by Calculated Risk on 5/20/2006 10:15:00 PM

Saturday, May 20, 2006

Lansner: Q&A with Mortgage Broker

Here is OC Register's Jonathan Lansner Q&A with local mortgage broker Norm Bour: Insider Q&A: A lender's perspective. A few excerpts:

Q. How slow is it?

A. No question loan originations are down, both in the purchase and the refi market. Speaking for myself we're down by 40-50% year-to-date since last year and certainly the year prior and most people I know are saying the same.

Q. What does the kind of business you're doing today say about the state of the O.C. housing market?

A. I can only speak for myself, but ... We're concerned. ... If the economy DOES become soft (likely), and people are pressured, will they SELL to get out of their jam or refi to get cash out even at a higher rate than they have now?

Q. What's the most popular loan today? Why? Is that different from, say, a year ago?

A. ... the majority of people are still going with (adjustable) ARMs, though more hybrid ARMs rather than the more volatile Option ARMs. I'd say 5/1 (5-year-fixed,) 7/1 (7-year-fixed,) and 10/1 (10-year-fixed,) are the majority of what people want.

Friday, May 19, 2006

California Construction Employment Falls

by Calculated Risk on 5/19/2006 04:15:00 PM

Click on graph for larger image.

Click on graph for larger image.

The California Employment Development Department reports that seasonally adjusted California construction employment fell by 8,300 in April. This followed a loss of 9,900 construction jobs in March.

For overall employment:

California's seasonally adjusted unemployment rate was 4.9 percent in April, up 0.1 percentage point from the revised rate in March, and down 0.5 percentage point from one year ago. In comparison, the U.S. unemployment rate was 4.7 percent in April remaining unchanged from the rate in March, and down 0.4 percentage point from one year ago.

There were 14,951,100 seasonally adjusted jobs in total nonfarm industries in April, down 2,600 jobs from last month. This followed a 13,400-job loss in March and a 31,400-job gain in February.

The second graph shows construction employment as a % of total employment in California. Note that "construction" includes non-housing related construction too - so this is just a general guide to the impact of the housing slowdown. Also, there are many other housing related jobs (real estate agents, mortgage brokers, etc.) that will also be impact by the housing slowdown.

The second graph shows construction employment as a % of total employment in California. Note that "construction" includes non-housing related construction too - so this is just a general guide to the impact of the housing slowdown. Also, there are many other housing related jobs (real estate agents, mortgage brokers, etc.) that will also be impact by the housing slowdown.For California, Dr. Thornberg estimates:

Construction employment will lose 200,000 jobs statewide over the next three years, with an additional unknown number of jobs lost in the informal sector.This is just the beginning of the job losses.

For Arizona see: Housing decline triggers layoffs

Housing Busts: Looking Back

by Calculated Risk on 5/19/2006 02:13:00 PM

Greenspan says the housing boom is over. Bernanke suggests the cooling is "orderly". Leamer and Thornberg predict prices will be flat for a number of years, unless employment falls. What is likely to happen?

Although every bust is different, and this boom was larger than previous booms (so the bust might be worse), taking a look back at previous busts might give us an idea of what to expect:

Housing "bubbles" typically do not "pop”, rather prices tend to deflate slowly in real terms, over several years. Historically real estate prices display strong persistence and are sticky downward. Sellers want a price close to recent sales in their neighborhood, and buyers, sensing prices are declining, will wait for even lower prices. This means real estate markets do not clear immediately, and what we usually observe is a drop in transaction volumes.

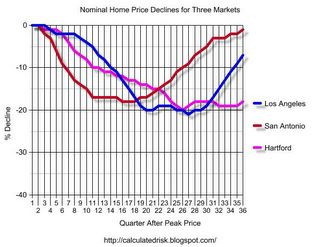

Even though prices tend to deflate slowly, they can still drop significantly over time. On the following graph are the nominal price declines for three busts: Los Angeles in the early '90s, San Antonio in the mid '80s (the oil patch bust) and Hartford starting in '89. The peaks of all three housing booms are aligned on the left and the relative price declines are plotted by quarter after the local market’s price peak.

Click on graph for larger image.

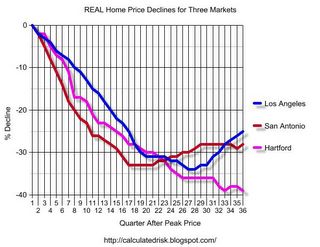

Click on graph for larger image.For all three busts, the prices steadily declined over many quarters. Although these are three of the worst busts of the last 25 years, the price action is representative of other housing busts. In real terms (adjusted by CPI less shelter), the price declines are even more dramatic:

Data Sources: OFHEO House Price Index, BLS CPI less Shelter.

In real terms, prices in the Hartford market declined for over 8 consecutive years before reaching a nadir of almost 40% off the peak price of 1989. The other markets experienced similar declines:

Percent Decline (Real and Nominal), Years from Peak to Trough Real Years Nominal Years Decline Decline Los Angeles 34% 6 3/4 21% 6 3/4 San Antonio 33% 4 3/4 18% 4 Hartford 39% 8 1/4 15% 6 1/2

NOTE: Most of this post is excerpted from my post last year on Angry Bear: After the Boom.

UCLA: Drs. Leamer and Thornberg on Housing

by Calculated Risk on 5/19/2006 11:12:00 AM

A couple of quotes from the UCLA Anderson Forecast economists:

"The housing market was like a rocket that has gone up and now it's lost its fuel. Some people think it will stay suspended up there magically. We think it's going to come back to Earth -- sales will drop even more, and then next comes weakness in pricing."Dr. Leamer, May 18, 2006

"Appreciation (in Bay Area) has been flat for six months. This is how a real estate bubble pops. It's not a price pop. It's a volume pop. ... It's not going to be pretty."Dr. Thornberg, May 18, 2006

Both Leamer and Thornberg think prices will remain flat for a number of years unless the job market deteroriates (see Phoenix). In addition to jobs, I'd be concerned about any area with a heavy concentration of exotic mortgages. Either the loss of jobs, or rising foreclosures due to execessive leverage, could lead to significant price declines.

Phoenix: Housing and Employment

by Calculated Risk on 5/19/2006 10:39:00 AM

The Arizona Republic reports: Housing decline triggers layoffs

Home builders are laying off construction superintendents, subdivision sales agents, finance specialists and other employees, a telling sign that metropolitan Phoenix's new-home market has taken a radical turn from last year's selling frenzy.Many of these jobs are relatively high paying with skills that do not transfer easily to other high paying jobs. So these people might have to sell their homes too, putting even more pressure on the Phoenix housing market.

Builders are struggling with reduced demand brought on by skeptical buyers hit with higher prices and rising interest rates. The pileup of unsold houses helped push Valley home building down nearly 24 percent in March and more than 16 percent in the first quarter, following a record 2005.

The Phoenix economy is especially vulnerable to a housing slowdown:

Housing is the Valley's biggest industry. At least one of every $3 in the area's economy is generated by housing, according to Republic research. A downturn in home building will be felt throughout the state's economy.

Greenspan: Housing Boom Over

by Calculated Risk on 5/19/2006 02:21:00 AM

From AP: Former Fed Chair Alan Greenspan Says Housing Boom Over and Consumer Spending Could Taper

Former Federal Reserve Chairman Alan Greenspan said Thursday that Americans' consumption could taper off somewhat now that the U.S. housing market's "extraordinary boom" has ended.

Greenspan, in his first public U.S. speech since retiring in January from a storied tenure leading the Fed, predicted there is no danger of a total collapse of the housing market.

His comments come on speculation the Fed could pause its cycle of rate hikes as a housing slowdown feeds a cooling of the U.S. economy.

"This has been quite an extraordinary boom," Greenspan said in remarks at the Bond Market Association's 30th anniversary dinner in New York. "Home sales are off, applications are off, everything is going in the same direction. The boom is over, and you can say that with a fairly strong degree of confidence."

Greenspan said he doesn't see home prices falling on a national basis, but instead in certain areas of the country. He warned reduced access of Americans to equity loan extraction would have an economic impact, which has had an "important effect" in stimulating the economy.

Thursday, May 18, 2006

DataQuick: Bay Area home sales and appreciation slow

by Calculated Risk on 5/18/2006 02:59:00 PM

DataQuick reports on the California Bay Area: Bay Area home sales and appreciation slow; new price peak

Bay Area home sales in April dropped to their lowest level in five years as prices slowly reached a new peak, a real estate information service reported.I agree, Summer will be "interesting to say the least"!

A total of 8,358 new and resale houses and condos were sold in the nine-county region last month. That was down 14.2 percent from 9,745 for March, and down 25.1 percent from 11,158 for April last year, according to DataQuick Information Systems.

Last month was the slowest April since 2001 when 7,193 homes were sold. April's year-over-year decline in sales was the steepest since November 2001 when sales dropped 27.2 percent to 6,644 from 9,122 one year earlier.

"These are strange times for forecasters and analysts. Are we heading into a market lull? Or are we seeing the beginning of a significant downturn? Many of the fundamentals for housing are at a crossroads: Inflation, interest rates, demand, household incomes, prices, and whether homes are a good investment compared to other investments. Summer is going to be interesting to say the least," said Marshall Prentice, DataQuick president.

...

Indicators of market distress are still largely absent. ... Foreclosure rates are coming up from last year's low point, but are still below normal levels.

WSJ: Late Payments on Mortgages Rise

by Calculated Risk on 5/18/2006 02:38:00 PM

From the WSJ: Studies Find Higher Loan Delinquencies Stemming From 2005's Lending Boom

To be sure, mortgage delinquencies remain low by historical standards. But experts worry the trend could worsen. With the housing market cooling and interest rates rising, "by the end of the year you could see a substantial increase in delinquency rates" for mortgages, says Thomas Lawler, a former Fannie Mae economist and now a private housing consultant.With so many homeowners with so little equity, Bernanke's "orderly" housing slowdown could get a lot worse!

Mortgage delinquencies historically peak around three years after loans are made, which means some of the more aggressive loans made last year might experience their biggest problems in 2008. However, some borrowers with adjustable-rate mortgages could see problems sooner. Others, who took out exotic mortgages such as interest-only loans and option ARMs that hold down monthly payments in their early years, could run into trouble later, when payments reset. Still, there are early signs that even some of these non-traditional mortgage loans are starting to be squeezed by rising interest rates.

Borrowers who took out mortgages in the past two years are likely to be more vulnerable should home prices fall because they could wind up owing more than their home is worth. Twenty-nine percent of borrowers who took out mortgages last year have no equity in their homes or owe more than their house in worth, according to a study completed this year by Christopher L. Cagan, director of research and analytics for First American Real Estate Solutions, a unit of First American Corp. That compares with 10.6 percent of those who took out loans in 2004.

Bernanke: Housing Cooling is "Orderly"

by Calculated Risk on 5/18/2006 12:02:00 PM

From Reuters: Bernanke sees cooling housing market

The current cooling in the U.S. residential housing market looks to be orderly and moderate at this time, Federal Reserve Chairman Ben Bernanke said Thursday.So far the slowdown has been orderly, but there are definite warning signs of both rising inflation and a slowing economy.

"In combination with rising interest rates affordability is becoming much more difficult and therefore as you would expect you are seeing some cooling in those markets," Bernanke said in a question and answer session after speaking to the Chicago Fed conference on banking regulation.

The central bank is watching carefully for signs that the slowdown might be faster than expected, Bernanke said.

Still, with the U.S. labor market strong and incomes rising, 2006 could still turn out to be a pretty strong year for real estate, he said.

Retail Survey: Shoppers Might Hold Back

by Calculated Risk on 5/18/2006 10:48:00 AM

The National Retail Federation released the results of a new survey today: Survey Finds Consumers Adjusting to Higher Prices at the Pump

While consumers have seemed resilient in the face of higher energy costs, a tipping point may soon be in sight. According to the National Retail Federation’s (NRF) 2006 Gas Prices Consumer Intentions and Actions Survey, 76.0 percent of consumers believe fluctuating gas prices have impacted their spending habits, up from 67.2 percent in 2005 and 56.8 percent in 2004. The survey will be featured as the cover story in the June 2006 issue of STORES Magazine.And from the Stores cover story: Are Shoppers Running Out of Gas?

Consumers say they will find a variety of ways to cope with higher prices. Most (44.8%) say they will simply drive less. Additionally, 37.2 percent of those surveyed say they plan to decrease vacation and/or travel, 36.2 percent will cut back on dining out, while only 22.2 percent will delay a major purchase such as a car or television. Also, eight percent of respondents say they will carpool, almost double the amount from the previous year (4.5%).

While the luxury market has been particularly immune to the rise in gas prices, new evidence suggests that even the recession-proof shopper may start pulling in the reins. According to the study, 69.3 percent of affluent shoppers (with household incomes of $50,000 or higher) concede that gas prices are negatively affecting spending, compared to 59.1 percent in 2005.

With per-gallon prices now at or above $3 in many parts of the country, there are signals that often-impulsive shoppers are dangerously close to running out of gas.

Right now they’re in cost-cutting mode — driving and dining out less and scaling back on discretionary spending.