by Calculated Risk on 7/10/2007 02:05:00 PM

Tuesday, July 10, 2007

Housing Spillover and the Consumer Slowdown

There is more evidence today that the housing slump is spilling over into consumer spending. We already know that Personal Consumption Expenditures (PCE) slowed sharply in Q2. And today, Home Depot and Sears released "troubling forecasts".

From Reuters: ... Disappointing Forecasts From Home Depot and Sears

... investors ... cringed at troubling forecasts from retailers Home Depot and Sears.From AP: Home Depot Warns 2007 Will Be Weaker Than Expected

... Home Depot Inc., Sears Holdings Corp. and homebuilder D.R. Horton Inc. offered disappointing financial outlooks that raised concerns about the housing market dampening consumer spending.

Home Depot said it now expects its earnings per share to decline by 15 percent to 18 percent for fiscal 2007. In May, the company had projected an earnings per share decline of 9 percent for the year.Also from AP: Sears Lowers Earnings Guidance on Languid Summer Sales Figures

...

[Chief Executive Frank Blake] said Home Depot sees "continued headwinds through 2007 and probably some into 2008 as well."

Sears Holdings Corp.'s second-quarter earnings will likely fall well below Wall Street expectations due to more disappointing sales of home appliances ...Please allow me to repeat this from a post in May:

During a nine-week period that ended July 7, same-store sales at Kmart's U.S. locations fell 3.9 percent while same-store sales fell 4 percent at Sears.

"We believe the home-improvement market will remain soft throughout 2007."Soft? Actually real spending on home improvement is holding up pretty well. If this housing bust is similar to the early '80s or '90s, real home improvement investment will slump 15% to 20%.

Frank Blake, Home Depot Chairman and CEO, May 15, 2007

Click on graph for larger image.

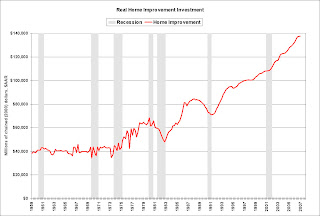

Click on graph for larger image.This graph shows real home improvement investment (2000 dollars) since 1959. Recessions are in gray.

Although real spending was flat in Q1 2007, home improvement spending has held up pretty well compared to the other components of Residential Investment. With declining MEW, it is very possible that home improvement spending will slump like in the early '80s and '90s.