by Calculated Risk on 11/14/2007 08:50:00 AM

Wednesday, November 14, 2007

HSBC: $3.4 billion Writedown, Warns of "Further Deterioration"

From MarketWatch: HSBC to take $3.4 billion charge over U.S. losses

HSBC Holdings on Wednesday ... it's taking a $3.4 billion loan-impairment charge in its U.S. consumer finance business during the third quarter, which it said was $1.4 billion higher than would have been implied by extrapolating first-half trends.From AP: HSBC mortgage takes $3.4B charge in US (hat tip Keith)

...

"I think the thing that's emerged in the third quarter is that the housing market deterioration is beginning to have a broader impact, both within the market and beginning to extend into other areas," said Douglas Flint, group finance director, in a prepared interview.

HSBC warned that the subprime crisis could deepen and said further volatility as a result of the credit crunch was "more than a remote possibility"The confessional is busy this morning.

"There is the probability of further deterioration if the current housing market distress continues and further impacts the broader economy," the company said.

Countrywide Commercial Real Estate Loan Pipeline

by Calculated Risk on 11/14/2007 12:48:00 AM

In the Countrywide 8-K SEC filing Tuesday was a table that included the company's commercial real estate loan pipeline (hat tip idoc). Click on graph for larger image.

Click on graph for larger image.

In October, Countrywide had $752 Million commercial real estate loans in their pipeline, compared to $1,824 million last October and $1,323 million in September.

This is more evidence that the CRE boom is over.

Tuesday, November 13, 2007

Percent Owner Occupied Households With Mortgages

by Calculated Risk on 11/13/2007 08:29:00 PM

NOTE: See next post for context for this data.

Some useful data from the 2006 American Community Survey

B25097. MORTGAGE STATUS BY MEDIAN VALUE (DOLLARS) - Universe: OWNER-OCCUPIED HOUSING UNITS

United States | ||

Estimate | Margin of Error | |

Median value -- |

|

|

Total: | 185,200 | +/-489 |

Median value for units with a mortgage | 208,000 | +/-379 |

Median value for units without a mortgage | 140,400 | +/-549 |

B25096. MORTGAGE STATUS BY VALUE - Universe: OWNER-OCCUPIED HOUSING UNITS

United States | ||

Estimate | Margin of Error | |

Total: | 75,086,485 | +/-218,471 |

With a mortgage: | 51,234,170 | +/-153,174 |

Less than $50,000 | 2,242,784 | +/-23,231 |

$50,000 to $99,999 | 7,002,253 | +/-48,064 |

$100,000 to $149,999 | 8,245,296 | +/-49,068 |

$150,000 to $199,999 | 7,219,252 | +/-44,875 |

$200,000 to $299,999 | 8,898,887 | +/-41,910 |

$300,000 to $499,999 | 9,785,782 | +/-43,282 |

$500,000 or more | 7,839,916 | +/-38,531 |

Not mortgaged: | 23,852,315 | +/-87,013 |

Less than $50,000 | 3,840,853 | +/-30,480 |

$50,000 to $99,999 | 4,972,827 | +/-33,618 |

$100,000 to $149,999 | 3,773,919 | +/-28,801 |

$150,000 to $199,999 | 2,857,034 | +/-23,712 |

$200,000 to $299,999 | 3,025,977 | +/-23,331 |

$300,000 to $499,999 | 2,942,344 | +/-22,828 |

$500,000 or more | 2,439,361 | +/-17,432 |

Bloomberg's Berry: No Recession

by Calculated Risk on 11/13/2007 06:43:00 PM

From Bloomberg: Consumer Spending Won't Fall and Cause Recession: John M. Berry. An excerpt on the impact of declining homeowners' equity:

Some analysts argue that falling home prices are wiping out a chunk of owners' equity and limiting their ability to borrow against it. In addition, having less equity will depress owners' willingness to spend on consumption, they say.First, a typo correction in Berry's piece. According to the Fed's Flow of Funds report, the value of household real estate was

Again, there is some truth to both those points, though it's not clear how much.

While homeowners' equity has begun to fall and is likely to continue doing so for some time, there are still huge paper gains in place from previous years.

For example, the Federal Reserve's most recent Flow of Funds report said that at the end of the second quarter owners' equity was $18.85 trillion. That was still almost $40 billion more than at the end of last year and $1.56 trillion more than at the end of 2004.

...

So homeowners can still borrow to supplement their current income even though it may be more difficult and somewhat more expensive.

Berry notes correctly that homeowner equity has started to decline, and will decline further in the future. But then he argues that "there are still huge paper gains in place" that homeowners can continue to borrow against.

Really? Are there huge gains that homeowners can borrow against to supplement their incomes?

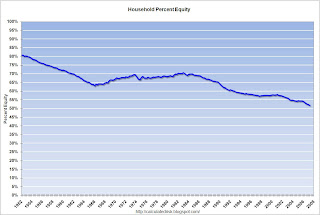

Click on graph for larger image.

Click on graph for larger image.This graph shows the percent of homeowner equity for the last 50 years. Although the percent of homeowner equity was at a record low of 51.7% at the end of Q2 2007, that still sounds pretty good ... at least until you realize that about 1/3 of all owner occupied households have no mortgage debt (their homes are paid off).

You can't do a direct subtraction because the value of these paid-off homes is, on average, lower than the mortgaged 2/3. But it is unreasonable to expect these more risk-averse homeowners will suddenly change their habits and start borrowing against their homes.

So, although there have been gains, there is a real question of much more the already leveraged homeowners can borrow against their equity.

The second graph shows the Federal Reserve's estimate of household assets and mortgage debt as a percent of GDP.

The second graph shows the Federal Reserve's estimate of household assets and mortgage debt as a percent of GDP.With falling house prices, the value of household assets will probably fall significantly as a percent of GDP. Yet Berry appears to be arguing that mortgage debt, as a percent of GDP, will continue to increase. And remember that 1/3 of owner occupied households have no mortgage debt.

Although there are several unknowns, if assets fell to 120% of GDP, it is hard to conceive of mortgage debt growing faster than GDP - even staying even with GDP would imply that the mortgaged 2/3 would owe something like 80% of the value of their homes - unlikely.

On this point, I think Berry is wrong. Sure, some homeowners will be able to supplement their incomes by borrowing against their homes, but I think in the aggregate this borrowing will slow significantly over the next few quarters.

Pending Home Sales Flat in September

by Calculated Risk on 11/13/2007 03:03:00 PM

From the National Association of Realtors: Modest Recovery for Existing-Home Sales in 2008 as Credit Crunch Subsides

The Pending Home Sales Index, a forward-looking indicator based on contracts signed in September, rose 0.2 percent to a reading of 85.7 from an index of 85.5 in August. It was 20.4 percent lower than the September 2006 level of 107.6.Here is the NAR Pending Home Sales data.

And here is the NAR forecast:

Existing-home sales are projected at 5.67 million this year, edging up to 5.69 million in 2008, in comparison with 6.48 million in 2006 which was the third highest year on record. Existing-home prices are expected to decline 1.7 percent to a median of $218,200 for all of this year and hold essentially even in 2008 at $218,300.Another downward revision (a monthly ritual for the NAR), but they are getting closer with only one more downward revision scheduled for December. The NAR price forecast is a complete joke too.

Note that Pending Home Sales lead existing home sales by about 45 days. So this September report is partially for October sales and partially for November. The 6.5% decline in August Pending Home sales will also impact the October existing home sales report (due on Nov 28th).

JPMorgan: SIVs have No Business Purpose

by Calculated Risk on 11/13/2007 02:05:00 PM

Quote of the day from Bloomberg: JPMorgan's Dimon Says SIVs Will `Go the Way of the Dinosaur'

"SIVs don't have a business purpose."

Jamie Dimon, JPMorgan Chase & Co. CEO, Nov 13, 2007

Hot Potato

by Anonymous on 11/13/2007 11:55:00 AM

From Triad's 10-K (thanks, Clyde):

On November 5, 2007, American Home Mortgage Investment Corp. and American Home Mortgage Servicing, Inc. filed a complaint against Triad Guaranty Insurance Corp. in the U.S. Bankruptcy Court for the District of Delaware. The plaintiffs are debtors and debtors in possession in Chapter 11 cases pending in the U.S. Bankruptcy Court. The lawsuit is an action for breach of contract and declaratory judgment. The basis for the complaint’s breach of contract action is the cancellation by us of our certification of American Home Mortgage’s coverage on 14 loans due to irregularities that we allegedly uncovered following the submission of claims for payment and that existed when American Home Mortgage originated the loans. The complaint alleges that our actions caused American Home Mortgage to suffer a combined net loss of not less than $1,132,105.51 and seeks monetary damages and a declaratory judgment. We expect to rescind additional loans originated by American Home Mortgage and we intend to contest the lawsuit vigorously.Something to keep in mind: these days a lot of mortgage insurance works on the same "representation and warranty" business that everything else in mortgage-land does. The insurer does not necessarily or even usually underwrite the loan file itself prior to issuing a certificate; it "delegates" this to the lender. However, that means that the insurer can refuse to pay if it believes that the lender knew or should have known that the loan did not meet the insurer's requirements. The insurer generally doesn't find this out unless 1) the file is subject to routine QC audit or 2) the worst happens and a claim is filed.

So it's another episode of Finding Out Later, and the MIs don't want to hold the bag for it.

BofA: $3 Billion in CDO mark-downs

by Calculated Risk on 11/13/2007 11:35:00 AM

From John Spence at MarketWatch: Bank of America sees $3 bln in CDO mark-downs

Bank of America ... said it's currently estimating a $3 billion pretax charge in the fourth quarter to mark down collateralized debt obligations, or CDOs.

...

"As market conditions change and possibly worsen there could be additional diminution in value," [Chief Financial Officer Joe Price] warned.

Home Builders: To Build or Not to Build

by Calculated Risk on 11/13/2007 10:11:00 AM

The WSJ has an article today, Home Builders Opt for Mothballing, that starts with Lennar's decision to halt work on projects in Orange County, CA.

The WSJ article discusses an important point that we've discussed before. Many of the home builders are stuck with too much land and too much debt. They can't sell the raw land, so they keep building - and selling at a discount - to service their debt.

One alternative would be for builders to sell their land instead, but that market is even more dismal than the one for housing. Recent land transactions in California, Phoenix and Southeast Florida, while few in number, have fetched discounts of 70% and 80% on finished lots, according to Zelman & Associates, an independent housing research firm.To build or not to build: that is the question.

...

Some builders don't have the luxury of waiting for a brighter day. The more highly leveraged companies are slashing prices to move inventory to generate cash and pay down debt. This fall, builder Hovnanian Enterprises Inc., based in Red Bank, N.J., offered discounts on homes of as much as 30%, while Standard Pacific Corp., of Irvine, Calif., has been offering discounts and other incentives of as much as 25% on certain homes.

...

"Many builders are stuck between a rock and hard place," says Jonathan Dienhart, director of published research at Hanley Wood Market Intelligence, a housing research firm in Costa Mesa, Calif. "They can't make money by building, and they can't make money by not building. They have to choose the lesser of two evils."

I suspect there is no right answer for some.

Countrywide AVMs

by Anonymous on 11/13/2007 08:43:00 AM

Countrywide's October operations numbers are out. You can see the score here.

The financial press will report on the headline numbers (loan production down year over year, no kidding!). I confess that this little thing down in "Loan Closing Services" caught my eye: AVM (automated valuation of a mortgaged property) services for October: 5,793,171 units. For context purposes, CFC's entire $1.4 trillion servicing portfolio is 8,999,292 units. AVM volume for October 2006 was 539,126 units, and was only 6,743,360 units for the first three quarters of 2006. This is reported under "loan closing services," but quite obviously not all these AVMs are being run for newly closed or closing loans.

So, is CFC running AVMs on everything it owns and showing those as "production" of its loan closing services division? Or, is CFC selling AVM services to some other big portfolio?

Why should anyone care? I don't know . . . there's been some stuff in the news lately about lawsuits and inflated appraisals . . . I'd sure love to know whether somebody is busy getting a AVM on every loan it's exposed to . . .