by Calculated Risk on 8/29/2007 12:05:00 PM

Wednesday, August 29, 2007

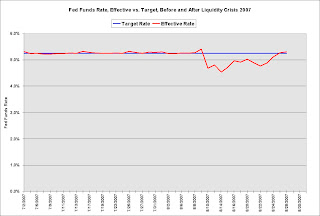

Effective Fed Funds Rate

For about two weeks this month, the Fed allowed the effective Fed Funds rate to drift below the target rate. The effective rate is now back to the target rate. Click on graph for larger image.

Click on graph for larger image.

These two graphs compare the effective Fed Funds rate vs. the target rate for the recent liquidity crisis, and for 9/11/2001.

The scales are the same on both graphs (2 months and 0% to 6% on the y-axis). Although the effective rate was allowed to stay below the target rate for almost two weeks during the liquidity crisis, the difference between the effective and target rates was small when compared to 9/11.

Although the effective rate was allowed to stay below the target rate for almost two weeks during the liquidity crisis, the difference between the effective and target rates was small when compared to 9/11.

Some people have suggested this has been a "stealth" rate cut by the Fed. If it was, it is over.

Note: According to Fed President Poole, the Fed will only cut rates in September if there is clear evidence that the economy is slowing (looking at employment, retail sales and industrial production). Right now the market expectations for a Fed rate cut in September are pretty high (see Cleveland Fed: Fed Funds Rate Predictions).

This does raise the question: Is the worst of the liquidity crisis over? Note: it is important to distinguish between the ongoing credit crunch and the recent liquidity crisis. The credit crunch is far from over.

Weiling About Modifications, Again

by Anonymous on 8/29/2007 11:02:00 AM

Bloomberg's Jonathan Weil is a menace to society.

Last time I bothered to read any of his hysterical Emily Latella-style ravings on the subject, he was completely missing the point about the accounting rules involved in the "modification problem," but making up for his ignorance in inflammatory rhetoric.

He's at it again.

Aug. 29 (Bloomberg) -- It's bad enough when a company's outside auditor is a pushover for management. Equally galling would be for the auditor to try telling management how to run the company. Yet that's what U.S. Senator Charles Schumer has asked the Big Four accounting firms to do at the subprime lenders they audit, pronto.Schumer, just like the SEC, is telling auditors that they should stop telling their clients that accounting rules forbid modifications of defaulting and soon-to-default loans in securitizations, because the SEC and FASB have determined that this does not violate accounting rules.

``One of the most promising solutions to the anticipated foreclosure crisis is the voluntary modification by lenders of existing unsustainable subprime loans,'' Schumer, a New York Democrat, said in an Aug. 23 letter to the firms' top executives.

The chairman of Congress's Joint Economic Committee then called on the firms to ``assist this country's mortgage crisis'' and ``urge your clients to do their part to keep our housing markets afloat, by modifying subprime loans that are at risk of default.''

In so doing, Subprime Chuck made a blithering fool of himself, though he probably doesn't realize why.

Weil then spends much ink assuming that we're talking about lenders' balance sheet loans, and waxing horrified over the idea that an accounting firm might give advice about accounting rules. It all ends up involving apple pie, somehow.

I have no idea why Weil is so spastic on the subject of accounting rules. Maybe he had a mean accounting teacher in the fourth grade who scarred him for life. But of all the criticisms of Schumer I've heard recently, I must say this is the most clearly lunatic.

IndyMac Hires Retail Loan Officers

by Anonymous on 8/29/2007 10:00:00 AM

From Bloomberg via NYT:

One mortgage lender announced that it was hiring yesterday as it tried to take advantage of the turmoil in the market, while another said it was cutting jobs.Why is this interesting? Well, I have no idea whether Indy's approach is going to work here. My own experience is that changing the corporate culture of "acquired" origination offices is always harder than people think it's going to be. And there seem to be some questions about some of the culture at some American Home Mortgage offices.

IndyMac Bancorp said it had hired more than 600 former employees of the American Home Mortgage Investment Corporation and might hire 250 more.

IndyMac will also assume the leases on more than 90 offices where the employees worked.

Last month, IndyMac eliminated 400 back-office processing jobs, about 4 percent of the work force.

That said, my own argument for years uncounted has been that wholesale origination models--loans originated by brokers who have no capital in the game and are not under the control of the lenders--are a large part of the problem we have been experiencing. Wholesale lending always looks cheap, since you don't have to pay loan officers and assume brick and mortar overhead in down cycles of the business. But it always ends up expensive, what with fraud, sloppiness, price-gouging, lack of warranties, and so on.

So it's encouraging, on one hand, to see IndyMac beefing up its retail origination capacity at the expense of its wholesale and correspondent capacity. On the other hand, I'd be looking for some real serious discipline from Indy were I a regulator, and I'd be rather cautious about valuing these "acquisitions" were I an investor. I'd further be mildly concerned about laying off the back office indiscriminately. It doesn't seem like a good time to short the risk-management side and beef up the sales side to me, so I'd want to know just what back office jobs got eliminated.

MMI: The Answer Is Blowing In the Wind

by Anonymous on 8/29/2007 08:42:00 AM

It appears that Barack Obama has had the gall to suggest funding homeowner bailouts with fines from predatory lenders instead of the taxpayer's dime. You know what that means:

The proposal is among the most radical yet from a leading Democrat and comes as Washington tries to respond to a growing wave of foreclosures and a crisis in credit markets.Yeah, too crazy. Just like that tobacco settlement thing . . . totally radical. Next thing you know they'll be playing the Internationale on the Senate floor.

Fear not, lovers of that which is not radical: the Maestro has blown in/been blown in/benefitted from the blow in/blown it/whatever:

The ill winds blowing out of Wall Street could have one well-known beneficiary: Alan Greenspan. The credit crunch of the last few weeks has put the former Fed chairman back in the news. Some pundits have suggested that Greenspan would have responded more energetically than Ben Bernanke has, while others have charged that Greenspan bears much of the blame for the market troubles because of the cheap-money policies implemented during his tenure. Just in time to take advantage of this buzz comes Greenspan's book, The Age of Turbulence: Adventures in a New World, which hits the stores on Sept. 17.If you need me on September 17, I'll be at Barnes and Noble buying a copy of Zen and the Art of Motorcycle Maintenance.

Tuesday, August 28, 2007

"Delusional Borrowers" and Reality Checks

by Anonymous on 8/28/2007 07:32:00 PM

One of the things we've noticed--not to say beaten like a dead horse from time to time--is that in the last several years a lot of people who aren't very good money managers got much bigger loans that they could reasonably be expected to carry. A lot of people are out for the blood of these borrowers, demanding that they be "punished" for having done something powerfully dumb.

I am often reminded of this little gem, "Unskilled and Unaware of It: How Difficulties in Recognizing One's Own Incompetence Lead to Inflated Self-Assessments," by Justin Kruger and David Dunning. They argue:

People tend to hold overly favorable views of their abilities in many social and intellectual domains. The authors suggest that this overestimation occurs, in part, because people who are unskilled in these domains suffer a dual burden: Not only do these people reach erroneous conclusions and make unfortunate choices, but their incompetence robs them of the metacognitive ability to realize it. Across 4 studies, the authors found that participants scoring in the bottom quartile on tests of humor, grammar, and logic grossly overestimated their test performance and ability. Although their test scores put them in the 12th percentile, they estimated themselves to be in the 62nd. Several analyses linked this miscalibration to deficits in metacognitive skill, or the capacity to distinguish accuracy from error. Paradoxically, improving the skills of participants, and thus increasing their metacognitive competence, helped them recognize the limitations of their abilities.I remain convinced that there's something wrong with blaming the financially inept for not realizing that they are financially inept, when those who are supposed to be financially ept--loan officers, brokers, financial counselors, advice columnists in business publications--spent the last several years refusing to tell them that they were financially inept.

Of course people who are in over their heads are surprised. They lacked the skills necessary to understand what "over their heads" might mean.

Mortgage Broker Gets Two Years for Stated Income Fraud

by Calculated Risk on 8/28/2007 05:39:00 PM

From Newsday: Ex-American Home Mortgage manager going to prison

A U.S. District Court in Alaska Monday sentenced a former American Home Mortgage branch manager to serve more than 2 years in prison ... in connection with wire fraud charges after he falsified documentation to secure "stated income" mortgage loans from American Home and Countrywide Financial.Back in March, Tanta pointed out that there are two types of mortgage fraud: “Fraud for Housing” and “Fraud for Profit.”

...

In the American Home case, Partow, 41, helped a client refinance his home in 2006. Despite the client having provided accurate information about his income, Partow listed the income as $20,000 per month -- "an amount that significantly overstated [the client's] true income," according to Partow's plea agreement.

In the Countrywide case, he admitted to knowingly overstating an applicant's income to qualify the client for a loan in April 2004.

...

By misstating applicants' financial statuses, Partow enabled them to qualify for loans they might not otherwise have gotten.

In this case, it appears the mortgage broker overstated the borrower's income without the borrower's knowledge. So this would be a fraud for profit scheme, and I expect to see many more prosecutions of this type soon. If the borrower had overstated their own income, the borrower would probably not be prosecuted. Prosecuting fraud for housing usually isn't worth the effort, and it is difficult to distinguish between whether the borrower was committing "fraud for housing", or if the borrower was just overly optimistic (i.e. delusional) about the potential income from that side job cutting lawns.

I recommend reading Tanta's piece on mortgage fraud: Unwinding the Fraud for Bubbles

Countrywide 8-K SEC Filing on BofA Investment

by Calculated Risk on 8/28/2007 05:30:00 PM

Here is the Countrywide 8-K filing regarding the BofA investment.

The Convertible Preferred Securities are convertible at the option of the holders, at any time or from time to time, into a number of shares of common stock equal to the Liquidation Preference of the Convertible Preferred Securities being converted, divided by the Conversion Price (as defined below), plus cash in an amount equal to any accumulated and unpaid dividends on such securities. The "Conversion Price" of the Convertible Preferred Securities is $18.00 per share, subject to customary adjustments.Note: this is NOT a floorless convertible.

Another Tidbit on Refis

by Anonymous on 8/28/2007 04:39:00 PM

Here's another little bit of data to fit into the big picture on refinances. It doesn't solve any problems or prove anything conclusively. It's from a Countrywide Capital Markets newsletter that I get (not on the web, I'm afraid.)

What this means is that, of the refinances into a 30-year fixed-rate conforming loan that Countrywide did in the six months prior to December 2005, 3.2% were borrowers refinancing out of an Option ARM. By June 2007, the number had increased to 11.4%.

At the same time, the percent of new FRM refis that were originally subprime seems to be slowing down.

This suggests that the number of subprime borrowers who can refinance into a conforming fixed is decreasing as we get toward a "residual" pool of subprime loans that either do not qualify for a 30-year fixed or whose monthly payment cannot be lowered with one.

Blight Follows Foreclosures

by Calculated Risk on 8/28/2007 01:22:00 PM

From David Streitfeld at the LA Times: Blight moves in after foreclosures

Houses abandoned to foreclosure are beginning to breed trouble, adding neighbors to the growing ranks of victims.We tend to think of REOs as "inventory", but to the neighbors they are a nuisance.

Stagnant swimming pools spawn mosquitoes ... Empty rooms lure squatters and vandals. And brown lawns and dead vegetation are creating eyesores in well-tended neighborhoods.

ARM Reset Charts

by Calculated Risk on 8/28/2007 12:59:00 PM

For reference, here are a couple of ARM reset charts.

Here is a chart from BofA analyst Robert Lacoursiere via Mathew Padilla at the O.C. Register. Please see Mathew's discussion from June 29th: BofA Analyst: Mortgage correction just 'tip of the iceberg'.

This fits with Tanta's post this morning on Subprime Borrower Refi Options.

Another chart, from March, is from Ivy Zelman at Credit Suisse (Zelman has since left CS). The March Credit Suisse report, Mortgage Liquidity du Jour: Underestimated No More is available at Bill Cara's site (see page 47 for reset chart).