by Anonymous on 8/14/2007 12:41:00 PM

Tuesday, August 14, 2007

Dean Baker on Hedge Fund Bailouts

Now this, I admit, is an idea that never crossed my mind:

If the assets held by the hedge funds are sound, and it’s just an issue of stemming a momentary panic, then the Fed should step in as lender of last resort and try to stabilize the market. However, if the issue is just one of giving the hedge fund crew time to dump their bad debts, then the Fed has no business getting involved.Hmmmm. Overnight, turn all those CMOs and CDOs into REITs that hold income-producing REO instead of mortgage loans . . . CPR (prepayment rates) go to zero . . . trustees develop new skills as they review remittance reports and come unplug your sink . . . I'm liking this . . .

A quick look at the evidence strongly argues for scenario # 2. The problem is that homes are worth less than the value of the mortgages. This is the main fuel for the surge in defaults. This process will only get worse as house prices continue to decline. With the inventory of unsold new homes more than 50 percent above its previous peak, and the number of vacant ownership units nearly twice the previous record, there can be little doubt about the future direction of home prices.

One final point: the hedge fund crew may try to take the homeowners hostage, arguing that the only way to keep millions of low and moderate income homeowners from being thrown out on street is to bailout the hedge funds. This is not true. Congress can just pass legislation that allows homeowners who default to remain in their house as renters, as long as they pay the fair market rent (as determined by an independent appraisal) for their home.

We must be careful not to confuse the plight of distressed homeowners with the plight of the hedge fund crew. As we all know, you can never give in to hostage takers, especially if they run hedge funds.

Sentinel Management Group asks to Halt Money Market Redemptions

by Calculated Risk on 8/14/2007 11:27:00 AM

UPDATE: This is a weird twist. In the letter below, Sentinel wrote:

We contacted the CFTC today and asked for their permission to halt redemptions until we can honor them in an orderly fashion.From Reuters: US CFTC says it can't halt Sentinel's redemptions

The U.S. Commodity Futures Trading Commission has no authority to grant Sentinel Management Group's request to halt client redemptions, an agency official said on Tuesday.Back to the original post:

"The CFTC has no authority in this area," the CFTC official, who asked not to be identified, told Reuters. "This isn't something we do.

"We have no role in whether or not the company does this and whether the client accepts it," the official said.

via Briefing.com: (hat tip Lance McDude)

CNBC reported that Sentinel Management Group has asked permission from the CFTC to halt money market redemptions.Sentinel Letter from the Street.com:

Sentinel's inability to meet significant redemption requests has exacerbated the liquidity concerns that have led many to believe a real credit crunch is forthcoming.

As you undoubtedly know, the credit markets, along with most other markets, have experienced a liquidity crisis in the past several weeks. Investor fear has overtaken reason and has induced a period in which most securities have simply ceased to trade. We’ve all read the stories about one hedge fund or another suffering losses related to subprime exposure and closing down or being rescued. This fear, while warranted in some cases, has spilled over into the rest of the credit market and liquidity has dried up all over the street. In addition, investment banks and securities firms are stuck with LBO deals they’ve already entered into but cannot find buyers for the bonds so must inventory them themselves. This liquidity crisis has caused bids to disappear from the market and makes it virtually impossible to properly price securities or to trade them. High grade securities are trading like junk bonds as panicked investors dump names like General Electric at Tyco‐like prices.

We have carefully monitored this situation for the past several weeks and have met regularly to discuss the potential impact it may have on our clients. We had previously thought that the market would return to some semblance of order and that our clients would not join in the panic. Unfortunately, this has not been the case. We are concerned that we cannot meet any significant redemption requests without selling securities at deep discounts to their fair value and therefore causing unnecessary losses to our clients. We contacted the CFTC today and asked for their permission to halt redemptions until we can honor them in an orderly fashion.

Sentinel has always sought to protect your interests and since our inception in 1980, we have never experienced a situation quite like this one. We will continue to monitor the markets and we will raise cash as opportunities present themselves.

We understand that this will obviously cause inconveniences on your part however, at present, we do not see an alternative and we don’t believe it is in anyone’s best interest if a run on Sentinel took place and we were in a forced liquidation mode.

We value your trust in us these past 28 years and this has been a very difficult decision for us and we understand the implications of this decision both on you and on Sentinel. We feel, however, that this is the best way to assure you the best possible value on your investment.

We will remain in contact with you and update you as things progress.

June Trade Deficit: $58.1 Billion

by Calculated Risk on 8/14/2007 10:21:00 AM

The Census Bureau reported today for June 2007:

"a goods and services deficit of $58.1 billion, compared with $59.2 billion in May"

Click on graph for larger image.

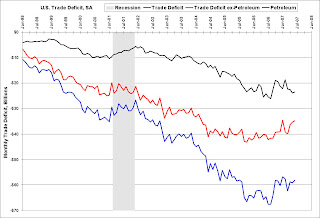

Click on graph for larger image.The red line is the trade deficit excluding petroleum products. (Blue is the total deficit, and black is the petroleum deficit).

Looking at the trade balance, excluding petroleum products, it appears the deficit peaked at about the same time as Mortgage Equity Withdrawal in the U.S. This is an interesting correlation (but not does imply causation). I had more on MEW vs. the trade deficit a couple months ago.

I think the declining trade deficit and the Wal-Mart stories are related.

Thornburg's Trouble

by Anonymous on 8/14/2007 10:20:00 AM

From Associated Press:

NEW YORK (AP) -- Four analysts downgraded Thornburg Mortgage Inc. on Tuesday, saying the mortgage lender will probably have to sell off some of its loans to stay afloat. . . .This is ugly. In my view, outfits like AHM and LUM were accidents looking for a place to happen. Thornburg makes those pretty, competitively-priced, conservatively-underwritten jumbo loans whose rate spread over conforming has tripled over the last few months.

The theme was one familiar to mortgage lenders: Its financial backers are probably asking for their money back, these analysts said. The investment banks that finance mortgage lending typically are entitled to demand repayment when the mortgage loans acting as collateral for the credit lines lose too much value.

This is what has happened in the mortgage industry this year, leading to dozens of bankruptcies. The flare-ups started in "subprime" mortgages, or loans to people with checkered credit histories. Decaying credit quality made subprime loans less valuable, triggering margin calls.

The flight from risky mortgage debt has now spread to loans carrying little actual credit risk. With a $56.4 billion portfolio, Thornburg is the largest mortgage-related security REIT and owns primarily prime loans. But the absence of liquidity for home loans means their market prices have tumbled this year.

Keefe, Bruyette & Woods analyst Bose George expects the company to sell a fifth of its assets to satisfy lenders. The credit markets where Thornburg Mortgage previously raised money are in turmoil, and George said they could take months to recover.

"The company has no opportunity to raise permanent capital to stem the tide," Jefferies analyst Richard Shane Jr. wrote in a client note.

Wal-Mart: 'Customers Under Economic Pressure'

by Calculated Risk on 8/14/2007 10:19:00 AM

From AP: Wal-Mart Cuts Profit Outlook Amid Weakening Economy, 2Q Sales Up

[Lee Scott, Wal-Mart president and chief executive officer] said its customers are under a lot of economic pressure ...

Wal-Mart has been dogged by the crumbling housing market, a widening credit crunch and higher gasoline and food prices, which have hit lower-income consumers particularly hard.

Tom Schoewe, Wal-Mart's executive vice president and chief financial officer, said that he saw bigger spending swings around the time when people usually get paychecks than he had in the past. That suggests are under more financial pressure than usual.

Monday, August 13, 2007

Aegis Mortgage files BK

by Calculated Risk on 8/13/2007 09:08:00 PM

From Reuters: Aegis Mortgage files for Chapter 11 bankruptcy

Aegis has described itself as one of the 30 largest U.S. mortgage lenders. It made "prime" and "Alt-A" wholesale loans, and "subprime" retail and wholesale loans to residential borrowers who couldn't qualify for the best rates.I wonder who the other creditors are? Anyone have a link to the documents?

In court papers, Aegis listed more than $100 million of assets, and estimated it owes more than $600 million to creditors. The latter included $178 million of unsecured debt owed to Madeleine LLC, a Cerberus affiliate that has an 80.9 percent equity stake, the papers show.

Poll: New Record Low for Builder Confidence?

by Calculated Risk on 8/13/2007 08:43:00 PM

Click on graph for larger image.

Click on graph for larger image.

The National Association of Home Builders (NAHB) Housing Market Index (HMI) is scheduled to be released on Wednesday for August. The all time record low was 20 in January 1991.

The NAHB reported that builder confidence fell to 24 in July from 28 in June.

I doubt the home builders are feeling more confident in August!

Coventree Fails to Sell Asset-Backed Commercial Paper

by Calculated Risk on 8/13/2007 05:24:00 PM

From Bloomberg: Coventree Fails to Sell Asset-Backed Commercial Paper (hat tip rcyran, Bill)

Coventree Inc., the Canadian finance company that went public in November, failed to sell asset-backed commercial paper to replace maturing debt because of the credit crunch ...

... the company extended maturities on C$250 million ($238 million) of commercial paper and sought emergency funding for another C$700 million of debt. Toronto-based Coventree's units have about C$16 billion of asset- backed commercial paper outstanding.

...

Coventree is among the first companies to delay payments on asset-backed commercial paper in the U.S. and Canada in the 12 years since the debt was created....

...

In the U.S., asset-backed commercial paper, which comprises about $1.15 trillion of the $2.16 trillion in commercial paper outstanding, is bought by investors such as money market funds. The cash allows entities such as those owned by Coventree to buy mortgages, bonds, credit card and trade receivables as well as car loans.

Fed: Loan Officers Report Tighter Lending Standards for July

by Calculated Risk on 8/13/2007 02:21:00 PM

From the Fed: The July 2007 Senior Loan Officer Opinion Survey

on Bank Lending Practices

Commercial Real Estate Lending

Lending standards for commercial real estate loans were reportedly tightened further over the past three months: About one-fourth of domestic institutions—a slightly smaller net fraction than in the previous survey—and about 40 percent of foreign institutions indicated that they had tightened lending standards on commercial real estate loans in the July survey. Regarding demand, approximately one-fourth of domestic and foreign institutions reported that demand for commercial real estate loans had weakened over the past three months.

Click on graph for larger image.

Click on graph for larger image.Graph added. This graph shows loan demand for CRE, as reported in the Fed's Senior Loan Officer survey, and year-over-year investment in non-residential structures from the GDP report.

This suggests that CRE investment will probably slow in the coming year.

Update: The loan survey showed tightening standards and falling demand in most categories: Commercial & Industrial loans (C&I), commercial real estate loans (CRE), household mortgages including prime loans, and other consumer loans. The one exception was for credit card loans with slightly looser standards.

What Goes to Jesus Comes to Jesus

by Anonymous on 8/13/2007 11:26:00 AM

. . . or, well, something. I think I skipped the "Jesus and Karma: A Cross-Cultural Perspective" unit in my continuing education course on "Business and Blasphemy: It's Better Than Turkey Metaphors."

Exhibit A, especially for lovers of schadenfreude, is those well-known theologians at Institutional Risk Analytics:

From a risk management perspective, MHP [S&P] and MCO [Moody's] look a lot more fragile when it comes to financial and reputational exposure than do leading investment banks focused on the mortgage sector like BSC or Lehman Brothers (NYSE:LEH). Unlike a financial institution, publishing companies such as MHP and MCO lack the capital cushion and access to liquidity with which to absorb large financial losses. Even though the ratings agencies reportedly charged up to three times the customary fees for CDO ratings, this compared to the fee charged for a similar size bond issue, there still is not enough money in the proverbial cookie jar to offset the added risk from these complex structured assets.So, maybe, the sales force shoulda spent some more time in church?

Indeed, wouldn't it be a delicious irony if one or both of the major ratings agencies were forced into bankruptcy due to legal claims made regarding CDOs? As Bloomberg noted back in May of 2007: "When it comes to CDOs, rating companies actually do much more than evaluate them and give them letter grades. The raters play an integral role in putting the CDOs together in the first place." . . .

The Almighty, it seems, does have a sense of humor. But what is the real damage to the Street from CDOs?

The illusion of an investment-grade credit rating resulted in roughly a trillion dollars worth of subprime and other non-investment grade mortgages being packaged and sold to the Buy Side. We discount the recent market upset that has seen some commentators claim, irresponsibly in our view, that CDOs have little or no value. If you consider the situation more calmly, then a haircut of 25-30% or some $250 to $300 billion in aggregate principal loss, seems reasonable to us -- at least for starts. And that's just the basic loss, not counting punitive damages and costs.

Given the above estimate of aggregate losses to the Street, the bad news coming from BSC seems just the beginning. True, the folks at BSC have been generating headlines, but there are still dozens of Sell and Buy Side firms that have yet to come to Jesus when it comes to the CDO fisasco. We are still very early in the process of unwinding the excesses of the past several years. Bottom of the first inning, to be precise.

But that does not mean that the Sell Side firms are standing still. One well-placed reader of The IRA reports that the top Sell Side firms are closing down a couple of hedge funds a day in an effort to staunch the bleeding from CDOs.

Says the Buy Sider: "I'm hearing about prime brokers shutting down hedgies, taking back collateral and then reselling the same collateral to other hedge funds without a mark to market. Is this possible?"

Of course it's possible. Whenever OTC derivatives, hedge funds and members of the Sell Side are involved, anything is possible. The great thing about CDOs and other derivative securities is that the value is set not in the public markets, but by the sales force.

Exhibit B, from the Wall Street Journal (thanks, kett82!):

While many mortgage brokers screamed through the real-estate boom with blaring television ads and exotic loan structures, HomeBanc Corp. positioned itself as the good guy.Apparently counting on the Almighty's sense of humor to remain eternal and unchanging, CFC just put a bid out for that "expensive sales infrastructure." All I can say is that I'd buy tickets to the first meetings between those sleek secular suits from Calabasas and Dr. Ike's Dixie disciples of debt . . .

Inside the company, executives opened companywide gatherings and internal meetings with Christian prayers. Every branch office kept a chaplain on call. The company's $365,000-a-year human-resources chief, Dwight "Ike" Reighard, was the founder of a mega-church in an Atlanta suburb. He says he encouraged employees to pray, put others first and become better workers -- and also performed weddings and funerals for employees. "People who never attended church would tell me, you're my pastor," Dr. Reighard said in an interview on Saturday.

But over the past few weeks, as investors fled securities tied to mortgages, HomeBanc's sources of loan funds dried up. Unable to continue originating loans, the company staggered under the burden of its expensive sales infrastructure.

On Thursday, HomeBanc filed for bankruptcy-court protection. It fired most of its 1,100 employees on Friday and is shuttering its 22 branches and 139 kiosks . . .