by Calculated Risk on 12/18/2007 12:27:00 PM

Tuesday, December 18, 2007

CNBC: Goldman's 'horrible' November

From MarketWatch: Goldman's 'horrible' Nov. points to more credit losses: CNBC

... Goldman Sachs ... suffered through a "horrible" November, in a signal that the credit crunch may continue, CNBC reported Tuesday ... the business channel reported that Goldman recently endured the worst two weeks in the company's history.This follows this mornings news: Goldman Sachs again outpaces expectations

Goldman Sachs on Tuesday posted fourth quarter earnings that were well ahead of analyst estimate ... highlighting the firm's ability to manage risk and outride rivals in one of the toughest markets in memory.Goldman's Q4 ended in November, so that included the "horrible" November.

Hey! The Fed's Ready to Regulate!

by Anonymous on 12/18/2007 10:04:00 AM

Only a mere fifteen months after the eagerly-awaited Nontraditional Mortgage Guidance began closing the barn door slowly enough that the entire wretched 2006 subprime and Alt-A loan vintage still managed to get out, the Fed has deemed the time right to take decisive action on mortgage regulation:

Dec. 17 (Bloomberg) -- The Federal Reserve will make it harder for lenders to charge fees for early repayment of subprime mortgages, according to consumer advocates and a regulator.In the real world, it is common practice for tax and insurance escrows to be required on prime loans only when the LTV is greater than 80%; if there's still a lender around who won't waive escrows for lower-LTV loans (usually for an additional 0.25% in points), I haven't heard about it. I can tell you that nobody complains more bitterly than a prime borrower with a low LTV forced to escrow; these are responsible folks who quite rightly consider escrows on a par with excess tax withholding. It is particularly galling when servicer escrow processes, in this day and age of frequent loan servicing transfers and stripped-down operations, are such a mess in so many respects. Escrowing your tax and insurance payments should at least guarantee that you'll never have a policy cancelled or get a late notice from the county assessor, but too many people are finding that not to be the case.

The change will probably be one of several recommendations from the Fed's Board of Governors when it gathers in Washington tomorrow to respond to the collapse in the market for subprime home loans. . . .

Fed staff, with input from policy makers, will propose as many as four new requirements for lenders tomorrow before a Board of Governors meeting scheduled for 10 a.m. They may also set two new standards for disclosure.

The proposal will suggest limiting prepayment penalties for most high-cost loans, while giving lenders some flexibility through several exceptions.

``The consensus seems to be that they are going to do something on no-documentation loans, and they are going to ban prepayment penalties,'' said Brenda Muniz, legislative director in Washington at Acorn, a community advocacy group. ``The devil is in the details,'' she said. There may be several loopholes for lenders, Muniz added.

The staff memorandum will also probably recommend lenders be forced to include property taxes and insurance in monthly payments. They are already included in payments on most prime home loans, which banks make to their best customers. The proposal will also address standards for measuring whether borrowers can afford a loan for the duration of the mortgage, instead of just for an initial period of lower interest rates. . . .

"It is a common practice for these payments to be escrowed in the prime markets, and I see no reason that escrows should not be standard practice in the subprime markets too," Kroszner said in a Nov. 5 address in Washington.

Practically speaking, what changed in the world of the last several years was the explosion of the piggyback loan. Purchase mortgages, especially for first-time homebuyers, that would a few years ago have had high LTVs and mortgage insurance (which is always escrowed), became 80% first mortgages and therefore fell under the escrow waiver rules. So at some level this problem is going to solve itself, as second-lien lenders exit the game and low-down loans have to secure mortgage insurance, which then require escrow accounts. I will be quite interested to see what gets proposed here by the Fed, however, as a rule.

The interesting thing is that the industry never knows what to think about escrow rules. Servicers like them, since in addition to the obvious risk reduction, escrow balances are a profitable source of float. Originators, however, have two important reasons to resist giving up escrow waivers: you lose low-LTV refi business (it's hard to talk a low-LTV borrower into refinancing an existing loan that doesn't require escrows into a new loan that does, if the low-LTV borrower wants to manage her own T&I), and you just can't play qualifying games with stretched borrowers. A high-DTI loan without T&I included in the payment is more than usually likely to fail eventually, but often not until the first or second tax bill comes due. A high-DTI loan with T&I included in the payment is more than usually likely to fail early, while it's in that nasty early default warranty period. So I expect the usual schizoid response from the lobbyists.

One thing that has been a particular problem lately is estimated tax payments--escrowed or just calculated for qualifying purposes--on new construction. A perfectly common slimy origination practice is simply to use the last actual tax bill on the parcel to calculate next year's tax bill, even though a moderately alert cub scout could tell you that as the property was unimproved acreage last year and will be assessed next year with a 3,000 square foot home on it, last year's tax bill is going to be a tiny fraction of what the borrower will actually have to pay. Every underwriter knows this practice is creating loan failure; every loan officer knows this practice is shoe-horning in marginal borrowers who wouldn't meet DTI requirements using sane numbers and hence is a way of keeping the party going.

I certainly wouldn't expect Fed regulations on mortgage escrows to include drilled-down rules on how to calculate taxes on recently improved property. But that's kind of the point: the industry has behaved in such perverse, self-defeating ways lately that you probably do have to actually write legislation including the kind of blindingly obvious rules on tax calculation that underwriter trainees used to master by the end of their first week. If you don't, then these self-defeating practices will continue as long as the industry is structured so that someone profits from it.

There's also the chronic problem of "de minimus" HOA assessments and ground rents. Servicers hate having to manage escrow accounts for HOA assessments of $50 a year, not to mention those $1.00 ground rents. Those things never get escrowed. But that means that the increasing number of loans with quite significant assessments are also going un-escrowed, as servicers just decide not to handle HOA dues across the board. That wasn't a huge problem back when we didn't put first-time homebuyers with no savings into gated communities with an absurd DTI. Now that we do, we're seeing the first foreclosure notice coming from the HOA, not the lender or the tax assessor.

The safe prediction is that as soon as the draft rules are announced, we'll get a press release from the MBA decrying the additional cost of mortgage financing that will result. What with the add-ons from cram-down legislation and prepayment penalty restrictions and eliminating no-docs and ending appraiser-shopping and everything else they've warned us about in dire tones, we can (should we choose to believe them) prepare for 12.00% mortgage rates by about March. Of course, by then your tax bills might actually start dropping a bit, once the assessor gets the new comps . . .

Single Family Starts Fall to Lowest Level Since April 1991

by Calculated Risk on 12/18/2007 08:30:00 AM

The Census Bureau reports on housing Permits, Starts and Completions.

Seasonally adjusted permits fell; permits for single family units fell sharply:

Privately-owned housing units authorized by building permits in November were at a seasonally adjusted annual rate of 1,152,000. This is 1.5 percent below the revised October rate of 1,170,000 and is 24.6 percent below the revised November 2006 estimate of 1,527,000.Starts fell sharply, with starts for single family units at the lowest level since April 1991:

Single-family authorizations in November were at a rate of 764,000; this is 5.6 percent below the October figure of 809,000.

Privately-owned housing starts in November were at a seasonally adjusted annual rate of 1,187,000. This is 3.7 percent below the revised October estimate of 1,232,000, and is 24.2 percent below the revised November 2006 rate of 1,565,000.And Completions declined sharply:

Single-family housing starts in November were at a rate of 829,000; this is 5.4 percent below the October figure of 876,000.

Privately-owned housing completions in November were at a seasonally adjusted annual rate of 1,344,000. This is 4.1 percent below the revised October estimate of 1,402,000 and is 28.7 percent below the revised November 2006 rate of 1,885,000.

Single-family housing completions in November were at a rate of 1,088,000; this is 4.1 percent below the October figure of 1,135,000.

Click on graph for larger image.

Click on graph for larger image.Here is a long term graph of starts and completions. Completions follow starts by about 6 to 7 months.

Look at what is about to happen to completions: Completions were at a 1,344 million rate in November, but are about to follow starts to below the 1.2 million level. I'd expect completions to fall rapidly over the next few months, impacting residential construction employment.

Even with single family starts at the lowest level since the '91 recession, when you look at inventories and new home sales, the builders are still starting too many homes. I expect starts to continue to decline over the next several months.

Greenspan Shrugged

by Calculated Risk on 12/18/2007 12:00:00 AM

From the NY Times: Fed and Regulators Shrugged as the Subprime Crisis Spread. This story offers an opposing perspective to Greenspan's personal exoneration.

Greenspan is no Atlas.

Monday, December 17, 2007

Fitch: FGIC on Rating Watch Negative

by Calculated Risk on 12/17/2007 06:17:00 PM

Press Release: Fitch Places FGIC on Rating Watch Negative After CDO & RMBS Review

Fitch Ratings has placed the following ratings of FGIC Corporation (FGIC Corp.) and subsidiaries Financial Guaranty Insurance Co. (FGIC) and FGIC UK Ltd. on Rating Watch Negative:

FGIC Corp.

--Long-term 'AA';

--$325 million of 6% senior notes due Jan. 15, 2034 'AA'.

Financial Guaranty Insurance Company

FGIC UK Ltd.

--Insurer financial strength 'AAA'.

This action follows the completion of the updated assessment by Fitch into FGIC's current exposure to structured finance collateralized debt obligations (SF CDOs) backed by subprime mortgage collateral and one CDO-Squared deal, as well as FGIC's exposure to residential mortgage-backed securities (RMBS). This review indicates that FGIC's capital adequacy under Fitch's Matrix financial guaranty capital model currently falls below guidelines for an 'AAA' IFS rating by more than $1 billion, due to downgrades by Fitch in a number of FGIC's insured SF CDO's coupled with some deterioration in the company's RMBS portfolio, including second-lien mortgage securitizations.

If within the next four-to-six weeks, FGIC is able to obtain firm capital commitments, and/or put in place reinsurance or other risk mitigation measures in order to meet capital guidelines, Fitch would expect to affirm FGIC's ratings with a Stable Rating Outlook. If FGIC is unable to meet capital guidelines in the noted time frame, Fitch would expect to downgrade FGIC's ratings. In that event, Fitch anticipates downgrading FGIC's IFS rating no lower than one or two notches. FGIC and its investor group have presented plans to Fitch about bolstering FGIC's capital position to support an 'AAA' IFS rating. While the basics of the plan would appear to be sufficient to restore FGIC's 'AAA' rating and Stable Outlook, execution of the plan could be challenged by individual requirements at each of FGIC's primary investors.

Paulson: Let Fannie and Freddie Buy Jumbos

by Calculated Risk on 12/17/2007 03:57:00 PM

From Bloomberg: Paulson Favors Fannie, Freddie Buying Jumbo Mortgages

Paulson said in an interview today that he favors allowing the two companies to purchase so-called jumbo loans, which exceed $417,000. ...

Paulson said he agreed with Federal Reserve Chairman Ben S. Bernanke, who suggested to lawmakers that they consider allowing Fannie Mae and Freddie Mac into the jumbo mortgage market. ``I think Ben Bernanke and I are on the same page,'' Paulson said.

Bernanke indicated in a Nov. 8 hearing that he favored letting Fannie Mae and Freddie Mac buy mortgages of up to $1 million.

ECB Offers Unlimited Funds at Below Market Rates

by Calculated Risk on 12/17/2007 02:54:00 PM

From the Financial Times: ECB steps up liquidity fight

Emergency help for financial markets entered new territory on Monday night as the European Central Bank announced it would on Tuesday offer unlimited funds at below market interest rates in a special operation to head off a year-end liquidity crisis.

The surprise move, which follows last week's co-ordinated barrage of measures by the world's central banks to increase market liquidity, suggests the ECB is still frustrated at the failure to ease market tensions.

NAHB: Builder Confidence Unchanged at Record Low

by Calculated Risk on 12/17/2007 01:11:00 PM

| Click on graph for larger image. The NAHB reports that builder confidence was unchanged at a record low 19 in December. |  |

Builder confidence in the market for new single-family homes remained unchanged for a third consecutive month in December as problems in the mortgage market and excess inventory issues continued, according to the latest NAHB/Wells Fargo Housing Market Index (HMI), released today. The HMI held even at 19 this month, its lowest reading since the series began in January 1985.

“Builders continue to look for signs of improvement in the ongoing mortgage market crisis that is weighing on housing and the overall economy,” said NAHB President Brian Catalde, a home builder from El Segundo, Calif. ...

“Today’s report shows that builders’ views of housing market conditions haven’t changed in the past several months, and there clearly are signs of stabilization in the HMI,” noted NAHB Chief Economist David Seiders. “At this point, many builders are bracing themselves for the winter months when home buying traditionally slows, scaling down their inventories and repositioning themselves for the time when market conditions can support an upswing in building activity – most likely by the second half of 2008.”

...

In December, the index gauging current sales conditions for single-family homes improved by a single point, to 19, and the index gauging sales expectations for the next six months rose two points to 26. Meanwhile, the index gauging traffic of prospective buyers declined three points to 14.

Regionally, the HMI results were mixed in December. The Midwest and South each posted two-point gains in their HMI readings, to 15 and 21, respectively. The West held even at 18, and the Northeast, which experienced wetter weather conditions than normal in the survey period, posted a seven-point decline to 19. All regions were down on a year-over-year basis.

National City Corp. Warns

by Calculated Risk on 12/17/2007 12:30:00 PM

From the WSJ: National City Warns of Loan Losses

National City Corp. expects to set aside about $700 million to cover loan losses in the fourth quarter and said it incurred mortgage-related charges of about $200 million in October and November.Here is the National City SEC filing.

"The mortgage business continues to be under stress," the financial-services company said in a Securities and Exchange Commission filing....

Click on graph for larger image.

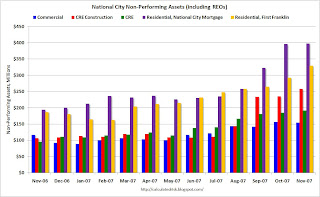

Click on graph for larger image.This graph shows the key nonperforming assets of National City Corp. Residential REO's are including in National City mortgage and First Franklin nonperforming assets.

According to the SEC filing:

Credit quality in the commercial and core consumer portfolios, including direct home equity lending, remains satisfactory. The areas of elevated risk continue to be in the run-off portfolios of First Franklin non-prime mortgages, especially seconds; broker-originated home equity loans and lines of credit associated with the former National Home Equity business; and certain sectors of investment real estate and residential construction. In particular, indirect home equity loans and lines that were transferred to portfolio in the third quarter have shown further deterioration beyond that which was anticipated at the time the September 30 loan loss allowance was established.Look at the graph. Most of the problems are in residential, but the nonperforming CRE (green) and nonperforming CRE construction (red) are definitely climbing.

emphasis added

Moody's Warnings on Monoline Guarantors Impacts $1.2 Trillion Debt

by Calculated Risk on 12/17/2007 10:05:00 AM

From Bloomberg: Moody's Warnings on FGIC, MBIA Cast Doubt on $1.2 Trillion Debt

Moody's Investors Service's warning that the top credit ratings of FGIC Corp. and three other bond insurers may be cut casts doubt on $1.2 trillion of municipal, corporate and asset-backed securities.Does everyone understand the systemic risk? I'm not so sure. This warning puts 89,709 public finance issues on negative watch and probably impacts most communities in the U.S..

...

``Everyone understands the systemic risk if even one of these companies is downgraded,'' said Peter Plaut, an analyst at hedge fund manager Sanno Point Capital Management in New York.