by Calculated Risk on 4/18/2007 11:11:00 AM

Wednesday, April 18, 2007

MBA: Mortgage Applications Decrease

The Mortgage Bankers Association (MBA) reports: Purchase Applications Rise, Refinance Applications Decline in Latest MBA Survey

The Market Composite Index, a measure of mortgage loan application volume, was 630.6, a decrease of 2.5 percent on a seasonally adjusted basis from 646.6 one week earlier. On an unadjusted basis, the Index decreased 2.2 percent compared with the previous week and was up 9.9 percent compared with the same week one year earlier.Mortgage rates increased:

"Since the survey covered the week after the Easter weekend, it is likely that home sales were a little lower, and thus, possibly impacted purchase applications last week.” said Vincent Varma, Director of Industry Surveys at the Mortgage Bankers Association.

The Refinance Index decreased 0.3 percent to 2008.4 from 2015 the previous week and the seasonally adjusted Purchase Index decreased 4.2 percent to 396.5 from 413.8 one week earlier.

The average contract interest rate for 30-year fixed-rate mortgages increased to 6.22 percent from 6.16 percent ...

The average contract interest rate for one-year ARMs increased to 5.89 from 5.88 percent ...

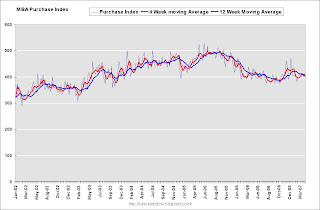

Click on graph for larger image.

Click on graph for larger image.This graph shows the Purchase Index and the 4 and 12 week moving averages since January 2002. For the Purchase Index, the four week moving average is down 0.9 percent to 406.1 from 409.6.

The refinance share of mortgage activity increased to 43.6 percent of total applications from 42.8 percent the previous week. The adjustable-rate mortgage (ARM) share of activity decreased to 18.1 from 18.7 percent of total applications from the previous week.

Alt-A Update: Downey Reports

by Anonymous on 4/18/2007 07:23:00 AM

Downey Financial (DSL), one of our favorite California thrifts stuffed to the overhead bins with neg-am ARMs, has a press release out this morning.

Highlights:

- REO doubled in Q107 from $8.5MM to $17.2MM

- Non-performing assets were .94% of all assets, up from .68% at 06 year-end and .22% a year ago

- Delinquencies were 1.32% of total loans, up from 1.03% at Q406 and .32% a year ago

- Neg am ARMs are down to a mere 81% of portfolio, from 92% a year ago. Neg am during Q1 was $37MM or 3.56% of neg am portfolio, representing 31% of loan interest income

- Allowance for loan losses was unchanged from Q406 and down $9.4MM from a year ago

Tuesday, April 17, 2007

WSJ: Problems May be Spreading to Prime Home Loans

by Calculated Risk on 4/17/2007 10:56:00 PM

From the WSJ: Regional Banks Report Profit Declines

Earnings reports at some regional banks suggested subprime credit problems may be spreading to certain types of prime home loans.These appear to be minor problems right now, but as housing prices fall, more problems will most likely emerge.

...

John McDonald, an analyst with Banc of America Securities LLC, says prime home-equity loans may become the next problem-loan category given rapid growth and "looser" underwriting.

Housing Starts and Completions

by Calculated Risk on 4/17/2007 01:16:00 PM

The Census Bureau reports on housing Permits, Starts and Completions Click on graph for larger image.

Click on graph for larger image.

The first graph shows Starts vs. Completions.

As expected, Completions are now following Starts "off the cliff". Completions are the key number in this release, since employment follows completions.

Based on the rapidly increasing inventory (both new and existing homes), it appears home builders are still overly optimistic. They are pulling too many permits, and still starting too many homes.  This graph shows starts, completions and residential construction employment. (starts are shifted 6 months into the future). Completions follow starts, and employment usually tracks completions.

This graph shows starts, completions and residential construction employment. (starts are shifted 6 months into the future). Completions follow starts, and employment usually tracks completions.

Based on historical correlations, it is reasonable to expect BLS reported residential construction employment to follow Starts and Completions "off the cliff" soon. Yes, cash workers (many illegal immigrants) were probably the first to be let go, and many of them don't show up in the employment statistics. Still I expect BLS reported jobs to decline soon and significantly. Night still follows day.

Alt-A Update: "Completely Manageable"

by Anonymous on 4/17/2007 11:29:00 AM

SunTrust appears to be having a bit of an Alt-A problem:

Mortgage profit sank 90 percent to $7.5 million from $77.6 million, hurt by lower margins on loans sold, lower servicing income and higher write-offs for "Alt-A" loans. The latter is short for "Alternative-A" loans, which often go to borrowers who cannot provide full documentation of income or assets. . . .

A SunTrust investor relations official, Greg Ketron, on a conference call said Alt-A pressures cut first-quarter profit by 5 cents per share and should reduce second-quarter earnings by a similar amount.

"We feel the situation is completely manageable, given the controls and guidelines that are in place," he said.

Completely manageable, huh? I take this as a promise that no Big Dog Bank is going to suddenly declare that "Alt-A" is "subprime," for potential bailout purposes. Don't you?

GSEs Announce New Subprime Take-Outs

by Anonymous on 4/17/2007 09:23:00 AM

According to CNN, Fannie and Freddie are preparing to take the workout-refinances of some of the subprime mess on the chin:

WASHINGTON (Reuters) -- Mortgage finance companies Fannie Mae and Freddie Mac have new programs to help troubled subprime borrowers avoid foreclosure, the companies' chiefs will say Tuesday, according to prepared testimony for a congressional hearing.

Daniel Mudd, Fannie's chief executive officer, will unveil a new effort called "HomeStay" when he testifies Tuesday before a congressional panel to discuss the subprime lending crisis, according to text of his prepared remarks obtained by Reuters.

The program will offer troubled borrowers "a range of workout solutions," looser credit requirements and ways to shed subprime mortgages before payments spike, according to prepared testimony to be presented to a House Financial Services Committee discussing the subprime mortgage crisis. . .

According to the prepared testimony, Freddie Mac chief executive Richard Syron will offer services and products that will help troubled subprime borrowers ease into a mortgage that they can afford.

The company is "working on a major effort to develop more consumer-friendly subprime products that will provide stable financing alternatives going forward," Syron is due to tell the House Financial Services Committee. "These offerings will include 30-year and possibly 40-year fixed-rate mortgages and ARMs with reduced margins and longer fixed-rate periods.".

Dear reporters: You are aware, we hope, that Fannie and Freddie do not actually originate loans. They buy them from loan originators. The subprime loans to be refinanced into these new products could be on the books of a GSE seller/servicer, or they could be on the books of some ailing REIT or in some private-issue security. Are the originators of the refinance just middle-men making a quick buck on the deal, or are they bagholders getting a problem off their own books and onto the GSEs' books? How will the g-fee or the cash window price for the "HomeStay" loans work? Will the originator get to take its share of the cost here? Have the MIs been dragged onto the team yet? Inquiring minds want to know.

Monday, April 16, 2007

DataQuick: California Foreclosure Activity Jumps Again

by Calculated Risk on 4/16/2007 02:55:00 PM

From DataQuick: California Foreclosure Activity Jumps Again

The number of default notices sent to California homeowners last quarter increased to its highest level in almost ten years, the result of flat appreciation, slow sales, and post teaser-rate mortgage resets, a real estate information service reported.

Lending institutions filed 46,760 Notices of Default (NoDs) during the January-to-March period. That was up by 23.1 percent from a revised 37,994 for the previous quarter, and up 148.0 percent from 18,856 for first-quarter 2006, according to DataQuick Information Systems.

Click on graph for larger image.

Click on graph for larger image.This graph shows the annual Notice of Defaults filed in California. The year 2007 is estimated at four times the first quarter rate.

So far defaults haven't had much of an impact on price, but price declines are most likely coming. As DataQuick noted:

While foreclosure properties tugged property values down by almost 10 percent in some areas ten years ago, the effect on today's market is negligible ...So far.

Builder Confidence Recedes Further In April

by Calculated Risk on 4/16/2007 01:55:00 PM

Click on graph for larger image.

Click on graph for larger image.

NABH Press Release: Builder Confidence Recedes Further In April

Deepening problems in the subprime mortgage market continued to take a toll on builder confidence in April, according to the National Association of Home Builders/Wells Fargo Housing Market Index (HMI), released today. The index declined three points to 33 in April, its lowest level since December of 2006.

“The tightening of mortgage lending standards in connection with the subprime crisis has shaken the confidence of both consumers and builders, as reflected in this report,” said NAHB Chief Economist David Seiders. “Indeed, the unfolding effects of this crisis have compelled NAHB to trim our forecasts of home sales and housing production for both 2007 and 2008,” he said. “While we still expect to see some improvements in housing market activity beginning later this year, the downside risks and uncertainties surrounding that forecast are considerable.”

Derived from a monthly survey that NAHB has been conducting for more than 20 years, the NAHB/Wells Fargo HMI gauges builder perceptions of current single-family home sales and sales expectations for the next six months as either “good,” “fair” or “poor.” The survey also asks builders to rate traffic of prospective buyers as either “high to very high,” “average” or “low to very low.” Scores for each component are then used to calculate a seasonally adjusted index where any number over 50 indicates that more builders view sales conditions as good than poor.

All three component indexes registered declines in April. The index gauging current single-family home sales fell three points to 33, while the index gauging sales expectations for the next six months declined six points to 44 and the index gauging traffic of prospective buyers declined a single point, to 27.

All four regions posted HMI declines in April, with the Northeast showing a one-point decline to 38, the Midwest registering a five-point decline to 22, the South posting a three-point decline to 37, and the West posting a two-point decline to 35.

“The subprime shakeout clearly is a serious matter for the single-family housing market,” noted NAHB President Brian Catalde, a home builder from El Segundo, Calif. “Builders in the field are reporting adverse effects on both sales and cancellations at this time, and it remains to be seen how serious these effects will be as we move through the spring home buying season.”

Retail Sales

by Calculated Risk on 4/16/2007 01:43:00 PM

The Census Bureau reported today for March 2007:

The U.S. Census Bureau announced today that advance estimates of U.S. retail and food services sales for March, adjusted for seasonal variation and holiday and trading-day differences, but not for price changes, were $371.6 billion, an increase of 0.7 percent from the previous month and up 3.8 percent from March 2006.

Click on graph for larger image.

Click on graph for larger image.This graph shows the year over year change in real retail sales ex-food, using the monthly PCE price index. Although March sales were strong, the real YoY change is fairly weak.

From the National Retail Federation: As Expected, March Retail Sales Show Solid Growth, According to NRF

Retailers saw strong March sales thanks to an early Easter and unseasonably warm weather. According to the National Retail Federation, retail industry sales for March (which exclude automobiles, gas stations, and restaurants) rose 3.7 percent unadjusted over last year and 0.8 percent seasonally adjusted from February.

“The big winners in March were clothing stores, whose shoppers splurged on new spring apparel,” said NRF Chief Economist Rosalind Wells. “Clearly the weather and the early Easter had a desirable impact on retail sales.”

Fitch on Subprime Early Defaults

by Anonymous on 4/16/2007 07:25:00 AM