by Anonymous on 8/28/2007 04:39:00 PM

Tuesday, August 28, 2007

Another Tidbit on Refis

Here's another little bit of data to fit into the big picture on refinances. It doesn't solve any problems or prove anything conclusively. It's from a Countrywide Capital Markets newsletter that I get (not on the web, I'm afraid.)

What this means is that, of the refinances into a 30-year fixed-rate conforming loan that Countrywide did in the six months prior to December 2005, 3.2% were borrowers refinancing out of an Option ARM. By June 2007, the number had increased to 11.4%.

At the same time, the percent of new FRM refis that were originally subprime seems to be slowing down.

This suggests that the number of subprime borrowers who can refinance into a conforming fixed is decreasing as we get toward a "residual" pool of subprime loans that either do not qualify for a 30-year fixed or whose monthly payment cannot be lowered with one.

Blight Follows Foreclosures

by Calculated Risk on 8/28/2007 01:22:00 PM

From David Streitfeld at the LA Times: Blight moves in after foreclosures

Houses abandoned to foreclosure are beginning to breed trouble, adding neighbors to the growing ranks of victims.We tend to think of REOs as "inventory", but to the neighbors they are a nuisance.

Stagnant swimming pools spawn mosquitoes ... Empty rooms lure squatters and vandals. And brown lawns and dead vegetation are creating eyesores in well-tended neighborhoods.

ARM Reset Charts

by Calculated Risk on 8/28/2007 12:59:00 PM

For reference, here are a couple of ARM reset charts.

Here is a chart from BofA analyst Robert Lacoursiere via Mathew Padilla at the O.C. Register. Please see Mathew's discussion from June 29th: BofA Analyst: Mortgage correction just 'tip of the iceberg'.

This fits with Tanta's post this morning on Subprime Borrower Refi Options.

Another chart, from March, is from Ivy Zelman at Credit Suisse (Zelman has since left CS). The March Credit Suisse report, Mortgage Liquidity du Jour: Underestimated No More is available at Bill Cara's site (see page 47 for reset chart).

S&P Says Housing Prices Fell in 2Q

by Calculated Risk on 8/28/2007 10:51:00 AM

From AP: Home Prices: Steepest Drop in 20 Years

U.S. home prices fell 3.2 percent in the second quarter, the steepest rate of decline since Standard & Poor's began its nationwide housing index in 1987, the research group said Tuesday.

The decline in home prices around the nation shows no evidence of a market recovery anytime soon, one of the architects of the index said.

MacroMarkets LLC Chief Economist Robert Shiller said the declining residential real estate market "shows no signs of slowing down."

Subprime Borrower Refi Options

by Anonymous on 8/28/2007 09:50:00 AM

Bank of America's RMBS Desk has a research note out (not publically available) that attempts to estimate the realistic refinance options, if any, for outstanding subprime ARMs that are facing reset in the immediate future.

The analysis looks at both credit standards and current interest rates on alternative loans, and concludes that refinancing into a new subprime loan or, for those borrowers whose credit profile has improved since loan origination, a new Alt-A loan, is essentially not an option. The interest rates on new subprime and Alt-A, given the current environment, are simply too high to offer any improvement in the monthly payment.

Therefore, the report concludes that FHA and Fannie Mae's "Expanded Approval" program (EA, its existing program for "near prime") are the only realistic options, given pricing structures. BoA estimates that approximately 18% of outstanding subprime ARM borrowers could qualify for an FHA refi (on both credit guidelines and rate reduction), and approximately 36% could qualify for Fannie Mae's EA. (That's best understood as 36% qualifying for either FHA or EA, not a total of 54%.) The larger bucket of loans qualifying for EA is mostly a matter of the larger GSE maximum loan amount compared to the FHA maximum, as well as a slice of the highest-credit class for which EA, at least in theory, offers 100% financing in contrast to FHA's 97% maximum.

Still, BoA's analysis is assuming an effective interest rate (including FHA or private mortgage insurance premiums) of around 8.50% for FHA and 8.50%-9.50% for the EA loans. In other words, the refi rate for these borrowers, at best, is enough to keep them at pre-reset payment levels. It isn't enough to bail out anyone who cannot carry the pre-reset payment.

It is always possible to change the eligibility and qualifying rules on either FHA or EA so that more borrowers can be accommodated, and there are certainly demands out there, especially for FHA, to do this. How, exactly, we will price the risk so that these borrowers are in the money is, as far as I can tell, the unmentioned part that probably matters.

MMI: The Eagle Soars or the Vulture Circles?

by Anonymous on 8/28/2007 08:01:00 AM

The official story on Bank of America and Countrywide is, apparently, still in flux. That's always the trouble with mythologizing in real time; events often catch up with one in troublesome ways. Mythic narrative, of course, is only comprehensible in "ageless" terms. A story with a shelf life of a couple of weeks may invoke grand narrative structures and heroic motifs, but that, as we say in literary land, is short-term financing.

David Weidner at Marketwatch struggles with conflicting stories about BoA and its CEO:

NEW YORK (MarketWatch) -- Sentiment is growing that Bank of America Corp.'s Kenneth Lewis may have won a place in the pantheon of great Wall Street titans by using his financial clout to help the country avoid economic ruin.

If you found yourself at this point wondering who the hell else was in that pantheon of great Wall Street titans who saved the country from economic ruin, you'll probably have noticed that we had to go back to 1907 to find one. I'd say, if you're not familiar with the story of J.P. Morgan and the Panic of 1907, you might want to brush up on the details. This may well become mythological motif du jour for some while, so you'd best be prepared.

Me, I just skip to the last paragraph:

Maybe there's a modern-day Morgan out there. We can all pitch in and buy him a railroad.I suspect we're going to get so worried about pitching in to buy Joe Spendthrift an affordable mortgage that we'll allow ourselves to get suckered into buying some Morgan a railroad, but I undoubtedly read too much.

Monday, August 27, 2007

Credit-card defaults on rise

by Calculated Risk on 8/27/2007 06:12:00 PM

From the Financial Times: Credit-card defaults on rise in US

US consumers are defaulting on credit-card payments at a significantly higher rate than last year ...As an aside, business bankruptcy filings are rising too, from Barron's Business-Bankruptcy Blues (hat tip Viv)

Credit-card companies were forced to write off 4.58 per cent of payments as uncollectable in the first half of 2007, almost 30 per cent higher year-on-year. Late payments also rose, and the quarterly payment rate ... fell for the first time in more than four years.

...

But Moody’s said the rate of losses remained well below the 6.29 per cent average seen in 2004 ...

Recent increases in credit card losses can in part be ascribed to a steady rise in personal bankruptcy filings since 2005. According to the Administrative Office of the US Courts, quarterly non-business bankruptcy filings have been rising since the first quarter of 2006.

For the second quarter, such bankruptcies rose 38% from the same quarter in 2006, and first-half bankruptcies were up a full 45% from the 2006 half, to 12,985. That's according to ... data from the U.S. Bankruptcy Courts.The new bankruptcy law in October 2005 caused some distortions in the data, but it appears the trend is negative.

Update: Just a few months ago we saw this Bloomberg story: Subprime Borrowers More Apt to Pay Card Debt, Ignore Mortgages (hat tip BR)

"The number of people with subprime credit ratings whose home payments were overdue by 30 days or more rose 13.2 percent in the past four years, while bank-card delinquencies among the group dropped 25.4 percent."And from the Chicago Tribune: As home loan market tightens, mounting credit card debt could spur new crisis (hat tip Gort)

More: July Existing Home Sales and Contest

by Calculated Risk on 8/27/2007 11:50:00 AM

For more existing home sales graphs, please see the previous post: July Existing Home Sales

Contest on Inventory and Months of Supply:

For fun (winner will be announced in a January post), predict:

1) The maximum existing home inventory number for 2007 (NAR report).

2) The maximum "months of supply" for 2007 (NAR report).

The months of supply metric is calculated by dividing the total inventory by the seasonally adjusted annual sales rate, then multiply by 12 months. As an example, the current existing home inventory is 4.592 million units, and the SAAR of sales is 5.750 million units.

The formula is: Months of Supply = (4.592 / 5.750) * 12 = 9.6 months.

Please enter your prediction in the comments to this post. Good luck!

To help with the contest, here are a few more graphs on inventory and months of supply.

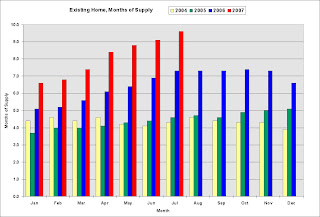

Click on graph for larger image.

Click on graph for larger image.The first graph shows the monthly inventory levels for the last four years. There is somewhat of a seasonal pattern, with inventory peaking in the summer months.

This wasn't true in 2005 - as inventory continued to increase throughout the year - and that was one of the indicators that the housing boom had ended.

For 2007, I expect that inventory levels are close to the peak level.

The second graph shows the monthly 'months of supply' metric for the last four years.

Even if inventory levels stabilize, the months of supply could continue to rise - and possibly rise significantly - if sales continue to decline.

To put the NAR numbers into perspective, here are the year-end sales, inventory and months of supply numbers, since 1969.

This graph shows the actual annual sales, year end inventory and months of supply, since 1982 (sales since 1969). For 2007, the July inventory and Seasonally Adjusted Annual Rate (SAAR) for sales were used.

This graph shows the actual annual sales, year end inventory and months of supply, since 1982 (sales since 1969). For 2007, the July inventory and Seasonally Adjusted Annual Rate (SAAR) for sales were used.The current inventory of 4.592 million is the all time record. The "months of supply" metric is 9.6 months. The "months of supply" is now above the level of the previous housing slump in the early '90s, but still below the levels of the housing bust in the early '80s.

Both the numerator and the denominator are moving in the wrong direction. Not only is inventory at record levels, but sales - though falling - are still significantly above the normal range as a percent of owner occupied units.

Forecasts

The following graph shows the actual cumulative existing home sales (through July) vs. three annual forecasts for 2007 made at the beginning of the year (NAR's Lereah, Fannie Mae's Berson, and me).

My forecast was for sales to be between 5.6 and 5.8 million units (shown as 5.7 million).

My forecast was for sales to be between 5.6 and 5.8 million units (shown as 5.7 million).NSA sales are 3.498 million units through July. In a typical year, sales through July are about 59% of the sales for the year. So at the current pace, sales will be around 5.9 million. It appears that sales will slow, perhaps significantly, in the second half of 2007, so the risk to my forecast is most likely on the downside.

To reach the NAR forecast, revised downward again on Aug 8th to 6.04 million units, sales would have to be significantly above the 2006 levels for the remainder of the year. Given tighter lending standards, we can probably already say that even the August NAR forecast was too optimistic.

July Existing Home Sales

by Calculated Risk on 8/27/2007 10:00:00 AM

Update: for more on existing home sales (and a fun contest), please see July Existing Home Sales and Contest

The National Association of Realtors (NAR) reports Existing-Homes Sales Stable In July

Total existing-home sales – including single-family, townhomes, condominiums and co-ops – slipped 0.2 percent to a seasonally adjusted annual rate1 of 5.75 million units in July from an upwardly revised pace of 5.76 million in June, and are 9.0 percent below the 6.32 million-unit level in July 2006.

...

The national median existing-home price for all housing types was $228,900 in July, down 0.6 percent from July 2006 when the median was $230,200, the highest monthly price on record. The median is a typical market price where half of the homes sold for more and half sold for less.

Click on graph for larger image.

Click on graph for larger image.The first graph shows the NSA sales per month for the last 3 years.

The pattern of YoY declines in sales is continuing. For New home sales, March is usually the strongest sales month of the year. For existing homes, the Summer months are more critical.

The second graph shows the months of supply. With the months of supply now well over 8 months, we should expect falling prices nationwide.

The 9.6 months of supply is the highest since 1982 - when mortgage rates averaged 16% (see Freddie Mac)!

The third graph shows nationwide inventory for existing homes. According to NAR, inventory increased to an all time record 4,592,000 in July.

The third graph shows nationwide inventory for existing homes. According to NAR, inventory increased to an all time record 4,592,000 in July.Total housing inventory rose 5.1 percent at the end of June to 4.59 million existing homes available for sale, which represents a 9.6-month supply at the current sales pace, up from an upwardly revised 9.1-month supply in June.More on existing home sales later today.

Note: For existing homes, the sales data is compiled at the close of escrow. So this report is mostly for homes were the sales agreements were signed in June or even May. This is all pre-turmoil, and even the August existing home report will be mostly pre-turmoil.

Those Other Incomprehensible Ratings

by Anonymous on 8/27/2007 09:17:00 AM

Being a mortgage and bond weenie, I have never claimed to fully understand equity analyst ratings. However, I must say I understand them less lately than I used to not understand them.

"Market underperform" means "maybe not quite worthless"?

NEW YORK (AP) -- A JMP Securities analyst upgraded Luminent Mortgage Capital Inc. late Friday, saying the deal the mortgage investment fund cut to rescue itself shrinks the chances the stock will end up worthless.

Analyst Steven C. DeLaney upgraded Luminent Mortgage Capital to "Market Underperform" from "Sell."

Whether the San Francisco-based real estate investment trust's shares have value is open to debate. A number of analysts -- including DeLaney himself -- have predicted the company will go bankrupt.

With $8.61 billion in assets at the beginning of the year, Luminent Mortgage Capital borrows money to invest in home loans and other types of mortgage debt. Luminent earns profit when the yields on the mortgage debt outpace how much the company pays to borrow money.

With the mortgage market in distress and investors fleeing from risky loans, Luminent has had to pay more to borrow and the mortgage debt the company invests in is worth less.

The company's stock has fallen from more than $10.80 late last year to as low as 36 cents this month.

Earlier this month, Luminent announced a deal with Arco Capital Corp. Luminent is granting Arco Capital the option to buy a 51 percent stake in the company at 18 cents per share, a discount even for a stock that had lost more than 90 percent of its value this year.

In exchange for this option, Arco Capital is lending Luminent $60 million and agreed to buy $65 million of the company's mortgage debt.

"This lifeline financing provided by Arco improves the possibility that some value may be preserved for Luminent's shareholders," DeLaney said.

DeLaney's price target on Luminent is $1. The stock closed Friday at $1.34.