by Calculated Risk on 5/16/2007 08:59:00 PM

Wednesday, May 16, 2007

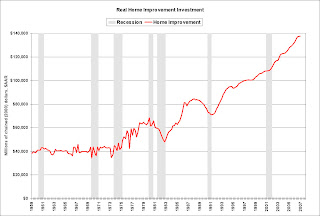

What Home Improvement Investment Slump?

"We believe the home-improvement market will remain soft throughout 2007."Soft? Actually real spending on home improvement is holding up pretty well. If this housing bust is similar to the early '80s or '90s, real home improvement investment will slump 15% to 20%.

Frank Blake, Home Depot Chairman and CEO, May 15, 2007

Click on graph for larger image.

Click on graph for larger image.This graph shows real home improvement investment (2000 dollars) since 1959. Recessions are in gray.

Although real spending was flat in Q1 2007, home improvement spending has held up pretty well compared to the other components of Residential Investment. With declining MEW, it is very possible that home improvement spending will slump like in the early '80s and '90s.

California Home Sales: Lowest Since '95

by Calculated Risk on 5/16/2007 08:05:00 PM

From DataQuick: California April 2007 Home Sales

A total of 34,949 new and resale houses and condos were sold statewide last month. That's down 12.2 percent from 39,811 for March, and down 28.5 percent from 48,894 for April 2006. Last month's sales made for the slowest April since 1995 when 27,625 homes were sold. April sales from 1988 to 2007 range from the 27,625 in 1995 to 66,938 in 2005. The average is 46,141. On a year-over-year basis, sales have declined the last 19 months.

Starts, Completions and Recessions

by Calculated Risk on 5/16/2007 01:13:00 PM

By popular demand, here is a graph of Starts and Completions with Recessions. Click on graph for larger image.

Click on graph for larger image.

An optimist might argue that we should already be in a recession based on previous housing slumps - so if the worst is over for this housing slump, a soft landing is very possible. Of course I think starts will fall further - perhaps to the 1.1 million SAAR level.

The WSJ housing story led with this sentence:

Home construction unexpectedly rose during April, making a surprise increase despite bloated inventories and tighter credit for subprime borrowers ...And yes, fundamentals like "bloated inventories" and less demand, do matter.

Housing Starts and Completions

by Calculated Risk on 5/16/2007 10:50:00 AM

The Census Bureau reports on housing Permits, Starts and Completions. Seasonally adjusted permits declined:

Privately-owned housing units authorized by building permits in April were at a seasonally adjusted annual rate of 1,429,000. This is 8.9 percent below the revised March rate of 1,569,000 and is 28.1 percent below the revised April 2006 estimate of 1,987,000.Starts rebounded:

Privately-owned housing starts in April were at a seasonally adjusted annual rate of 1,528,000. This is 2.5 percent above the revised March estimate of 1,491,000, but is 16.1 percent below the revised April 2006 rate of 1,821,000.And Completions declined to the level of starts:

Privately-owned housing completions in April were at a seasonally adjusted annual rate of 1,523,000. This is 5.8 percent below the revised March estimate of 1,616,000 and is 26.0 percent below the revised April 2006 rate of

2,058,000.

Click on graph for larger image.

Click on graph for larger image.The first graph shows Starts vs. Completions.

As expected, Completions have followed Starts "off the cliff". Completions are now at the level of starts. Starts will probably fall further (based on permits and housing fundamentals) and completions will most likely decline further too.

This graph shows starts, completions and residential construction employment. (starts are shifted 6 months into the future). Completions and residential construction employment were highly correlated, and Completions used to lag Starts by about 6 months.

Both of these relationships have broken down somewhat (although completions have fallen to the level of starts). Why residential construction employment hasn't fallen further is a puzzle. Also the time between start and completion has increased recently.

This report shows builders are still starting too many projects, and that residential construction employment is still too high.

Tuesday, May 15, 2007

Commercial Real Estate: Slump Ahead?

by Calculated Risk on 5/15/2007 08:44:00 PM

With the release of the Fed Loan Survey, we can connect another dot in the possible Commercial Real Estate (CRE) slump later this year. Click on graph for larger image

Click on graph for larger image

The first graph shows the YoY change in nonresidential structure investment vs. loan demand data from the Fed Loan survey: Net Percentage of Domestic Respondents Reporting Stronger Demand for Commercial Real Estate Loans

Unfortunately the demand survey data is only available since 1995, but the correlation is clear: falling demand leads lower investment by about a year. The causation is obvious, loans taken out today impact investment over the next couple of years.

This is more evidence that the normal pattern will hold: nonresidential structure investment will probably follow residential investment "over the cliff".

Here are some earlier dots:

1) Non-residential structure investment has been booming for the last few years. Commercial rents have been rising and office vacancy rates have been falling. But signs of a trend change are emerging, from the IHT on May 2nd: Alarm raised over U.S. commercial real estate lending

... signs are emerging that the office market is slowing down in the United States. Though rents continued to rise in the first quarter of this year, the average vacancy rate for 58 U.S. metropolitan markets rose to 12.6 percent from 12.5 percent, the first increase for any quarter since 2004, according to Torto Wheaton Research, a division of CB Richard Ellis.

2) This graph shows the YoY change in Residential Investment (shifted 5 quarters into the future) and investment in Non-residential Structures. In the typical cycle, non-residential investment follows residential investment, with a lag of about 5 quarters. Residential investment has fallen significantly for four straight quarters (following two minor declines). So, if this cycle follows the typical pattern, non-residential investment will start declining later this year.

2) This graph shows the YoY change in Residential Investment (shifted 5 quarters into the future) and investment in Non-residential Structures. In the typical cycle, non-residential investment follows residential investment, with a lag of about 5 quarters. Residential investment has fallen significantly for four straight quarters (following two minor declines). So, if this cycle follows the typical pattern, non-residential investment will start declining later this year.3) The WSJ noted earlier this month that demand was "sluggish" for office space. The current office space absorption rate is about 8 to 10 million square feet per quarter, but "... developers will open 76 million square feet of new office space by the end of this year." Since supply will grow significantly faster than the absorption rate, vacancy rates will rise.

4) Many banks are over-exposed to CRE lending. With rising vacancy rates, defaults will probably start to rise for CRE loans.

And remember, non-residential investment is the great hope of the soft landing view. That is why many economists are watching non-residential investment closely.

SoCal home sales hit 12-year low

by Calculated Risk on 5/15/2007 02:54:00 PM

From the LA Times: SoCal home sales hit 12-year low

Southern California home sales plunged to a 12-year low for the month of April, dragged down by a dearth of transactions at the lower end of the market even as prices held steady ... DataQuick Information Systems reported.The changing market poses a problem with the "median price" method of tracking prices. As an example, say 100 homes sold in a certain month, 20 homes each at $300K, $400K, $500K, $600K, and $700K. The median price would be $500K.

... nearly a third fewer homes in Los Angeles, Orange, Riverside, San Bernardino, San Diego and Ventura counties closed escrow last month compared to a year earlier for the worst April showing since 1995, DataQuick found.

...

Most of the erosion in sales appeared in the lower-priced markets of the Inland Empire that only a year ago still seemed to be soaring. In Riverside County, sales dropped 45.1% to 2,987 year over year, while in neighboring San Bernardino County, sales plunged 46.7% to 2,049 ...

"The falloff in starter home sales has the effect of pushing median prices up a bit, although it's still somewhat surprising prices haven't declined more," said DataQuick president Marshall Prentice.

However, during the next month, say half the homes in the two lower brackets didn't sell (only 10 each for $300K and $400K), but all the other homes sold at the same price as the month before. Sales would decrease by 20% (similar to the declines reported by DataQuick). However the median price would increase 10% to $550K! Clearly this is misleading.

The OFHEO house price index uses same home sales, so it doesn't suffer from this problem (although there are other problems with the OFHEO Index, especially for more expensive areas). The Q1 OFHEO HPI will be released on Thursday, May 31st.

Builder Confidence Slips Again In May

by Calculated Risk on 5/15/2007 01:56:00 PM

Click on graph for larger image.

Click on graph for larger image.

NAHB Press Release: Builder Confidence Slips Again In May

Ongoing concerns about subprime-related problems in the mortgage market caused builder confidence about the state of housing demand to decline three more points in May, according to the National Association of Home Builders/Wells Fargo Housing Market Index (HMI), released today. With a current reading of 30, the HMI has now returned to the lowest level in its current cycle, which was previously hit in September of 2006.

“Builders are feeling the impacts of tighter lending standards on current home sales as well as cancellations, and they are bracing for continued challenges ahead,” said NAHB President Brian Catalde, a home builder from El Segundo, Calif.

“The crisis in the subprime sector has infected other parts of the mortgage market as well as consumer psychology, and as a result the housing outlook has deteriorated,” added NAHB Chief Economist David Seiders. “We’re now projecting that home sales and housing production will not begin improving until late this year, and we’re expecting the early stages of the subsequent recovery to be quite sluggish. There still are tremendous uncertainties regarding our baseline forecast going forward, owing largely to the subprime crisis that is having widespread effects throughout the mortgage market.”

Derived from a monthly survey that NAHB has been conducting for more than 20 years, the NAHB/Wells Fargo HMI gauges builder perceptions of current single-family home sales and sales expectations for the next six months as either “good,” “fair” or “poor.” The survey also asks builders to rate traffic of prospective buyers as either “high to very high,” “average” or “low to very low.” Scores for each component are then used to calculate a seasonally adjusted index where any number over 50 indicates that more builders view sales conditions as good than poor.

All three component indexes declined in May. The index gauging current single-family sales slipped two points to 31, while the index gauging sales expectations for the next six months fell three points to 41 and the index gauging traffic of prospective buyers fell four points to 23.

Three out of four regions posted declines in the May HMI. The Northeast posted a six-point decline to 32, while the South posted a four-point decline to 33 and the West posted a three-point decline to 32. The Midwest eked out a one-point gain, to 23.

Lender Beware

by Anonymous on 5/15/2007 01:08:00 PM

I’m not sure, but this little anecdote from the Wall Street Journal may include at least one example of everything we have been complaining about for three solid years. It’s like a mystification buffet: you just don’t know where to start nibbling. I have added the emphasis to the following, which is from the paper edition (“Lenders Get Tougher," May 15, D1):

Increased scrutiny by lenders is meant to weed out problem loans and reduce mortgage fraud. But it also can inconvenience borrowers. Jordan Lipton, a physician, got waylaid by tougher appraisal standards when he recently applied for a mortgage to finance the $1.05 million purchase of a four-bedroom home in Charlotte, N.C.Let’s just take these in order:

The lender, American Home Mortgage Corp., requested two appraisals of the property, and then sought a price opinion from a real-estate broker, who said the home was worth just $750,000, well below the $885,000 Mr. Lipton wanted to borrow, according to Mr. Lipton's mortgage broker. Mr. Lipton was able to get the financing he needed from another lender two weeks later, but by that time the rate on his loan had risen a quarter percentage point to 6 3/8%. "It's ended up costing us a lot more over a 30-year period," he says. The higher rate could amount to tens of thousands of dollars in added interest payments over that time.

Mr. Lipton's broker, Daniel Jacobs, chief executive of Empire Equity Group's 1st Metropolitan Mortgage unit, says the two appraisals supported his client's purchase price. But he says getting a third layer of verification -- the broker's opinion -- was "an overreaction" to the rise in problem loans, especially because his client had good credit and provided full documentation of his income and assets.

1. Lenders are certainly tightening credit guidelines to protect themselves. It is, however, an odd perspective to think that borrowers and lenders have entirely opposing interests here. As compared, for instance, to the way that the interests of borrowers and sellers might conflict. There is a theory that borrowers don’t want to spend more than they have to. We have a case where Mr. Lipton is being encouraged by his lender to not overpay for a property. Mr. Lipton sees himself as “inconvenienced.” Anyone who has ever been a fiduciary for a teenager can probably relate. To the lender.

2. A four-bedroom home for over $1MM? That would have required two appraisals during the boom from every lender except the ones that are currently bankrupt, and not all of those. So let’s put this “tightening” thing into some perspective.

3. A price opinion does not tell you what a home is “worth.” That is what an appraisal is supposed to do. A price opinion tells you what an informed market participant thinks the likeliest price is today. Since so many people struggle with this “value/price” distinction, let’s be clear on it. Simply put, “value” is the price you could expect in a market experiencing general supply/demand equilibrium, typical buyer and seller motivation (average distress levels), and sufficient transaction volume to produce reasonable estimates of market exposure. In periods of time when a given market is out of balance, experiencing seller distress, and slowing considerably, the likeliest price for a property is quite possibly substantially less than its value. Another way to say this is a borrower paying “appraised value” for a property in a declining market is not a bargain-hunter. This does not mean that the market in question will never return to conditions that allow an objective “value” to be determined. It does, however, suggest that a borrower wanting to pay more than the current BPO price needs to display to the lender more “durability” as a credit risk than someone else does, since this borrower will have a longer than usual wait in store if he’s counting on anything like appreciation.

4. I don’t think that odd shift from what Mr. Lipton “wanted to borrow” to “the financing he needed” in a matter of a sentence or two is just casual language. We just spent a whole long housing/mortgage/MEW/debt/spending boom being confused about how much we want to borrow and how much we need to borrow. Mr. Lipton’s lender was telling him he was overpaying for the property, and Mr. Lipton understood that as the lender not giving him what he needed. Mr. Lipton wants to be able to overpay for a property. Mr. Lipton’s lender suggests that he therefore make the “overpayment” part in cash. Mr. Lipton thinks he needs to be able to borrow the overpayment part. Mr. Lipton’s lender does not need to lend the overpayment part. Worlds collide.

5. Did Mr. Lipton’s rate go up because the market moved during the time he was struggling to find someone to make him a dumb loan, or because the lender who finally made a dumb loan charged more for it? Do we know this from the article? I have my suspicions, but I do love that business of it "costing us more." I also can't help wondering if our broker informed our new lender about that BPO. It doesn't matter if the new lender didn't order that. One represents and warrants that one has disclosed everything one knows that might be material to someone's estimation of the quality of a loan, and knowing that the last lender had a scary BPO is material. I confess that if I still worked for a lender I'd be doing a database search on a loan for a Mr. Lipton in Charlotte right about now, to see what was in that file.

6. Ah. Mr. Lipton’s broker is where the information, and presumably the "us," is coming from. What a surprise. Does Mr. Lipton think his interests are more aligned with his broker’s than with his lender’s?

7. The part we didn’t get: what about the seller? What about the neighborhood? How old were the comps? What was actually on those appraisals that made American Home—not my idea, by the way, of an overly cautious, traditional lender—get that BPO? Could it have been, precisely, that the appraisals appeared to do no more than "support" the contract price? There is another fruitful avenue of inquiry when an only moderately conservative lender goes out of its way to obtain deal-breaking information.

Look, folks, using a BPO in a booming market is nuts. That’s because they tend to err on the upside, if you get my drift. A BPO coming in not just under the appraised value but under the contract sales price by that much is a big flashing screaming

Stalking off in a huff to find someone who will accept a higher LTV, on the other hand, gets you a pity party in the Wall Street Journal, but it doesn’t make you rational. Obviously we’ve got a lot more “tightening” to do, especially in the story-line. There is a possible way of reading this anecdote as a lender refusing to prey on a borrower. The WSJ seems to take seriously the right of the prey to be preyed upon if the prey is upper-middle-class and that’s what’s convenient at the time, which is unsurprisingly the point of view of the only perspective we're given: a mortgage broker's.

A mortgage broker who is not a fiduciary does his "duty" just by getting you a loan; there is no duty to get you a loan that is good for you. Proposals on the table these days to force brokers to become fiduciaries are not just about poor folks or fees and points.

Housing Hits Home Depot

by Calculated Risk on 5/15/2007 09:44:00 AM

From MarketWatch: Home Depot's net falls 30%; housing hurts

Home Depot Inc. on Tuesday reported a 30% drop in quarterly profit, blaming the faltering U.S. housing market as well as unusual weather, and forecast a weak home-improvement market for the rest of the year.

...

"The housing market continues to be a challenge, and erratic weather conditions across the United States negatively affected our spring selling season," said Frank Blake, Home Depot's chairman and chief executive ...

"We believe the home-improvement market will remain soft throughout 2007," said Blake.

Fraud and Collateral Risk Index

by Anonymous on 5/15/2007 09:25:00 AM

I thought you all might find this interesting; it also gives me an opportunity to try posting a wide chart and blowing up the new format before CR gets up (sorry, boss, I was just experimenting).

From First American CoreLogic, Core Mortgage Risk Monitor Q2 2007:

As house prices stabilize, we are entering a transitional period where the risks associated with rising delinquencies and foreclosures can have a concentrated and contagious impact on local markets. The Fraud and Collateral Risk Index (exhibit 3) is stabilizing at a relatively high level not reached in recent years, while the Foreclosure Index (exhibit 4) is expected to continue rising despite relatively unchanged employment conditions and a stabilization of house prices. Overall the CMRM data reveals continued turbulence in the residential real estate sector that is affecting local economies across the country.

A recent study performed by First American CoreLogic indicates that there is a strong correlation between fraud and collateral risk and foreclosure rates. The study of more than 150,000 loan transactions revealed that for every one percent increase in the local market foreclosure rate, the likelihood of fraud increases by approximately four percent. A rising foreclosure rate, in part due to the pressures of ARM resets as well as other fundamental economic factors, has placed upward pressure on the fraud and collateral risk index. This upward pressure is expected to continue throughout 2007 and into 2008 as the markets continue to digest payment resets. These effects are likely to be geographically concentrated since foreclosures and economic stress are concentrated in specific markets.