinder, a professor of economics at Princeton, has called for a new government vehicle modelled on the Home Owners Loan Corporation of the 1930s to borrow between $200bn and $400bn to buy up and restructure distressed loans.

Mark Zandi, chief economist at Moody’s Economy.com told the House financial services committee that it would take about $250bn in upfront funds to purchase all 2m loans expected to end in foreclosure by the end of this decade.

Mr Frank said “reality constrains” and his plan was limited to $20bn for the FHA because of the budget deficit and the need to meet pay-as-you-go spending rules.

The Committee on Financial Services urges the congressional budget resolution to prioritize the following critical issues:I still have no particular idea where the "one million distressed homeowners" figure comes from, but we can, I think, conclude that it would be a total number of all FHA-related initiatives, including FHASecure and other kinds of fairly straightforward refinance programs, not just a program that involves FHA purchasing an existing loan in order to refinance it.

(1) Housing Initiative. Over the last six months, the nation has experienced a significant increase in the number of homeowners facing the risk of foreclosure, with estimates of as many as 2.8 million subprime and “Alt A” borrowers facing loss of their homes over the next five years. We have already experienced declining home prices in many areas of the country, and the physical deterioration of certain communities, as a result of waves of vacant homes that were foreclosed or abandoned.

The Financial Services Committee is developing a number of proposals to address these growing problems. Given the urgency to take action, a significant portion of the cost of such proposals will likely be incurred in the current fiscal year. However, there would be some loan activities, FHA administrative costs, and additional housing counseling funding that would be needed over the period of the Budget Resolution.

First, the Committee is working on a proposal to provide refinancing opportunities to save as many as 1 million distressed homeowners from having their homes go into foreclosure. Such a proposal will likely involve using FHA and may involve the federal government purchasing loans. It would be implemented through separate authorizing legislation. Any proposal will require the existing holder to write down the loan to a level that is consistent with the homeowner’s ability to pay, and would exclude investor-owned and second homes. The estimated credit subsidy cost could be as much as $15 billion over the next five years. The Committee is also exploring options to limit federal government exposure and thus reduce costs. We could, for instance, require a limited soft second mortgage to the government that would enhance recoveries resulting from future property sales.

Second, the Committee is working on a proposal to provide as much as $20 billion in the form of grants, loans, or a combination of the two, for purchase of foreclosed or abandoned homes at or below market value. The purpose would be to help stabilize home prices and to begin to reverse the serious physical deterioration of neighborhoods with high numbers of subprime borrowers, defaults, and foreclosures. The structuring of such an initiative as a loan program would help to minimize the cost of the federal government, through net recoveries from the subsequent sale of properties.

Third, a substantial expansion of FHA to help keep homeowners in their home will require the contracting out by FHA for independent expertise for the development of underwriting criteria for refinanced loans and for quality control of the loans as they are being made, as well as increased FHA personnel costs for such activities as loan processing. This will require additional FHA administrative funding in the Budget Resolution for FY 2009 and possibly in subsequent years, in an estimated range of several hundred million dollars a year.

Finally, it is important for Congress to increase funding over FY 2008 levels by at least an additional $200 million a year for federal housing counseling grants. Such grants would increase capacity, in order to ensure that sufficient numbers of borrowers are assisted in implementing these and other initiatives to keep people in their homes.

If the FT has the number right, we're looking at $20 billion for loan purchases. It's hard to calculate how many loans that would be without knowing just what kind of a discount is on the table. If you assumed a 10% discount and an average original loan balance of $200,000, you'd get just over 100,000 loans. At a 50% discount you could buy around 200,000 loans. That's a long way from a goal of one million loans, however you slice it.

On the other hand, there's the potential of several hundred million dollars a year on the table for independent experts who want to write FHA's credit guidelines for them. We knew that was coming.

The sanity level of this kind of plan still depends on why it is we want FHA to buy these loans and then refinance them, as opposed to simply refinancing them. The risk in the buyout, of course, is always that FHA pays too much for the loan; if buyer and seller need to do the full loan-level analysis to calculate the amount of the necessary loan balance to write off before establishing a price, then the practical thing to do at that point is simply a refinance, without FHA ever owning the old loan. If the point is that there isn't time or capacity for current loan holders to do that analysis, then the amount of the discounted price FHA would pay is uncertain at best.

I am also still eager to hear how this proposes to work from the perspective, specifically, of buying loans out of REMIC pools--and that is, presumably, where the problem loans in question are likely to be, not in bank whole loan investment portfolios. REMICs just cannot sell loans at less than par under current rules; without a change to those rules, it seems likely to me that in the process of selling defaulted loans to the government at a discount, the sponsors of these securities are committing themselves to bringing the deals onto their balance sheets, and possibly facing taxation of the trust itself (not just the investors receiving pass-through income). This is one of the several important differences between the current situation and the old HOLC situation in the Depression (where loans were being purchased from banks and were not securitized).

At this point I'm tempted to think it's a lot of additional mess for $20 billion. The Securities Lawyer Full Employment Act probably wasn't what anyone had in mind . . .

Tuesday, February 26, 2008

FDIC Releases Quarterly Report

by Calculated Risk on 2/26/2008 01:30:00 PM

From the FDIC: Quarterly Banking Profile. A few headings:

Quarterly Net Income Declines to a 16-Year LowOn Bank Failures: "Three Failures in 2007 Is Most Since 2004"

One in Four Large Institutions Lost Money in the Fourth Quarter

Margin Erosion Persists

Full-Year Earnings Fall to Five-Year Low

Net Charge-Off Rate Rises to Five-Year High

Growth in Noncurrent Loans Accelerates

Large Boost to Loss Reserves Fails to Stem Decline in Coverage Ratio

At the end of 2007, there were 76 FDIC-insured commercial banks and savings institutions on the “Problem List,” with combined assets of $22.2 billion, up from 65 institutions with $18.5 billion at the end of the third quarter.And a graph from the FDIC:

Click on graph for larger image.

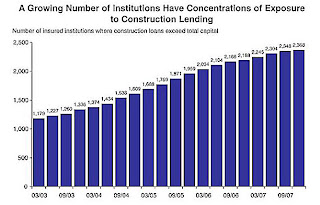

Click on graph for larger image. "A Growing Number of Institutions Have Concentrations of Exposure to Construction Lending"

This graph shows the number of institutions, by quarter, where the construction loans exceed total capital.

These are the higher risk institutions. There are 2,368 institutions that met this criteria in Q4 2007, out of 8500 insured institutions.

No wonder the FDIC is hiring.

Lost Note Affidavits & Skeletons in the Closet

by Anonymous on 2/26/2008 11:54:00 AM

Some day I will learn to stop ignoring stuff. I saw this Bloomberg piece on the day it was published, my eyes rolled into the back of my head, and I realized that on a good day I haven't got the ability to unscramble this frittata of anecdote, conflation, fact and side-issue in less than 10,000 words. I certainly have a hard time doing that temporarily blinded. But I have now received a round dozen emails from you all drawing my attention to it, plus all the uncounted times it has come up in the comments. Okay, fine.

The thing starts off with its one and only specific example, and it's a doozy:

Feb. 22 (Bloomberg) -- Joe Lents hasn't made a payment on his $1.5 million mortgage since 2002."Former CEO" seems a tad bit complimentary to Lents here--perhaps Bloomberg is afraid of getting sued by this particular piece of work. We do get this:

That's when Washington Mutual Inc. first tried to foreclose on his home in Boca Raton, Florida. The Seattle-based lender failed to prove that it owned Lents's mortgage note and dropped attempts to take his house. Subsequent efforts to foreclose have stalled because no one has produced the paperwork.

``If you're going to take my house away from me, you better own the note,'' said Lents, 63, the former chief executive officer of a now-defunct voice recognition software company.

Lents is former CEO of Investco Inc., a Boca Raton, Florida-based developer of voice recognition software. In 2002, the U.S. Securities and Exchange Commission sanctioned Lents and others for stock manipulation, according to the SEC Web site. He lost his job, was fined and his assets were frozen. That's the reason he couldn't pay his mortgage, he said.Well, I never miss an opportunity to go wade through the SEC website. As far as I can determine, Lents cooked up a pump-and-dump scheme, and then found a company he could take over to implement it. This part is amusing: "Investco, Inc. is a Nevada corporation headquartered in Boca Raton, Florida. Investco formerly purported to be a provider of voice recognition technology and now claims to be a provider of financial services." If it takes one to know one, we have one.

This article from January in the South Florida Business Journal gives us a touch more color on the Lents foreclosure:

Somebody has been trying to foreclose on Joseph Lents' Boca Raton home for five years. So far, they have been unsuccessful because he has legally fought them every step of the way. . . .I have so far been unable to find an update on the DLJ hearing. I cannot even tell, from this narrative, whether DLJ was the "investor" to whom WaMu had sold the loan at the time it defaulted, or if WaMu subsequently sold the loan to DLJ after it dismissed FC proceedings, as a "non-performing loan." If the latter is the case, I admit I'd like to know just how much "premium" DLJ paid for it. (Note to the irony impaired: no, I don't want to know that. I sleep better not knowing that.)

"I probably have been to the Palm Beach County courthouse 100 times or more over the last five years, just to observe," Lents said. "In 99 percent of the residential foreclosure cases, plaintiffs are asking the court to accept a promissory note copy as the original because it is presumed lost."

Resistance doesn't come cheap. Lents has paid more than $120,000 in legal fees and costs so far to save his 5-acre, $2.5 million home. . . .

The Lentses built their home in 1992 and, on May 15, 2001, according to public records, refinanced it for $1.49 million with Washington Mutual Bank (NYSE: WM).

Lents, a retired CPA, lost his corporate job in 2002 when the SEC charged the company he led (Ivesco/Intraco) with a pump-and-dump scheme, according to SEC documents. While the SEC agreed that Lents had not made money - he actually lost money on the transactions - the damage was done. His income stopped and he fell five months behind on his mortgage payments.

"I tried contacting WaMu [Washington Mutual] and couldn't get through to anyone who could help me reset or recast the mortgage," Lents said. He contacted the mortgage broker, Express Financial, which had helped him shop around for the best mortgage in 2001. "They contacted WaMu and were told it couldn't do anything because, even though they were servicing the mortgage, the loan had been sold. It was a Catch-22," Lents said.

In January 2003, WaMu filed for foreclosure against the Lentses.

Where's the note?

The first count of the complaint was curious, according to Lents. It said the $1.49 million promissory note was lost.

"Now, I have audited a number of banks and credit unions in my time, and I can tell you they don't lose million-dollar notes," Lents said. "If auto dealers can keep track of auto titles, surely banks can keep track of promissory notes."

West Palm Beach attorney Brook Fisher filed an objection, and WaMu filed an affidavit, swearing the note had been lost.

The employee who filed the lost note affidavit was deposed. Under sworn testimony, she said she hadn't searched for the note and just signed a stack of lost note affidavits.

WaMu's attorney filed for summary judgment in 2003. However, since the facts surrounding the allegedly lost note were in dispute, the judge set the case for trial and allowed discovery for records and depositions.

Lents acknowledged that he owed the money, but would only pay the legal note holder, whoever that might be.

In October 2003, WaMu dismissed the suit.

Nothing more happened until February 2005, when Donaldson Lufkin Jenrette (acquired in 2000 by Credit Suisse) filed a foreclosure suit against the Lentses.

In a September 2005 mediation meeting, the attorney representing Donaldson Lufkin Jenrette said it had paid a premium for the Lentses' mortgage, apparently purchased as part of a package of non-performing loans. . . .

The Lentses' case is coming to a head. A hearing is set for Jan. 8 in which Donaldson Lufkin Jenrette is seeking summary judgment. Their attorney, Miami-based Jane Serene Raskin of Raskin & Raskin, will probably be asking for the same thing. (She did not return calls for comment.)

So here's what seems to be the deal. Lents, who knows a little something about obfuscation and has a lot of free time since the SEC took care of his employment opportunities, hung out at the courthouse long enough to notice that FCs are routinely filed with either a certified true copy of the promissory note or a Lost Note Affidavit (LNA), which in every instance I have ever personally seen is a sworn statement that the original note is lost, and is accompanied by a certified true copy of the lost original. (It is theoretically possible to submit an LNA without a copy, if there were a case that both the original and all copies of the note were lost. However, there would have to be other documents attached to the LNA that would provide evidence that it once existed, such as other closing documents, the loan payment history, a sworn statement of the notary or escrow officer, etc. As I said, I've never actually seen an LNA without a copy of the note attached to it.)

Having noticed that, Lents filed an objection to the FC based on the dubious standing of the LNA; discovery proceeded and it turned out, not surprisingly to me, that there was no particular evidence that WaMu had lost the note. Someone simply decided that the quick and easy way to process a batch of foreclosure filings was to grab the copy of the note that was easily available in the servicing file, slap an LNA on it, and go with that, rather than going through the process of locating the custodian who held the original note, filing the paperwork required to have it released to WaMu, etc. Based on the article, it seems possible to conclude that the original note really was lost, but since WaMu made no effort to find it in the first place, it's a no-brainer to conclude that at least one statement in that LNA was false. (They all say something to the effect that all practicable efforts to locate the original have been made and have failed, and that the affiant has personal knowledge of this.)

What this article does not say is whether DLJ has an original note or not. If DLJ owned the note at the time WaMu, the originator and servicer, tried to foreclose on an LNA, that might be why WaMu didn't have it: DLJ had it and either WaMu didn't try to get it from them or DLJ failed to produce it. If DLJ purchased the loan subsequently, as "non-performing," then either DLJ bought with an LNA (it allowed the sale to go through with only an LNA to evidence the note), or WaMu found some note for DLJ. It really drives me nuts that these news reports bring all this stuff up, and then never really report all the relevant details. My best guess is that DLJ bought a pool of junk loans and accepted an LNA instead of requiring the original note. That's probably why DLJ is having to bring other evidence into court, such as the evidence of its purchase of this pool.

I note for y'all that I have personally executed one or two LNAs in my day, and have therefore had all known hard file folders associated with this loan (the servicing file, the branch's copy, the custodial file, whatever there is), as well as all correspondence with the warehouse bank or custodian or whoever else might have had it brought to my desk, so I could personally root through it all once more before I put my officer's signature on an LNA. In all but one of the LNAs I can remember executing, I had documentation from FedEx or some other shipper that a package had indeed been lost, plus clear documentation in the loan file that this specific note had been included in that specific lost shipment. (My shipping department always put the copy of the airbill in the loan file. Always.) And of course I always had a certified true and correct copy of the note to attach to the affidavit.

I bring all this up because, Lents' self-serving nonsense aside, not only can original notes be lost or damaged, so can car titles and any other piece of paper. (I have a friend who once had to execute over 100 LNAs after a fire in an adjoining office suite triggered the sprinkler system in her post-closing department. Those LNAs were accompanied by copies of sodden bits of semi-readable paper that had been patched together on the copier plate, one at a time.) A financial institution in the business of making mortgage loans has no business routinely losing or damaging original promissory notes, and any institution that does so should be shut down by the federal regulators and I mean that.

But if consumer attorneys want to create a situation in which the simple fact of loss of or irreparable damage to an original note vacates the debt, I can promise you you will not like the consequences of that. If it turns into Total War here, don't ever lose an original cancelled check. You should know that there is actually one fairly respectable reason for doing FC filings with note copies, besides servicer laziness or loan sale screw-ups: taking your original note out of the custodian's vault to send to some local attorney to attach to a court filing creates several more opportunities for it to get lost. If it becomes a requirement that FC can proceed only with the original note in the courtroom, and the presence of an LNA always means dismissal, then the things are going to have to be handled and shipped and received with the same level of security as a million-dollar bearer bond. Like, a Brink's truck and a bonded courier carrying a briefcase handcuffed to his wrist. You want to pay the cost of that? No. You don't. But you will.

The problem here, I suspect, is that the jurisdiction in question does not provide for a legitimate way to file with a true and correct certified copy of the original note; the only way servicers can get by without giving up their original notes to the county clerk is by filing an LNA, which at minimum makes them look bad (and involves false statements). I'll leave it to the lawyers to argue about the wisdom of forcing servicers to hand over original notes at the same time they are offered no legal remedy if counsel or clerk or FedEx misplaces it. I am simply observing, once again, that this kind of half-serious half-frivolous objection to a foreclosure action can end up having consequences nobody is going to be happy with.

To return to Bloomberg, though, you will notice that an article that goes on and on at length about the dangers of the secondary market in mortgage loans and originators going out of business and so on has exactly one example, which appears to be of a loan with a note that doesn't seem to have been lost in a loan sale and the originator in question is still in business. Meanwhile, some slick operator for whom $120,000 in legal fees is cheaper than five years of mortgage payments and whose hobby is hanging out at the courthouse is creating a precedent for FC filings in Florida that will no doubt be hailed by so-called consumer advocates as a victory for the little guy.

Lost in all of this is the apparent fact, once again, that WaMu was and probably still is exceptionally sloppy with its handling of original notes; that an outfit like DLJ will apparently buy loans with nothing other than a note copy (and pay premium, too!); and that in the absence of the industry getting serious about confronting its true operating costs and failed "efficiencies," its practices are being "criminalized." Back to Bloomberg:

Borrower advocates, including Ohio Attorney General Marc Dann, have seized upon the issue of missing mortgage notes as a way to stem foreclosures.Joe Lents is not the victim of a "foreclosure machine." He's a deadbeat who has found a way to go five years without making a mortgage payment. He can apparently afford $120,000 in legal fees. But little people who cannot afford the mortgages they have are being convinced to let a lawyer fight their foreclosure on the grounds that the original note wasn't in the courtroom, and all that's going to do is delay the inevitable, add legal fees and even more accrued interest to the deal, and draw this whole horrible unwind of the RE bust out into years and years of hell.

``The best thing to do is to keep people in their homes and for everybody to take steps necessary to make that happen,'' said Chris Geidner, an attorney in Dann's office. ``These trusts are purchasing these notes, and before they even get the paperwork, they foreclose on people. They become foreclosure machines.''

I'm sorry, but AG Dann needs to go after predatory lenders who took advantage of borrowers. If he has evidence that loans were originated with the intent to foreclose--which is predatory by definition--then he should go after that. Intervening to stop a foreclosure because an assignment was filed after the loan purchase is just pandering and grandstanding and wasting resources.

The WaMu problem needs to be taken care of by the OTS: how, I want to know, does anyone pass a safety and soundness examination with a pattern of being unable at any given time to tell you where its notes are? With a pattern of requiring some low-level employee to fill out LNAs with false declarations in them to "save time"? If this isn't a pattern, then what's with all the insinuations in the Bloomberg article that it is? If it is a pattern, it's unsafe and unsound and WaMu's charter should be in danger. This is not the kind of problem you "solve" by challenges to individual FC cases, particularly ones like Lents's--the man by his own admission hasn't made a mortgage payment in five years. He deserves to lose that house, yesterday. I wouldn't go on record defending DLJ's loan purchase due diligence practices here, but DLJ deserves to win.

The rest of us deserve to have this kind of crap prevented, rather than enabled. The regulators and the investment community have to stop putting up with sloppy operations and cavalier attitudes toward document custody. At the risk of repeating myself once more, the true costs of the secondary market in mortgages has to come onto somebody's income statement sooner or later. We are seeing what happens when you claim to have careful operations at the same time you go on a cost-cutting spree to get rid of all that back-room stuff. This problem will not be solved by enriching foreclosure-avoidance attorneys.

I suppose I should end with a nod to this one, which got featured yesterday at The Big Picture and which many of you have also emailed to me. From the Chicago Tribune:

The new buyers of a rundown graystone on the South Side showed up Jan. 9 to look at the house they won at a foreclosure auction. They took the plywood off the front door and went inside to make sure the utilities had been shut off. Then they called the police.Keep reading, and you'll find that Countrywide made a 100% financing deal on this thing, either without requiring an appraisal with a physical inspection, or by having relied on a fraudulent appraisal made by an appraiser who never entered the premises, or that corpse wasn't there until after the loan was made. You really can't conclude anything with the evidence we've been given. I confess I'm a bit more startled by this part:

Sitting upright in the corner of a bedroom off the kitchen was a human skeleton in a red tracksuit. Next to him lay a dead dog. Neighbors told police the corpse was almost certainly Randy Johnson, a middle-age man who lived alone in the North Kenwood house.

The cause of Johnson's death has not yet been determined, but it is just one of the mysteries about 4578 S. Oakenwald Ave. Somehow, Johnson's house was transferred three times to new owners without anyone noticing he was inside. It's a story involving forged deeds, a corrupt title company and a South Side family that has been under investigation for mortgage fraud.

When Johnson hadn't appeared outside for weeks in early 2006, neighbors called the city's non-emergency number asking for well-being checks, fearing he might have had an accident. Firefighters broke down the front door and searched but didn't locate Johnson. His death remains under investigation.Sure, the thing is worth a few bad jokes at Countrywide's expense, but honestly. If the fire department broke in and searched and didn't find a corpse in 2006, nearly a year before the CFC mortgage was made, you have to wonder when the corpse got put there. As there is evidence that the 2007 purchase with the CFC loan was entirely fraudulent, there's certainly reason to suspect that the body was hidden in the home after the loan was made and the conspirators skipped out with the money. Until we get more information, I'm not inclined to see this as "three transfers without anyone noticing."

But consider it useful evidence that the mortgage mess has gotten bad enough that absolutely any insinuation against lenders, especially Countrywide, is now considered plausible. I'm personally a bit more concerned that certain parties have figured out that foreclosed properties are great places to hide corpses in. Those green pools may not end up being the neighbors' biggest complaint . . .

OFHEO: Widspread House Price Declines in Q4

by Calculated Risk on 2/26/2008 10:36:00 AM

From OFHEO: Widespread House Price Declines in Q4

U.S. home prices fell in the fourth quarter of 2007 according to OFHEO’s seasonally-adjusted purchase-only house price index. The index, which is based on data from home sales, was 1.3 percent lower on a seasonally-adjusted basis in the fourth quarter than in the third quarter of 2007. This decline was substantially greater than the 0.3 percent price decline between the second and third quarters. Over the past year, prices fell 0.3 percent, as the fourth quarter decline erased earlier price gains.OFHEO is finally showing significant price declines. More later ...

...

“The year 2007 showed the first four-quarter decline in the purchase-only index since its earliest data in 1991,” [OFHEO Director James B. Lockhart] added.

... prices declined 0.2 percent in December across the U.S., on average. This is the sixth consecutive monthly decline, bringing the total drop from the April 2007 peak to 2.4 percent.

S&P Case-Shiller: Prices Fall Sharply in Q4 2007

by Calculated Risk on 2/26/2008 09:27:00 AM

S&P Case-Shiller reported that house prices fell sharply in Q4 2007. Click on graph for larger image.

Click on graph for larger image.

The first graph shows the Case-Shiller index since 1987. The index fell to 170.64 in Q4, from 180.31 in Q3. A decline of 5.3%, or over 20% at an annual rate.

This is the lowest level for the index since Q1 2005.  The second graph shows the year-over-year change in the Case-Shiller index.

The second graph shows the year-over-year change in the Case-Shiller index.

Prices fell 8.9% in 2007 according to Case-Shiller.

The index is off 10.2% from the peak.

Existing Home Inventory: Seasonal Pattern

by Calculated Risk on 2/26/2008 12:18:00 AM

The following graph shows the seasonal pattern for existing home inventory. Each year is normalized to 100 at the ending level of the prior year.

The dashed lines are the final boom years (2002, 2003, and 2004) and the solid lines are the bust years (2005, 2006, 2007, and 2008 through January in red).

Actually 2005 was a transition year from boom to bust. The inventory pattern started out looking like a boom year, but then inventory kept building all year; the first clear signal that the housing bubble was over. Click on graph for larger image.

Click on graph for larger image.

During the first few months of each year, there is little difference between the boom and bust seasonal patterns. The main difference happens in the summer when the inventory just keeps building during a housing bust.

For 2008, inventory has already increased 5.4% from the 2007 year end level. Another 10% increase (to the 115 line on the graph) and the inventory will be at a record all time level (the record is 4.561 million in July 2007).

If the inventory increases 25% from year end (at the low end of the housing bust years), then inventory would reach 5 million units, and that would put the "months of sales" over 12 months, at the current sales pace. I expect Months of Supply to be over 12 soon, possibly as early as May or June.

Monday, February 25, 2008

FDIC Bracing for Bank Failures

by Calculated Risk on 2/25/2008 09:49:00 PM

From the WSJ: FDIC Readies for a Rise in Bank Failures (hat tip Peter)

The Federal Deposit Insurance Corp. is taking steps to brace for an increase in failed financial institutions as the nation's housing and credit markets continue to worsen.Frequent contributor FFIDC has mentioned these hiring efforts for months in the comments. I expect quite a few bank failures over the next couple of years, mostly due to bad Construction & Development (C&D) and Commercial Real Estate (CRE) loans.

FDIC spokesman Andrew Gray said the agency was looking to bulk up "for preparedness purposes." ...

The agency, which insures accounts at more than 8,000 financial institutions, is also seeking to hire an outside firm that would help manage mortgages and other assets at insolvent banks, according to a newspaper advertisement.

...

"Regulators are bracing for well over 100 bank failures in the next 12 to 24 months, with concentrations in Rust Belt states like Michigan and Ohio, and the states that are suffering severe housing-market problems like California, Florida, and Georgia," said Jaret Seiberg, Washington policy analyst for financial-services firm Stanford Group.

Look at the concentration of C&D loans in late 2006 (from the FDIC Semiannual Report: Economic Conditions and Emerging Risks in Banking):

Small and mid-size institutions have been increasing their concentrations in riskier assets, such as CRE loans and construction and development (C&D) loans. This suggests that, although small and mid-size institutions have been more successful in limiting the erosion of their nominal NIMs, they have achieved this success in part by assuming higher levels of credit risk.

... continued increases in concentrations and reports of loosened underwriting standards at FDIC-insured institutions signal the potential for future credit quality deterioration. In addition, regulators have noted increasing C&D and overall CRE loanAnd that was in late 2006; C&D and CRE lending really went crazy in 2007.

concentrations, especially at institutions with total assets between $1 billion and $10 billion. Four of six Regional Risk Committees expressed some level of concern about CRE lending, in part due to continuing increases in concentrations.

MBIA Plans to Split, Cuts Dividend, Questions 2007 Results

by Calculated Risk on 2/25/2008 06:17:00 PM

From Bloomberg: MBIA Plans to Split Asset-Backed, Municipal Units

MBIA Inc., ... will separate its municipal unit from the asset-backed securities it guarantees within five years after posting record losses on subprime debt.From MBIA: MBIA Inc. Eliminates Quarterly Dividend

The Armonk, New York-based company will stop writing asset- backed securities guarantees for six months, new Chief Executive Officer Jay Brown said in a letter to shareholders today. Brown also said he has ``questions'' about the company's 2007 preliminary results released last month and hasn't yet signed off the statements.

...

``Everything we are working towards right now is centered on regaining stability,'' Brown said in the letter. ``We can expect a bumpy ride over the coming months and possibly longer.''

MBIA Inc. today announced that its Board of Directors voted to eliminate the quarterly dividend.Split within 5 years? Why even mention it now?

Add: MBIA Issues Letter to Owners (hat tip risk capital)

"Here Comes Another Bubble"

by Calculated Risk on 2/25/2008 05:34:00 PM

This is just for afternoon entertainment and isn't a reflection of Tanta or my views. CR