by Calculated Risk on 10/04/2005 03:16:00 PM

Tuesday, October 04, 2005

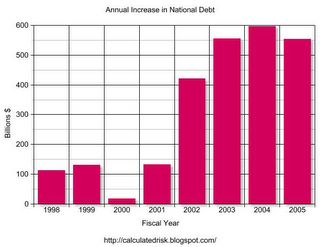

Fiscal 2005: National Debt Increases $553.7 Billion

The US Treasury Department reports that the US National Debt increased $553.7 Billion in fiscal 2005 (ends Sept 30, 2005).

The total National Debt is now $7,932,709,661,723.50.

Click on graph for larger image.

The increase in the National Debt was slightly less than the record set in fiscal 2004 of $595.8 Billion in additional debt.

The initial estimates for fiscal 2006 are for a new record of approximately $650 Billion in new debt. On the positive side, tax revenues from the housing boom will help in fiscal '06. On the negative side are the additional expenditures for hurricane recovery.

In addition, if the economy weakens significantly, as the housing market slows, the increase in the debt could be substantially higher.

Mercury News: Unreal Estate Series

by Calculated Risk on 10/04/2005 11:54:00 AM

The Mercury News has an excellent series of articles called "Unreal Estate". Today's article is Part III: Loan landslide on shaky soil

The previous articles in the series:

Part I: Housing boom showing its age

Part II: How the boom has hit home

Also see the companion articles in the side bar.

Excerpt from Part III:

Almost overnight, a transformed mortgage industry has rewritten the rules for home-buying. Relying on improved credit scoring, better risk-analysis tools and abundant cheap capital from around the globe, lenders have flooded the market in the past two years with exotic loans that allow consumers to take on more debt and more risk. People who once would have been denied mortgages now get the chance to join the auction and bid up home prices.And for a description of some of the risky mortgage products available today, see Schwanhausser's companion article: The lowdown on loans

Such loans are particularly popular in Silicon Valley, helping to push prices at a double-digit pace that many experts worry is unsustainable.

Interest-only loans, for example, accounted for more than half the purchase loans in the Bay Area in the first quarter of the year. That's nearly five times higher than in 2002, says LoanPerformance, a San Francisco firm that analyzes mortgage trends. And piggy-back loans -- which package two loans for borrowers putting less than 20 percent down -- accounted for about 60 percent of the loan volume in the Bay Area in the first half of 2005, according to SMR Research, a financial-services market research firm in Hackettstown, N.J.

But while exotic loans have swelled the ranks of potential buyers, slowing homes sales this summer are fueling worries about the economic aftershocks if the real estate market cools or slumps.

• Adjustable-rate loans with tantalizing "teaser" rates: Some ARMs dangle introductory interest rates as low as 1 percent. But beware: Some ARMs begin to adjust within as little as a month and can ratchet higher rapidly. That can lead to "payment shock."Also the NY Times continues their reporting on the housing market: Slowing Is Seen in Housing Prices in Hot Markets and Home Builders' Stock Sales: Diversifying or Bailing Out?

• Hybrid ARMs: They start out like fixed-rate loans, charging the same flat monthly payment of principal and interest. After three to seven years, typically, they turn into adjustable-rate loans. The payment shock can be substantial if interest rates rise.

• Interest-only loans: Borrowers may pay only the interest portion of the monthly payment, typically for three to five years but sometimes up to 10 years. After that, the monthly payments can vault higher to pay off the principal over the remainder of the loan.

• Option ARMs: Every month borrowers get to choose from a handful of payment options. When times are flush, they can pay what they would owe under a standard 15- or 30-year fixed-rate mortgage. Or they can just pay the interest. But if cash is tight, they can make a minimum payment that is less than the interest charge.

The last option can result in "negative amortization" that leaves homeowners owing more than they borrowed in the first place. Also, monthly payments can jump after a number of years or if the negative amortization exceeds the "cap" allowed by the loan.

• "Piggyback" loans: This is an increasingly popular tactic that involves packaging two loans to avoid the hefty monthly bills for private mortgage insurance, or PMI, that is required when borrowers make a down payment of less than 20 percent. For example, lenders often package one mortgage for 80 percent of the home's value with a home-equity loan or line of credit for the remaining 20 percent.

Monday, October 03, 2005

The 2006 Economy: Soft or Hard Landing?

by Calculated Risk on 10/03/2005 04:39:00 PM

"...make no mistake about it, the froth in the U.S. housing market is about to lose its effervescence; the bubble is about to become less bubbly. If real housing prices decline in the U.S. in 2006 or 2007, a recession is nearly inevitable." Bill Gross, PIMCO, October 2005Here are two interesting perspectives on the economy going forward. The first is from Dr. Duy who ventures inside Greenspan's head: How Does the Fed See the Economy Evolving? And the second is from PIMCO's Bill Gross: Deliberate Acts Of Kindness.

Dr. Duy writes:

"... the Fed has shown concern that economic slack has evaporated, and, with rising energy prices in the background, inflationary pressures are building. To stem these pressures, they have tightened policy to reduce growth. They are not targeting the housing market directly, but recognize that since housing has been a driving force in the expansion, it will likely be the recipient of the brunt of their policy efforts.Of course this will lead to a slowdown in consumption, but Dr. Duy believes the Fed is looking for investment to fill the gap. The Fed's soft landing:

A cooling of the housing market, however, is not undesirable, and a major decline in values is unlikely. ... And, under the Greenspan scenario, a housing slowdown is necessary to trigger a needed rebalancing of economic activity. Moreover, with excess slack drying up, some sector needs to pull back, especially with any sense of fiscal discipline long gone."

"The upshot it that the economy evolves in such a way that consumption slows, savings rises, and, as long as investment spending continues to grow, we avoid a recession."Bill Gross is not quite as optimistic and summarizes his "sequence for house bubble popping or froth skimming" as:

1) Housing prices will cool/stop going up very much/even go down in some cities, WHEN...Mr Gross sees a recession as likely:

a. Interest rates rise to a high enough level to make the purchase of a new home a burden instead of a boon for first time buyers.

b. Mild regulatory pressure begins to reduce the amount of funny-money lending.

c. Speculators sniff the beginning of the end.

2) Home equitization should retreat shortly thereafter.

3) Consumption/the U.S. economy will then weaken when the house ATM starts running out of fresh new $25,000/$50,000/$100,000 home equity loan dollar bills.

4) The Fed will cut interest rates in order to start the game all over again.

Let me state categorically that the above sequence is barely questionable, almost inevitable, 99% unavoidable, and in modern parlance - "slam-dunk." In so saying, I hope I am not being unkind to those of you who think otherwise - IÂ’m trying to do you a favor!

How weak the U.S. economy gets will depend on numerous factors: oil/natural gas prices, China's continuing growth miracle, and of course the level of U.S. interest rates - themselves a function of the Fed and foreign willingness to buy our Treasury and corporate bonds. But make no mistake about it, the froth in the U.S. housing market is about to lose its effervescence; the bubble is about to become less bubbly. If real housing prices decline in the U.S. in 2006 or 2007, a recession is nearly inevitable. If higher yields simply slow the pace of appreciation to a more rational single digit number, then we could escape with a 1-2% GDP economy.The consistent theme is a slowing housing market and the questions are: What will the housing slowdown look like? And how large an impact will that have on US economic growth?

If the housing slowdown is gradual, and investment can replace the lost consumption associated with equity extraction, GDP growth will slow but the economy will stay healthy. Savings will rise, the current account deficit will fall and Americans will all hold hands and sing Kumbaya. Very unlikely in my view for several reasons:

1) The excessive leverage and speculation in the housing market means achieving a soft landing is very difficult. Many recent buyers will be hurt if house prices just flatten, making the FED's job very difficult.

2) The transition from a housing centric economy to a more balanced economy will involve significant dislocations. Many jobs in the housing related industries have non-transferable skills, require low levels of education, and are relatively well paying. These jobs will be difficult to replace.

3) The lowering of US consumption will have a worldwide ripple effect and especially impact China and other countries currently running trade surpluses with the US. These countries will probably sell US assets for domestic purposes (to minimize economic weakness) leading to higher rates in the US - exacerbating the US housing slowdown.

I'm sure I've left off several other problems (I need to read Dr. Setser and Dr. Kash Mansori). As much as I would like to see a soft landing, I think a hard landing is very likely.

NOTE: Please read Dr. Duy's piece - it is excellent. Also, Gross' piece starts with a nice tribute to his wife and the wonders of kindness in our everyday life.

Best to all.

Tighter Lending Standards?

by Calculated Risk on 10/03/2005 12:11:00 PM

From the WSJ: Mortgage lenders tighten loan standards (hat tip: Bailey and pwilliamson)

After years of easy money, some mortgage lenders are beginning to tighten their standards.The article mentions that rates are rising and offers examples of some lenders tightening lending standards. Some examples:

Lenders have rolled out a raft of mortgage products in recent years that have made housing purchases more affordable and allowed many people to extract cash from their homes' equity without boosting their monthly payments.

Now, in what could be the first signs of a reversal, some lenders are starting to raise the bar on making these products available to new borrowers.

Two weeks ago, Washington Mutual, one of the nation's biggest mortgage lenders, told mortgage brokers that it will make it more difficult for borrowers to qualify for its option ARMs, which carry an introductory rate of as low as 1.25 percent. Under the new rules, which are expected to take effect next month, borrowers will have to show they can afford the monthly payment if the interest rate on the loan is 6 percent - or 6.25 percent for borrowers purchasing a second-home or investment property - after the introductory rate expires. Currently, the bank's rate for qualifying borrowers for these loans is roughly 5.25 percent.These are small steps in the right direction but probably too little, too late. In the comments to the previous post, Tanta is "underwhelmed":

New Century Financial Corp., a mortgage lender in Irvine, the same week said it was aiming to reduce the amount of interest-only loans it grants to less than 25 percent of total loan production from 33 percent in the year's first half. New Century said it was making the move in an effort to boost profit margins.

Some lenders are making their loans more costly, which could discourage borrowing. Last month, Option One Mortgage, a unit of H&R Block Inc., boosted the rates on all of its mortgage products by 0.40 percentage point. Option One says the move reflects both rising interest rates and changes in investor appetite for its loans.

...

Among other changes, Countrywide Financial, another big lender, earlier this month made it tougher for borrowers to qualify for a 1 percent teaser rate on its option ARMs. Countrywide now considers a number of factors in setting the introductory rate, including the size of the loan, how much documentation the borrower provides and whether the property is a second home or for investment. The teaser rate for borrowers with multiple risk factors can be as high as 3 percent, the company says.

" ... this strikes me as the usual "find a couple of examples and make it sound like a trend" crap the press is so good at.And even with these "tighter standards" and rising rates, the number of mortgage applications is still strong. Fannie Mae Chief Economist David Berson, writing in his weekly economic commentary, still sees a strong housing market based on new loan applications: Housing: The good, the bad, and the ugly.

Of the four lenders mentioned in this article, exactly one is a regulated financial institution: WAMU. And WAMU's big tightening is . . . 100 bps increase on the qualifying rate. I'm underwhelmed.

Two of the other four lenders are subprime. New Century is a REIT. Option One is owned by H&R Block. And Option One is "tightening standards" by repricing its rate sheet by 40 bps? When they came right out and said that part of the reason for that is that, well, market rates are going up?

The last is Countrywide. In my view they're the only ones listed here doing anything actually meaningful: they're upping the start rate on loans with a lot of layered risk, which means that if the borrower chooses the neg am option, it will negatively amortize more slowly. Still, this is adjusting the price for the risk you're taking on, not limiting the risk by changing the underwriting guidelines.

...

if this is the best the Wall Street Journal could come up with, we haven't even skimmed the surface yet.

"...the Mortgage Bankers Association’s (MBA) weekly survey of mortgage applications (for home purchases) provides a pretty good leading indicator for home sales one-to-three months ahead. Purchase applications had risen to record highs in each of May, June, and July -- helping to power new and existing home sales to either high or record sales in those months. There was a small decline in August (reflected in the dip in August new home sales), but purchase applications have increased again thus far in September. In fact, purchase applications have climbed to a record high in September, presaging strong home sales figures for the September-November period."Berson also comments on rising inventories as a potential problem for housing - and I think rising inventories are the first sign of a slowing housing market. But I don't think we have seen any real tightening in lending standards as suggested in the WSJ article.

Sunday, October 02, 2005

More housing

by Calculated Risk on 10/02/2005 09:27:00 PM

My most recent post is up on Angry Bear: Mortgage Rates.

Here is a commentary from Fleck on housing: Empty houses, falling prices: A boom dies

Best to all.

Saturday, October 01, 2005

NYTimes: My House, My Piggy Bank

by Calculated Risk on 10/01/2005 10:50:00 PM

The NYTimes offers a few anecdotes of homeowners using their houses as ATMs. This has allowed homeowners in financial trouble to stall off bankruptcy. A few quotes from the article:

"When you're living in a place with home values up 50 percent, you have what Alan Greenspan calls a piggy bank," said Elizabeth Warren, a Harvard law professor and an author of "The Fragile Middle Class" (Yale University Press, 2000), a study of bankruptcy. "The bubble has operated like wreckage from the Titanic - you could climb on and float along for a while. The question is for how long."Housing prices do not need to fall, just flatten, and then I believe serious problems will be revealed.

...

"Some people have been spared filing the petitions because they have home equity," said Andrew Thaler, a bankruptcy trustee on Long Island. "My guess is when the housing market flattens, people are not going to be able to sustain the lifestyle they've been maintaining, and you'll suddenly see a lot more bankruptcies."

...

"Two or three years ago, mortgage companies were giving money to anyone," Mr. [Heath Berger, a bankruptcy lawyer in Woodbury] said. "They didn't care whether they could afford it, just that they had a house. Now I'm seeing all these people who never had the income to pay these loans in trouble."

Professor Warren of Harvard believes that disaster lurks as homeowners borrow against their homes to forestall bankruptcy. When the stock market tumbled five years ago, people in trouble could sell stocks to stay afloat, she said. But home equity doesn't work the same way. As she put it, "You can't sell a part of your home like you could a stock in the stock market bubble."

...

"When a family uses its home like a piggy bank and then a job loss, a divorce or an increase in the adjustable-rate mortgage leaves them unable to make the payments, the family is out of options," Professor Warren said. "That's true before and after Oct. 17. Borrowing against a home leaves a family with the fewest possible options when something goes wrong."

"After Oct. 17, bankruptcy gets harder for everyone - more expensive, more traps, less coverage," she said. "And that means more families are set up to lose their homes."

Friday, September 30, 2005

Taiwan Typhoon

by Calculated Risk on 9/30/2005 09:32:00 PM

This hurricane and typhoon season is very active in the Pacific Ocean too.

Click on photo for larger image.

Typhoon Longwang is threatening Taiwan and is expected to make landfall this weekend.

Here is the projected track from the US Navy.

And here is the most recent Guam IR satellite loop - incredible. The typhoon will probably impact the entire island of Taiwan.

Housing Bubble Contrarians

by Calculated Risk on 9/30/2005 05:29:00 PM

Occasionally people ask me: "Can there be a bubble when so many people think there is a bubble?"

The answer is: The prevailing opinion on housing is that there is no bubble. From MarketWatch:

A survey out this week from RBC Capital Markets shows U.S. homeowners have little regard for talk of a housing bubble; nearly 60% expect that the value of their homes will increase at least 5% annually over the next several years -- not a bad guess given home prices historically have risen a percentage point or two higher than inflation every year.Greenspan sees a little "froth". Others see some local bubbles, but not a national problem. Only 3% of homeowners think prices will decline.

But one-quarter of homeowners say they still think their houses will go up in value 10% or more a year, despite strong price hikes in most parts of the country in the last few years that economists say aren't sustainable. Only 3% of homeowners said they think their home will decline in value -- pessimists who probably fear they mistakenly jumped into homeownership.

Only a few contrarians think there is a housing bubble. If the contrarians are correct this time (and I think they are), when sentiment changes, housing prices will start to fall.

Thursday, September 29, 2005

CNN Poll on Gas Prices

by Calculated Risk on 9/29/2005 02:55:00 PM

CNN had an online poll today on the cause of rising gas prices. Without getting into the flaws of online polls (a self selecting sample), this poll shows several other problems. First the results:

Q: What do you think is the main cause of rising gas prices?

| Cause | percent | votes |

| Hurricanes | 4% | 6738 votes |

| Lack of refining capacity | 21% | 33619 votes |

| Price gouging | 65% | 104096 votes |

| Other market forces | 10% | 16527 votes |

However gas prices have been rising for some time. This wasn't due to hurricanes or the lack of refining capacity. Instead this was due primarily to market forces.

Regardless of the time frame used, "price gouging" (the most popular answer) is incorrect.

The 'R' Word

by Calculated Risk on 9/29/2005 01:17:00 PM

Knight Ridder reports: Economists mention the ‘R’ word

Economic forecasters and Wall Street analysts are quietly hedging their bets after months of rosy reports about a vibrant U.S. economic outlook. They’re now mentioning the growing possibility of recession.The article quotes Ed Yardeni of Oak Associates:

Why? Soaring gas prices, nightmarish home-heating costs this winter, plunging consumer confidence, rising interest rates and falling new-home sales.

"The U.S. economy has been remarkably resilient in recent years, but consumers may start to postpone discretionary spending to build some cushion to pay their higher heating bills on top of paying more to fill up their gasoline tanks," he wrote to investors. "In other words, I am not sure that the economy is resilient enough to withstand the one-two punches from the Katrina-Rita tag team."Also the Conference Board reported that the help wanted market weakened in August, BEFORE the storms hit: U.S. Help-Wanted Advertising Index Declines Four Points

Yardeni said it was "increasingly likely" the U.S. economy soon could face a six-month bout of stagflation — in which prices rise but wages and hiring stagnate — the economic curse of the 1970s.

The Conference Board Help-Wanted Advertising Index - a key measure of job offerings in major newspapers across America - declined four points in August. The Index now stands at 35, down from 39 in July. It was 37 one year ago.However, online help wanted "ad volume continued to edge higher".

In the last three months, help-wanted advertising declined in seven of the nine U.S. regions. Steepest declines occurred in the West South Central (-19.4%) and West North Central (-10.8%) regions.

Says Ken Goldstein, Labor Economist at The Conference Board: "Key market indicators gave ground just before the storms and flooding. While print want-ad volume rose a bit in June and July, it sagged to May levels in August. Consumers' concerns about finding a new job were also essentially the same in August as in May, but declined noticeably in September, after the hurricanes and flooding. Latest readings show that job growth has been downsized significantly. Before the storms, there was a chance for 150,000 to 175,000 jobs per month over the near term. However, prospects may now be reduced by as much as half of that."

It appears the economy was starting to weaken prior to the devastation of Hurricanes Katrina and Rita. But one thing is certain, all problems will be blamed on the hurricanes.