by Calculated Risk on 10/05/2007 12:37:00 PM

Friday, October 05, 2007

Homebuilders Struggle to Survive

From Bloomberg: Homebuilders Liquidate Assets as Threat to Survival Spurs Sales (hat tip Jim)

``It's desperation time and some companies may not make it,'' said Alex Barron, an industry analyst at Agency Trading Group Inc. in Wayzata, Minnesota. ``At this point in the housing cycle, if you have too much debt, it's hard to get out from under it.''We could make fun of the analysts that claimed the homebuilders would have strong cash flow during a downturn (due to less investment in land and improvements) and that the homebuilders were "land banks". Those investment ideas were Dumb and Dumber!

...

``They are all losing money,'' [John Burns, president of John Burns Real Estate Consulting] said.

...

The 15 largest homebuilders are saddled with $7.75 billion in debt due to be repaid through 2009 and the companies' bonds trade as if they were junk ...

The five biggest homebuilders by revenue -- Lennar, D.R. Horton, Pulte, Centex and KB Home -- wrote off a combined $3.3 billion in the third quarter on land they own and will not build on or options to buy land they are choosing not to exercise.

But the more important point is that the homebuilders struggle to survive shows why the builders are still overbuilding. Building homes, and selling at a deep discount, is the only way they can liquidate land to raise cash and pay down their debts in the current environment. This is why housing starts are still too high and will likely fall further over the next few quarters.

WaMu Visits the Confessional

by Calculated Risk on 10/05/2007 09:08:00 AM

From Bloomberg: Washington Mutual Says Third-Quarter Profit Fell 75%

Washington Mutual Inc., the biggest U.S. savings and loan, said third-quarter net income fell about 75 percent because of "a weakening housing market and disruptions in the secondary market."Added: Merrill Lynch Says Credit Market Conditions to Adversely Impact Third Quarter 2007 Results

Loan loss provisions total about $975 million and losses and writedowns on mortgage loans and securities amount to $410 million, the Seattle-based company said in a statement today.

Merrill Lynch & Co., Inc. today announced that challenging credit market conditions will have an adverse impact on its net earnings for the third quarter. The company expects to report a net loss per diluted share ... resulting from significant negative mark-to-market adjustments to its positions in two specific asset classes: collateralized debt obligations (CDOs) and sub-prime mortgages; and leveraged finance commitments.There appears to be a line at the confessional, also from Bloomberg: JPMorgan, Bank of America May Write Down Buyout Loans

...

The primary drivers of the FICC net losses in the third quarter were as follows:* Write-downs of an estimated $4.5 billion, net of hedges, related to incremental third quarter market impact on the value of CDOs and sub-prime mortgages. These valuation adjustments reflect in part significant dislocations in the highest-rated tranches of these securities which were affected by an unprecedented move in credit spreads and a lack of market liquidity in these securities, which intensified during the third quarter. During the quarter, the company significantly reduced its overall exposure to these asset classes.

* Write-downs of an estimated $967 million on a gross basis, and $463 million net of related underwriting fees, related to all corporate and financial sponsor, non-investment grade lending commitments, regardless of the expected timing of funding or closing. These commitments totaled $31 billion at the end of the third quarter of 2007, a net reduction of 42% from $53 billion at the end of the second quarter. The net losses related to these commitments were limited through aggressive and effective risk management, including disciplined and selective underwriting and exposure reductions through syndication, sales and transaction restructurings.

JPMorgan Chase & Co. and Bank of America Corp., the biggest arrangers of U.S. leveraged loans, may have combined markdowns of $3 billion in the third quarter ...These possible writedowns are because of LBO related pier loans.

September Employment Report

by Calculated Risk on 10/05/2007 08:46:00 AM

From MarketWatch: Job growth rebounds to 110,000 in September

Nonfarm payrolls rose by 110,000 in September, including 73,000 in the private sector, very close to expectations of 113,000 total payrolls.Here is the BLS report. Note that the decline in employment in August has been revised away. The unemployment rate increased slightly again and is now at 4.7%.

Payroll growth in July and August was revised higher by 118,000, the government said. Instead of falling by 4,000 in August, payrolls rose 89,000 after revisions. The unemployment rate ticked up to 4.7%, the highest in a year. ...

The annual benchmark revision will lower the level of employment by an estimated 297,000 as of March 2007. ... The actual revision occurs in February, but a preliminary estimate is given in October.

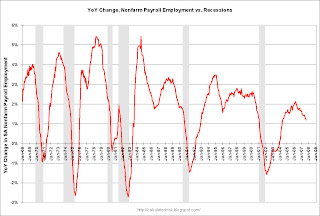

Click on graph for larger image.

Click on graph for larger image.This graph shows the year-over-year change in nonfarm employment. This shows the weak - but not recessionary - job growth over the last year.

Residential construction employment declined 20,000 in September, and including downward revisions to previous months, is down 191.5 thousand, or about 5.6%, from the peak in March 2006. (compare to housing starts off 30%+).

Note the scale doesn't start from zero: this is to better show the change in employment.

The initial benchmark revision shows the loss of an additional 8,000 construction jobs, but the initial report doesn't breakout residential construction.

Overall this is a stronger than expected report. Even the projected downward revision (that will be included in the January report) is smaller than expected.

Excellent Hedge, There, But Your Tie is Ugly

by Anonymous on 10/05/2007 08:45:00 AM

Because we really needed to know that 47% of you think a professional opinion about cycling vs. jogging or miniblinds vs. drapes or mary janes vs. t-straps is of more value to you than a professional opinion about stocks vs. bonds.

According to the Securities Industry and Financial Markets Association:

Washington, D.C., October 3, 2007 – A majority of adults (53%) would choose to receive financial advice over that of a personal trainer, interior designer or fashion consultant if given the opportunity, according to the findings of a recent survey conducted on behalf of the Securities Industry and Financial Markets Association (SIFMA).Should you for some reason really care, the question was "If you could have a free consultation session with an expert, which would you choose?" The responses were:

Financial Advisor: 53%

Personal Trainer: 23%

Interior Designer: 9%

Fashion/Style Consultant: 6%

Don't Know: 8%

We have certainly managed successfully to redefine the term "expert." I for one see great opportunities for financial advisors who also offer personal training services. If you could discuss portfolio allocation while teaching yoga--good morning, CR!--you could make a fortune. (I, whose interior design has been described as "presence of the usual items of furniture" and whose fashion has been described as "clothed and shod" and whose major form of aerobic exercise is typing, am angling for the "don't know" crowd.)

Homeowners "Too Broke to Sell"

by Calculated Risk on 10/05/2007 12:00:00 AM

From the Chicago Tribune: Here's a new one: Being too broke to sell

A survey of mortgage brokers suggests that one in three consumers who recently signed purchase contracts canceled in August -- up from just 4 percent three years ago, according to the research firm that conducted the survey for Inside Mortgage Finance, a trade journal.Actually this isn't "new"; if the seller is making the payments - and can afford the payments - the lender won't do a short sale. The only way out is for the seller to bring cash to the closing. I wrote about this in March: Escrow to Seller: "Bring Money". Tanta called this "making your downpayment after the fact."

The cancellation rate undoubtedly was fed by two scenarios playing out: Many buyers couldn't get mortgage approval because lending suddenly tightened; or, financially strained lenders yanked funding from their borrowers at the last minute.

But another factor was at work: Sellers -- not buyers -- were in trouble as their closing dates neared.

"Our office had four sales in one week that failed to close because the seller didn't have the cash," said the real estate agent, who declined to be identified because she feared office repercussions.

Thursday, October 04, 2007

More Moody's Subprime Data

by Anonymous on 10/04/2007 05:50:00 PM

As a follow-up to CR's post below, here's a chart from the Moody's report, "Subprime Mortgage Market Update: September 2007," released yesterday.

Note that this chart calculates delinquencies as a percent of the original security balance, so these numbers may not match other delinquency measures you have seen reported that are based on current security balances.

And what seems to be driving 2006 and 2007 delinquencies?

The data show that, as we have noted in previous communications, loan performance for the 2006 subprime vintage seems to be driven primarily by the proportions of stated documentation loans and high CLTV loans backing the transactions as well as the proportion of loans that combine (or "layer") these risk characteristics. (Stated documentation loans are those loans for which the borrower's income and assets are not verified by documentation during the loan approval process and therefore are more likely to be overstated.) Interestingly, FICO scores and LTV ratios do not vary significantly between the strongest and weakest performing transactions and on average transaction performance does not appear to have been influenced by these characteristics.

Proposals to Stop Foreclosure

by Calculated Risk on 10/04/2007 04:34:00 PM

From Bloomberg: Subprime Borrowers' Payments Should Be Fixed, FDIC's Bair Says (hat tip Brian)

Federal Deposit Insurance Corp. Chairman Sheila Bair called for payments on most subprime mortgages to be fixed at current levels.And from Congress: (hat tip NYT junkie)

Lenders should extend "teaser" rates on all subprime adjustable-rate mortgages if the borrowers haven't missed any payments and they live in the homes, Bair said today in New York. Modifying loans on a case-by-case basis and fixing rates for limited periods won't avert enough foreclosures, she said.

House: "Miller and Rep. Linda Sánchez Introduce Legislation to Protect Consumers in Financial Distress from Losing Their Homes"

Senate: Durbin Introduces Bill to Help Hundreds of Thousands of Homeowners Avoid Foreclosure

To help families save their homes, the Durbin bill would:And from Sentor Specter: Specter Introduces Bill To Combat Home Mortgage Crisis

* Eliminate a provision of the bankruptcy law that prohibits modifications to mortgage loans on the debtor’s primary residence, so that primary mortgages are treated the same as vacation homes and family farms.

* Extend the time frame debtors are allowed for repayment, to support long-term mortgage restructuring.

* Waive the bankruptcy counseling requirement for families whose houses are already scheduled for foreclosure sale, so that precious time is not lost as families fight to save their homes.

To further help families get back on their feet financially as they go through bankruptcy, the bill would also:

* Combat excessive fees that are sometimes charged to debtors in bankruptcy.

* Maintain debtors’ legal claims against predatory lenders while in bankruptcy.

* Reinforce that bankruptcy judges can rule on core issues rather than deferring to arbitration.

* Enact a higher homestead floor for homeowners over the age of 55, to help older homeowners who are fighting to keep their homes as they go through bankruptcy but live in states with low homestead floors.

* Reinforce that consumer protection claims are still available in bankruptcy.

And there is a growing backlash against the bailout proposals, from CNNMoney Subprime: Bailout backlash

But judging from the hundreds of reader responses CNNMoney.com has received in recent weeks, "foreclosure prevention" sounds a lot like "bailout" to many Americans, and they don't like it one bit.Who is this "everyone"? I support no income taxes on debt forgiveness on the purchase debt (or equal amount if the homeowner refi'd), but for homeowners that borrowed money on their home - tax free using their home as an ATM - shouldn't they be liable for the taxes on that forgiven debt? What a mess.

...

Joseph Mason, an associate professor of finance at Drexel University and a senior fellow at Wharton, argues in a research paper released Wednesday that proposed remedies could actually make things worse and even that troubled borrowers have gotten some benefit from their loans.

...

One proposal seems to be garnering support from everyone: exempting homeowners who foreclose or otherwise have some of their mortgage debt forgiven from having to pay income tax on the forgiven amount.

Note: Say someone bought a house with a $200K first, and then loses the house in foreclosure. I don't think there should be any tax consequences. But if they borrowed an additional $50K tax free (now owe $250K) and then lose their home in foreclosure, I think they should be liable for taxes on the additional $50K.

FDIC Closes Ohio Bank

by Calculated Risk on 10/04/2007 03:58:00 PM

From MarketWatch: Citizens Banking Co. takes on Miami Valley deposits (hat tip REBear)

The Citizens Banking Company of Sandusky, Ohio, got federal approval to take over the insured deposits of the failed Miami Valley Bank on Thursday, a U.S. banking regulator announced.FDIC link is here.

The Ohio Superintendent of Financial Institutions' closure of Miami Valley, which had $86.7 million in total assets and $76 million in total deposits, marks the third FDIC-insured bank to fail this year.

Moody's: Subprime Delinquencies Accelerating

by Calculated Risk on 10/04/2007 03:04:00 PM

From Bloomberg: Subprime Delinquencies Accelerating, Moody's Says (hat tip Brian)

Subprime mortgage bonds created in the first half of 2007 contain loans that are going delinquent at the fastest rate ever, according to Moody's Investors Service.

The average rate of "serious loan delinquencies" in the bonds has been higher than 2006 bonds ...

"It is shocking what you see," said Kyle Bass of Hayman Advisors LP, a Dallas-based hedge fund that reported a 400 percent return on its bet the U.S. housing market would fall. "Anything securitized in 2007 has got to have the worst collateral performance of any trust I've seen in my life."

Office Space: Rents Still Rising, Absorption Slows

by Calculated Risk on 10/04/2007 10:35:00 AM

From the WSJ: Rent Growth Slows a Bit In Sluggish Office Market

... the three-and-a-half year old office recovery is still under way, if showing signs of weakness. The vacancy rate hit its lowest level in six years, dropping to 12.5% in the third quarter from 12.7% in the second quarter, though the pace of absorption -- the change in the total amount of space leased nationwide -- slowed. Absorption totaled 14.8 million square feet in the third quarter compared to 17.3 million in the second.For my area - Orange County, CA - Jon Lansner of the O.C. Register notes: O.C. office vacancies soar

"There is a slowdown," said Barry M. Gosin, chief executive of Newmark Knight Frank, a New York-based commercial real-estate services firm.

Third-quarter data from commercial real estate brokers show that renting O.C. office space has gotten suddenly easier. Why? New buildings and shuttered mortgage makers add to supply. As a result, the countywide vacancy rate ... rose to 10.9% in the last quarter vs. an average of 7.1% a year ago.