by Calculated Risk on 6/27/2007 04:41:00 PM

Wednesday, June 27, 2007

MISC Shelves $750M Bond Offering

From the Financial Times: Debt deals pulled as banks feel subprime chill

Companies are pulling financing deals across the globe, in one of the clearest signs yet that investors’ worries about rising interest rates and US subprime mortgages could be infecting other areas of the credit world and driving up the cost of corporate borrowing.UPDATE: Another interesting quote from MarketWatch: Hedge fund CEO: 'day of reckoning to come' in credit market

...

MISC, the world’s biggest owner of liquefied gas tankers on Wednesday shelved its $750m bond offering. The move came a day after US Foodservice, the American division of Ahold, the Dutch supermarket group postponed its $650m bond offering and Arcelor Finance put plans for its euro-denominated benchmark bond issue on hold, citing turbulent market conditions.

The bonds and loan deals were pulled after investors refused to buy them under the proposed terms, demanding higher premiums and more protection.

Stephen Green, chairman of HSBC, on Wednesday fuelled investor concern when he forecast that some large corporate deal was going to “end in tears” because of over-leverage. He warned the losses could be high because the parcelling out of risk to some many parties would make it more difficult to organise a financial reconstruction.

In an interview with the Financial Times, Mr Green admitted that he was “worried by the degree of leverage in some big ticket transactions nowadays” and felt that “something is going to end in tears”.

Eric Mindich, the chief executive of Eton Park Capital Management ... said the "day of reckoning" may be here, in reference to recent problems in the securitized debt markets. "There's dry timber out there," Mindich said at the Wall Street Journal Deals and Deal Makers Conference on Wednesday. "There are people's lives that are going to be changed by what happens."

Blackstone and the Green Shoe

by Calculated Risk on 6/27/2007 12:28:00 PM

Blackstone is now trading below the IPO price of $31.00 per share (last quote was $29.99).

When a deal is sold, the underwriters (the lead underwriters for Blackstone were Morgan Stanley and Citigroup) actually sell more shares than the amount raised by the company. Blackstone sold 133.3 million shares raising $4.13 Billion, and for this deal, the overallotment was 20 million shares, meaning the underwriters raised an additional $620 million - and they put the money in what is called the "Green Shoe".

For most IPOs, the underwriter exercises the overallotment option after some waiting period, and the entire amount in the Green Shoe goes to the company. But if the stock falls below the initial price, the underwriters start buying back stock using the cash in the Green Shoe. This usually sets a floor for the price of the stock, at around the IPO price - just for the overallotment period.

Since the current stock price is below the IPO price, the Green Shoe is probably being spent right now to support the stock price. We will know how much was spent in a couple of months when (if) the overallotment option is exercised.

IMO, the Blackstone IPO probably marks the peak of the PE LBO wave. And if the stock price stays below the IPO price, the company will jokingly be called Blackpebble (or something far worse).

LBO Deals to Watch

by Calculated Risk on 6/27/2007 11:22:00 AM

Following the postponement of the U.S. Foodservice debt offering, the WSJ put together a table titled: Ten Horses of the Buyout Apocalypse?

The course of the great leveraged-buyout and corporate-acquisition boom of the early 21st century will be determined in large part by 10 companies. ... The companies have agreed to be bought and will soon be asking credit investors to finance the deals. It’s part of a $200-billion plus tidal wave of financing needs that will crash ashore in the next six months.The ten companies listed are:

TXU $25.9 Billion

First Data $24B

Alltel $23.2B

Clear Channel $22.1B

Chrylser $20B

Sallie Mae $16.5B

Cablevision $9.2B

Harrah’s Entertainment $9B

Biomet $7B

Alliance Data $6.6B

A nice list of deals to watch.

Distrust, Ridicule, Contempt and Disgrace

by Anonymous on 6/27/2007 09:00:00 AM

Yeah, another mortgage post.

Via the intrepid Housingdoom.com, we see that the forthright, reputable, upstanding and not funny firm eAppraiseIT, LLC is suing a website, mortgagefraudwatchlist.org.

Mortgagefraudblog.com posts a copy of the complaint:

Defendant's false and malicious statements, when considered alone and without innuendo, have (a) negatively impacted Plaintiff's trustworthiness and character, (b) caused Plaintiff to be subjected to distrust, ridicule, contempt and disgrace, and (c) injured Plaintiff's reputation and goodwill in the appraisal management industry.

Of course, it should be noted that Calculated Risk is drawing your attention to this story, alone and without innuendo, merely for the purpose of informing the investment community, which has big boatloads of money at stake in mortgage and housing-related investments, and which often relies on muck-raking blogs for crucial information ignored or garbled by the mainstream media and paid-for analysts, which information has saved them a lot of money over the last few years, that the possibility exists that bloggers may have to form legal defense funds if certain complaints which have nothing to do with the complaint referenced above are filed and are not dismissed on the grounds of distrust, ridicule, contempt and disgrace.

I'm willing to bet that there's not a lot of deep pockets to be picked in blogland. Most blogs are volunteer efforts and the legal costs of nuisance suits would shut them down, pronto. If the eAppraiseIT suit has merit--if the statements made about eAppraiseIT were truly false and defamatory, and I wouldn't know that--then by all means it should proceed, and the blogger in question should make it right. If, on the other hand, those parties who have enabled a disastrous frenzy of fraud and misrepresentation in the mortgage and housing market over the last few years are going to respond to their deserved ridicule with legal harassment, I for one am going to call on the moneyed bagholder community to step up to the plate behind the shoestring blogs. You know who you are and why you read us and what you have to lose.

Tuesday, June 26, 2007

LBO Debt Market Changing

by Calculated Risk on 6/26/2007 11:50:00 PM

From the WSJ: Bonds Becoming a Tougher Sale

Investors issued a resounding 'No' to a leveraged-buyout debt offering yesterday, leaving banks holding the bag for more than $3 billion and raising concerns about the changing economics of the takeover boom.From the NY Times: Delay in Buyout Bond Sale

...

Underwriters pulled a $1.55 billion bond offering by U.S. Foodservice, the nation's second-largest food distributor. The company also postponed plans to sell $2 billion in loans to fund the deal, according to people familiar with the matter. For now, the banks involved in underwriting the deal will have to lend the $3.6 billion directly to U.S. Foodservice, which is being bought from Royal Ahold NV of the Netherlands.

...

The pushback comes at a challenging moment. Investors are looking ahead at $250 billion of new debt coming to market in the coming months. Just this week, Chrysler Group, which is being sold by DaimlerChrysler AG, began marketing a debt fund raising that will total more than $60 billion.

This week, two other buyouts, the $4.7 billion deal for ServiceMaster and the $6.9 billion sale of Dollar General, are expected to price their bonds.It will be interesting to see what happens to these other bond sales. The WSJ noted that ServiceMaster reduced it's "payment in kind" feature, so maybe that sale will be OK.

S&P: Alt A Loans `Disconcerting,' Jumbos Weaker

by Calculated Risk on 6/26/2007 06:52:00 PM

From Bloomberg: Alt A Loans `Disconcerting,' Jumbos Weaker, S&P Says (hat tip risk capital)

U.S. homeowners with good credit are increasingly falling behind on mortgage payments, a sign lenders have been offering ``higher risk'' loans outside the so-called subprime market, Standard & Poor's Corp. said today.Is this the end of the word "contained"?

Rising late payments and defaults on so-called Alt A mortgages made last year are ``disconcerting'' and delinquent borrowers appear to be ``finding it increasingly difficult to refinance'' or catch up on their payments, S&P analysts said today in a statement. ``Serious'' delinquencies, foreclosures and seized property among ``prime jumbo'' mortgages in bonds from 2006 reached the highest among loans of less than 13 months since at least before 2000, S&P said in a separate report.

...

S&P, one of the two largest ratings firms, is now ``examining how the risk profile clearly increased'' in the Alt A market, it said in a statement sent by e-mail today. ``We will communicate our findings to the market,'' S&P said, in language it typically uses ahead of adjusting its rating methodology.

JPMorgan: Planned CDO Sales Dry Up Amid Bailout

by Calculated Risk on 6/26/2007 05:00:00 PM

From Bloomberg: Planned CDO Sales Dry Up Amid Bailout, JPMorgan Says (hat tip Brian)

Planned sales of collateralized debt obligations backed mainly by subprime mortgages are drying up and may shut down amid concerns about the integrity of the market following the near collapse of hedge funds run by Bear Stearns Cos., JPMorgan Chase & Co. said.No wonder Dr. Altig asks: What's That Unpleasant Sound?

The amount of U.S. high-grade, structured finance CDOs that are being offered to investors has plunged to $3 billion, from $20 billion a month ago ...

"We expect events surrounding warehousing liquidations last week to further slow, if not halt entirely, the new issue market," JPMorgan analysts led by Chris Flanagan in New York said in the report.

...

The damage to the $1 trillion CDO market could freeze what has been a large source of liquidity for the credit markets, Tim Backshall, chief strategist at Credit Derivatives Research LLC, said yesterday.

According to Lombard Street Research, it's a credit crunch. From the U.K. Telegraph:Altig is rightly skeptical of the report, but I do think the sector specific credit crunch is definitely getting more severe, and might expand to other sectors (like M&A loans and CRE investments).The United States faces a severe credit crunch as mounting losses on risky forms of debt catch up with the banks and force them to curb lending and call in existing loans, according to a report by Lombard Street Research.

More on May New Home Sales

by Calculated Risk on 6/26/2007 03:32:00 PM

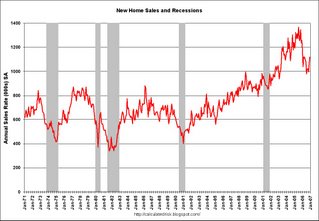

For more graphs, please see my earlier post: May New Home Sales Click on graph for larger image.

Click on graph for larger image.

The first graph shows New Home Sales vs. Recession for the last 35 years. New Home sales were falling prior to every recession, with the exception of the business investment led recession of 2001. This should raise concerns about a possible consumer led recession in the months ahead.

For Fun: Here is the same graph after the December 2006 sales were reported just a few months ago. The housing bust was "over". Not! The bounce back was revised away.

Once again, this reminds us to take the "just reported" data with a grain of salt. As reported this morning, much of the surprise "bounce back" in April has already been revised away.

The third graph compares annual New Home Sales vs. Not Seasonally Adjusted (NSA) New Home Sales through April.

Typically, for an average year, about 44% of all new home sales happen before the end of May. At the current pace, new home sales for 2007 will probably be under 900 thousand - about the same level as the late '90s. This is significantly below the forecasts of even many bearish forecasters.

As a final note, this puts total reported inventory at a record 4.967 million units (4.431 existing homes and 0.536 new homes).

Bear Stearns: A Brat Sneers

by Anonymous on 6/26/2007 02:08:00 PM

Instead of writing intellectually-serious posts that provide cogent analyses of financial and economic issues of profound import, I've been playing on the internet. And I found this, the Internet Anagram Server.

So I had to test it by typing in "Bear Stearns."

Bareness Rat. Bean Arrests. Barren Asset. Banes Raters. Absent Rears. Barest Snare. Bases Errant. Barn Teasers. Bars Nearest. Stabs Earner. Baa Nests Err. Bare Ass Rent. Betas An Errs. (I left out all the ones with "breast" and "bra" because this is a family blog.)

Enjoy yourself, from Data Click Rules (a/k/a A Crack Duellist).

BONG HiTS 4 BILL GROSS!

by Anonymous on 6/26/2007 12:00:00 PM

I want some of of what the man is smoking:

Well prudence and rating agency standards change with the times, I suppose. What was chaste and AAA years ago may no longer be the case today. Our prim remembrance of Gidget going to Hawaii and hanging out with the beach boys seems to have been replaced in this case with an image of Heidi Fleiss setting up a floating brothel in Beverly Hills. AAA? You were wooed Mr. Moody’s and Mr. Poor’s by the makeup, those six-inch hooker heels, and a “tramp stamp.” Many of these good looking girls are not high-class assets worth 100 cents on the dollar. And sorry Ben, but derivatives are a two-edged sword. Yes, they diversify risk and direct it away from the banking system into the eventual hands of unknown buyers, but they multiply leverage like the Andromeda strain. When interest rates go up, the Petri dish turns from a benign experiment in financial engineering to a destructive virus because the cost of that leverage ultimately reduces the price of assets. Houses anyone?

If I followed all that, somebody just got called a ho.

But look at it this way: using the current default rate of 7% (3-4% total losses), the holders of some BBB investment grade subprime-based CDOs will lose all of their moolah because of the significant leverage. No need to worry about fictitious 100 cents on the dollar marks here. One hundred percent of nothing equals nothing. If subprime total losses hit 10% then even some single-A tranches face the grim reaper. AAA’s? Folks the point is that there are hundreds of billions of dollars of this toxic waste and whether or not they’re in CDOs or Bear Stearns hedge funds matters only to the extent of the timing of the unwind. To death and taxes you can add this to your list of inevitabilities: the subprime crisis is not an isolated event and it won’t be contained by a few days of headlines in The New York Times.

Wow. Maybe Mr. Gross should take a yoga class. He sounds a little stressed out.