by Calculated Risk on 7/11/2007 01:49:00 PM

Wednesday, July 11, 2007

FDIC chief looking at banks' CDO exposure

From Reuters: U.S. FDIC chief looking at banks' CDO exposure (hat tip dotcommunist)

The Federal Deposit Insurance Corp. is looking "very carefully" at banks' exposure to collateralized debt obligations (CDOs) tied to subprime mortgages and whether rising default rates may creep into higher-rated CDO tranches.Did someone forget to send Bair the "contained" talking point memo?

"We're going to see more downgrades," FDIC Chairman Sheila Bair said on Wednesday, referring to a slew of CDO downgrades announced on Tuesday by two major credit rating agencies.

...

"I think the question is, to what extent is this going to creep into the higher-rated tranches. Most of these securitizations are over-collateralized but giving rising default rates and the fact that a lot of these loans haven't reset yet, it could creep into the higher-rated tranches," Bair said after addressing a Washington meeting of the New York Bankers Association.

"We're certainly looking at CDO exposures (of banks) very carefully and monitoring whether they could creep into higher-rated tranches," Bair said.

Those Wacky NAR Forecasts

by Calculated Risk on 7/11/2007 12:35:00 PM

Another month, another downward revision to the NAR forecast for 2007:

Feb 7, 2007: Existing-Home Sales To Improve, With Later Recovery For New Homes

Existing-home sales ... are forecast at 6.44 million in 2007April 11, 2007: Tighter Lending Standards Good For Housing, But Will Dampen Sales

Existing-home sales are likely to total 6.34 million in 2007May 9, 2007: Housing Forecast Changed Slightly Due to Impact From Tighter Lending

Existing-home sales are likely to total 6.29 million this yearJune 6, 2007: Home Sales Projected to Fluctuate Narrowly With a Gradual Upturn

Existing-home sales are projected to total 6.18 million in 2007July 11, 2007: Home Prices Expected to Recover in 2008 As Inventories Decline

Existing-home sales are expected to total 6.11 million this yearThe NAR forecasts are too optimistic, and the headlines are hilarious too (see Nutting's comment on the current headline below). My forecast is still for 5.6 to 5.8 million existing home sales in 2007.

Rex Nutting at MarketWatch on the current NAR forecast: Single-family starts to fall again in 2008: Realtors

Construction of single-family homes will probably decline for a third straight year in 2008, according to the latest monthly forecast from the National Association of Realtors.

The group's July forecast, released Wednesday, is more pessimistic than its June forecast in nearly every aspect.

...

The realtors' press release was headlined "Home prices expected to recover in 2008 as inventories decline" -- even though the forecast median price for existing homes in 2008 was unchanged from last month's at $222,700.

Alt-A: The New Home of Subprime?

by Anonymous on 7/11/2007 10:32:00 AM

UBS has a report out today (not available on the web) which suggests the possibility of an alarming trend in recent (2007) RMBS issuance: while subprime issuance has dropped, as we expected, and "agency" issuance (the GSEs, mostly, are meant by the rather old-fashioned industry term "agency"), particularly of fixed-rate loans and the better quality hybrid ARMs, is edging up as a share of the market, which we also expected, non-agency Alt-A is actually increasing as well, which is somewhat more surprising. At the same time Alt-A volume is creeping up, its credit quality shows some signs of deteriorating. The implication is that loan production that would, last year, have ended up in a subprime security is migrating into Alt-A securities.

In one sense this is hardly surprising: the line between Alt-A, "Alt-B," and subprime has never been sharply clear, as loan quality and underwriting standards operate on a continuum and different participants bucket the loans in somewhat different ways. I put the term "Alt-B" in quotation marks because, while some of you may have heard the term before, it's not universally popular in the industry. Traditionally, credit quality at the level of individual homeowners used letter grades, more or less uniformly, of "A" to mean "prime" credit, "A-" to mean near-prime (FHA programs, for instance, were historically considered near-prime), and "B" and "C" to mean subprime. (There is "D," which has always been considered "hard money" lending, not typically a kind of loan made by institutional mortgage lenders of any sort.) You can, of course, put plusses or minuses on any of these letters, if you want to denote the top or bottom of a range of credits.

Under this kind of rubric, the term "Alt-A" was originally seized upon as a way of describing loans that we used to just call "non-agency." The "A" part indicated prime borrower credit quality, supposedly comparable to the credit quality demanded by the GSEs, but the "Alt" part meant that other characteristics of the loan, apart from borrower credit quality, exceeded the guidelines required by the GSEs. Most famously, these were the high-LTV or CLTV stated income deals. "High LTV" is of course relative to things like occupancy: while the GSEs accept a lot of high-LTV primary residences, they have always been less interested in high-LTV second home or investment properties. So Alt-A has always included much larger percentages of non-owner-occupied loans.

You can see why "Alt-B" is an odd concept, then: the GSEs don't, as a general rule, securitize "B" credit loans. (They do invest in some subprime securities for their retained portfolios, which provides some liquidity for high-rated subprime tranches, but they didn't issue those securities and they don't own the residuals.) So "B" credit is by definition non-agency, whatever terms you offer. The term "Alt-B" is not an attempt to describe a kind of subprime lending as much as it is a derogatory term for the worst kind of officially-described "Alt-A," rather like the term "liar loan" is a derogatory term for the blander "no doc." If it has any clear definition, it generally refers to the lowest-quality segment of the somewhat nebulous "Alt-A" world.

My point is that there has for some time been quite a bit of low-quality Alt-A, enough that the term "Alt-B" has unofficially been used to describe it, but that the expectation has been that guideline tightening in the wake of regulatory guidelines and the general cratering of the housing market would have gone a ways toward bringing the "A" back to "Alt-A." Yet there are hints, at least, that we are possibly seeing the relabeling of subprime loans as Alt-A recently, given the loss of investor appetite for anything called "subprime."

It is, of course, possible that a certain percentage of loans "belonged" in Alt-A all along, but were steered to subprime in order to increase originator commissions or just to jazz volume. If that is so, then seeing those loans get steered back to Alt-A may well be only a matter of justice. I think there's undoubtedly some truth in this, but it seems questionable to me that the addition of "steered" loans into the Alt-A pipeline should more than compensate for the loss of production due to guideline tightening within Alt-A. Unfortunately, we'll probably just have to wait and see on this, but like the UBS analysts, I am concerned that there's still a fair amount of toxicity out there that is just getting relabeled. You can call it "Alt-B" if you want, but that just means it's subprime with high LTVs or reduced documentation, and the point of tightening was to get rid of that stuff, not to bump it up into so-called "Alt-A" securities.

One of the problems with both a slovenly use of terms and a kind of demonization of "The Subprime"--both of which we've seen in the mainstream business press for quite a while--is that it can, actually, enable this kind of problem. Investors are spooked over anything called "subprime," but still not spooked enough to do much due diligence on these deals, so you can easily get a situation in which shaky deals just migrate into the less-demonized category.

To me, the most troubling part of the S&P announcement yesterday was that it both conceded that the data it uses to analyze loan pools may be seriously corrupt, and basically had nothing to offer in terms of fixing that. Adding a fraud-prevention questionnaire to its review of mortgage originators isn't going to solve the problem of inflated appraisals, inflated income, manipulated FICOs, and just plain old half-assed data reporting in the absence of actual fraud. S&P knows this perfectly well, but they (and the other rating agencies) have never been in the business of loan-level due diligence or serious auditing of originators or issuers, and they're not in the position to start now.

As I have argued before, we as an industry have known how to prevent a lot of fraud for a long time; we just didn't do it. It costs too much, and too many bonuses were at stake to carve out the percent of loan production it would take to get a handle on fraud. The only thing that got anybody's attention, finally, was a flood of repurchase demands on radioactive EPD loans and other violations of reps and warranties. If S&P wants to accomplish something, I'd suggest skipping the fraud-detection questionnaire directed to the mortgage originators (they'll just make up good answers to it, for heaven's sake, if they have inadequate operations, and the rating agencies can't verify it), and start slapping some issuers around on their pre-purchase or pre-securitization quality control and due diligence. If you want reliable loan-level data to do your ratings analysis with, you make it expensive for people to give you cruddy data.

Tuesday, July 10, 2007

Anyone Want Some "Cheap" Mortgage Backed Bonds?

by Calculated Risk on 7/10/2007 09:25:00 PM

From Dow Jones: US Broker-Dealer Circulating List Of Subprime Bonds For Sale. Some excerpts:

In what one investor characterized Tuesday as a "fire sale," a broker dealer - which the investor said was John Devaney's United Capital Markets ... circulated a list of subprime mortgage bonds for sale.

...

The low prices of the bonds may point to a continued broad-based cheapening of the whole subprime sector.

...

The offering was for 11 different classes of bonds totalling $82 million, including $10 million in below-investment-grade subprime mortgage-backed bonds from an Ameriquest Mortgage issuer at 58 cents on the dollar.

Other below-investment-grade bonds from separate issuers were listed as sold, with final offering prices for two such bonds listed at 45 cents and 28 cents on the dollar. There was also $32 million in AAA-rated bonds listed at 92 cents on the dollar.

More Ratings News: Moody's Downgrades 399

by Anonymous on 7/10/2007 05:00:00 PM

New York, July 10, 2007 -- Moody's Investors Service today announced negative rating actions on 431 securities originated in 2006 and backed by subprime first lien mortgage loans. The negative rating actions affect securities with an original face value of over $5.2 billion, representing 1.2% of the dollar volume and 6.8% of the securities rated by Moody's in 2006 that were backed by subprime first lien loans.

Of the 431 rating actions taken today, Moody's downgraded 399 securities and placed an additional 32 securities on review for possible downgrade. One of the downgraded securities remains on review for possible further downgrade. The vast majority of rating actions taken today impacted securities originally rated Baa or lower. The 239 securities originally rated Baa on which action was taken represented 19% of the total number of Baa ratings issued in 2006; the 185 securities originally rated Ba on which action was taken represented 42% of the total number of Ba ratings issued in 2006; and, the 7 securities originally rated A on which action was taken represented 0.6% of the total number of A ratings issued in 2006. No action was taken on securities rated Aaa or Aa. . . .

Recent data shows that the first lien subprime mortgage loans securitized in 2006 have delinquency rates that are higher than original expectations. Those loans were originated in an environment of aggressive underwriting. This aggressive underwriting combined with prolonged, slowing home price appreciation has caused significant loan performance deterioration and is the primary factor in these rating actions. In addition, Moody's analysis shows that the transactions backed by collateral originated by Fremont Investment & Loan, Long Beach Mortgage Company, New Century Mortgage Corporation and WMC Mortgage Corp. have been performing below the average of the 2006 vintage and represent about 60% of the rating actions taken today. . . .

Moody's has noted a persistent negative trend in severe delinquencies for first lien subprime mortgage loans securitized in 2006. For example, the 90+ day delinquency rate for loans securitized in 2006 has increased from 7.9% in March 2007 to 10.8% in May 2007. However, losses have remained relatively low, with the May cumulative loss rate reaching only 0.30%.

As part of the recently completed review of all 2006 subprime RMBS, Moody's said it examined the portion of each pool that was severely delinquent -- that is, over 90 days past due, in foreclosure or held as "real estate owned" -- and assessed the amount of credit enhancement available to the rated tranches in the form of subordination and excess spread. "Early defaulting borrowers often exhibit distinct characteristics: they are more likely to be first-time home buyers, speculators, or are over-leveraged or have 80%-20% first-second lien loan combinations," said Weill. Consequently, the early defaulters may exhibit different behavior than other borrowers in the pool. Those borrowers may face other challenges in the next few months when rate and payment resets take effect, especially in the absence of effective loan modifications.

In analyzing loans that are severely delinquent, Moody's said it considered a number of scenarios based on various assumptions about the percentage of currently delinquent loans that would eventually default (the "roll rate") and the expected severity of loss given default. The roll rates used were: for over 90 days delinquent: 50%, 75% and 90%; for those loans in foreclosure and held as real estate owned: 95% and 100%. While these roll rates are higher than those that have been realized historically, Moody's believes that these loans, with their high vacancy rates and high "no contact" rates, are more likely to default than other subprime loans.

The severity rates Moody's assumed ranged from 25%-30% (in particular, for deals with strong coverage from mortgage insurance), to 40% (for most originators), to 50% for originators whose mortgage assets are revealing particularly high severe delinquency rates.

For the portion of each pool that is not severely delinquent, Moody's increased its original loss expectations for the pool by a stress factor of 20% which is consistent with the increased loss expectations that the rating agency published in its March 2007 report: "Challenging Times for the US Subprime Mortgage Market."

While we considered both the projected losses associated with the seriously delinquent loans (the "pipeline losses") as well as the projected losses associated with the remaining portion of the pool, we gave more weight to the pipeline losses.

MarketWatch: New S&P Methodology is "Death Warrant" for Subprime Industry

by Calculated Risk on 7/10/2007 04:08:00 PM

Rex Nutting at MarketWatch comments on the new S&P rating change: New methodology is death knell for the troubled industry

Standard & Poor's just drove a huge harpoon into the heart of the mortgage credit bubble, and it's going to take a long time to clean up the mess once the beast finally dies.I'm looking forward to Tanta's further comments on the new S&P methodology.

... S&P isn't going along with the charade anymore. S&P said it would change its methodology for rating hundreds of billions of dollars in residential-mortgage-backed securities. And it would review its ratings on hundreds of billions of dollars in the more complex collateralized debt obligations based on those subprime loans.

A lot of debt will be downgraded to junk status. ...

S&P's announcement is a death warrant for the subprime industry.

Housing Spillover and the Consumer Slowdown

by Calculated Risk on 7/10/2007 02:05:00 PM

There is more evidence today that the housing slump is spilling over into consumer spending. We already know that Personal Consumption Expenditures (PCE) slowed sharply in Q2. And today, Home Depot and Sears released "troubling forecasts".

From Reuters: ... Disappointing Forecasts From Home Depot and Sears

... investors ... cringed at troubling forecasts from retailers Home Depot and Sears.From AP: Home Depot Warns 2007 Will Be Weaker Than Expected

... Home Depot Inc., Sears Holdings Corp. and homebuilder D.R. Horton Inc. offered disappointing financial outlooks that raised concerns about the housing market dampening consumer spending.

Home Depot said it now expects its earnings per share to decline by 15 percent to 18 percent for fiscal 2007. In May, the company had projected an earnings per share decline of 9 percent for the year.Also from AP: Sears Lowers Earnings Guidance on Languid Summer Sales Figures

...

[Chief Executive Frank Blake] said Home Depot sees "continued headwinds through 2007 and probably some into 2008 as well."

Sears Holdings Corp.'s second-quarter earnings will likely fall well below Wall Street expectations due to more disappointing sales of home appliances ...Please allow me to repeat this from a post in May:

During a nine-week period that ended July 7, same-store sales at Kmart's U.S. locations fell 3.9 percent while same-store sales fell 4 percent at Sears.

"We believe the home-improvement market will remain soft throughout 2007."Soft? Actually real spending on home improvement is holding up pretty well. If this housing bust is similar to the early '80s or '90s, real home improvement investment will slump 15% to 20%.

Frank Blake, Home Depot Chairman and CEO, May 15, 2007

Click on graph for larger image.

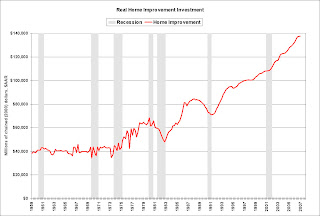

Click on graph for larger image.This graph shows real home improvement investment (2000 dollars) since 1959. Recessions are in gray.

Although real spending was flat in Q1 2007, home improvement spending has held up pretty well compared to the other components of Residential Investment. With declining MEW, it is very possible that home improvement spending will slump like in the early '80s and '90s.

D.R. Horton: 38% Cancellation Rate

by Calculated Risk on 7/10/2007 12:18:00 PM

"Market conditions for new home sales declined in our June quarter as inventory levels of both new and existing homes remained high, and we expect the housing environment to remain challenging. We adjusted our sales prices as selling conditions deteriorated, and we continue to react quickly to market dynamics. We expect to report a profit from operations before impairments for the June 30, 2007 quarter. However, as a result of the factors mentioned above, we will realize significant asset impairments which will result in a loss for both the quarter and the nine months ended June 30, 2007."Press Release: D.R. Horton, Inc. ... Reports Net Sales Orders for the Third Quarter of Fiscal Year 2007

Donald R. Horton, Chairman, D.R. Horton

D.R. Horton, Inc. ... the largest homebuilder in the United States, ... reported net sales orders for the third quarter ended June 30, 2007 of 8,559 homes ($2.0 billion), compared to 14,316 homes ($3.8 billion) for the same quarter of fiscal year 2006. Net sales orders for the first nine months of fiscal year 2007 totaled 27,313 homes ($6.9 billion), compared to 41,550 homes ($11.4 billion) for the same period of fiscal year 2006. The Company's cancellation rate (sales orders cancelled divided by gross sales orders) for the third quarter of fiscal 2007 was 38%.Remember when improving cancellations rates were the sign that housing had bottomed? Well, cancellations rates are rising again. The builders are taking "significant asset impairments" and reporting losses. And prices are being adjusted down as "conditions deteriorate".

There is no question that the housing market has taken another down turn. I expect this bad news from the builders to show up soon in the new home sales and housing starts reports.

S&P Changes Subprime Ratings Methodology

by Anonymous on 7/10/2007 12:00:00 PM

S&P managed to surprise the markets this morning by publishing a whopper of a combined downgrade list/methdology change for subprime mortgage-backed securities this morning.

Many of the classes issued in late 2005 and much of 2006 now have sufficient seasoning to evidence delinquency, default, and loss trend lines that are indicative of weak future credit performance. The levels of loss continue to exceed historical precedents and our initial expectations.

We are also conducting a review of CDO ratings where the underlying portfolio contains any of the affected securities subject to these rating actions (see separate media release to be published today). . . .

On a macroeconomic level, we expect that the U.S. housing market, especially the subprime sector, will continue to decline before it improves, and home prices will continue to come under stress. Weakness in the property markets continues to exacerbate losses, with little prospect for improvement in the near term. Furthermore, we expect losses will continue to increase, as

borrowers experience rising loan payments due to the resetting terms of their adjustable-rate loans and principal amortization that occurs after the interest-only period ends for both adjustable-rate and fixed-rate loans.

Although property values have decreased slightly, additional declines are expected. David Wyss, Standard & Poor's chief economist, projects that property values will decline 8% on average between 2006 and 2008, and will bottom out in the first quarter of 2008. While our LEVELS model assumes property value declines of 22% for the 'BBB' and lower rating category stress environments (with higher property value declines for higher rating category stress environments), the continued decline in prices will apply additional stress to these transactions by

increasing losses on the sale of foreclosed properties, as well as removing or reducing the borrowers' ability to refinance or sell their homes to meet debt obligations.

As lenders have tightened underwriting guidelines, fewer refinance options may be available to these borrowers, especially if their loan-to-value (LTV) and combined LTV (CLTV) ratios have risen in the wake of declining home prices. . . .

Data quality is fundamental to our rating analysis. The loan performance associated with the data to date has been anomalous in a way that calls into question the accuracy of some of the initial data provided to us regarding the loan and borrower characteristics. A discriminate analysis was performed to identify the characteristics associated with the group of transactions

performing within initial expectations and those performing below initial expectations. The following characteristics associated with each group were analyzed: LTV, CLTV, FICO, debt-to-income (DTI), weighted-average coupon (WAC), margin, payment cap, rate adjustment frequency, periodic rate cap on first adjustment, periodic rate cap subsequent to first adjustment, lifetime max rate, term, and issuer. Our results show no statistically significant differentiation between the two groups of transactions on any of the above characteristics. . . .

As performance continues to deteriorate, we have increased the severity of the surveillance assumptions we use to evaluate the ongoing creditworthiness for this group of transactions. The level of severity was increased to 40% from 33% to reflect the average severity that subprime servicers are currently experiencing . . .

In addition, we have modified our approach to reviewing the ratings on senior classes in a transaction in which subordinate classes have been downgraded. Historically, our practice has been to maintain a rating on any class that has passed our stress assumptions and has had at least the same level of outstanding credit enhancement as it had at issuance. Going forward, there

will be a higher degree of correlation between the rating actions on classes located sequentially in the capital structure. A class will have to demonstrate a higher level of relative protection to maintain its rating when the class immediately subordinate to it is being downgraded. . . .

For transactions that close on or after July 10, 2007, We will incorporate several changes to our ratings methodology that will result in greater levels of credit protection for rated transactions. Our cash flow methodology assumptions will include a simultaneous combination of faster voluntary and involuntary (default) prepayments that will result in less credit to excess

spread. Furthermore, our default expectation for 2/28 hybrid ARM loans will increase by approximately 21%. We are in the process of updating our LEVELS and SPIRE models. A separate article will be released in the next few days describing the revisions to our ratings methodology, and will provide the estimated timing for release of the updated models. . . .

Given the level of loosened underwriting at the time of loan origination, misrepresentation, and speculative borrower behavior reported for the 2006 vintage, we will be increasing our review of the capabilities of lenders to minimize the potential and incidence of misrepresentation in their loan production. A lender's fraud-detection capabilities will be a key area of focus for us. The review will consist of a detailed examination of: (a) the overall capabilities and experience of the executive and operational management team; (b) the production channels and broker approval process; (c) underwriting guidelines and the credit process; (d) quality control and internal audits; (e) the use of third-party due diligence firms, if applicable; and (f)secondary marketing. A new addition to this review process will be a fraud-management questionnaire focusing on an originator's tools, processes, and systems for control with respect to mitigating the potential for misrepresentation.

Oh, my, no. A fraud management questionnaire? What a crackdown!

More later . . .

Note: the entire document is available in pdf on standardandpoors.com if you are a registered user.

Fitch Downgrades Two Second-Lien ABS

by Anonymous on 7/10/2007 11:23:00 AM

I think we missed our Friday afternoon downgrades last week because of the odd holiday schedule. This one, however, caught my eye today:

Fitch Ratings-New York-09 July 2007: Fitch takes rating actions on the following Structured Asset Security Corp. (SASCO) residential mortgage-backed certificates:

Series 2006-ARS1:

--Class A1 affirmed at 'AAA';

--Class M1 affirmed at 'AA+';

--Class M2 affirmed at 'AA';

--Class M3 affirmed at 'AA-';

--Class M4 rated 'A+' is placed on Rating Watch Negative;

--Class M5 downgraded to 'A-' from 'A' and placed on Rating Watch Negative;

--Class M6 downgraded to 'BBB' from 'A-' and placed on Rating Watch Negative;

--Class M7 downgraded to 'BB' from 'BBB+' and placed on Rating Watch Negative;

--Class M8 downgraded to 'B' from 'BBB' and placed on Rating Watch Negative;

--Class M9 downgraded to 'C' from 'BBB-'; assigned distressed recovery (DR) rating of 'DR6'

--Class B1 downgraded to 'C' from 'BB+'; assigned DR rating of 'DR6';

--Class B2 downgraded to 'C' from 'BB+'; assigned DR rating of 'DR6'.

Series 2006-S1

--Class A1 & A2 affirmed at 'AAA';

--Class M1 affirmed at 'AA';

--Class M2 affirmed at 'AA-';

--Class M3 rated 'A+' and placed on Rating Watch Negative;

--Class M4 downgraded to 'A-' from 'A' and placed on Rating Watch Negative;

--Class M5 downgraded to 'BBB+' from 'A-' and placed on Rating Watch Negative;

--Class M6 downgraded to 'BBB-' from 'BBB+' and placed on Rating Watch Negative;

--Class M7 downgraded to 'BB' from 'BBB' and placed on Rating Watch Negative;

--Class M8 downgraded to 'B' from 'BBB-' and placed on Rating Watch Negative;

--Class B1 downgraded to 'C' from 'BB+'; assigned DR rating of 'DR6';

--Class B2 downgraded to 'C' from 'BB'; assigned DR rating of 'DR6'.

Fitch's Distressed Recovery (DR) ratings, introduced in April 2006 across all sectors of structured finance, are designed to estimate recoveries on a forward-looking basis while taking into account the time value of money. For more information on Distressed Recovery ratings, see the full report ('Structured Finance Distressed Recovery Ratings'), which is available on the Fitch Ratings web site at 'www.fitchratings.com'.

The affirmations reflect adequate relationships of credit enhancement (CE) to future loss expectations and affect approximately $327 million of outstanding certificates. CE is in the form of subordination, overcollateralization (OC) and excess spread. The negative rating actions, affecting approximately $111.1 million of outstanding certificates, reflect deterioration in the relationship between CE and expected losses.

Approximately 11.31% of the pool for series 2006-ARS1 is more than 60 days delinquent (including loans in Bankruptcy, Foreclosure and Real Estate Owned [REO]). The OC amount is currently $5,954,369, or roughly $11 million below its target amount. At 12 months since the first distribution date, the OC is currently equal to 2.54% of the original collateral balance, as compared to a target level of 7.65% of the original collateral balance. In four of the past 6 months, the excess spread has not been sufficient to cover the monthly losses incurred and as a result, OC has further deteriorated. Cumulative losses as a percent of the original collateral balance are 7.98%.

For series 2006-S1, approximately 6.19% of the pool is more than 60 days delinquent (including loans in Bankruptcy, Foreclosure and REO). This series was structured to have growing OC. Because of the faster-than-expected prepayments and earlier-than-expected collateral losses, the OC did not reach the initial target amount of $19.2 million. In five of the past 6 months, the excess spread has not been sufficient to cover the monthly losses incurred. Cumulative losses as a percent of the original collateral balance are 3.70%.

The transactions are twelve and sixteen months seasoned, respectively. The pool factors (current mortgage loan principal outstanding as a percentage of the initial pool) are approximately 71% and 58%, respectively.

The mortgage pools consist of conventional, fixed rate, fully-amortizing and balloon, second lien residential mortgage loans. The mortgage loans were acquired by Lehman Brothers Holdings Inc. from various banks and other mortgage lending institutions and are master serviced by Aurora Loan Services, Inc., which is rated 'RMS1-' by Fitch.

The first security (2006-ARS1) is subprime credit; the second (2006-S1) is definitely Alt-A (I checked the prospectus). The very different serious delinquency numbers reflect that: 11.31% for the subprime pool and 6.19% of the Alt-A pool. Yet these two pools are in almost exactly the same boat, ratings-wise.

How did that happen? The subprime pool started out with more overcollateralization, but losses have exceeded excess interest and so the OC is shrinking. The Alt-A pool started out with low OC--it was meant to grow through application of excess interest--but it too experienced losses exceeding the excess, as well as fast prepayments which have reduced the gross excess spread amount, and so its OC has not grown to its target.

You will notice also that both of these pools are fixed rate closed-end second liens. These borrowers did not get caught in a nasty rate adjustment, nor did they max out a credit line in order to pay bills.

The moral of the story, it seems to me, is twofold: Alt-A isn't performing anywhere near as well as its boosters claimed it would, for one thing. For another, a bad security structure can go a long way to offsetting the higher credit quality of the collateral. A security set up with "growing" OC, that is, initial low overcollateralization that is expected to reach its "target" over time, depends absolutely crucially on the accuracy of the prepayment speed estimates and the loss timing projections that went into its initial structure. The media's obsession with credit risk to the exclusion of other kinds of risk is obscuring this problem for sure.