by Calculated Risk on 5/25/2007 11:24:00 AM

Friday, May 25, 2007

More on Existing Home Sales

NAR reported that existing home inventories are at record levels today. To put these numbers into perspective, here are the year-end inventory and months of supply numbers, since 1982 (Note: The only data I have is year-end starting in 1982). Click on graph for larger image.

Click on graph for larger image.

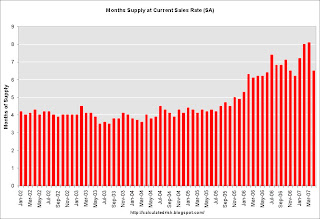

The current inventory of 4.2 million units is an all time record. The "months of supply" metric is now above the level of the previous housing slump in the early '90s, but still below the levels of the housing bust in the early '80s.

The "months of supply" is calculated by dividing the total inventory by the seasonally adjusted annual rate (SAAR) of sales, and multiplying by 12. Currently inventory is 4.2 million, SAAR sales are 5.99 million giving 8.4 months of supply.

Both the numerator and the denominator are moving in the wrong direction. Not only is inventory at record levels, but sales - though falling - are still significantly above the normal range as a percent of owner occupied units (a measure of turnover). See this post from last year Historical: Existing Home Sales and Inventory.

And writing about sales, the followings shows the actual cumulative existing home sales (through April) vs. three annual forecasts for 2007 (NAR's Lereah, Fannie Mae's Berson, and me). My forecast was for sales to be between 5.6 and 5.8 million units (shown as 5.7 million).

My forecast was for sales to be between 5.6 and 5.8 million units (shown as 5.7 million).

To reach the NAR forecast (revised downward on April 11 to 6.34 million units), sales will have to be slightly above 2006 levels for the remainder of the year. Given tighter lending standards, we can probably already say the recent NAR forecast is "no longer operative"!

April Existing Home Sales

by Calculated Risk on 5/25/2007 10:07:00 AM

UPDATE: Added NAR press release.

The National Association of Realtors (NAR) reports Tighter Lending Standards Affect April Existing-Home Sales

Total existing-home sales including single-family, townhomes, condominiums and co-ops fell 2.6 percent to a seasonally adjusted annual rate of 5.99 million units in April from an upwardly revised level of 6.15 million in March, and are 10.7 percent lower than the 6.71 million-unit pace in April 2006.

...

The national median existing-home price for all housing types was $220,900 in April, down 0.8 percent from April 2006 when the median was $222,600.

Click on graph for larger image.

Click on graph for larger image.The first graph shows the NSA sales per month for the last 3 years.

The pattern of YoY declines in sales is continuing. For New home sales, March is usually the strongest sales month of the year. For existing homes, the Summer months are more critical.

The second graph shows the months of supply. With the months of supply now over 8 months, we should expect falling prices nationwide. The NAR reports that YoY prices fell again in April.

The third graph shows nationwide inventory for existing homes. According to NAR, inventory increased to a record 4.2 million units in April.

The third graph shows nationwide inventory for existing homes. According to NAR, inventory increased to a record 4.2 million units in April.Total housing inventory rose 10.4 percent at the end of April to 4.20 million existing homes available for sale, which represents a 8.4 month supply at the current sales pace, up from a 7.4 month supply in March.I'm surprised that the NAR doesn't mention this is the all time record for inventory (not months of supply though).

All Your Access to Money Are Belong To Us

by Anonymous on 5/25/2007 06:10:00 AM

I have argued that if a mortgage broker isn't acting in a fiduciary capacity, I don't see the point of hiring a broker. It appears I fail to understand this business. From the Wall Street Journal, "Mortgage Brokers: Friends or Foes" (hat tip, yal):

Borrowers often see mortgage brokers as their allies, searching far and wide for just the right home loan at an attractively low price. But many brokers are making it clear they don't see things that way. They are fighting efforts by federal and state politicians to impose a fiduciary duty on them to put their customers' interests first, as lawyers, real-estate agents and financial planners generally are required to do with their clients.

"The mortgage broker does not represent the borrower," says Chris Holbert, president of the Colorado Mortgage Lenders Association. "We sell access to money." The industry group recently opposed language in Colorado legislation that would have required mortgage brokers to act "primarily for the benefit of the borrower." That provision was later deleted. . . .

The National Association of Mortgage Brokers, the main nationwide trade group for brokers, argues that brokers work neither for consumers nor for lenders. Imposing a fiduciary duty would increase the risk of litigation over whether brokers are to blame for loans that go bad, says Joseph Falk, legislative chairman of the association. He adds that the group favors clear disclosures to consumers and no hiding of important details.

I had the idea that "we sell access to money, so you can't sue us" probably didn't make for a winning mission statement, so I wandered over to NAMB's website:

A typical broker has a working relationship with numerous banks and other lenders and provides the consumer with access to hundreds of options when it comes to financing a home. This allows mortgage brokers to provide consumers the most efficient and cost-effective method of obtaining a mortgage that fits the consumer's financial goals and circumstances. Mortgage brokers have helped many consumers, including low-to-moderate income borrowers with less than perfect credit histories, enjoy the benefits of homeownership.

How odd. If you read NAMB's Mission Statement rather carelessly, you'd get the impression that the broker works for the consumer.

Thursday, May 24, 2007

More on April New Home Sales

by Calculated Risk on 5/24/2007 06:20:00 PM

For more graphs, please see my earlier post: April New Home Sales Click on graph for larger image.

Click on graph for larger image.

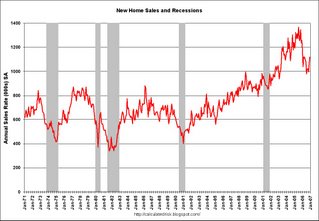

The first graph shows New Home Sales vs. Recession for the last 35 years. New Home sales were falling prior to every recession, with the exception of the business investment led recession of 2001. This should raise concerns about a possible consumer led recession in the months ahead.

For Fun: Here is the same graph after the December 2006 sales were reported just a few months ago.

The housing bust was "over".

Ooops!

Once again, this reminds us to take the "just reported" data with a grain of salt.

The third graph compares annual New Home Sales vs. Not Seasonally Adjusted (NSA) New Home Sales through April.

Typically, for an average year, about 35% of all new home sales happen before the end of April. At the current pace, new home sales for 2007 will probably be under 900 thousand - about the same level as the late '90s. This is significantly below the forecasts of even many bearish forecasters.

Fed: Loan Delinquency Rates Increase in Q1

by Calculated Risk on 5/24/2007 05:31:00 PM

Click on graph for larger image.

Click on graph for larger image.

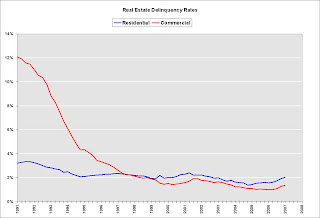

The Federal Reserve reports that delinquency rates at U.S. commercial banks increased in Q1 for all types of real estate loans. For residential real estate, the delinquency rate increased to 2.04% from 1.94% in Q4 2006. For commercial real estate, the delinquency rate increased to 1.37% from 1.29% in Q4.

Housing Revisions

by Calculated Risk on 5/24/2007 11:09:00 AM

Here was the original report for April 2006. Many analysts claimed housing had bottomed and the recovery was starting.

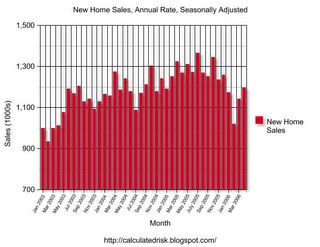

Click on Graph for larger image.

NOTE: The graph starts at 700 thousand units per month to better show monthly variation.

Originally the Census Bureau reported a significant increase in sales for both March and April 2006.

Here is the graph today. The "recovery" in March and April 2006 has been revised away.

I expect the April 2007 sales number to be revised downwards too.

More later today on New Home Sales.

April New Home Sales

by Calculated Risk on 5/24/2007 10:00:00 AM

According to the Census Bureau report, New Home Sales in April were at a seasonally adjusted annual rate of 981 thousand. Sales for March were revised down to 844 thousand, from 858 thousand. Numbers for January and February were revised up.

Click on Graph for larger image.

Sales of new one-family houses in April 2007 were at a seasonally adjusted annual rate of 981,000 ... This is 16.2 percent above the revised March rate of 844,000, but is 10.6 percent below the April 2006 estimate of 1,097,000.

The Not Seasonally Adjusted monthly rate was 92,000 New Homes sold. There were 100,000 New Homes sold in April 2006.

April '07 sales were the lowest since April 2003 (91,000).

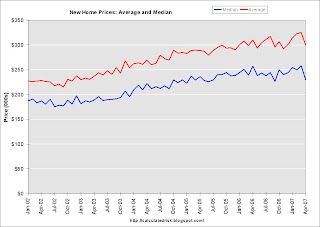

The median and average sales prices were up down. Caution should be used when analyzing monthly price changes since prices are heavily revised.

The median sales price of new houses sold in April 2007 was $229,100; the average sales price was $299,100.

The seasonally adjusted estimate of new houses for sale at the end of April was 538,000.

The 538,000 units of inventory is slightly below the levels of the last six months. Inventory numbers from the Census Bureau do not include cancellations - and cancellations are at record levels. Actual New Home inventories are much higher - some estimate about 20% higher.

This represents a supply of 6.5 months at the current sales rate.

This is a surprisingly strong report, and sales will probably be revised down. More later today on New Home Sales.

WSJ on the Construction Employment Riddle

by Calculated Risk on 5/24/2007 01:29:00 AM

From the WSJ: Job Market's Strength May Have Been Overstated

Official employment data may have overstated job growth, especially in the home-building industry, some economists say.Nothing new - maybe it's laid-off illegal immigrants, maybe it's out of work self-employed, maybe there is a lag between the housing slump and layoffs, maybe the BLS missed the turning point, maybe commercial construction has absorbed some of the residential construction workers ...

"There's a lot of potential answers and partial solutions" to the riddle, [Michael Feroli, an economist at J.P. Morgan Chase & Co.] said. "With each one of these stories, you fix one hole, but you spring another leak somewhere else."The "riddle" may be caused by a combination of several factors, but it does appear that the BLS will revise job growth down significantly this year.

Wednesday, May 23, 2007

Quotes from MBA Mortgage Conference

by Calculated Risk on 5/23/2007 03:39:00 PM

From CNNMoney: Speed of subprime bust surprises lenders. A few quotes from the article:

"Last October, I predicted the subprime market would collapse and many issuers would go out of business. But the violence and speed of the market sell-off surprised people."

Michael Marriott, managing director, Credit Suisse, 5/21/2007

"35 percent of what once could be done, can no longer be done," referring to mortgage loan products that have effectively been taken off the shelves.

David Lowman, chief executive of JPMorgan Chase & Co.'s global mortgage business

"Anything that smacks of no-income and no-documentation is history. Anything above 85 percent to 90 percent loan-to-value, anything non-owner occupied, anything ludicrous as to value - like someone stepping up from a $1,000 a month payment to a $6,000 a month - is history."Tough talk, so I'm sure everyone welcomed Comptroller Dugan's comments: Dugan Opens Fire.

Allen Hardester, director of business development, Guaranteed Rate

Stated Income Update: Dugan Opens Fire

by Anonymous on 5/23/2007 10:48:00 AM

I made a little joke the other day about the Comptroller of the Currency reading Angelo Mozilo's remarks to the MBA, and I guess that was too inside baseball for those who are not regulatory afficionados.

John C. Dugan is the C of the C, head of the OCC which is a regulator of some big banks, and he has been one of the major drivers behind what regulatory responses we've been getting, such as they are, over the last few years (like the Nontraditional Mortgage Guidance).

He just let loose with a speech on stated income lending that is gonna have some lenders hiding behind the credenza:

“Sound underwriting – and, for that matter, simple common sense – suggests that a mortgage lender would almost always want to verify the income of a riskier subprime borrower to make sure that he or she had the means to make the required monthly payments,” Mr. Dugan said in a speech to Neighborhood Housing Services of New York.

“But the norm appears to be just the opposite: nearly 50 percent of all subprime loans last year accepted stated income,” he said.

Mr. Dugan noted that in a market where house prices are rising, the risks of stated income loans are masked, since borrowers can refinance if they run into trouble.

“As a result, the rapidly rising housing market of 2003-2005 was the perfect Petri dish to incubate the widespread practice of stated income loans,” he said. “At a very fundamental level, it was a bet that the increasing value of a borrower’s collateral would offset any inadequacy of the borrower’s income.”

However, he added, we are now seeing the results of stated income loans in a market where house prices are falling or failing to increase, and the consequences have been rising delinquencies and foreclosures, with serious costs for families and communities.

While reliance on stated income is not the only cause of today’s problems, Mr. Dugan said, “I do find it telling that, when faced with new housing market conditions, lenders have responded first by tightening standards on stated income.” In addition, he said, one of the first things loan servicers do when trying to decide whether to restructure or foreclose on a mortgage is to seek verification of income.

“Apparently verified income is viewed as a critical factor in determining whether a loan can be saved, which of course begs the question: if loan verification is such an important predictor of the borrower’s ability to repay in the current environment, why wasn’t it equally important when the loan was first made?” Mr. Dugan asked.

The Comptroller said there are clearly some circumstances in which reliance on stated income is appropriate, such as a straight refinancing that doesn’t involve a cash take-out and which is underwritten by the same lender. The lender not only has experience with the borrower, but knows that the new mortgage will be more affordable, and hence more secure, than the one it replaces.

But he said such uses of stated income lending should be the exception, rather than the rule, for three key reasons:

*Stated income is too great a temptation for misrepresentation and, in its most extreme form, outright fraud.

*The practice also undermines transparency: “How can lenders seriously talk about debt-to-income ratios, for example, if the denominator of ‘income’ is really an unknown variable that can be whatever the borrower says it is?” he asked.

*It is not a safe and sound underwriting practice to make mortgage loans that substitute future house price appreciation for borrower income as a key source of repayment, as appears to have been the case in many subprime loans underwritten in the last few years.

Mr. Dugan noted that the use of stated income has been addressed by the federal banking agencies in guidance on home equity lending and nontraditional mortgages.

“Now we must decide whether to address the practice even more strongly in the context of finalizing the guidance on subprime lending,” he said. “For the reasons described above, I believe we should, although how we do so and the extent to which we do it are of course decisions that should only be made after careful consideration of the comments we have received.”

Oh, man. Dad's home, and he's not happy.