by Calculated Risk on 4/18/2007 01:53:00 PM

Wednesday, April 18, 2007

Class Action Lawsuit Against Toll Brothers

Lerach Coughlin today announced that a class action has been commenced in the United States District Court for the Eastern District of Pennsylvania on behalf of purchasers of Toll Brothers, Inc. common stock during the period between December 9, 2004 and November 8, 2005.I wonder if Larry Kudlow will want to join the lawsuit since he singled out Toll Brothers in June 20, 2005: The Housing Bears Are Wrong Again

...

The complaint charges Toll Brothers and certain of its officers and directors with violations of the Securities Exchange Act of 1934. Toll Brothers is a home builder which specializes in building large, expensive homes.

The complaint alleges that defendants made a series of false and misleading statements indicating that Toll Brothers’ business model, which was based on developing expensive homes for a niche market of high-end buyers, was unique and thus immune from the adverse impact of rising interest rates and other negative macro-economic factors that appeared to be negatively impacting the home-building industry during 2004 and 2005.

... particularly well-run companies like Toll Brothers ...For some interesting quotes, see the complaint. The complaint also notes that Chairman Robert Toll, and Vice Chairman Bruce Toll, sold millions of dollars of stock during the class period.

Freddie Mac's Syron on Subprime

by Anonymous on 4/18/2007 12:36:00 PM

From Freddie Mac CEO Richard Syron's testimony to the House Committee on Financial Services yesterday:

First and foremost, regulation is needed to ensure that borrowers have the information they need to make informed mortgage choices. To be most effective, consumer disclosures need to be uniformly and consistently applied.

Second, good regulation also would set prudent guidelines on what I call the “socially acceptable” level of defaults. As a nation, we need to set some limit on the level of risk we are willing to take in order to promote higher levels of homeownership. We need to be honest that there's a major tension between putting as many families into homes as possible – and ensuring they can sustain homeownership over the long term.

Third, good regulation should ensure a level playing field. As long as some institutions operate under different, or no, regulatory strictures, potential for these sort of excesses and abuses will exist. There are a lot of investors in this market, and relying on any one set of participants will be ineffective. As a case in point, relying on the GSEs to “regulate” the behavior of other entities will not work because non-GSE investors account for the vast majority of subprime mortgages that have been securitized.

We also should carefully distinguish between those borrowers who can be “rescued” and those who cannot. I realize such a triage will not be easy or popular, but policy prescriptions such as widespread “bailouts” or foreclosure moratoriums should be considered only in certain extreme situations. Broad application of such prescriptions could have lasting, unintended consequences that harm the housing finance system in the long term.

Neg Am and Lender Accounting

by Anonymous on 4/18/2007 11:28:00 AM

Because it is always a minor controversy during earnings season, here's what the OTS has to say on the subject of a thrift with a neg am portfolio:

Capitalized interest. Lenders may record negative amortization as income in the form of capitalized interest. The lender does not actually receive the negative amortization amount as a payment from the borrower. Under generally accepted accounting principles (GAAP) the lender may capitalize (add to the loan balance) the accrued but unpaid interest amount and recognizes it as income as long as the

capitalized interest is considered collectible. The collectibility of the interest depends on the borrower’s ability and willingness to repay to full principal and interest, which is influenced by the borrower’s ability to service the debt and the size of the loan relative to the property value. When borrowers consistently make only the minimum required payments on option ARM mortgages, the increasing capitalized interest balance may indicate increasing credit risk, as it might indicate declining borrower equity and the borrower’s inability to make fully amortizing payments. A high level of capitalized interest may also create cash flow or liquidity concerns for the lender.

Credit risk. LTVs can increase over time (if property values decline or the borrower chooses to make only the minimum required payments), which increases the credit risk to the association. Recast requirements are designed to prevent runaway LTVs. If property values do not appreciate and interest rates rise, all lenders may be adversely affected, but NegAm lenders face greater exposure because of escalating LTVs. Additionally, the reported earnings sometimes mask credit risk in a NegAm portfolio, where the association is accruing income at a higher rate than the borrower is paying on the loan. Traditional credit quality monitoring reports of point-in-time delinquency and default data may lag as indicators of asset quality problems because borrowers facing payment problems can opt to reduce their monthly payments without causing the loan to go delinquent or disrupting the income accrual on the loan. Therefore, a strong indicator of potential credit risk is the number of an institution’s option-ARM loans that actually negatively amortize.

MBA: Mortgage Applications Decrease

by Calculated Risk on 4/18/2007 11:11:00 AM

The Mortgage Bankers Association (MBA) reports: Purchase Applications Rise, Refinance Applications Decline in Latest MBA Survey

The Market Composite Index, a measure of mortgage loan application volume, was 630.6, a decrease of 2.5 percent on a seasonally adjusted basis from 646.6 one week earlier. On an unadjusted basis, the Index decreased 2.2 percent compared with the previous week and was up 9.9 percent compared with the same week one year earlier.Mortgage rates increased:

"Since the survey covered the week after the Easter weekend, it is likely that home sales were a little lower, and thus, possibly impacted purchase applications last week.” said Vincent Varma, Director of Industry Surveys at the Mortgage Bankers Association.

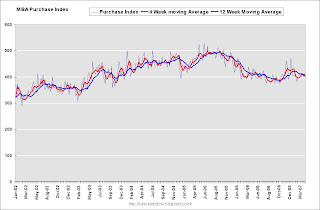

The Refinance Index decreased 0.3 percent to 2008.4 from 2015 the previous week and the seasonally adjusted Purchase Index decreased 4.2 percent to 396.5 from 413.8 one week earlier.

The average contract interest rate for 30-year fixed-rate mortgages increased to 6.22 percent from 6.16 percent ...

The average contract interest rate for one-year ARMs increased to 5.89 from 5.88 percent ...

Click on graph for larger image.

Click on graph for larger image.This graph shows the Purchase Index and the 4 and 12 week moving averages since January 2002. For the Purchase Index, the four week moving average is down 0.9 percent to 406.1 from 409.6.

The refinance share of mortgage activity increased to 43.6 percent of total applications from 42.8 percent the previous week. The adjustable-rate mortgage (ARM) share of activity decreased to 18.1 from 18.7 percent of total applications from the previous week.

Alt-A Update: Downey Reports

by Anonymous on 4/18/2007 07:23:00 AM

Downey Financial (DSL), one of our favorite California thrifts stuffed to the overhead bins with neg-am ARMs, has a press release out this morning.

Highlights:

- REO doubled in Q107 from $8.5MM to $17.2MM

- Non-performing assets were .94% of all assets, up from .68% at 06 year-end and .22% a year ago

- Delinquencies were 1.32% of total loans, up from 1.03% at Q406 and .32% a year ago

- Neg am ARMs are down to a mere 81% of portfolio, from 92% a year ago. Neg am during Q1 was $37MM or 3.56% of neg am portfolio, representing 31% of loan interest income

- Allowance for loan losses was unchanged from Q406 and down $9.4MM from a year ago

Tuesday, April 17, 2007

WSJ: Problems May be Spreading to Prime Home Loans

by Calculated Risk on 4/17/2007 10:56:00 PM

From the WSJ: Regional Banks Report Profit Declines

Earnings reports at some regional banks suggested subprime credit problems may be spreading to certain types of prime home loans.These appear to be minor problems right now, but as housing prices fall, more problems will most likely emerge.

...

John McDonald, an analyst with Banc of America Securities LLC, says prime home-equity loans may become the next problem-loan category given rapid growth and "looser" underwriting.

Housing Starts and Completions

by Calculated Risk on 4/17/2007 01:16:00 PM

The Census Bureau reports on housing Permits, Starts and Completions Click on graph for larger image.

Click on graph for larger image.

The first graph shows Starts vs. Completions.

As expected, Completions are now following Starts "off the cliff". Completions are the key number in this release, since employment follows completions.

Based on the rapidly increasing inventory (both new and existing homes), it appears home builders are still overly optimistic. They are pulling too many permits, and still starting too many homes.  This graph shows starts, completions and residential construction employment. (starts are shifted 6 months into the future). Completions follow starts, and employment usually tracks completions.

This graph shows starts, completions and residential construction employment. (starts are shifted 6 months into the future). Completions follow starts, and employment usually tracks completions.

Based on historical correlations, it is reasonable to expect BLS reported residential construction employment to follow Starts and Completions "off the cliff" soon. Yes, cash workers (many illegal immigrants) were probably the first to be let go, and many of them don't show up in the employment statistics. Still I expect BLS reported jobs to decline soon and significantly. Night still follows day.

Alt-A Update: "Completely Manageable"

by Anonymous on 4/17/2007 11:29:00 AM

SunTrust appears to be having a bit of an Alt-A problem:

Mortgage profit sank 90 percent to $7.5 million from $77.6 million, hurt by lower margins on loans sold, lower servicing income and higher write-offs for "Alt-A" loans. The latter is short for "Alternative-A" loans, which often go to borrowers who cannot provide full documentation of income or assets. . . .

A SunTrust investor relations official, Greg Ketron, on a conference call said Alt-A pressures cut first-quarter profit by 5 cents per share and should reduce second-quarter earnings by a similar amount.

"We feel the situation is completely manageable, given the controls and guidelines that are in place," he said.

Completely manageable, huh? I take this as a promise that no Big Dog Bank is going to suddenly declare that "Alt-A" is "subprime," for potential bailout purposes. Don't you?

GSEs Announce New Subprime Take-Outs

by Anonymous on 4/17/2007 09:23:00 AM

According to CNN, Fannie and Freddie are preparing to take the workout-refinances of some of the subprime mess on the chin:

WASHINGTON (Reuters) -- Mortgage finance companies Fannie Mae and Freddie Mac have new programs to help troubled subprime borrowers avoid foreclosure, the companies' chiefs will say Tuesday, according to prepared testimony for a congressional hearing.

Daniel Mudd, Fannie's chief executive officer, will unveil a new effort called "HomeStay" when he testifies Tuesday before a congressional panel to discuss the subprime lending crisis, according to text of his prepared remarks obtained by Reuters.

The program will offer troubled borrowers "a range of workout solutions," looser credit requirements and ways to shed subprime mortgages before payments spike, according to prepared testimony to be presented to a House Financial Services Committee discussing the subprime mortgage crisis. . .

According to the prepared testimony, Freddie Mac chief executive Richard Syron will offer services and products that will help troubled subprime borrowers ease into a mortgage that they can afford.

The company is "working on a major effort to develop more consumer-friendly subprime products that will provide stable financing alternatives going forward," Syron is due to tell the House Financial Services Committee. "These offerings will include 30-year and possibly 40-year fixed-rate mortgages and ARMs with reduced margins and longer fixed-rate periods.".

Dear reporters: You are aware, we hope, that Fannie and Freddie do not actually originate loans. They buy them from loan originators. The subprime loans to be refinanced into these new products could be on the books of a GSE seller/servicer, or they could be on the books of some ailing REIT or in some private-issue security. Are the originators of the refinance just middle-men making a quick buck on the deal, or are they bagholders getting a problem off their own books and onto the GSEs' books? How will the g-fee or the cash window price for the "HomeStay" loans work? Will the originator get to take its share of the cost here? Have the MIs been dragged onto the team yet? Inquiring minds want to know.

Monday, April 16, 2007

DataQuick: California Foreclosure Activity Jumps Again

by Calculated Risk on 4/16/2007 02:55:00 PM

From DataQuick: California Foreclosure Activity Jumps Again

The number of default notices sent to California homeowners last quarter increased to its highest level in almost ten years, the result of flat appreciation, slow sales, and post teaser-rate mortgage resets, a real estate information service reported.

Lending institutions filed 46,760 Notices of Default (NoDs) during the January-to-March period. That was up by 23.1 percent from a revised 37,994 for the previous quarter, and up 148.0 percent from 18,856 for first-quarter 2006, according to DataQuick Information Systems.

Click on graph for larger image.

Click on graph for larger image.This graph shows the annual Notice of Defaults filed in California. The year 2007 is estimated at four times the first quarter rate.

So far defaults haven't had much of an impact on price, but price declines are most likely coming. As DataQuick noted:

While foreclosure properties tugged property values down by almost 10 percent in some areas ten years ago, the effect on today's market is negligible ...So far.